Acv Insurance Term

ACV insurance, or Actual Cash Value insurance, is a widely-used term in the insurance industry, particularly in the context of property and casualty coverage. This type of insurance policy is designed to provide financial protection to policyholders by covering the cost of repairing or replacing their insured property, taking into account depreciation. It is a common choice for homeowners, vehicle owners, and businesses, offering a balance between comprehensive coverage and cost-effectiveness.

Understanding ACV Insurance: A Comprehensive Overview

ACV insurance operates on the principle of reimbursing the policyholder for the actual cash value of their property at the time of a covered loss. This value is calculated by considering the original purchase price of the item, its current condition, and the depreciation it has incurred over time. The depreciation factor is a crucial aspect, as it reflects the natural wear and tear or obsolescence of the insured item.

For instance, if you have an ACV insurance policy on your car and it is involved in an accident, the insurance company will assess the vehicle's pre-accident value, factoring in its age, mileage, and condition. They will then offer a reimbursement based on this assessment, which will likely be lower than the car's original purchase price.

Key Benefits and Considerations of ACV Insurance

One of the primary advantages of ACV insurance is its affordability. By taking into account depreciation, insurance companies can offer lower premiums, making insurance coverage more accessible to a broader range of individuals and businesses. This is especially beneficial for older properties or vehicles, where the replacement cost insurance might be prohibitively expensive.

However, it's essential to understand that ACV insurance may not fully cover the cost of replacing an item with a new one. In situations where the insured item is older or has significant depreciation, the reimbursement may fall short of the cost of purchasing a similar new item. This is a trade-off that policyholders need to consider when choosing ACV insurance over other types of coverage, such as replacement cost insurance.

| Coverage Type | Key Characteristics |

|---|---|

| ACV Insurance | Covers the actual cash value of the property at the time of loss, factoring in depreciation. Offers cost-effective premiums. |

| Replacement Cost Insurance | Provides coverage for the cost of replacing the insured property with a new one of similar kind and quality, without deducting for depreciation. Generally offers more comprehensive coverage but may have higher premiums. |

How ACV Insurance Works: A Step-by-Step Guide

The process of claiming on an ACV insurance policy involves several steps, each designed to ensure a fair and efficient resolution for the policyholder.

- Assessment of Loss: Upon experiencing a covered loss, the policyholder must report the incident to their insurance company. This could be a natural disaster, theft, or an accident, depending on the type of insurance policy.

- Policy Review: The insurance company will then review the policyholder's claim, verifying the coverage and any applicable exclusions or limitations. This step ensures that the loss is indeed covered by the policy.

- Determining the Actual Cash Value: The insurance company will assess the pre-loss value of the insured item, considering factors like age, condition, and depreciation. This value will be used to calculate the reimbursement amount.

- Reimbursement Process: Once the ACV is determined, the insurance company will reimburse the policyholder for the assessed value. This process may involve deductibles, which are the portion of the loss that the policyholder must pay out of pocket.

- Repairs or Replacement: With the reimbursement received, the policyholder can then proceed with repairing or replacing the damaged property. It's important to note that the insurance company may have specific guidelines or requirements for these repairs or replacements.

Real-World Example: ACV Insurance in Action

Let’s consider an example to illustrate how ACV insurance works in practice. Imagine you have an ACV insurance policy on your 5-year-old laptop, which is stolen from your home.

Upon reporting the theft to your insurance company, they will review your policy to ensure the loss is covered. They will then assess the pre-loss value of your laptop, considering its age, specifications, and current market value. Let's say they determine that the ACV of your laptop is $500.

After deducting any applicable deductibles, the insurance company will reimburse you for the $500 ACV. With this reimbursement, you can then purchase a new laptop or use the funds for repairs if the laptop is recovered.

Comparing ACV Insurance with Other Coverage Types

ACV insurance is just one of the many types of insurance coverage available, each with its own set of advantages and limitations. Understanding these differences is crucial when choosing the right insurance policy for your needs.

