Advantages Of Term Life Insurance

Term life insurance is a fundamental component of financial planning, offering a range of benefits to individuals and families seeking to secure their loved ones' future. This type of insurance provides coverage for a specified term, typically ranging from 10 to 30 years, during which the policyholder's beneficiaries receive a death benefit if the insured individual passes away. In this article, we will explore the advantages of term life insurance, highlighting why it is a popular choice for those aiming to protect their financial well-being.

Affordable Protection for the Long Term

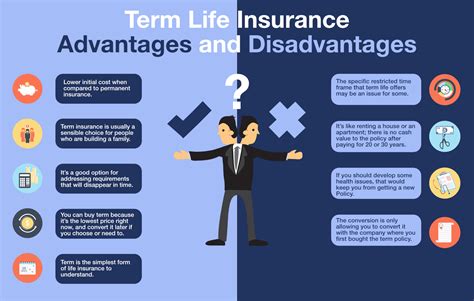

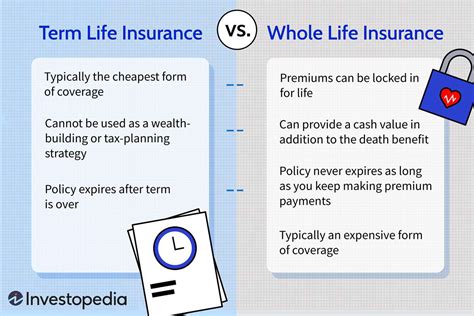

One of the most appealing aspects of term life insurance is its cost-effectiveness. Compared to permanent life insurance policies, term life insurance offers substantial coverage at a fraction of the price. This makes it an ideal option for individuals and families with limited budgets who still want to ensure their financial security.

For instance, consider a 35-year-old non-smoker purchasing a $500,000 term life insurance policy for a 20-year term. The annual premium for such a policy could be as low as $200, representing a significant savings compared to the potential cost of permanent life insurance. This affordability allows individuals to secure long-term protection without straining their finances.

Flexibility and Customization

Term life insurance policies offer a high degree of flexibility, allowing policyholders to tailor their coverage to their specific needs. Policyholders can choose the term length, death benefit amount, and even add optional riders to enhance their coverage.

For example, a policyholder might opt for a 30-year term to cover their mortgage repayment period, ensuring their family's financial stability in the event of their untimely death. Additionally, riders such as waiver of premium or accelerated death benefit can be added to further enhance the policy's value and provide additional peace of mind.

| Rider | Description |

|---|---|

| Waiver of Premium | Waives premium payments if the policyholder becomes disabled. |

| Accelerated Death Benefit | Provides a portion of the death benefit if the insured is diagnosed with a terminal illness. |

Simplicity and Transparency

Term life insurance policies are straightforward and easy to understand. Unlike permanent life insurance, which often includes complex investment components, term life insurance focuses solely on providing a death benefit. This simplicity makes it an attractive option for those who prefer a clear and concise financial product.

Policyholders can easily comprehend their coverage limits, premium amounts, and the terms of their policy. This transparency allows individuals to make informed decisions about their financial future without the need for extensive financial expertise.

Peace of Mind for Your Loved Ones

The primary advantage of term life insurance is the peace of mind it provides to policyholders and their beneficiaries. By purchasing a term life insurance policy, individuals can rest assured that their loved ones will receive a financial cushion if they pass away during the policy’s term.

For instance, imagine a young couple with a newborn child. By investing in a term life insurance policy, they can ensure that their child's future is financially secure, covering expenses such as education, childcare, and daily living costs. This peace of mind allows them to focus on their family's well-being without the added stress of financial uncertainty.

Adaptability to Changing Needs

Life circumstances can change dramatically over the years, and term life insurance policies are designed to adapt to these changes. Policyholders can adjust their coverage as their needs evolve, allowing them to maintain adequate protection throughout their lives.

Consider a middle-aged individual with grown children who no longer rely on them financially. At this stage, they may choose to reduce their term life insurance coverage or opt for a shorter term to align with their changing needs. This adaptability ensures that policyholders are not paying for unnecessary coverage, making term life insurance a cost-effective choice for various life stages.

Potential for Conversion

Many term life insurance policies offer the option to convert to permanent life insurance without undergoing a new medical exam. This feature provides policyholders with the flexibility to transition their coverage as their financial goals shift.

For example, a policyholder who initially purchased a term life insurance policy may later decide that they want the lifelong coverage and cash value accumulation offered by permanent life insurance. By converting their term policy, they can secure permanent coverage without the need for additional health assessments, ensuring they can maintain their desired level of protection.

Conclusion: A Wise Investment for Financial Security

Term life insurance is a wise financial decision for individuals and families seeking to protect their loved ones’ future. Its affordability, flexibility, and simplicity make it an accessible and effective tool for ensuring financial security. With term life insurance, policyholders can have the peace of mind that comes with knowing their family’s financial well-being is safeguarded.

As we've explored, term life insurance offers a range of advantages, from long-term affordability to adaptability for changing needs. By understanding these benefits, individuals can make informed choices about their financial planning and secure the protection they need for their unique circumstances.

How does term life insurance differ from permanent life insurance?

+

Term life insurance provides coverage for a specified term, typically ranging from 10 to 30 years, and offers a death benefit if the insured passes away during that term. Permanent life insurance, on the other hand, provides lifelong coverage and includes a cash value component that accumulates over time. While term life insurance is more affordable, permanent life insurance offers additional financial benefits and can be used for long-term savings or estate planning.

What factors determine the cost of term life insurance premiums?

+

The cost of term life insurance premiums is influenced by various factors, including the policyholder’s age, health status, smoking habits, and the amount of coverage desired. Generally, younger and healthier individuals will enjoy lower premiums, while older individuals or those with health issues may pay higher rates. The term length and death benefit amount also impact the premium cost.

Can I renew my term life insurance policy when it expires?

+

Yes, many term life insurance policies offer the option to renew at the end of the initial term. However, the renewal process may involve a new medical exam, and the premiums are likely to increase as the policyholder ages. It’s essential to review the policy terms and understand the renewal options to ensure continued coverage.

Are there any tax benefits associated with term life insurance?

+

Term life insurance death benefits are typically tax-free, providing a significant advantage for beneficiaries. However, it’s important to consult with a tax professional to understand the specific tax implications in your jurisdiction, as tax laws can vary.