Aaa Car Insurance Number

Welcome to a comprehensive exploration of the AAA Car Insurance Number, a unique identifier associated with one of the most trusted and renowned insurance providers in the United States. In this article, we delve into the significance of this number, its role in the insurance process, and how it impacts policyholders and their coverage. As we navigate through the intricate world of automotive insurance, we aim to provide an in-depth understanding of this essential aspect of AAA's services.

The AAA Car Insurance Number: An Overview

At its core, the AAA Car Insurance Number is a distinctive numerical code assigned to each policyholder by the American Automobile Association (AAA). This number serves as a critical identifier, allowing AAA to manage and administer the vast array of insurance policies it offers to its members. With a long-standing reputation for excellence and a commitment to providing comprehensive coverage, AAA has become a go-to choice for millions of drivers across the nation.

The AAA Car Insurance Number is not merely a random sequence of digits; it is a strategically designed system that facilitates efficient policy management. Each digit within the number holds a specific meaning, enabling AAA to quickly access and process policy information. This number is a vital tool for both the insurer and the insured, ensuring a smooth and transparent insurance experience.

The Structure and Meaning of the AAA Car Insurance Number

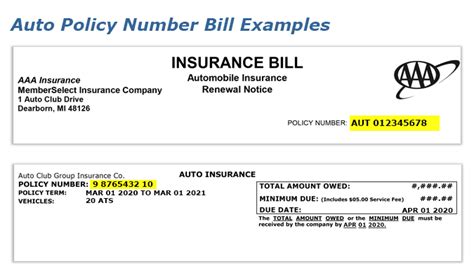

The AAA Car Insurance Number typically consists of a combination of digits and letters, arranged in a specific format. While the exact structure may vary based on regional offices and policy types, the general pattern remains consistent. Here’s a breakdown of the typical components:

| Section | Description |

|---|---|

| Prefix | This section often denotes the type of insurance and may include letters or special characters. For instance, "AAAC" might indicate car insurance, while "AAAH" could signify home insurance. |

| Policy Number | A unique sequence of digits that identifies the individual policy. This number is crucial for policy administration and is often used in communication between AAA and its members. |

| Suffix | Some AAA Car Insurance Numbers may include a suffix, which could provide additional information, such as the policyholder's state or region. This helps AAA efficiently manage policies across its vast network of local clubs. |

Understanding the structure of the AAA Car Insurance Number is essential for policyholders, as it empowers them to quickly identify and reference their policy in various scenarios, from making claims to updating their coverage.

Obtaining and Utilizing Your AAA Car Insurance Number

Upon purchasing a car insurance policy from AAA, you will receive your AAA Car Insurance Number either via email, postal mail, or through your online account. It is essential to keep this number safe and easily accessible, as it is a key identifier for your policy.

The AAA Car Insurance Number is integral to various insurance processes, including:

- Making Claims: When an incident occurs, you will need to provide your AAA Car Insurance Number to initiate the claims process. This number helps AAA locate your policy and process your claim efficiently.

- Policy Updates: Whether you're adding a new vehicle to your policy, changing your coverage, or updating your personal information, your AAA Car Insurance Number is a vital reference point.

- Customer Service: When contacting AAA's customer support, having your Car Insurance Number ready ensures a faster and more accurate service, as it allows representatives to quickly access your policy details.

AAA provides its members with user-friendly online platforms and mobile apps where they can easily access and manage their policies. These digital tools often display the Car Insurance Number prominently, making it convenient for policyholders to reference it whenever needed.

The Benefits of AAA’s Car Insurance Services

Choosing AAA for your car insurance needs comes with a range of advantages. AAA is renowned for its comprehensive coverage options, tailored to meet the diverse needs of its members. From basic liability coverage to more extensive plans that include roadside assistance and rental car benefits, AAA offers a suite of customizable policies to suit different driving habits and budgets.

AAA's expertise in the automotive industry is a significant benefit. The organization has a deep understanding of the unique challenges and risks associated with driving, allowing it to design insurance policies that provide robust protection for its members. Additionally, AAA's extensive network of local clubs ensures that policyholders receive personalized service and support, catering to their specific regional needs.

Furthermore, AAA's commitment to customer satisfaction is evident in its highly responsive claims process. Policyholders can expect timely assistance and efficient claim resolutions, minimizing the stress and inconvenience associated with accidents or vehicle damage.

