Address For Medicare Health Insurance

Medicare, the federal health insurance program in the United States, provides essential healthcare coverage for individuals aged 65 and older, as well as certain younger individuals with disabilities and specific medical conditions. Understanding the nuances of Medicare, including its eligibility criteria, enrollment processes, and coverage options, is crucial for those seeking to access this vital healthcare resource.

Navigating the Medicare System: A Comprehensive Guide

Medicare is a complex yet indispensable component of the American healthcare landscape. It serves as a safety net for millions of individuals, offering comprehensive coverage for a wide range of medical services. The program is administered by the Centers for Medicare & Medicaid Services (CMS), a federal agency that oversees the delivery of healthcare services and ensures compliance with Medicare regulations.

The core of Medicare's coverage is divided into several parts, each addressing different aspects of healthcare. Part A covers inpatient hospital stays, skilled nursing facility care, and hospice services. Part B covers outpatient medical services, including doctor visits, laboratory tests, and durable medical equipment. Part C, also known as Medicare Advantage, offers an alternative to traditional Medicare, providing additional benefits and coverage options through private insurance companies. Part D, on the other hand, focuses on prescription drug coverage, helping individuals manage the costs of their medications.

Eligibility and Enrollment

Determining eligibility for Medicare is the first step in accessing its benefits. Generally, individuals become eligible for Medicare when they turn 65 years old. However, there are certain circumstances where younger individuals may also qualify. For instance, people with certain disabilities or those with end-stage renal disease (ESRD) may be eligible for Medicare before the age of 65.

The enrollment process for Medicare is straightforward but time-sensitive. It's crucial to understand the various enrollment periods to ensure you don't miss out on the opportunity to sign up. The Initial Enrollment Period (IEP) is a 7-month window around your 65th birthday. This period includes the 3 months before your birthday, the month of your birthday, and the 3 months after your birthday. During this time, you can enroll in Medicare without penalty, regardless of whether you're already covered by another health insurance plan.

If you miss the IEP, you can still enroll during the General Enrollment Period (GEP), which runs from January 1 to March 31 each year. However, if you don't have other credible health coverage during this time, you may incur late enrollment penalties when you eventually sign up for Medicare. These penalties can add up over time, so it's important to stay informed about your enrollment options.

Medicare Parts: A Deep Dive

As mentioned earlier, Medicare is divided into several parts, each designed to address specific healthcare needs. Let's delve deeper into these parts and explore what they entail.

- Part A (Hospital Insurance): This part of Medicare covers inpatient hospital stays, skilled nursing facility care, and hospice services. It's typically premium-free for most people, as they or their spouse have paid Medicare taxes while working. Part A covers a wide range of services, including semi-private room and board, general nursing, medications administered during an inpatient stay, and more.

- Part B (Medical Insurance): Part B covers outpatient medical services and preventative care. This includes doctor visits, outpatient hospital care, certain home healthcare services, and durable medical equipment. Unlike Part A, Part B does require a monthly premium, which can vary based on income.

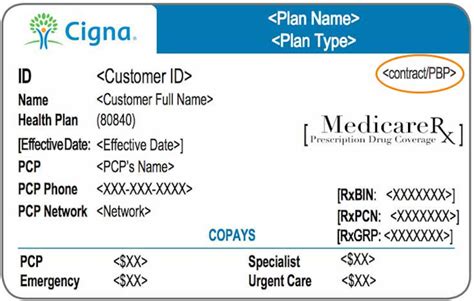

- Part C (Medicare Advantage): Part C, also known as Medicare Advantage, is an alternative to Original Medicare (Parts A and B). It's offered by private insurance companies that have been approved by Medicare. Medicare Advantage plans often include additional benefits, such as dental, vision, and hearing coverage, and may have lower out-of-pocket costs. However, it's important to note that not all Medicare Advantage plans are the same, and the benefits and costs can vary significantly.

- Part D (Prescription Drug Coverage): Part D is an optional component of Medicare that provides coverage for prescription drugs. It's also offered by private insurance companies approved by Medicare. While Part D plans may have different formularies and costs, they all must provide at least the same level of coverage as the standard Medicare prescription drug benefit.

Choosing the Right Medicare Plan

With the various parts and options available, choosing the right Medicare plan can be a daunting task. Here are some key considerations to help guide your decision-making process.

