Aca Insurance Cost

Aca Insurance Cost is a topic of great interest, particularly in the context of healthcare and financial planning. Understanding the costs associated with ACA (Affordable Care Act) insurance plans is crucial for individuals and families seeking affordable healthcare coverage. This comprehensive guide will delve into the various factors that influence ACA insurance costs, providing valuable insights and practical information to help readers make informed decisions about their healthcare coverage.

Understanding ACA Insurance Costs

The Affordable Care Act, commonly known as Obamacare, revolutionized the healthcare industry by introducing comprehensive health insurance reforms. One of the key aspects of the ACA is the establishment of insurance marketplaces, where individuals and families can shop for and purchase health insurance plans. These marketplaces, often referred to as ACA exchanges, offer a range of insurance options, each with its own set of costs and benefits.

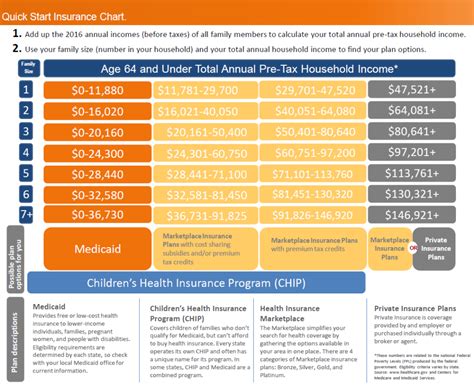

The cost of ACA insurance plans can vary significantly based on several factors. These factors include the specific plan chosen, the level of coverage desired, and the location of the policyholder. Additionally, personal circumstances such as age, income, and family size can also influence the overall cost of insurance.

Factors Affecting ACA Insurance Costs

When considering the cost of ACA insurance, it’s essential to understand the key drivers that impact the price. Here are some of the primary factors that influence ACA insurance costs:

- Plan Type and Level of Coverage: ACA insurance plans are categorized into different metal tiers, such as Bronze, Silver, Gold, and Platinum. Each tier offers a different level of coverage, with Bronze plans typically having higher deductibles and out-of-pocket costs, while Platinum plans provide more comprehensive coverage with lower out-of-pocket expenses. The choice of plan type and coverage level directly affects the insurance premium.

- Location: Insurance costs can vary significantly based on the policyholder's location. Different states and regions have their own healthcare markets, and the cost of insurance can be influenced by local healthcare costs, provider networks, and population demographics. It's important to consider the location-specific factors when comparing insurance plans.

- Age and Family Size: Age is a significant factor in determining insurance costs. Generally, younger individuals pay lower premiums, while older individuals may face higher costs. Additionally, family size plays a role, as family plans often come with additional costs for each dependent. The age and composition of the household can have a substantial impact on the overall insurance expenses.

- Income and Subsidies: The ACA provides financial assistance in the form of subsidies for eligible individuals and families. Income is a critical factor in determining subsidy eligibility. Those with lower incomes may qualify for premium tax credits, which can significantly reduce the cost of insurance. Understanding the income thresholds and subsidy options is essential for optimizing ACA insurance costs.

- Provider Networks and Out-of-Network Costs: ACA insurance plans typically have networks of healthcare providers. The cost of care can vary depending on whether the provider is in-network or out-of-network. Out-of-network care often incurs higher expenses, so it's important to choose a plan with a robust network that aligns with the policyholder's healthcare needs.

By considering these factors and understanding their impact on insurance costs, individuals can make more informed choices when selecting an ACA insurance plan. It's crucial to carefully review the plan details, compare options, and assess personal healthcare needs to find the most suitable and cost-effective coverage.

Breaking Down ACA Insurance Costs

To better understand the financial aspects of ACA insurance, let’s delve into the specific components that contribute to the overall cost of healthcare coverage.

Premiums and Deductibles

Premiums are the regular payments made by policyholders to maintain their health insurance coverage. The premium amount is typically determined by the chosen plan type and coverage level. Bronze plans, for instance, often have lower premiums but higher deductibles, while Platinum plans may have higher premiums but lower deductibles.

A deductible is the amount that policyholders must pay out of pocket before their insurance coverage kicks in. Higher deductibles can result in lower premiums, making it an important consideration for those seeking more affordable insurance options. Understanding the relationship between premiums and deductibles is crucial for managing healthcare expenses effectively.

| Plan Type | Average Premium | Average Deductible |

|---|---|---|

| Bronze | $400/month | $6,000 |

| Silver | $450/month | $4,000 |

| Gold | $550/month | $2,500 |

| Platinum | $650/month | $1,500 |

Copayments and Coinsurance

Copayments, often referred to as copays, are fixed amounts that policyholders pay for specific healthcare services, such as doctor visits or prescription medications. Copays can vary depending on the plan and the type of service. For instance, a primary care doctor visit may have a lower copay than a specialist visit.

