Acv Definition Insurance

ACV, or Actual Cash Value, is a fundamental concept in the world of insurance, particularly in property and casualty coverage. This valuation method plays a critical role in determining the amount an insurance company will pay out in the event of a claim. In this comprehensive article, we will delve deep into the intricacies of ACV insurance, exploring its definition, how it works, its advantages and limitations, and its practical applications in various insurance scenarios.

Understanding ACV Insurance

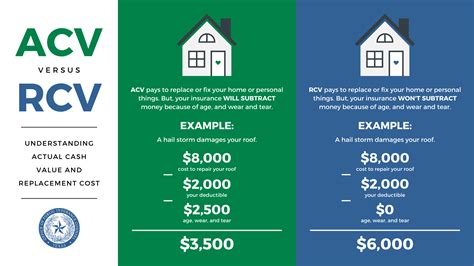

Actual Cash Value insurance is a type of coverage that considers the depreciated value of an insured asset at the time of a loss. Unlike replacement cost value (RCV) insurance, which pays out the full cost to replace the asset, ACV takes into account the asset’s age, condition, and expected lifespan to calculate a fair payout. This valuation method is commonly used for property insurance, casualty insurance, and business insurance policies.

The ACV Formula

The calculation of ACV involves two key components: the asset’s original cost and its depreciation. The formula is as follows:

ACV = Original Cost - Accumulated Depreciation

Depreciation is the reduction in an asset's value over time due to wear and tear, obsolescence, or changes in market value. There are several methods to calculate depreciation, including straight-line depreciation, declining balance depreciation, and sum-of-the-years'-digits depreciation. Each method considers different factors, such as the asset's useful life, salvage value, and depreciation rate.

Example of ACV Calculation

Let’s consider an example to illustrate the ACV calculation. Imagine you purchased a brand-new car for $30,000 and insured it with an ACV policy. After three years, your car is involved in an accident and is declared a total loss. Here’s how the ACV calculation would work:

- Original Cost: $30,000

- Depreciation Rate: Let's assume a 15% depreciation rate per year.

- Accumulated Depreciation: $30,000 * 15% * 3 years = $13,500

- ACV: $30,000 - $13,500 = $16,500

So, in this scenario, the insurance company would pay out $16,500 as the actual cash value of the car, taking into account its depreciation over the three years.

Advantages of ACV Insurance

ACV insurance offers several advantages for both policyholders and insurance companies:

Lower Premiums

ACV policies generally have lower premiums compared to RCV policies. This is because ACV considers the asset’s depreciation, resulting in a lower payout in the event of a claim. Policyholders can benefit from more affordable insurance coverage without compromising on the essential protection they need.

Simplified Claims Process

ACV insurance simplifies the claims process by eliminating the need for extensive documentation and proof of the asset’s current value. The insurance company can quickly assess the asset’s age and condition to calculate the ACV, leading to faster claim settlements.

Cost Savings for Insurance Companies

Insurance companies can achieve cost savings with ACV policies. By considering depreciation, they can offer more competitive premiums and reduce the risk of paying out excessive amounts for claims. This helps insurance providers maintain profitability and keep insurance rates manageable for policyholders.

Limitations and Considerations

While ACV insurance has its advantages, it’s essential to understand its limitations and potential drawbacks:

Potential Underinsurance

ACV policies may result in underinsurance, especially for assets that depreciate rapidly or have a shorter lifespan. Policyholders must be aware of the potential gap between the ACV payout and the cost of replacing the asset, which could leave them financially vulnerable.

Asset-Specific Considerations

The ACV calculation can vary depending on the type of asset being insured. For instance, the depreciation rates for vehicles, electronics, and buildings may differ significantly. Policyholders should understand how their specific assets are valued and consider whether ACV insurance aligns with their needs.

Limited Coverage for New Assets

ACV insurance may not provide sufficient coverage for new assets. Since ACV takes into account depreciation, the payout for a newly purchased asset could be significantly lower than its replacement cost. Policyholders may need to consider additional coverage options to protect their investments.

Practical Applications of ACV Insurance

ACV insurance finds application in various insurance scenarios:

Homeowners Insurance

ACV is commonly used in homeowners insurance policies to cover the cost of repairing or replacing damaged personal property. It provides a cost-effective option for homeowners, offering protection against losses while keeping insurance premiums affordable.

Auto Insurance

In auto insurance, ACV is used to determine the payout for total losses or severe damage to a vehicle. This valuation method considers the vehicle’s age, mileage, and condition to calculate the ACV. Auto insurance policyholders can choose between ACV and RCV coverage, depending on their preferences and budget.

Business Insurance

ACV insurance is valuable for businesses, especially small and medium-sized enterprises. It can cover the cost of replacing damaged or stolen business assets, such as office equipment, machinery, and inventory. ACV policies offer a balanced approach to protecting business assets without incurring excessive insurance costs.

Renters Insurance

Renters insurance often utilizes ACV to cover personal belongings in case of theft, damage, or loss. This type of insurance provides peace of mind to renters, ensuring they can replace their possessions without significant financial strain.

Future Implications and Trends

The insurance industry is evolving, and ACV insurance is no exception. Here are some future implications and trends to consider:

Technological Advancements

Advancements in technology, such as artificial intelligence and machine learning, can enhance the accuracy and efficiency of ACV calculations. Insurance companies can leverage these technologies to improve claim processing, reduce administrative burdens, and provide better customer experiences.

Increased Consumer Awareness

As consumers become more informed about insurance options, they may demand more transparency and flexibility in their coverage. Insurance providers will need to adapt to these changing preferences, potentially offering a wider range of valuation methods and customization options.

Sustainable Practices

With growing environmental awareness, insurance companies may explore sustainable practices in their valuation methods. This could involve considering the asset’s environmental impact and potential for recycling or repurposing when calculating depreciation and ACV.

Changing Asset Lifespans

The lifespans of various assets, especially technology and electronic devices, are evolving rapidly. Insurance companies will need to adapt their ACV calculations to reflect these changing lifespans and ensure accurate valuations.

Conclusion

ACV insurance is a fundamental concept in the insurance industry, offering a cost-effective approach to protecting assets while considering their depreciation. It provides a valuable option for policyholders seeking affordable coverage and a streamlined claims process. However, it’s crucial for individuals and businesses to carefully consider their specific needs and the potential limitations of ACV insurance to ensure they have adequate protection.

What is the difference between ACV and RCV insurance?

+

ACV insurance considers the depreciated value of an asset, while RCV insurance pays out the full cost to replace the asset. ACV policies are generally more affordable but may result in underinsurance for rapidly depreciating assets.

How is depreciation calculated in ACV insurance?

+

Depreciation is calculated using various methods, such as straight-line depreciation, declining balance depreciation, or sum-of-the-years’-digits depreciation. These methods consider factors like the asset’s useful life, salvage value, and depreciation rate.

Can I choose between ACV and RCV insurance?

+

Yes, many insurance providers offer both ACV and RCV coverage options. Policyholders can choose based on their budget, the nature of their assets, and their risk tolerance.