6 Month Renters Insurance

Renters insurance is a vital protection for individuals who rent their living spaces, offering coverage for personal belongings, liability, and additional living expenses in the event of unforeseen circumstances. This comprehensive guide delves into the intricacies of 6-month renters insurance, exploring its benefits, coverage options, and how it can provide peace of mind to renters.

Understanding 6-Month Renters Insurance

Renters insurance, also known as tenants insurance, is a type of property insurance designed specifically for individuals who rent apartments, condos, or houses. Unlike homeowners insurance, which covers the structure and its contents, renters insurance focuses on the personal property and liability of the insured. A 6-month policy is a flexible option, offering coverage for a shorter term, which can be especially beneficial for those with changing living situations or those who prefer more frequent policy reviews.

Key Benefits of 6-Month Renters Insurance

One of the primary advantages of a 6-month renters insurance policy is its flexibility. It allows renters to tailor their coverage to their specific needs, especially if their circumstances are likely to change in the near future. For instance, students who move frequently or individuals in transitional living situations may find this shorter-term option more suitable.

Moreover, 6-month policies often provide a cost-effective solution. Renters can assess their coverage needs more regularly, ensuring they're not overpaying for unnecessary coverage. This is particularly beneficial for those who may have made significant changes to their personal property or living situation during the policy term.

Coverage Options

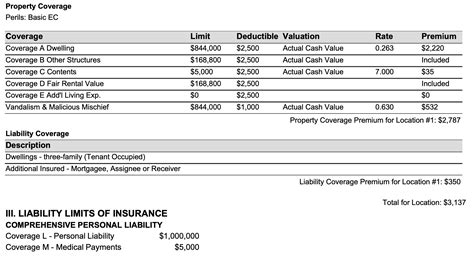

Renters insurance typically offers a range of coverage options, allowing policyholders to customize their plans based on their specific needs. Here’s a breakdown of some key coverage areas:

- Personal Property Coverage: This covers the policyholder's belongings, including furniture, electronics, clothing, and other personal items. It protects against damage or loss due to covered perils such as fire, theft, or natural disasters.

- Liability Coverage: Provides protection in the event the policyholder is sued for bodily injury or property damage to others. This coverage can help cover legal fees and any settlements or judgments up to the policy limit.

- Additional Living Expenses: If a policyholder's home becomes uninhabitable due to a covered loss, this coverage helps pay for temporary living expenses, such as hotel stays or additional food costs.

- Medical Payments: Covers reasonable medical expenses for injuries sustained by guests on the policyholder's property, regardless of liability.

- Personal Liability: Extends beyond the policyholder's rental unit, covering incidents that occur away from home.

It's important to note that specific coverage options and limits may vary depending on the insurer and the policy chosen. Policyholders should carefully review their options and choose coverage that aligns with their individual needs.

How to Choose the Right 6-Month Renters Insurance Policy

Selecting the appropriate 6-month renters insurance policy involves several considerations. Here are some steps to guide you through the process:

- Assess Your Valuables: Begin by evaluating the value of your personal belongings. Consider the cost of replacing items like furniture, electronics, and clothing. This will help you determine the appropriate coverage limit for your policy.

- Understand Your Liability Risks: Evaluate the potential risks associated with your rental situation. For instance, do you have frequent guests over, or do you own pets that could cause damage or injury to others? These factors can influence your liability coverage needs.

- Review Policy Exclusions: Every policy has exclusions, which are specific events or situations that are not covered. Ensure you understand what's excluded from your policy to avoid any surprises.

- Compare Quotes: Obtain quotes from multiple insurers to compare prices and coverage options. Don't just focus on the premium; ensure you're getting the right coverage for your needs.

- Read the Policy: Before committing to a policy, take the time to read through the fine print. This ensures you fully understand the terms and conditions, as well as any potential loopholes or limitations.

Performance Analysis: A Case Study

To better understand the effectiveness of 6-month renters insurance, let’s consider a hypothetical case study. Imagine a young professional, Sarah, who recently moved into a new apartment. She opted for a 6-month renters insurance policy to cover her personal belongings and liability.

During her first month in the new apartment, Sarah experienced a small kitchen fire due to a faulty electrical outlet. Thankfully, her renters insurance policy covered the cost of repairing the damaged outlet and replacing her ruined kitchen appliances. The policy also provided additional living expenses coverage, allowing Sarah to stay in a hotel while her apartment was being repaired.

Without renters insurance, Sarah would have had to pay for these expenses out of pocket, potentially incurring significant financial hardship. Instead, her 6-month policy provided the necessary coverage, offering her peace of mind and financial protection during a stressful time.

Future Implications and Trends

The demand for flexible insurance options like 6-month renters insurance is likely to increase as more individuals prioritize short-term commitments and flexibility in their living situations. This trend is particularly evident among younger generations, such as millennials and Gen Z, who are more likely to rent and move frequently.

Furthermore, the ongoing digital transformation in the insurance industry is making it easier for renters to compare policies and purchase coverage online. This shift towards digital insurance services is expected to continue, offering policyholders greater convenience and control over their insurance needs.

As the insurance market adapts to these changing dynamics, insurers will need to focus on providing tailored, flexible policies that meet the unique needs of renters. This may involve offering more customizable coverage options, introducing innovative digital tools for policy management, and providing educational resources to help renters understand their coverage.

Conclusion

6-month renters insurance offers a flexible, cost-effective solution for individuals who rent their living spaces. By understanding the coverage options and carefully selecting a policy that aligns with their needs, renters can protect their belongings, liability, and peace of mind. As the insurance landscape continues to evolve, renters insurance will play a crucial role in providing financial security and peace of mind to a growing segment of the population.

How much does 6-month renters insurance typically cost?

+

The cost of 6-month renters insurance can vary based on factors such as the location, the value of your belongings, and the level of coverage you choose. On average, you can expect to pay between 100 to 300 for a 6-month policy, but this can go up or down depending on your specific circumstances.

Can I extend my 6-month renters insurance policy if I decide to stay in the same rental for longer?

+

Absolutely! Most insurance providers offer the option to extend your policy for a longer term, typically on a month-to-month basis or for a full year. It’s a good idea to review your coverage needs and consider extending your policy if you plan to stay in your rental for an extended period.

What happens if I need to file a claim during my 6-month policy period but my policy expires before the claim is settled?

+

If you file a claim during your 6-month policy period and your policy expires before the claim is settled, the claim will typically be honored by your insurance provider. It’s important to notify your insurer as soon as possible to ensure your claim is processed efficiently.

Are there any discounts available for 6-month renters insurance policies?

+

Yes, many insurance providers offer discounts for renters insurance policies, including multi-policy discounts if you bundle your renters insurance with other policies like auto insurance. You may also qualify for discounts based on your rental’s security features or your membership in certain organizations.