Advantage Medicare Insurance

Welcome to an in-depth exploration of Advantage Medicare Insurance, a comprehensive healthcare plan designed to cater to the diverse needs of individuals and families. In today's dynamic healthcare landscape, understanding the intricacies of such plans is crucial for making informed decisions about your health coverage. This article aims to provide a detailed analysis of Advantage Medicare Insurance, shedding light on its features, benefits, and how it can empower you to take control of your healthcare journey.

Unraveling the Layers of Advantage Medicare Insurance

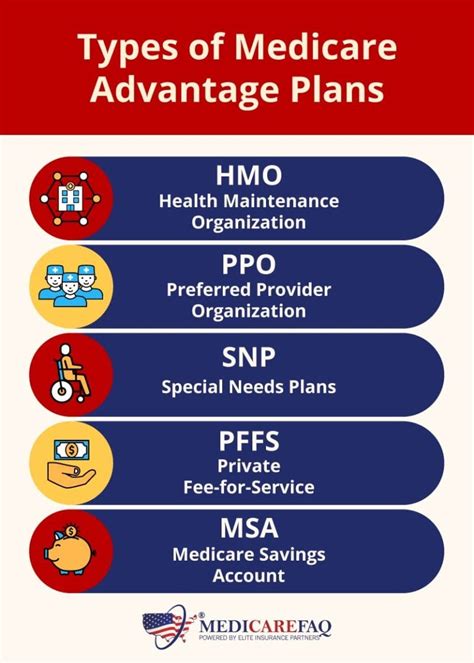

Advantage Medicare Insurance, often referred to as Medicare Advantage, is a private health insurance option offered by various companies and organizations. It operates within the framework of the original Medicare program, which is a federal health insurance program for individuals aged 65 and older, and certain younger individuals with disabilities or specific health conditions.

What sets Advantage Medicare Insurance apart is its comprehensive nature. It typically includes coverage for Part A (hospital insurance), Part B (medical insurance), and often additional benefits such as prescription drug coverage (Part D), dental, vision, and even fitness or wellness programs. This holistic approach ensures that enrollees have access to a wide range of healthcare services, catering to their diverse needs.

Key Features and Benefits

- Enhanced Coverage: Advantage Medicare Insurance goes beyond the basic coverage offered by traditional Medicare. It often includes additional services like preventive care, chronic disease management, and even access to specialized medical providers. This expanded coverage ensures that individuals can address a broader spectrum of health concerns.

- Prescription Drug Coverage: One of the significant advantages of Advantage Medicare Insurance is the inclusion of prescription drug benefits. This feature is particularly beneficial for individuals with chronic conditions who require ongoing medication. By bundling drug coverage with other healthcare services, Advantage Medicare plans provide a seamless and cost-effective solution.

- Network of Providers: Advantage Medicare plans typically have a network of healthcare providers, including hospitals, doctors, and specialists. This network can offer enrollees a more extensive choice of medical professionals, ensuring they receive the care they need without unnecessary limitations.

- Cost Savings: These plans are known for their cost-saving potential. With fixed monthly premiums and often lower out-of-pocket expenses compared to traditional Medicare, individuals can enjoy significant financial benefits. Additionally, some plans offer zero-dollar premiums, making healthcare more accessible.

- Additional Benefits: Depending on the plan, Advantage Medicare Insurance may include extra perks such as dental, vision, and hearing care. Some plans even offer fitness memberships or wellness programs, encouraging a healthier lifestyle and proactive healthcare management.

Who Can Benefit from Advantage Medicare Insurance?

Advantage Medicare Insurance is designed to cater to a wide range of individuals, but certain groups may find it particularly advantageous:

- Individuals with Chronic Conditions: Those managing chronic illnesses often require specialized care and medications. Advantage Medicare plans, with their comprehensive coverage and prescription drug benefits, can provide a tailored solution for managing these conditions effectively.

- Health-Conscious Individuals: For individuals who prioritize their health and well-being, Advantage Medicare plans with additional wellness benefits can be an excellent choice. These plans encourage preventive care and healthy lifestyles, often at reduced costs.

- Budget-Conscious Families: Families on a tight budget can benefit from the cost-saving features of Advantage Medicare Insurance. With lower premiums and potential savings on healthcare services, these plans can provide much-needed financial relief without compromising on quality care.

How to Choose the Right Advantage Medicare Plan

Selecting the right Advantage Medicare plan requires careful consideration of your unique healthcare needs and preferences. Here are some steps to guide your decision-making process:

- Assess Your Healthcare Needs: Begin by evaluating your current and potential future healthcare requirements. Consider any ongoing medical conditions, prescription medication needs, and desired additional benefits like dental or vision care.

- Research Plan Options: Explore the various Advantage Medicare plans available in your area. Compare their coverage, provider networks, and cost structures. Look for plans that align with your specific needs and offer the best value.

- Evaluate Premiums and Out-of-Pocket Costs: Consider the monthly premiums and potential out-of-pocket expenses for each plan. While some plans may have higher premiums, they might offer lower co-pays or deductibles, making them more cost-effective in the long run.

- Check Provider Networks: Ensure that your preferred healthcare providers are included in the plan’s network. A robust network can provide you with more flexibility and access to the care you require.

- Read the Fine Print: Pay close attention to the plan’s details, including any exclusions or limitations. Understand the coverage for specific procedures or treatments you may require. Don’t hesitate to seek clarification from the plan provider if needed.

The Impact of Advantage Medicare Insurance on Healthcare

Advantage Medicare Insurance has had a significant impact on the healthcare landscape, particularly in the United States. By offering enhanced coverage and cost-effective solutions, it has empowered individuals to take a more proactive approach to their healthcare. The inclusion of prescription drug coverage and additional benefits has made healthcare more accessible and comprehensive for a wide range of individuals.

| Plan Type | Key Benefits | Premium Range |

|---|---|---|

| Basic Advantage Plan | Covers Parts A, B, and D; often includes dental and vision. | $0 - $150/month |

| Enhanced Advantage Plan | Offers additional benefits like fitness memberships and wellness programs. | $100 - $250/month |

| Special Needs Plan | Catered to individuals with specific health conditions, providing tailored coverage. | $150 - $300/month |

Moreover, Advantage Medicare Insurance has encouraged innovation in the healthcare industry. Plan providers are continually developing new strategies and benefits to attract enrollees, leading to a more competitive and consumer-friendly market. This competition has resulted in improved plan designs, expanded coverage options, and enhanced customer service.

Frequently Asked Questions

What is the difference between Medicare and Advantage Medicare Insurance?

+Medicare is a federal health insurance program for individuals aged 65 and older, while Advantage Medicare Insurance is a private health insurance option that operates within the Medicare framework. Advantage plans offer enhanced coverage, including additional benefits like prescription drug coverage and dental care.

Are there any age restrictions for enrolling in Advantage Medicare Insurance?

+Advantage Medicare Insurance is primarily designed for individuals aged 65 and older. However, certain plans may be available to younger individuals with specific health conditions or disabilities.

How can I choose the right Advantage Medicare plan for my needs?

+To choose the right plan, assess your healthcare needs, compare plan options, evaluate premiums and out-of-pocket costs, check provider networks, and read the plan details carefully. Consider your specific medical conditions, prescription medication needs, and any additional benefits you desire.