A Closer Look at AAA’s Car Insurance Coverage Options

AAA offers a variety of car insurance coverage types to cater to different driver profiles and preferences. Here’s a glimpse into some of the key coverage options:

| Coverage Type | Description |

|---|---|

| Liability Coverage | This is the minimum required coverage in most states. It provides protection in the event you cause an accident, covering the costs of injuries or property damage sustained by others. |

| Collision Coverage | Optional coverage that pays for repairs or replacements if your vehicle is damaged in an accident, regardless of fault. |

| Comprehensive Coverage | Covers non-accident-related damages, such as theft, vandalism, or natural disasters. This type of coverage is crucial for protecting your vehicle against unforeseen events. |

| Personal Injury Protection (PIP) | Offers medical coverage for you and your passengers, regardless of fault, and can also cover lost wages and other related expenses. |

| Uninsured/Underinsured Motorist Coverage | Protects you in the event of an accident with a driver who does not have sufficient insurance coverage. |

AAA allows policyholders to customize their coverage based on their specific needs and budget. Whether you're a cautious driver looking for basic protection or an avid traveler requiring more comprehensive coverage, AAA has a plan tailored for you.

AAA’s Approach to Claims and Customer Service

AAA’s dedication to customer satisfaction extends beyond its insurance offerings. The organization prides itself on its exceptional claims handling and customer service practices. When policyholders need to make a claim, AAA’s experienced claims adjusters guide them through the process, ensuring a seamless and stress-free experience.

AAA's claims process is designed for efficiency, leveraging technology to streamline the assessment and resolution of claims. Policyholders can expect timely updates and clear communication throughout the process. AAA's goal is to minimize the impact of accidents or vehicle damage, allowing policyholders to get back on the road as quickly and safely as possible.

In addition to its claims expertise, AAA offers a range of customer service channels to cater to different preferences. Policyholders can reach out via phone, email, or live chat, ensuring they always have access to the support they need. AAA's dedicated customer service teams are known for their friendly and knowledgeable approach, making insurance-related interactions a pleasant experience.

The Impact of Technology on AAA’s Claims Process

AAA has embraced technology to modernize and enhance its claims process. By leveraging digital tools and platforms, AAA has made it easier and more convenient for policyholders to initiate and track their claims. Here are some key ways technology has improved AAA’s claims handling:

- Online Claim Submission: Policyholders can now initiate claims directly through AAA's website or mobile app, providing convenience and speed.

- Real-Time Claim Tracking: AAA's digital platforms offer real-time updates on the status of claims, allowing policyholders to stay informed without the need for frequent follow-ups.

- Digital Documentation: Policyholders can submit photos and videos of the accident scene and vehicle damage, enabling AAA to assess claims more efficiently.

- AI-Assisted Claim Processing: AAA utilizes artificial intelligence to analyze and process claims data, further expediting the claims resolution process.

Through these technological advancements, AAA has not only enhanced its operational efficiency but also improved the overall customer experience, making the claims process less daunting and more accessible.

The Future of AAA’s Car Insurance Services

As the automotive industry continues to evolve, AAA is committed to staying at the forefront of innovation in insurance services. The organization is actively exploring new technologies and coverage options to meet the changing needs of its members. Here’s a glimpse into AAA’s vision for the future of car insurance:

Autonomous Vehicles and Insurance

With the rise of autonomous vehicles, AAA recognizes the need for innovative insurance solutions. The organization is actively researching and developing coverage options that address the unique risks and benefits associated with self-driving cars. AAA aims to provide its members with comprehensive protection, even as driving technology advances.

Telematics and Usage-Based Insurance

AAA is exploring telematics technology to offer usage-based insurance options. This approach allows policyholders to tailor their coverage based on their actual driving behavior, potentially leading to more affordable premiums for safe drivers. AAA’s goal is to incentivize safe driving practices and provide members with insurance that aligns with their individual needs.

Enhanced Digital Services

AAA understands the importance of convenient and accessible digital services. The organization is continuously upgrading its online platforms and mobile apps to provide members with a seamless experience. From policy management to claims initiation, AAA aims to make insurance-related tasks as user-friendly and efficient as possible.

As AAA navigates the future of car insurance, its focus remains on delivering exceptional service and meeting the evolving needs of its members. By embracing innovation and staying connected to the automotive industry, AAA ensures that its insurance offerings remain relevant and beneficial for generations to come.

How can I find my AAA Car Insurance Number if I’ve misplaced it?

+If you’ve lost your AAA Car Insurance Number, you can easily retrieve it by logging into your AAA account online or through the AAA mobile app. Alternatively, you can contact AAA’s customer service, and a representative will assist you in locating your policy details, including your insurance number.

Can I change my AAA Car Insurance Number if I prefer a different one?

+No, AAA assigns a unique Car Insurance Number to each policy, and it is not possible to change it. This number is an essential identifier for your policy and is used for administrative purposes. It is recommended to keep this number safe and easily accessible for future reference.

What should I do if I suspect my AAA Car Insurance Number has been compromised?

+If you have concerns about the security of your AAA Car Insurance Number, it’s crucial to take immediate action. Contact AAA’s customer service as soon as possible to report the issue. They will guide you through the necessary steps to protect your policy and ensure your information remains secure.