Aaa Florida Auto Insurance

Understanding Florida auto insurance is crucial for residents and visitors alike, as it forms the backbone of financial protection and legal compliance for drivers in the Sunshine State. With its unique no-fault system and a range of coverage options, Florida's auto insurance landscape offers both challenges and opportunities for policyholders.

Navigating Florida’s Auto Insurance Landscape

Florida’s auto insurance market is distinct, characterized by a no-fault insurance system that requires drivers to carry personal injury protection (PIP) coverage. This mandatory coverage ensures that drivers can access medical benefits after an accident, regardless of fault. However, the intricacies of Florida’s auto insurance go beyond this basic requirement, offering a range of coverage options and considerations that drivers must navigate.

The Foundation: Personal Injury Protection (PIP)

Personal Injury Protection is the cornerstone of Florida auto insurance. It provides coverage for medical expenses, lost wages, and other related costs after an accident. PIP coverage is mandatory for all registered vehicles in Florida, with a minimum requirement of $10,000 in benefits. This coverage ensures that drivers can access immediate medical care without waiting for liability determinations.

However, the PIP system in Florida has its complexities. For instance, while PIP covers 80% of medical expenses, it only pays 60% of lost wages, up to a certain limit. Additionally, PIP benefits can be offset by any other health insurance coverage, which means drivers might not receive the full $10,000 in benefits if they have comprehensive health insurance plans.

| PIP Coverage | Description |

|---|---|

| Medical Benefits | Covers 80% of medical expenses, up to the policy limit. |

| Lost Wages | Pays 60% of lost income, with a maximum benefit limit. |

| Death Benefits | Provides a death benefit to the policyholder's estate in case of a fatal accident. |

Beyond PIP: Exploring Optional Coverage

While PIP is a mandatory requirement, Florida drivers have the flexibility to choose additional coverage options to tailor their auto insurance policies to their specific needs. These optional coverages include:

- Bodily Injury Liability (BIL): This coverage protects you if you cause an accident that results in injuries to others. It covers medical expenses, pain and suffering, and other related costs. BIL is not mandatory in Florida but is highly recommended to protect your assets.

- Property Damage Liability (PDL): Similar to BIL, PDL covers the cost of damage you cause to others' property, such as vehicles, buildings, or personal belongings. It is also not mandatory but provides crucial financial protection.

- Uninsured/Underinsured Motorist Coverage: In Florida, this coverage is optional but highly valuable. It protects you if you're involved in an accident with a driver who doesn't have enough insurance to cover your damages. It ensures you're not left paying out of pocket for expenses that should be covered by the at-fault driver's insurance.

- Collision and Comprehensive Coverage: These coverages are essential for protecting your vehicle. Collision coverage pays for damages to your vehicle in an accident, while comprehensive coverage covers damages from non-collision events like theft, vandalism, or natural disasters.

Factors Influencing Auto Insurance Rates

Auto insurance rates in Florida are influenced by various factors, including:

- Location: Insurance rates can vary significantly depending on where you live. Urban areas often have higher rates due to increased traffic and the potential for accidents and theft.

- Driving Record: Your driving history plays a crucial role in determining your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums, while a history of accidents or moving violations can increase your rates.

- Vehicle Type: The make, model, and year of your vehicle can impact your insurance rates. Sports cars and luxury vehicles often have higher premiums due to their performance capabilities and higher repair costs.

- Credit Score: In Florida, insurance companies are allowed to use your credit score as a factor in determining your rates. A good credit score can lead to lower premiums, while a poor credit score can result in higher costs.

Tips for Choosing the Right Auto Insurance

Navigating Florida’s auto insurance landscape can be complex, but here are some tips to help you choose the right coverage:

- Understand Your Needs: Assess your specific needs and the risks you face on the road. Consider factors like your daily commute, the value of your vehicle, and your personal financial situation.

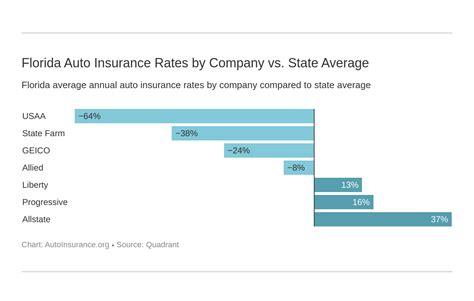

- Compare Quotes: Shop around and compare quotes from multiple insurers. Florida's competitive insurance market means rates can vary significantly between companies.

- Bundle Policies: If you have multiple insurance needs, consider bundling your auto insurance with other policies like homeowners or renters insurance. Bundling can often lead to significant savings.

- Review Your Coverage Regularly: Life circumstances and insurance needs can change. Review your coverage annually to ensure it aligns with your current situation and consider adjusting your policy accordingly.

The Future of Auto Insurance in Florida

Florida’s auto insurance landscape is evolving, with a growing focus on technology and data-driven solutions. The state’s regulatory environment is also in flux, with potential changes to the no-fault system on the horizon. These developments could impact the cost and availability of auto insurance, making it even more crucial for drivers to stay informed and adapt their coverage as needed.

The Rise of Telematics and Usage-Based Insurance

Telematics technology, which tracks driving behavior and habits, is gaining traction in Florida’s auto insurance market. Usage-Based Insurance (UBI) programs, which use telematics data to calculate insurance premiums, offer a more personalized approach to pricing. These programs reward safe driving habits with lower premiums, providing an incentive for drivers to improve their road safety.

| Telematics and UBI Benefits | Description |

|---|---|

| Safe Driving Rewards | Drivers who maintain safe driving habits can qualify for lower insurance rates. |

| Real-Time Feedback | Telematics devices provide drivers with real-time feedback on their driving behavior, helping them improve and stay safe on the road. |

| Data-Driven Pricing | UBI programs use data to accurately assess risk, leading to more fair and accurate insurance premiums. |

Potential Changes to the No-Fault System

Florida’s no-fault insurance system has been a subject of debate and potential reform. Some proposals suggest moving away from a pure no-fault system to a more traditional liability-based system, similar to many other states. This shift could impact the cost and coverage options available to Florida drivers, potentially increasing the importance of optional coverage choices.

The Impact of Autonomous Vehicles

The rise of autonomous and semi-autonomous vehicles is another factor shaping the future of auto insurance in Florida. As these vehicles become more prevalent, insurance companies will need to adapt their policies to account for the unique risks and benefits associated with this technology. This could lead to new coverage options and potentially lower insurance costs as autonomous vehicles are generally safer than traditional vehicles.

Conclusion

Florida’s auto insurance landscape is a complex but essential aspect of driving in the state. Understanding the mandatory and optional coverage options, as well as the factors influencing rates, is crucial for making informed decisions about your insurance coverage. As the market evolves with technological advancements and regulatory changes, staying informed and adaptable will be key to navigating Florida’s auto insurance landscape successfully.

How often should I review my auto insurance policy?

+It’s a good practice to review your auto insurance policy annually, or whenever your circumstances change significantly. This ensures that your coverage remains adequate and up-to-date with your needs.

What is the average cost of auto insurance in Florida?

+The average cost of auto insurance in Florida varies widely based on several factors, including location, driving record, and the coverage chosen. On average, drivers in Florida pay around 1,500 to 2,000 annually for auto insurance, but rates can be significantly higher or lower depending on individual circumstances.

Can I get auto insurance if I have a poor credit score?

+Yes, you can still obtain auto insurance with a poor credit score, but it may result in higher premiums. Some insurance companies offer programs or discounts specifically for drivers with less-than-perfect credit, so it’s worth shopping around to find the best rates.