Aarp Medical Insurance Plans

The AARP Medical Insurance Plans: Comprehensive Coverage for a Healthy Future

Aging gracefully is a journey that requires careful planning, and one of the essential aspects of this journey is having the right medical insurance coverage. Enter the AARP Medical Insurance Plans, a suite of health insurance options designed specifically for individuals aged 50 and above, offering a range of benefits tailored to meet their unique healthcare needs.

The AARP Medical Insurance Plans are a collaboration between AARP, a leading advocacy group for older Americans, and various reputable insurance providers. These plans provide an array of options, ensuring that members can find coverage that suits their individual circumstances and preferences.

Understanding the AARP Medical Insurance Plans

The AARP Medical Insurance Plans encompass a variety of coverage types, each with its own set of features and benefits. Here's an overview of the key plans:

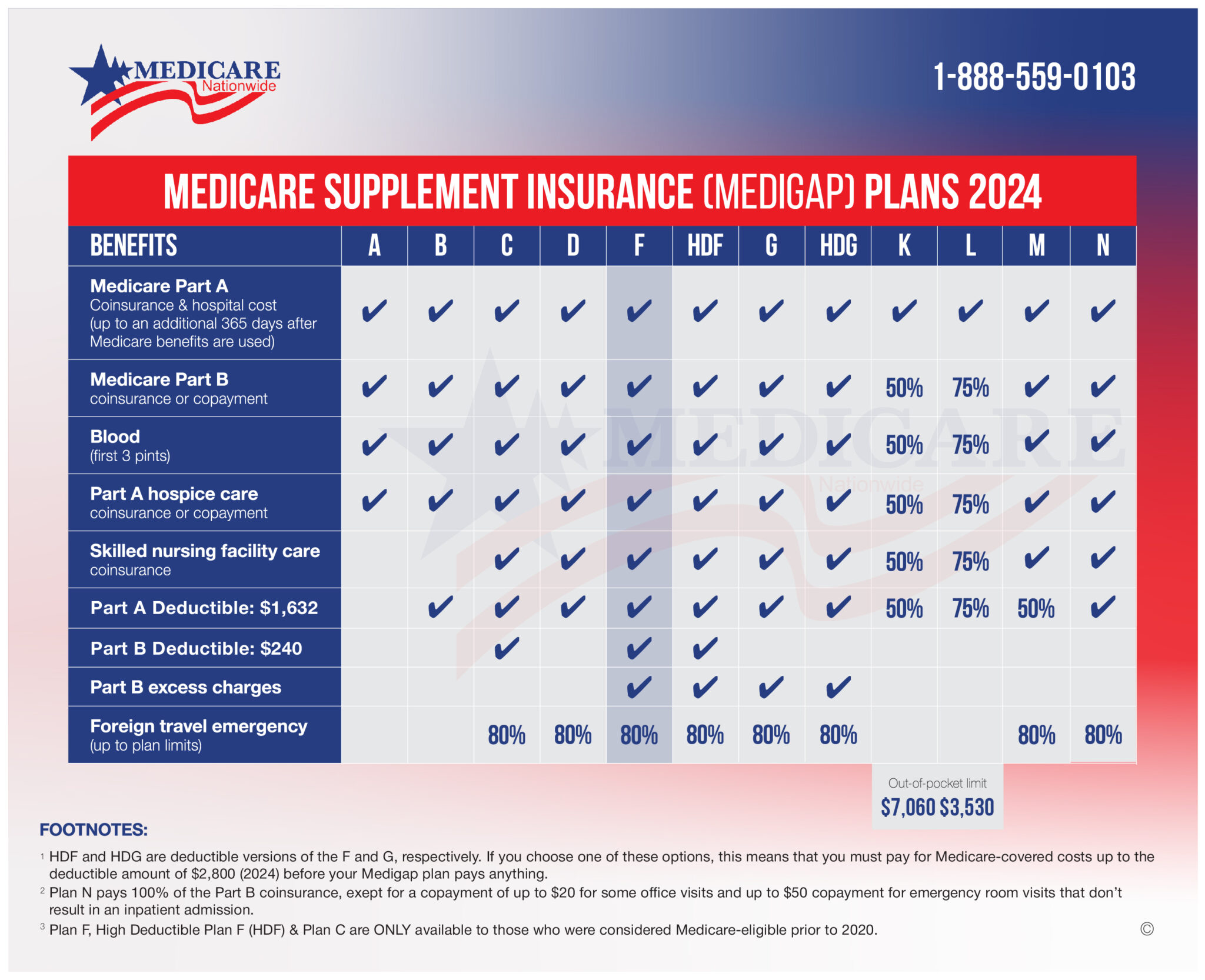

AARP Medicare Supplement Insurance Plans (Medigap)

Medigap plans are designed to supplement Original Medicare (Part A and Part B) coverage, filling in the gaps left by Medicare's standard benefits. These plans can help cover out-of-pocket costs like deductibles, coinsurance, and copayments, providing more comprehensive coverage for AARP members.

| Plan Type | Coverage Highlights |

|---|---|

| Plan A | Basic coverage for deductibles, coinsurance, and hospice care. |

| Plan F | Comprehensive coverage, including Part B excess charges. |

| Plan G | Similar to Plan F but without coverage for Part B deductible. |

| Plan N | Covers Part B coinsurance and some other out-of-pocket costs, but not Part B deductible. |

AARP Medicare Advantage Plans (Part C)

Medicare Advantage plans, also known as Part C, are an alternative to Original Medicare. These plans are offered by private insurance companies and approved by Medicare, providing all the benefits of Original Medicare and often additional coverage for services like vision, hearing, and dental care.

