Aetna Health Insurance Prices

Welcome to an in-depth exploration of Aetna health insurance prices, an essential topic for anyone seeking comprehensive health coverage. In today's dynamic healthcare landscape, understanding the intricacies of insurance plans and their associated costs is crucial. This article aims to provide an expert analysis of Aetna's pricing strategies, offering valuable insights to guide your decision-making process.

Understanding Aetna’s Health Insurance Plans

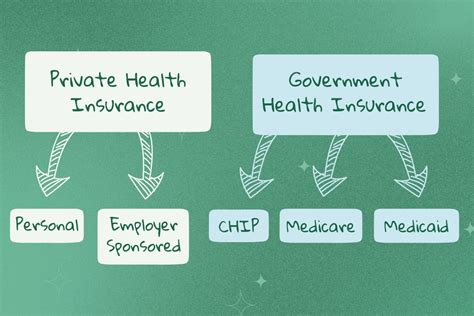

Aetna, a leading provider in the health insurance industry, offers a diverse range of plans tailored to meet the unique needs of individuals and families. Their portfolio includes:

- Individual and Family Plans: These plans are designed for personal or household coverage, offering flexibility and customization.

- Employer-Sponsored Plans: Many employers offer Aetna plans as part of their benefits package, providing comprehensive healthcare to their workforce.

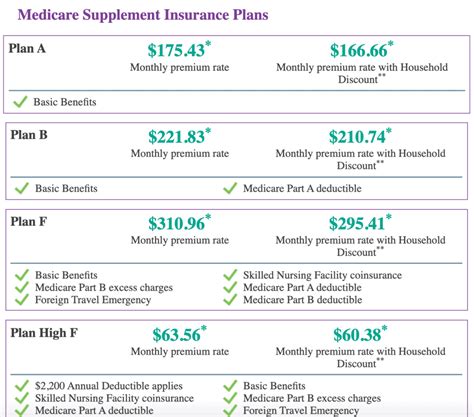

- Medicare Advantage Plans: Specifically tailored for individuals eligible for Medicare, these plans offer additional benefits and coverage beyond traditional Medicare.

- Medicaid Plans: Aetna also provides coverage for individuals and families who qualify for Medicaid, ensuring access to essential healthcare services.

- Student Health Plans: Targeted towards the unique healthcare needs of students, these plans offer affordable coverage during their educational journey.

Each of these plan categories encompasses a variety of options, including HMO, PPO, EPO, and POS plans, each with its own network of providers, coverage limitations, and cost structures.

Key Factors Influencing Aetna’s Pricing

Aetna’s health insurance prices are influenced by a multitude of factors, each playing a significant role in determining the overall cost of coverage. These factors include:

- Plan Type and Coverage Level: The type of plan and the level of coverage chosen directly impact the premium. For instance, HMO plans generally have lower premiums but a more limited network, while PPO plans offer more flexibility but at a higher cost.

- Age and Gender: Aetna, like many insurers, considers age and gender when calculating premiums. Typically, younger individuals pay lower premiums, while older individuals and females tend to pay more due to increased healthcare needs.

- Tobacco Usage: Insurers often charge higher premiums for individuals who use tobacco, as it increases the risk of various health issues.

- Geographic Location: The cost of healthcare varies significantly across different regions, influencing the premiums. Areas with higher healthcare costs generally have higher insurance premiums.

- Family Size: Plans covering multiple family members will typically have higher premiums compared to individual plans.

Aetna’s Pricing Structure: A Detailed Breakdown

Aetna’s pricing structure is designed to offer transparency and flexibility, ensuring that individuals and families can find a plan that suits their specific needs and budget. Here’s a comprehensive breakdown of their pricing components:

Premiums

Premiums are the regular payments made to Aetna for health insurance coverage. These can be paid monthly, quarterly, or annually, depending on the plan and the individual’s preference. The premium amount is influenced by the factors mentioned earlier, such as plan type, coverage level, age, and geographic location.

Deductibles and Out-of-Pocket Costs

Deductibles represent the amount an insured individual must pay out of pocket before the insurance coverage kicks in. For instance, if a plan has a $1,000 deductible, the insured must pay for healthcare services up to that amount before Aetna starts covering the costs. Out-of-pocket costs also include copayments (a fixed amount paid for a service) and coinsurance (a percentage of the service cost paid by the insured).

