Aarp Life Insurance Plans

AARP, which stands for the American Association of Retired Persons, is a well-known organization that offers a range of services and benefits to its members. One of its key offerings is the AARP Life Insurance Plans, designed specifically for older adults and their unique needs. These plans provide financial protection and peace of mind during the retirement years.

In this comprehensive guide, we will delve into the world of AARP Life Insurance, exploring its various aspects, benefits, and how it can be a valuable asset for retirees. By understanding the intricacies of these plans, individuals can make informed decisions to secure their financial future and ensure a comfortable retirement.

Understanding AARP Life Insurance Plans

AARP Life Insurance Plans are a collection of insurance products tailored to cater to the diverse needs of retirees and individuals approaching their golden years. These plans are underwritten by New York Life Insurance Company, one of the leading insurance providers in the United States. With AARP’s endorsement, these plans offer a reliable and trusted option for those seeking life insurance coverage.

The primary goal of AARP Life Insurance Plans is to provide financial security and ease the burden on loved ones in the event of the policyholder's passing. These plans offer a range of benefits, including death benefits, cash value accumulation, and, in some cases, the potential for dividends. By investing in an AARP Life Insurance Plan, individuals can ensure their legacy and leave a positive impact on their family and community.

Types of AARP Life Insurance Plans

AARP Life Insurance Plans come in various forms to suit different needs and preferences. Here’s an overview of the primary types:

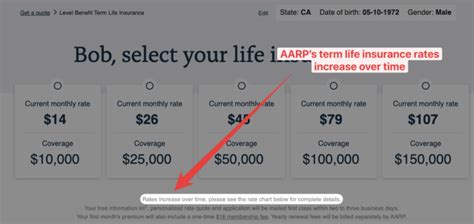

- Term Life Insurance: This plan provides coverage for a specified period, typically ranging from 10 to 30 years. It offers a death benefit to beneficiaries during the term and is often a more affordable option for those seeking temporary coverage.

- Whole Life Insurance: As a permanent life insurance plan, Whole Life offers coverage for the policyholder's entire life. It accumulates cash value over time, which can be borrowed against or withdrawn, providing financial flexibility.

- Guaranteed Acceptance Plan: This plan ensures acceptance for all applicants, regardless of their health status. While it may have higher premiums, it provides peace of mind and coverage for those with pre-existing conditions or health concerns.

- Annulities: AARP also offers annuities, which are financial products designed to provide a steady income stream during retirement. These can be immediate or deferred, offering flexibility in terms of when the income payments begin.

Benefits and Features of AARP Life Insurance Plans

AARP Life Insurance Plans come with a range of advantages and features that make them an attractive option for retirees. Here are some key benefits to consider:

Guaranteed Acceptance

One of the standout features of AARP Life Insurance Plans is the guaranteed acceptance option. This means that individuals can obtain coverage without undergoing a medical exam or providing detailed health information. This is particularly beneficial for those with health concerns or who may have difficulty qualifying for traditional life insurance.

Flexible Coverage Options

AARP Life Insurance Plans offer a variety of coverage amounts to suit different financial needs. Whether an individual requires a smaller policy to cover funeral expenses or a more substantial one to provide long-term financial support for their family, there is a plan to match.

Cash Value Accumulation

Whole Life Insurance plans under the AARP umbrella allow policyholders to build cash value over time. This cash value can serve as a financial reserve, providing access to funds in case of emergencies or for specific financial goals. It offers a level of flexibility and control over one’s retirement finances.

Dividend Potential

Some AARP Life Insurance Plans, particularly Whole Life policies, have the potential to earn dividends. These dividends are based on the insurance company’s performance and can be used to reduce premiums, purchase additional coverage, or receive cash payments. They add an extra layer of financial benefit to the policy.

