Aarp Insurance Quotes Auto

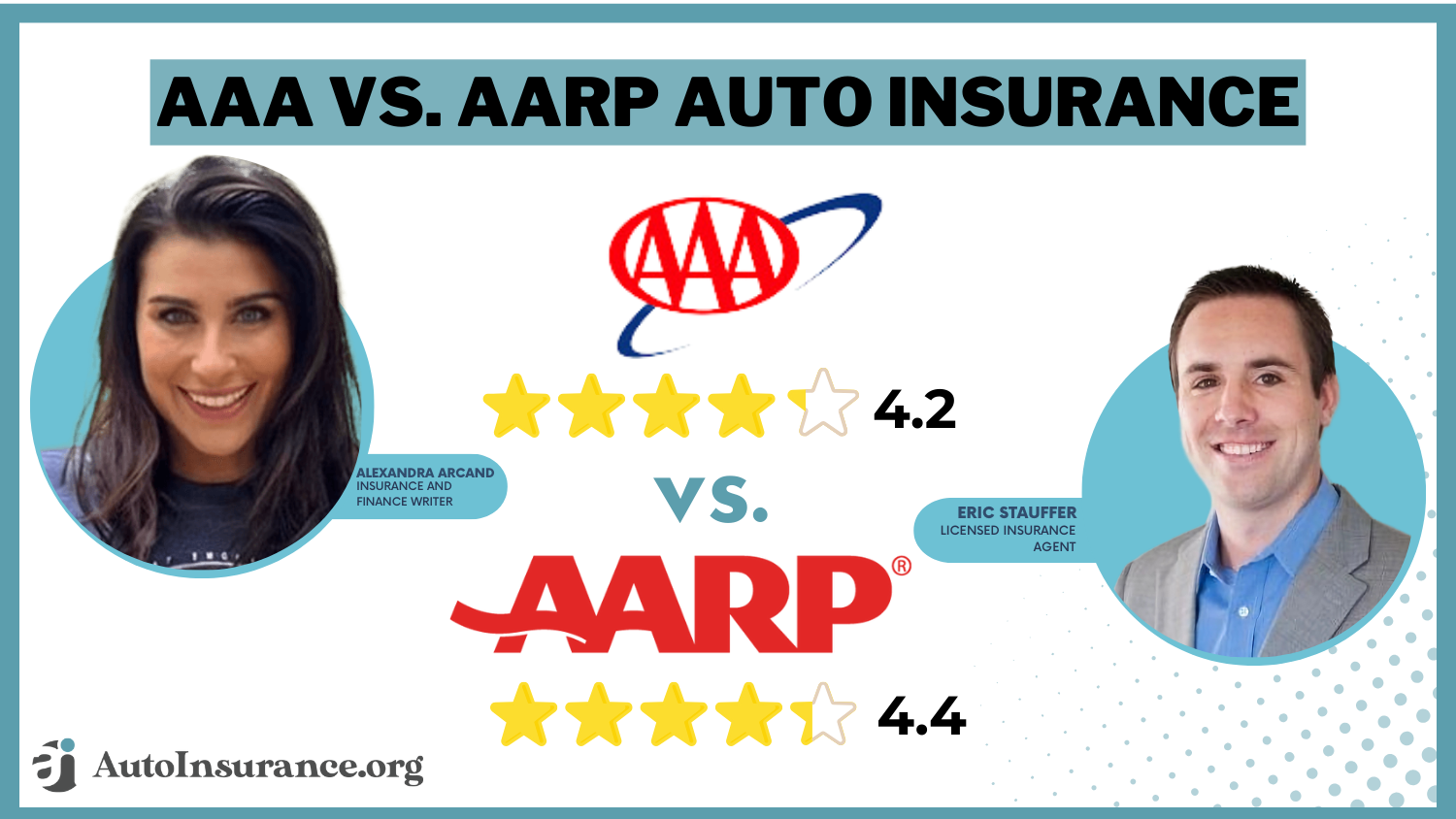

Welcome to a comprehensive guide on AARP auto insurance quotes, designed to help you understand the ins and outs of this insurance option and make an informed decision about your coverage. As one of the leading providers of insurance services for older adults, AARP offers a range of competitive policies, and we'll delve into the specifics to ensure you get the best value for your needs.

Understanding AARP Auto Insurance

AARP, or the American Association of Retired Persons, is a nonprofit organization that focuses on enhancing the quality of life for people aged 50 and above. A key aspect of this is their partnership with various insurance companies to offer exclusive rates and benefits to AARP members.

When it comes to auto insurance, AARP works with The Hartford and Foremost to provide a range of coverage options. These policies are tailored to meet the unique needs of older drivers, offering comprehensive protection at competitive rates.