Coinsurance, on the other hand, is a percentage of the cost of a healthcare service that the policyholder is responsible for paying. For example, if a policy has an 80/20 coinsurance ratio, the insurance provider covers 80% of the cost, while the policyholder pays the remaining 20%. Understanding copays and coinsurance is essential for predicting out-of-pocket expenses for various healthcare services.

Out-of-Pocket Maximums

An out-of-pocket maximum, or OOPM, is the maximum amount a policyholder will pay for covered healthcare services in a given year. This limit includes deductibles, copays, and coinsurance. Once the OOPM is reached, the insurance provider covers 100% of the cost for covered services for the remainder of the year. OOPMs can vary significantly between plans, so it’s important to consider this factor when comparing insurance options.

Optimizing ACA Insurance Costs

While ACA insurance costs can be influenced by various factors, there are strategies that individuals can employ to optimize their healthcare coverage and potentially reduce expenses. Here are some tips to help minimize the financial burden of ACA insurance:

- Compare Plans and Providers: Research and compare different ACA insurance plans and providers. Consider factors such as coverage, provider networks, and out-of-pocket costs. By evaluating multiple options, individuals can find the plan that best aligns with their healthcare needs and budget.

- Utilize Subsidies and Tax Credits: If eligible, take advantage of the financial assistance provided by the ACA. Subsidies and tax credits can significantly reduce the cost of insurance premiums, making healthcare coverage more affordable. It's important to understand the income thresholds and eligibility criteria for these subsidies.

- Choose the Right Plan: Select a plan that suits your healthcare needs and budget. Consider your expected healthcare expenses and choose a plan with appropriate coverage and cost-sharing arrangements. For those with relatively few healthcare needs, a higher-deductible plan with lower premiums may be a cost-effective option.

- Stay Within Provider Networks: To minimize out-of-pocket costs, it's crucial to use in-network providers. Out-of-network care can result in higher expenses, so understanding the provider network and choosing in-network healthcare professionals is essential for managing costs effectively.

- Take Advantage of Preventive Care: Many ACA insurance plans offer preventive care services at no additional cost. Utilizing these services can help identify and address health issues early on, potentially preventing more costly treatments down the line. Preventive care is an important aspect of maintaining overall health and managing healthcare expenses.

Future Implications and Trends

The ACA insurance landscape is continually evolving, and staying informed about future trends and developments is crucial for making informed decisions. Here are some key considerations for the future of ACA insurance costs:

- Healthcare Reform and Policy Changes: The ACA has undergone various policy changes over the years, and future reforms could further impact insurance costs. It's important to stay updated on any potential legislative changes that may affect insurance affordability and availability.

- Market Competition and Innovation: The healthcare insurance market is dynamic, and increased competition among insurers can drive down costs and improve coverage options. Innovations in healthcare delivery, such as telemedicine and digital health solutions, may also play a role in shaping the future of insurance costs.

- Economic Factors and Inflation: Economic conditions and inflation rates can influence the overall cost of healthcare services and insurance premiums. Monitoring economic trends and understanding their potential impact on insurance costs is essential for long-term financial planning.

- Advancements in Healthcare Technology: Advances in medical technology and treatment options can impact healthcare costs. While these advancements may improve patient outcomes, they can also lead to higher healthcare expenses. Understanding the balance between technological advancements and their financial implications is crucial for managing insurance costs.

Frequently Asked Questions

How do I know if I qualify for ACA subsidies?

+Eligibility for ACA subsidies is based on income. Individuals and families with incomes between 100% and 400% of the federal poverty level may qualify for premium tax credits. It’s recommended to use the Healthcare.gov subsidy calculator or consult with a healthcare insurance professional to determine your eligibility.

Can I change my ACA insurance plan during the year?

+In general, ACA insurance plans have a specific enrollment period. However, certain life events, such as losing job-based coverage or experiencing a significant change in income, may qualify you for a Special Enrollment Period, allowing you to change your plan outside of the regular enrollment window.

What happens if I don’t have health insurance under the ACA?

+Under the ACA, individuals who do not have health insurance may be subject to a penalty known as the Individual Shared Responsibility Payment. This penalty is calculated based on household income and the number of individuals without coverage. It’s important to note that the penalty has been eliminated as of 2019, but states may have their own requirements and penalties.

Are there any discounts or savings available for ACA insurance plans?

+In addition to subsidies and tax credits, some insurers offer discounts or savings programs for certain populations or behaviors. For example, some plans may provide incentives for healthy lifestyle choices or offer discounts for enrolling in wellness programs. It’s worth exploring these options to potentially reduce insurance costs.