| Plan Type | Deductible Range | Out-of-Pocket Maximum |

|---|---|---|

| HMO | $250 - $5,000 | $2,000 - $7,500 |

| PPO | $500 - $10,000 | $3,000 - $15,000 |

| EPO | $750 - $8,000 | $2,500 - $12,000 |

| POS | $1,000 - $12,000 | $4,000 - $20,000 |

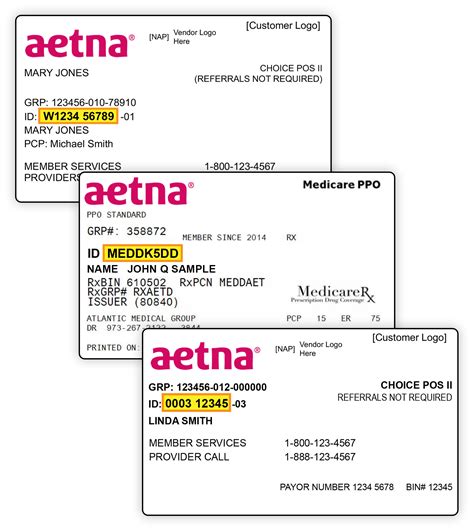

Network and Provider Fees

Aetna, like most insurers, has a network of preferred providers, including doctors, hospitals, and other healthcare professionals. Using in-network providers typically results in lower out-of-pocket costs compared to out-of-network providers. It’s essential to understand the network structure and provider fees associated with your plan to make informed healthcare decisions.

Specialized Coverage and Add-Ons

Aetna offers a range of specialized coverage options and add-ons to cater to specific healthcare needs. These can include dental, vision, and prescription drug coverage, as well as additional benefits like maternity care or mental health services. The cost of these add-ons varies and can significantly impact the overall premium.

Comparing Aetna’s Prices with Competitors

When evaluating Aetna’s pricing, it’s beneficial to compare it with other leading health insurance providers in the market. Here’s a brief comparison of Aetna’s premiums with those of major competitors, based on a sample individual plan:

| Insurance Provider | Monthly Premium |

|---|---|

| Aetna | $350 |

| UnitedHealthcare | $375 |

| Cigna | $320 |

| Humana | $390 |

While Aetna's premiums are competitive, it's important to note that pricing can vary significantly based on the plan, coverage level, and individual circumstances. It's always advisable to obtain multiple quotes to make an informed decision.

Key Considerations for Choosing Aetna

When deciding whether Aetna is the right health insurance provider for your needs, consider the following factors:

- Network Coverage: Aetna has a vast network of providers, ensuring you have access to a wide range of healthcare services. However, it's essential to check if your preferred doctors and facilities are in-network to avoid higher out-of-pocket costs.

- Plan Flexibility: Aetna offers a diverse range of plan options, allowing you to choose the coverage level and benefits that best suit your needs. This flexibility is particularly beneficial for individuals with unique healthcare requirements.

- Customer Service and Support: Aetna is known for its strong customer service, offering 24/7 support and easy access to resources and information. This can be a significant advantage when navigating the complexities of healthcare coverage.

- Additional Benefits: Aetna often provides additional perks and benefits, such as wellness programs, discounts on health-related products, and access to a dedicated health advisor. These added values can enhance your overall healthcare experience.

Conclusion: Navigating Aetna’s Health Insurance Options

Choosing the right health insurance plan is a critical decision that can significantly impact your financial and physical well-being. Aetna, with its comprehensive range of plans and competitive pricing, is undoubtedly a top choice for many individuals and families. By understanding the factors influencing Aetna’s pricing and the details of their plan offerings, you can make an informed decision that aligns with your healthcare needs and budget.

Remember, health insurance is a long-term investment in your health and financial security. Take the time to compare plans, understand the fine print, and choose a provider like Aetna that offers the coverage, support, and flexibility you deserve.

What is the average cost of an Aetna health insurance plan for an individual?

+The average cost of an Aetna health insurance plan for an individual can vary significantly based on factors such as age, location, plan type, and coverage level. As a general guideline, monthly premiums for an individual plan can range from 250 to 750, with higher-coverage plans often costing upwards of $1,000 per month.

How does Aetna determine its insurance prices?

+Aetna’s insurance prices are determined by various factors, including the type of plan (HMO, PPO, etc.), the level of coverage, the age and gender of the insured, tobacco usage, geographic location, and family size. These factors influence the risk profile associated with each individual or family, which in turn impacts the premium.

Are there any discounts or special programs available with Aetna health insurance plans?

+Yes, Aetna offers a range of discounts and special programs to make health insurance more affordable. These can include discounts for healthy lifestyles, wellness programs, and special rates for certain groups or organizations. Additionally, Aetna provides financial assistance programs for eligible individuals who may have difficulty affording coverage.

Can I negotiate the price of my Aetna health insurance plan?

+While it’s uncommon to negotiate the price of an Aetna health insurance plan directly, there are strategies to potentially lower your costs. These include comparing quotes from multiple insurers, opting for higher deductibles or out-of-pocket maximums, and exploring group plans through your employer or association. Additionally, certain life events, such as getting married or having a child, can trigger special enrollment periods that may offer more favorable pricing.