Replacement Cost vs. ACV Insurance

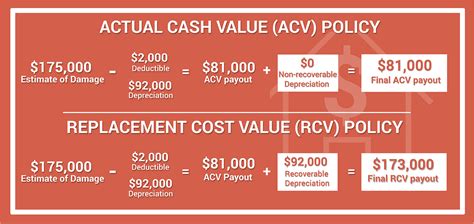

Replacement cost insurance is often compared to ACV insurance, as both provide coverage for the cost of replacing insured property. However, they differ significantly in their approach.

Replacement cost insurance aims to reimburse the policyholder for the full cost of replacing the insured item with a new one of similar kind and quality. This means that depreciation is not factored into the reimbursement, offering a more comprehensive level of coverage. However, this type of insurance typically comes with higher premiums, making it a more expensive option.

In contrast, ACV insurance provides a more cost-effective solution by considering depreciation. While this may result in lower reimbursements, it also means lower premiums, making it an attractive option for those on a budget.

ACV Insurance vs. Agreed Value Insurance

Agreed value insurance is another type of coverage that differs from ACV insurance. In this type of policy, the insurance company and the policyholder agree on a specific value for the insured property at the outset of the policy. This agreed value is the amount that will be paid out in the event of a covered loss, regardless of the actual cash value at the time of the loss.

Agreed value insurance provides a level of certainty for the policyholder, as they know exactly how much they will receive in the event of a claim. However, it typically comes with higher premiums due to the guaranteed payout. ACV insurance, on the other hand, offers a more flexible approach, allowing for adjustments based on the actual cash value at the time of the loss.

The Future of ACV Insurance: Emerging Trends and Technologies

The insurance industry is constantly evolving, and ACV insurance is no exception. Several emerging trends and technologies are shaping the future of this type of coverage, enhancing its efficiency and accuracy.

Adoption of Advanced Valuation Methods

Insurance companies are increasingly leveraging advanced technologies and data analytics to improve the accuracy of ACV assessments. These methods involve using historical data, market trends, and real-time information to determine the actual cash value of insured items more precisely.

For example, insurance companies may utilize machine learning algorithms to analyze vast datasets, considering factors like make, model, condition, and market demand to determine the ACV of a vehicle. This approach ensures a more fair and accurate valuation, benefiting both policyholders and insurance providers.

Integration of Digital Tools for Claim Processing

The digital transformation of the insurance industry is also influencing the ACV insurance space. Insurance companies are developing digital platforms and mobile apps to streamline the claim process, making it more efficient and convenient for policyholders.

With these digital tools, policyholders can report claims, upload supporting documents, and track the progress of their claim in real-time. Insurance companies, on the other hand, can leverage these platforms to gather data, assess losses, and process claims more rapidly. This digital integration enhances the overall customer experience and accelerates the resolution of claims.

Conclusion: Navigating the World of ACV Insurance

ACV insurance is a vital component of the insurance landscape, offering a cost-effective solution for protecting a wide range of properties. By understanding the intricacies of ACV insurance, policyholders can make informed decisions, ensuring they have the right coverage for their needs.

From its working principles to its real-world applications, ACV insurance provides a balance between comprehensive coverage and affordability. As the insurance industry continues to evolve, the future of ACV insurance looks promising, with emerging technologies and trends set to enhance its efficiency and accuracy.

What is the difference between ACV and replacement cost insurance?

+ACV insurance considers depreciation, offering lower premiums but potentially lower reimbursements. Replacement cost insurance does not factor in depreciation, providing more comprehensive coverage but often with higher premiums.

How is the ACV of an insured item determined?

+The ACV is determined by assessing the original purchase price, the current condition, and the depreciation incurred over time. Insurance companies use various methods, including historical data and market trends, to calculate the ACV accurately.

What are the advantages of ACV insurance over other coverage types?

+ACV insurance offers cost-effectiveness, making it an attractive option for those on a budget. It provides a balance between comprehensive coverage and affordable premiums, especially for older properties or vehicles.