Aarp Life Insurance Coverage

The topic of AARP Life Insurance Coverage is an important one, offering financial security and peace of mind to millions of Americans. AARP, or the American Association of Retired Persons, is a well-known organization that provides a wide range of services and benefits to its members, including access to life insurance plans tailored specifically for seniors. In this article, we will delve into the various aspects of AARP life insurance, exploring its coverage options, benefits, and how it can be a valuable tool for retirement planning.

Understanding AARP Life Insurance Coverage

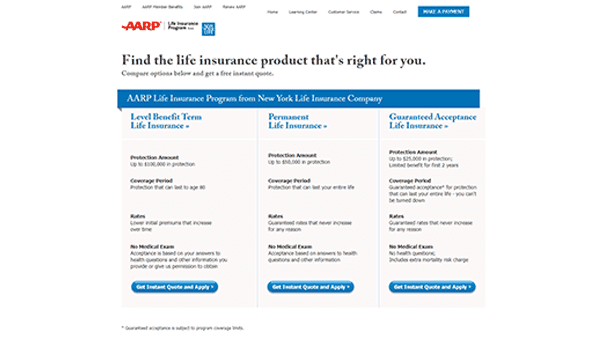

AARP Life Insurance Coverage is a collection of insurance products designed to cater to the unique needs of individuals aged 50 and above. These policies are underwritten by New York Life Insurance Company, one of the largest and most reputable insurance providers in the United States. AARP members have the advantage of accessing these plans at competitive rates, often with additional perks and discounts.

The primary objective of AARP life insurance is to provide financial protection for your loved ones, ensuring they receive a guaranteed death benefit upon your passing. This benefit can help cover a wide range of expenses, including funeral costs, outstanding debts, and even provide ongoing financial support for your family.

Coverage Options and Flexibility

AARP offers a comprehensive suite of life insurance policies to meet diverse needs and budgets. The two primary types of coverage available are:

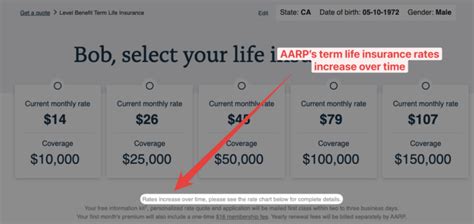

- Term Life Insurance: This type of coverage provides protection for a specific period, typically ranging from 10 to 30 years. It is ideal for individuals who seek coverage for a defined timeframe, such as until their children become independent or to cover a mortgage.

- Whole Life Insurance: Whole life policies offer permanent coverage for your entire life, as long as premiums are paid. They also accumulate cash value over time, which can be borrowed against or withdrawn, providing additional financial flexibility.

Both types of policies come with various options to customize your coverage. For instance, you can choose the death benefit amount, the term length for term life insurance, and add optional riders to enhance your policy. Some common riders include accelerated death benefits for terminal illnesses, waiver of premium for disability, and child riders that provide a small death benefit for your children.

| Coverage Type | Benefits |

|---|---|

| Term Life Insurance |

|

| Whole Life Insurance |

|

The Benefits of AARP Life Insurance

Choosing AARP life insurance brings several advantages, including:

Competitive Rates and Discounts

As an AARP member, you gain access to exclusive rates and discounts on life insurance policies. These savings can be significant, especially when compared to other providers. Additionally, AARP often offers special promotions and discounts, further reducing the cost of coverage.

Customizable Coverage

AARP life insurance policies are highly customizable, allowing you to tailor your coverage to your specific needs. Whether you require a large death benefit or are more interested in building cash value, there are options to suit your preferences.

Simple Application Process

Applying for AARP life insurance is straightforward and convenient. The application can often be completed online, and many policies do not require a medical exam. This streamlined process ensures a quick and hassle-free experience, making it an attractive option for those seeking efficient coverage.

Reliable Underwriting

AARP life insurance policies are underwritten by New York Life Insurance Company, a trusted name in the industry. With a long history of financial stability and strong customer satisfaction ratings, you can be confident that your policy will be backed by a reliable and reputable insurer.

Performance and Financial Strength

When considering life insurance, it’s crucial to assess the financial strength and performance of the insurance provider. New York Life Insurance Company, the underwriter of AARP life insurance policies, has consistently demonstrated exceptional financial health and stability.

According to leading rating agencies, New York Life Insurance Company holds the highest financial strength ratings, including an A++ (Superior) rating from A.M. Best and an AA+ rating from Standard & Poor's. These ratings reflect the company's strong capital position, excellent risk management practices, and a long-standing commitment to financial stability.

In addition to its robust financial standing, New York Life Insurance Company is renowned for its exceptional customer service and claim-paying ability. The company has a proven track record of timely and fair claim settlements, ensuring that policyholders and their beneficiaries receive the benefits they are entitled to without undue delays or complications.

Furthermore, the company's investment portfolio is meticulously managed, ensuring the long-term viability of its policies and the security of its policyholders' investments. This commitment to financial prudence and stability has positioned New York Life Insurance Company as one of the most trusted and reliable insurers in the industry, providing added peace of mind to AARP life insurance policyholders.

The Future of AARP Life Insurance

As the needs and preferences of seniors continue to evolve, AARP life insurance is committed to staying at the forefront of innovation. The organization actively monitors market trends and consumer feedback to ensure its policies remain relevant and accessible. With a focus on simplicity, flexibility, and affordability, AARP life insurance is well-positioned to continue serving the unique needs of its members for years to come.

One of the key areas of focus for AARP life insurance is the digital transformation of its services. Recognizing the growing importance of online convenience and accessibility, AARP is investing in technology to enhance the customer experience. This includes streamlining the application process, providing online policy management tools, and offering digital resources for education and support.

Furthermore, AARP life insurance is exploring new product offerings to meet the diverse needs of its members. This may include expanding its range of riders and optional benefits, as well as introducing innovative solutions such as hybrid policies that combine life insurance with long-term care coverage. By staying attuned to the changing landscape of senior financial needs, AARP life insurance aims to provide comprehensive and tailored protection for its members' futures.

Conclusion

AARP life insurance coverage is a valuable tool for seniors looking to secure their financial future and provide for their loved ones. With a range of customizable options, competitive rates, and the backing of a financially strong insurer, AARP life insurance policies offer peace of mind and a sense of security during retirement. Whether you choose term or whole life coverage, AARP’s plans are designed to meet your specific needs and provide the financial protection you deserve.

What is the eligibility criteria for AARP life insurance coverage?

+To be eligible for AARP life insurance, you must be aged 50 or above and a member of AARP. However, certain policies may have additional eligibility criteria, such as health or lifestyle requirements.

Can I convert my AARP term life insurance policy to a whole life policy?

+Yes, AARP offers a conversion option for term life insurance policies. This allows you to convert your term policy to a whole life policy without having to provide evidence of insurability. The conversion option is typically available until a certain age, as specified in your policy.

Are there any health restrictions for AARP life insurance coverage?

+AARP life insurance policies typically have health restrictions, and the eligibility criteria can vary depending on the specific policy and your health condition. Some policies may require a medical exam, while others may have simplified or guaranteed issue options for individuals with certain health conditions.