AARP's Medicare Advantage plans offer a range of options, including:

- Health Maintenance Organization (HMO) Plans: These plans typically cover services within a specific network, and members must choose a primary care physician to coordinate their care.

- Preferred Provider Organization (PPO) Plans: PPO plans offer more flexibility, allowing members to see out-of-network providers for a higher cost-share.

- Private Fee-for-Service (PFFS) Plans: In these plans, members can choose any Medicare-approved doctor or hospital, and the insurance company negotiates the cost of services.

- Special Needs Plans (SNPs): Tailored for individuals with specific health conditions or those in institutional care, these plans focus on providing specialized care.

AARP Medicare Prescription Drug Plans (Part D)

Medicare Part D plans are an essential addition to Medicare coverage, as they help cover the cost of prescription medications. AARP offers a variety of Part D plans, ensuring members can find a plan that aligns with their medication needs and budget.

Key features of AARP's Part D plans include:

- Coverage for both brand-name and generic drugs.

- Different tiers of drug coverage, with varying cost-shares for each tier.

- The option to combine Part D coverage with other AARP Medicare plans for a more comprehensive package.

Benefits and Features of AARP Medical Insurance Plans

The AARP Medical Insurance Plans offer a range of advantages, making them a popular choice for older Americans:

Comprehensive Coverage

These plans are designed to provide comprehensive healthcare coverage, ensuring members have access to a wide range of medical services. From routine check-ups and preventative care to specialized treatments and prescription medications, AARP's plans aim to cover all aspects of health.

Flexible Options

With a variety of plan types and coverage levels, AARP's Medical Insurance Plans offer flexibility to suit different needs and preferences. Whether it's a Medigap plan to supplement Original Medicare or a Medicare Advantage plan with additional benefits, there's an option for every member.

Discounts and Savings

AARP members often benefit from exclusive discounts and savings on their insurance plans. These savings can make healthcare more affordable, especially for those on a fixed income.

Access to a Network of Providers

AARP's insurance plans come with access to a network of healthcare providers, ensuring members can find quality care in their area. This network includes doctors, specialists, hospitals, and pharmacies, providing convenience and peace of mind.

Travel Benefits

For those who enjoy traveling, AARP's Medical Insurance Plans often include coverage for medical emergencies while abroad. This ensures that members can receive the care they need, even when they're away from home.

How to Enroll in AARP Medical Insurance Plans

Enrolling in an AARP Medical Insurance Plan is a straightforward process. Here's a step-by-step guide:

- Determine your eligibility: To enroll in an AARP Medical Insurance Plan, you must be 50 years or older and a member of AARP. If you're not a member, you can join by visiting AARP's official website.

- Assess your needs: Consider your current and future healthcare needs. Do you require supplemental coverage for Original Medicare, or would a Medicare Advantage plan be more suitable? Understanding your needs will help you choose the right plan.

- Compare plan options: Explore the various AARP Medical Insurance Plans available in your area. Compare the benefits, costs, and coverage limits to find the plan that best fits your needs.

- Contact AARP: Reach out to AARP's insurance team to discuss your options and enroll in your chosen plan. They can guide you through the enrollment process and answer any questions you may have.

- Review and finalize: Carefully review the plan details, including the summary of benefits and coverage. Ensure that the plan meets your needs and expectations before finalizing your enrollment.

Aging Gracefully with AARP Medical Insurance

As we navigate the journey of aging, having the right medical insurance coverage is crucial. The AARP Medical Insurance Plans offer a comprehensive and flexible approach to healthcare, ensuring that members can access the care they need, when they need it. With a range of plan options, exclusive benefits, and access to a network of providers, these plans provide peace of mind and support for a healthy and fulfilling future.

FAQ

Can I enroll in an AARP Medical Insurance Plan if I’m not a member of AARP?

+

No, you must be a member of AARP to enroll in their medical insurance plans. However, becoming a member is straightforward, and you can easily join by visiting their website or contacting their membership team.

What is the difference between Medigap and Medicare Advantage plans?

+

Medigap plans are designed to supplement Original Medicare, covering out-of-pocket costs like deductibles and coinsurance. Medicare Advantage plans, on the other hand, are an alternative to Original Medicare, offering all its benefits plus additional coverage for services like dental and vision care.

Do AARP Medical Insurance Plans cover pre-existing conditions?

+

Yes, AARP’s Medical Insurance Plans, including Medigap and Medicare Advantage plans, cover pre-existing conditions. However, the specific coverage and waiting periods may vary depending on the plan and your individual circumstances.