Key Features of AARP Auto Insurance

- Accident Forgiveness: AARP’s auto insurance policies often include this feature, which means your rates won’t increase after your first at-fault accident, provided you haven’t had an accident in the past three to five years.

- New Car Replacement: In the event of a total loss within the first year of ownership, AARP’s insurance may cover the cost of a new vehicle, ensuring you’re not left out of pocket.

- Discounts: Members can enjoy a range of discounts, including multi-policy discounts, safe driver discounts, and vehicle safety discounts for cars equipped with anti-theft devices or advanced safety features.

- Roadside Assistance: AARP’s roadside assistance program provides 24⁄7 help for a variety of situations, including flat tires, lockouts, dead batteries, and more.

- Travel Assistance: This benefit offers coverage for trips that are at least 100 miles from home, providing medical expense coverage, trip interruption benefits, and more.

These features, along with the potential for significant savings, make AARP auto insurance an attractive option for many older drivers.

Getting an AARP Auto Insurance Quote

Obtaining an AARP auto insurance quote is straightforward and can be done online or over the phone. The process typically involves providing information about yourself, your vehicle, and your driving history. Here’s a step-by-step guide:

Step 1: Visit the AARP Website

Go to the AARP auto insurance page on their official website. Here, you’ll find detailed information about the coverage options and the benefits of choosing AARP’s auto insurance.

Step 2: Enter Your Information

Fill out the online form with your personal details, including your name, date of birth, address, and contact information. You’ll also need to provide details about your vehicle, such as make, model, year, and mileage.

Step 3: Provide Driving History

Disclose your driving history, including any accidents, tickets, or claims you’ve made in the past few years. This information is crucial for an accurate quote.

Step 4: Receive Your Quote

Once you’ve provided all the necessary details, you’ll receive a personalized quote. This quote will detail the coverage options, the premium amount, and any applicable discounts.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Covers bodily injury and property damage if you're at fault in an accident. |

| Collision Coverage | Pays for damage to your vehicle after a collision, regardless of fault. |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision incidents, such as theft, fire, or natural disasters. |

| Uninsured/Underinsured Motorist Coverage | Protects you if you're involved in an accident with a driver who doesn't have enough insurance to cover the damages. |

Factors Affecting Your AARP Auto Insurance Quote

Several factors influence the cost of your AARP auto insurance quote. Understanding these factors can help you manage your expectations and potentially reduce your premium.

Vehicle Type

The make, model, and year of your vehicle play a significant role in determining your insurance rates. Generally, newer, more expensive vehicles will have higher premiums due to the cost of repairs and replacement parts.

Driving History

Your driving record is a critical factor in insurance pricing. A clean driving record with no accidents or violations in the past few years can lead to significant savings. Conversely, a history of accidents or traffic violations may result in higher premiums.

Coverage Options

The level of coverage you choose will directly impact your premium. Higher coverage limits typically result in higher premiums, while lower limits can reduce your costs.

Discounts

AARP members can take advantage of a variety of discounts, including:

- Multi-Policy Discount: Bundling your auto insurance with other policies, such as home or life insurance, can lead to savings.

- Safe Driver Discount: Maintaining a clean driving record for a certain period may qualify you for this discount.

- Vehicle Safety Discount: Vehicles equipped with advanced safety features or anti-theft devices may be eligible for this discount.

- Retired Status Discount: Being retired and driving fewer miles can result in lower premiums.

Benefits of Choosing AARP Auto Insurance

AARP auto insurance offers several advantages, making it a popular choice for older drivers:

Competitive Rates

AARP’s partnership with The Hartford and Foremost often results in competitive rates, especially when you bundle policies or take advantage of available discounts.

Tailored Coverage

The policies are designed with the specific needs of older drivers in mind, offering features like Accident Forgiveness and New Car Replacement.

Excellent Customer Service

AARP’s insurance partners are known for their responsive and efficient customer service, ensuring a smooth claims process.

Additional Benefits

Beyond auto insurance, AARP members can enjoy discounts on a range of services, from hotels and restaurants to prescription drugs and more.

FAQ

Can I get AARP auto insurance if I’m not a member?

+

No, you must be an AARP member to qualify for AARP auto insurance. However, membership is open to anyone over the age of 50, so it’s easy to join and start enjoying the benefits.

What is the process for filing a claim with AARP auto insurance?

+

Filing a claim is straightforward. You can report a claim online, over the phone, or via the mobile app. The claims team will guide you through the process, ensuring a smooth and efficient resolution.

Are there any age restrictions for AARP auto insurance?

+

While AARP caters to older adults, there are no specific age restrictions for auto insurance. However, the policies and rates are designed with the needs and driving patterns of older drivers in mind.