Simplified Issue Process

For those who prefer a more streamlined application process, AARP offers Simplified Issue plans. These plans require minimal health information and can provide coverage within a shorter timeframe, making it a convenient option for those seeking quick insurance solutions.

| Plan Type | Coverage Period | Key Benefits |

|---|---|---|

| Term Life Insurance | 10-30 years | Affordable coverage, death benefit |

| Whole Life Insurance | Lifetime | Cash value accumulation, potential dividends |

| Guaranteed Acceptance Plan | Varies | Guaranteed acceptance for all applicants |

| Annulities | Varies | Steady income stream during retirement |

Eligibility and Application Process

AARP Life Insurance Plans are open to individuals aged 50 and above. To apply, one must be a member of AARP, which requires an annual fee. The application process is straightforward and can be completed online or over the phone with the assistance of AARP representatives.

During the application, individuals will be asked to provide basic personal and health information. For Whole Life and Term Life plans, a medical exam may be required, but it is typically a simple process that can be completed at home.

Policy Costs and Premiums

The cost of AARP Life Insurance Plans varies depending on the type of plan, coverage amount, and the policyholder’s age and health status. Term Life Insurance tends to be more affordable, while Whole Life and Guaranteed Acceptance plans may have higher premiums due to their comprehensive nature.

It's essential to note that premiums for Whole Life Insurance remain level throughout the policy, providing stability and predictability in retirement planning. AARP representatives can provide personalized quotes to help individuals understand the costs associated with their chosen plan.

Performance and Customer Satisfaction

AARP Life Insurance Plans have a strong reputation for performance and customer satisfaction. New York Life Insurance Company, the underwriter, is known for its financial stability and has consistently received high ratings from independent agencies such as AM Best and Standard & Poor’s.

AARP's commitment to its members' well-being and the simplified application process contribute to a positive customer experience. Many retirees have found these plans to be a reliable source of financial security, providing peace of mind during their retirement years.

Real-Life Testimonials

Here are a few testimonials from satisfied AARP Life Insurance Plan holders:

"I was hesitant to apply for life insurance due to my age and health concerns, but AARP's Guaranteed Acceptance Plan gave me the coverage I needed. It's a relief to know my family is taken care of."

- John, Age 62

"The Whole Life Insurance plan has been a great investment. I've been able to build cash value over the years, and it's given me financial flexibility during retirement."

- Sarah, Age 58

Future Implications and Considerations

As individuals plan for their retirement, considering life insurance is a crucial aspect of financial security. AARP Life Insurance Plans offer a range of options to cater to diverse needs, providing peace of mind and a sense of control over one’s financial future.

While these plans have many benefits, it's essential to evaluate them alongside other retirement strategies. Consulting with financial advisors and exploring additional retirement income sources can help individuals create a comprehensive and well-rounded retirement plan.

Furthermore, staying informed about changes in the insurance market and regularly reviewing one's coverage is crucial. As life circumstances change, updating insurance plans can ensure continued financial protection and adaptability.

Frequently Asked Questions

Can I apply for AARP Life Insurance if I’m not an AARP member?

+No, AARP Life Insurance Plans are exclusively available to AARP members. To apply, one must first become a member by paying the annual membership fee.

What is the maximum coverage amount available for AARP Life Insurance Plans?

+The maximum coverage amount varies depending on the plan and the applicant’s age and health status. Whole Life Insurance plans typically offer higher coverage limits compared to Term Life plans.

Are there any medical exams required for AARP Life Insurance Plans?

+For Whole Life and Term Life plans, a medical exam may be required. However, the Guaranteed Acceptance Plan does not require a medical exam, making it an attractive option for those with health concerns.

Can I cancel my AARP Life Insurance Plan and receive a refund?

+AARP Life Insurance Plans are typically non-refundable. It’s important to carefully consider your coverage needs before applying to avoid unnecessary expenses.

How do I know which AARP Life Insurance Plan is right for me?

+The choice of plan depends on your specific needs and financial goals. Consulting with an AARP representative or a financial advisor can help you assess your options and make an informed decision.

In conclusion, AARP Life Insurance Plans offer a valuable solution for retirees seeking financial protection and peace of mind. With various plan options, guaranteed acceptance, and flexible coverage, individuals can tailor their insurance to their unique circumstances. As a trusted organization, AARP provides a reliable platform for retirees to secure their financial future and ensure a comfortable retirement.