Aetna Us Healthcare Insurance

Aetna, one of the largest health insurance providers in the United States, has a long and storied history in the healthcare industry. With a commitment to providing accessible and quality healthcare solutions, Aetna has evolved over the years to meet the diverse needs of its customers. In this comprehensive article, we will delve into the world of Aetna's healthcare insurance, exploring its offerings, impact, and future prospects.

Aetna’s Journey: A Historical Perspective

Aetna’s origins can be traced back to the mid-19th century, specifically to the year 1853, when it was founded as the Aetna Insurance Company in Hartford, Connecticut. Initially, the company focused on offering life insurance policies, but it soon expanded its horizons to include other forms of insurance, including health insurance.

The early 20th century marked a significant turning point for Aetna as it began to recognize the growing importance of health insurance. In 1937, Aetna made a strategic move by acquiring the United States Health and Accident Insurance Company, a move that laid the foundation for its dominance in the health insurance market. This acquisition allowed Aetna to expand its reach and develop a comprehensive range of healthcare insurance products.

The Aetna Advantage: Comprehensive Healthcare Solutions

Today, Aetna is renowned for its diverse range of healthcare insurance plans, catering to individuals, families, and businesses across the United States. Here’s an in-depth look at some of its key offerings:

Individual and Family Plans

Aetna understands that every individual and family has unique healthcare needs. Their individual and family plans are designed to offer flexibility and comprehensive coverage. These plans typically include access to a wide network of healthcare providers, prescription drug coverage, and various optional benefits such as dental, vision, and wellness programs.

One of the standout features of Aetna's individual plans is their focus on preventive care. By encouraging regular check-ups and screenings, Aetna aims to promote early detection and management of health issues, ultimately reducing long-term healthcare costs.

Group Health Insurance for Employers

Aetna recognizes the critical role that employers play in providing healthcare coverage to their employees. As such, they offer a range of group health insurance plans tailored to meet the specific needs of businesses. These plans often include customizable options, allowing employers to choose the level of coverage and benefits that align with their company’s culture and budget.

In addition to traditional health insurance, Aetna also provides employee wellness programs and tools to help businesses promote a healthy workforce. These initiatives can include health assessments, fitness challenges, and access to online wellness resources, all aimed at improving overall employee health and productivity.

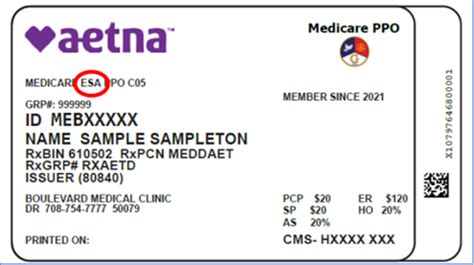

Medicare and Medicaid Plans

Aetna also participates in the Medicare and Medicaid programs, offering specialized plans to cater to the unique healthcare needs of older adults and individuals with low incomes. Their Medicare Advantage plans provide an alternative to original Medicare, offering additional benefits such as vision, hearing, and dental coverage.

For Medicaid beneficiaries, Aetna's plans often include access to a dedicated network of healthcare providers, prescription drug coverage, and various support services to help individuals navigate the complexities of the healthcare system.

Aetna’s Impact on Healthcare Access and Quality

Aetna’s presence in the healthcare industry has had a profound impact on access to quality healthcare services. By offering a wide range of insurance plans, Aetna has played a crucial role in making healthcare more affordable and accessible to a larger portion of the population.

One of Aetna's key strengths lies in its extensive provider network. With a vast array of doctors, hospitals, and specialists to choose from, Aetna members can often find in-network healthcare providers close to their homes or workplaces. This network not only ensures convenience but also helps to control costs, as in-network care is typically more affordable.

| Provider Category | Number of Providers |

|---|---|

| Physicians | Over 1,000,000 |

| Hospitals | 5,000+ facilities |

| Specialty Care Centers | Extensive network |

In addition to its extensive network, Aetna has also invested in digital health solutions to enhance the patient experience. Their mobile app, for instance, allows members to access their insurance information, locate nearby providers, and manage their healthcare needs on the go. This digital innovation has improved convenience and engagement, particularly among younger generations.

Navigating Challenges and Future Prospects

While Aetna has achieved remarkable success, the healthcare industry is not without its challenges. Rising healthcare costs, changing regulatory landscapes, and evolving consumer preferences are just a few of the hurdles that Aetna and other insurers face.

To address these challenges, Aetna has been proactive in its approach. They have focused on developing innovative solutions, such as value-based care models, which aim to improve patient outcomes while controlling costs. These models encourage providers to deliver high-quality, cost-effective care, often with incentives tied to patient health outcomes.

Furthermore, Aetna has recognized the importance of data-driven decision-making. By leveraging advanced analytics and machine learning, they can identify trends, predict healthcare needs, and optimize their insurance offerings. This data-centric approach allows Aetna to stay ahead of the curve and adapt to the dynamic healthcare landscape.

Conclusion

Aetna’s journey in the healthcare insurance sector is a testament to its adaptability and commitment to meeting the evolving needs of its customers. From its humble beginnings in the 19th century to its current status as a leading healthcare provider, Aetna has consistently strived to improve access to quality healthcare. With a focus on comprehensive plans, an extensive provider network, and a forward-thinking approach to healthcare delivery, Aetna remains a trusted name in the industry.

As the healthcare landscape continues to evolve, Aetna's dedication to innovation and its customer-centric philosophy will undoubtedly play a pivotal role in shaping the future of healthcare insurance. By staying attuned to the needs of its members and the industry as a whole, Aetna is poised to continue delivering exceptional healthcare solutions for years to come.

What types of healthcare plans does Aetna offer?

+Aetna offers a wide range of healthcare plans, including individual and family plans, group health insurance for employers, Medicare and Medicaid plans, and specialized plans for specific populations such as students and military personnel.

How does Aetna ensure quality healthcare services for its members?

+Aetna maintains a robust network of healthcare providers, ensuring members have access to quality care. They also promote preventive care and invest in digital health solutions to enhance the patient experience and improve overall health outcomes.

What is Aetna’s approach to managing rising healthcare costs?

+Aetna implements value-based care models and utilizes data analytics to control costs. By incentivizing providers to deliver high-quality, cost-effective care and predicting healthcare needs, they aim to improve patient outcomes while managing expenses.