- Assess Your Healthcare Needs: Evaluate your current and potential future healthcare needs. Consider your medical history, any ongoing treatments or conditions, and the types of services you're likely to require. This will help you determine which parts of Medicare are most crucial for your coverage.

- Compare Costs and Benefits: Different Medicare plans have varying costs and benefits. Look at the premiums, deductibles, copayments, and coverage limits for each plan. Consider not just the immediate costs but also potential long-term savings and the flexibility of the plan.

- Explore Supplemental Coverage: Medicare doesn't cover all healthcare expenses. To fill these gaps, you might consider purchasing a Medigap (Medicare Supplement Insurance) policy. These policies can cover costs like copayments, coinsurance, and deductibles, providing more comprehensive coverage.

- Consider Prescription Drug Needs: If you take prescription medications regularly, choosing a Part D plan that covers your medications is essential. Review the formularies of different Part D plans to ensure your medications are included and that the plan's costs are manageable.

- Seek Professional Advice: Navigating the complexities of Medicare can be challenging. Consider consulting with a licensed insurance agent or a healthcare professional who specializes in Medicare. They can provide personalized advice based on your specific circumstances and needs.

Medicare Resources and Support

The world of Medicare can be complex, but there are numerous resources available to help guide you through the process. Here are some trusted sources of information and support:

- Medicare.gov: This official website of the Centers for Medicare & Medicaid Services (CMS) is a comprehensive resource for all things Medicare. It provides detailed information on eligibility, enrollment, and the various parts of Medicare, along with tools to compare plans and estimate costs.

- State Health Insurance Assistance Programs (SHIPs): SHIPs are free, local counseling services for people with Medicare and their caregivers. SHIP counselors are trained to provide one-on-one help with choosing and understanding Medicare coverage, and they can also assist with resolving claims and billing issues.

- Medicare Rights Center: The Medicare Rights Center is a national, nonprofit organization that provides free tools, education, and advocacy for people with Medicare. They offer resources on a wide range of Medicare topics, including prescription drug coverage, appeals, and more.

- AARP: The American Association of Retired Persons (AARP) provides a wealth of information and resources for older Americans, including guides and tools to help understand and navigate Medicare.

Future Outlook and Reforms

Medicare is a dynamic program that continues to evolve to meet the changing needs of its beneficiaries. Ongoing reforms and initiatives aim to improve the quality and accessibility of healthcare for Medicare beneficiaries while also controlling costs.

One significant development is the expansion of Medicare Advantage plans, which offer an alternative to traditional Medicare. These plans have seen a surge in popularity due to their potential for more comprehensive coverage and lower out-of-pocket costs. The CMS has been actively encouraging the growth of Medicare Advantage, introducing new policies and regulations to enhance competition and quality in these plans.

Additionally, there is a growing focus on value-based care models within Medicare. These models aim to improve the quality of healthcare while reducing costs by rewarding healthcare providers for positive patient outcomes rather than the volume of services provided. This shift is expected to lead to more efficient and effective healthcare delivery for Medicare beneficiaries.

Furthermore, the ongoing digital transformation of healthcare is expected to have a significant impact on Medicare. Telehealth services, remote monitoring, and digital health solutions are becoming increasingly integrated into the Medicare program, offering more accessible and convenient healthcare options for beneficiaries.

In conclusion, navigating the Medicare system can be complex, but with the right information and resources, it's possible to make informed decisions about your healthcare coverage. Remember to stay informed about eligibility criteria, enrollment periods, and the various parts of Medicare to ensure you make the most of this vital healthcare resource.

How do I enroll in Medicare if I’m not yet 65 years old?

+If you’re under 65 and have a qualifying disability or medical condition, you may be eligible for Medicare. You’ll need to apply through the Social Security Administration, and they’ll determine your eligibility based on your specific circumstances.

What happens if I miss the Initial Enrollment Period for Medicare?

+If you miss the Initial Enrollment Period (IEP), you can still enroll during the General Enrollment Period (GEP) from January 1 to March 31. However, you may incur late enrollment penalties if you don’t have other credible health coverage during this time.

Can I have Medicare and other health insurance simultaneously?

+Yes, it’s possible to have Medicare and other health insurance coverage simultaneously. However, it’s essential to understand how these plans work together and which one takes precedence in different situations. The rules can be complex, so it’s advisable to consult with a healthcare professional or insurance agent.