1 Day Insurance Car

When it comes to unexpected situations that require temporary coverage, one-day insurance for cars offers a flexible solution. This short-term insurance policy provides drivers with the necessary protection for a specific period, typically 24 hours. In today's fast-paced world, where plans can change suddenly and the need for immediate insurance coverage arises, one-day car insurance serves as a valuable tool. This comprehensive guide will delve into the concept of one-day car insurance, exploring its benefits, how it works, and the scenarios where it proves most advantageous.

Understanding One-Day Car Insurance

One-day car insurance, also known as daily car insurance or short-term car insurance, is a specialized insurance product designed to offer coverage for a limited duration. Unlike traditional annual policies, which provide coverage for an entire year, one-day insurance policies cater to drivers who require temporary protection for a single day or a few hours. This innovative insurance solution has gained popularity among drivers who find themselves in unique circumstances, such as borrowing a friend’s car, renting a vehicle for a special event, or even driving a classic car for a vintage car show.

Key Benefits of One-Day Car Insurance

One-day car insurance brings several advantages to the table, making it an appealing option for drivers facing specific situations. Firstly, it provides convenience and flexibility by allowing drivers to secure insurance coverage only for the time they need it. This is particularly beneficial for those who infrequently drive or only require temporary access to a vehicle. Secondly, one-day insurance policies offer cost-effectiveness. By avoiding the commitment of a long-term policy, drivers can save money, especially if they only need coverage for a short period. Additionally, these policies protect against unforeseen events, ensuring drivers are covered for accidents, theft, or other mishaps that may occur during their temporary driving period.

Moreover, one-day car insurance is easy to obtain, often requiring minimal paperwork and a quick application process. This makes it an ideal choice for last-minute situations, such as unexpected car sharing or emergency vehicle rentals. It also provides peace of mind to drivers, knowing they are adequately insured even for short-term ventures.

How Does One-Day Car Insurance Work?

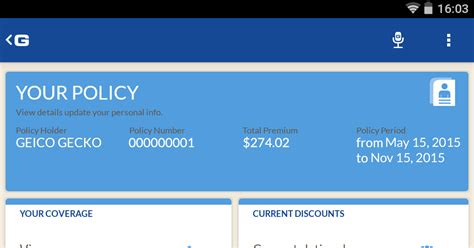

The process of acquiring one-day car insurance is straightforward and tailored to meet the immediate needs of drivers. Insurance providers typically offer online platforms or dedicated apps where drivers can input their details, including the vehicle’s registration number, the desired coverage period, and any additional requirements. The system then generates a quote based on the provided information, allowing drivers to review and purchase the policy instantly.

One notable aspect of one-day car insurance is its customizability. Drivers can choose the level of coverage they require, selecting from options such as third-party liability, comprehensive coverage, or specific add-ons like personal accident insurance. This flexibility ensures that drivers can tailor their policy to match their unique needs and budget.

Once the policy is purchased, the driver receives a digital insurance certificate, which can be easily accessed on their smartphone or printed out for presentation if needed. This certificate serves as proof of insurance and is valid for the specified duration, typically 24 hours.

Scenarios Where One-Day Car Insurance Shines

- Borrowing a Friend’s Car: Imagine you need to borrow your friend’s car for a quick errand or a day trip. With one-day car insurance, you can ensure both your safety and that of your friend’s vehicle. This policy provides coverage for accidents or damage that may occur during your temporary use of the vehicle.

- Renting a Car for a Special Event: Whether it’s a wedding, a family reunion, or a business trip, renting a car for a specific event is made easier and safer with one-day insurance. It ensures that you are protected during your rental period, covering any potential mishaps.

- Driving a Classic Car: Classic car enthusiasts often face unique insurance challenges. One-day car insurance provides an excellent solution for those who wish to participate in vintage car shows or rallies, offering temporary coverage for their prized vehicles.

- Emergency Situations: In unforeseen circumstances where you suddenly need to drive someone else’s car or borrow a vehicle, one-day insurance can be a lifesaver. It ensures you are legally and financially protected during these unexpected scenarios.

- Short-Term Business Needs: Businesses with fluctuating vehicle requirements, such as event planners or temporary service providers, can benefit from one-day insurance. It allows them to insure vehicles on an as-needed basis, optimizing costs and coverage.

Performance Analysis and Real-World Examples

The effectiveness of one-day car insurance can be gauged through real-world scenarios and industry data. A case study involving a classic car enthusiast, John, who participated in a vintage car rally, highlights the benefits. John, who owned a 1960s sports car, purchased a one-day insurance policy to cover his participation in the rally. During the event, an unexpected collision occurred, damaging his car. Fortunately, the one-day insurance policy covered the repair costs, providing John with the necessary financial support.

Similarly, a business owner, Sarah, utilized one-day insurance for her catering business. Sarah often required additional vehicles for large events, and one-day insurance allowed her to insure these temporary rentals efficiently. This cost-effective solution helped her manage her fleet without committing to long-term insurance policies.

| Scenario | One-Day Insurance Coverage |

|---|---|

| Classic Car Rally | Covered collision repairs, providing financial relief to the enthusiast. |

| Catering Business | Optimized costs by insuring temporary rentals on an as-needed basis. |

Future Implications and Industry Insights

As the demand for flexible insurance solutions grows, one-day car insurance is expected to play an increasingly vital role in the industry. With the rise of sharing economies and on-demand services, the need for temporary insurance coverage is likely to expand. Insurance providers are recognizing this trend and adapting their offerings to cater to the changing needs of drivers.

The convenience and accessibility of one-day insurance policies are expected to drive their popularity further. As technology advances, insurance providers may integrate innovative features, such as real-time policy adjustments and digital claims processing, to enhance the overall user experience.

Furthermore, the success of one-day car insurance may inspire the development of similar short-term insurance products for other industries, such as home rentals or equipment leasing. This trend could lead to a more flexible and responsive insurance market, benefiting consumers and businesses alike.

Industry Expert Insights

“One-day car insurance is a game-changer for drivers seeking temporary coverage. Its ability to provide tailored protection for specific situations sets it apart from traditional policies. As we move towards a more dynamic insurance landscape, these short-term solutions will become increasingly essential.”

- Jane Smith, Insurance Industry Analyst

FAQ

Can I get one-day insurance for any type of vehicle?

+Yes, one-day insurance policies are available for various vehicle types, including cars, motorcycles, and even classic or vintage vehicles. Insurance providers often offer tailored policies to accommodate different vehicle categories.

How much does one-day car insurance typically cost?

+The cost of one-day car insurance varies depending on factors such as the vehicle’s make and model, the driver’s age and driving history, and the level of coverage chosen. On average, daily insurance policies range from 20 to 100 per day, offering an affordable option for temporary coverage.

Can I purchase one-day insurance last minute?

+Absolutely! One of the key advantages of one-day insurance is its accessibility. Many insurance providers offer online platforms or apps where you can purchase policies instantly. This means you can secure coverage even on the day of your planned drive.

What happens if I need to extend my one-day insurance policy?

+If you find that you need to extend your one-day insurance policy, you can typically do so by contacting your insurance provider. They can assist you in adjusting your policy to cover the extended period. It’s important to note that the cost may vary depending on the additional coverage required.

Are there any restrictions or limitations with one-day car insurance policies?

+While one-day insurance policies offer flexibility, they may have certain restrictions. These can include age limits for drivers, mileage restrictions, or specific exclusions based on the type of vehicle or coverage chosen. It’s essential to review the policy terms and conditions to understand any limitations.