Affordable Auto Insurance California

Securing affordable auto insurance in California can be a challenging task, but it's not impossible. With a population of over 39 million and a diverse range of drivers, the Golden State offers a unique set of considerations when it comes to automobile insurance. This guide will delve into the factors that influence auto insurance rates in California and provide expert tips to help you find the most cost-effective coverage for your vehicle.

Understanding the California Auto Insurance Landscape

California is renowned for its beautiful scenery, diverse population, and vibrant culture, but it also has one of the most complex and highly regulated auto insurance markets in the United States. The state’s insurance laws and regulations, along with the unique characteristics of its driver population, play a significant role in determining insurance premiums.

The Role of California’s Insurance Laws

California has some of the strictest insurance laws in the country. For instance, the state requires all drivers to carry minimum levels of liability insurance, including 15,000 for bodily injury or death to one person, 30,000 for bodily injury or death to more than one person, and $5,000 for property damage. These minimums are often referred to as 15/30/5 coverage.

Additionally, California is a fault state, meaning that if you're involved in an accident, your insurance company will pay for damages and injuries based on who was at fault. This differs from no-fault states, where each party's insurance company pays for damages regardless of fault.

California also has a unique Low-Cost Auto Insurance Program (CLCA) designed to provide reduced-cost basic liability coverage to good drivers who meet certain income requirements. This program offers rates as low as $425 per year, making it a highly attractive option for eligible drivers.

| Insurance Type | CLCA Rates |

|---|---|

| Standard Liability | $425 - $500 |

| Full Coverage | Varies |

Factors Influencing Auto Insurance Rates in California

When it comes to determining auto insurance rates, insurance companies consider a multitude of factors, many of which are unique to California. These include:

- Location: Insurance rates can vary significantly depending on where you live. Cities like Los Angeles and San Francisco, known for their high population density and heavy traffic, often have higher insurance rates due to increased accident risks.

- Driver's Age and Gender: Younger drivers, especially males, tend to pay higher premiums due to their statistically higher risk of accidents. However, this gap narrows as drivers gain experience and age.

- Driving Record: A clean driving record is crucial for keeping insurance rates low. Even a single violation or accident can lead to significant rate increases.

- Vehicle Type and Usage: The make, model, and age of your vehicle, along with how and where you use it, can affect your insurance rates. Sports cars and luxury vehicles, for example, often have higher insurance costs due to their performance and higher repair costs.

- Credit Score: In California, insurance companies are allowed to use credit-based insurance scores when determining rates. A good credit score can lead to lower premiums, while a poor credit score may result in higher costs.

Strategies for Finding Affordable Auto Insurance in California

Navigating the California auto insurance market can be complex, but there are several strategies you can employ to find affordable coverage that meets your needs.

Compare Quotes from Multiple Insurers

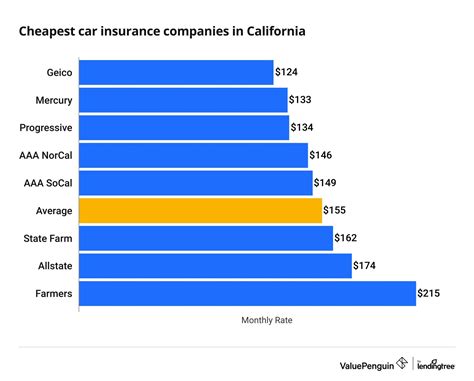

The California insurance market is highly competitive, with numerous insurers vying for your business. By comparing quotes from multiple providers, you can get a better sense of the range of rates available and potentially negotiate a better deal.

When requesting quotes, ensure you're comparing apples to apples. Ask for quotes for the same level of coverage, including deductibles, limits, and any optional add-ons you may want, such as rental car coverage or roadside assistance.

Understand Your Coverage Needs

Before shopping for auto insurance, it’s crucial to understand your coverage needs. California’s minimum liability limits may not be sufficient to protect your assets if you’re involved in an accident. Consider your financial situation and the potential costs you could incur if you were at fault in an accident.

Additionally, think about any unique needs you may have. For example, if you frequently drive long distances, you may want to consider adding roadside assistance to your policy. Or, if you often rent cars, rental car coverage could be a worthwhile addition.

Consider Bundle Discounts

Many insurance companies offer bundle discounts when you combine multiple types of insurance with them. For instance, you could bundle your auto insurance with your home, renters, or business insurance to potentially save money on both policies.

When exploring bundle options, be sure to compare the total cost of the bundle with the cost of individual policies. While bundles can often lead to savings, they may not always be the most cost-effective option.

Maintain a Clean Driving Record

A clean driving record is one of the best ways to keep your insurance rates low. In California, insurance companies can surcharge your policy for up to three years following a violation or accident. Even a single speeding ticket can lead to increased rates, so it’s crucial to drive safely and obey all traffic laws.

Shop Around Regularly

Insurance rates can change frequently, and the company that offered you the best rate last year may not be the most competitive option this year. Shopping around regularly, especially during major life events like getting married, buying a home, or turning 25, can help you ensure you’re always getting the best rate possible.

Explore Discounts

Many insurance companies offer a variety of discounts that can help lower your premiums. These may include discounts for:

- Safe driving (no accidents or violations)

- Good student (for young drivers with a certain GPA)

- Low mileage (for drivers who don't drive frequently)

- Anti-theft devices (for vehicles equipped with certain security features)

- Multi-car policies (for households with multiple vehicles)

Be sure to ask your insurance agent about any discounts you may be eligible for and how you can qualify for them.

The Future of Auto Insurance in California

The auto insurance landscape in California is constantly evolving, driven by changes in technology, consumer behavior, and state regulations. One of the most significant trends is the increasing use of telematics, which refers to the technology that tracks and transmits data about a vehicle’s location, speed, and driving behavior.

Telematics-based insurance, often referred to as usage-based insurance or pay-as-you-drive insurance, is gaining traction in California. This type of insurance uses real-time data to adjust premiums based on how, when, and where a vehicle is driven. While this can lead to higher rates for high-risk drivers, it also provides an opportunity for safe drivers to significantly reduce their premiums.

Additionally, the rise of electric vehicles (EVs) and autonomous vehicles is likely to have a significant impact on auto insurance in the coming years. As EVs become more common, insurance companies will need to adapt their policies and pricing to account for the unique risks and benefits associated with these vehicles. Similarly, as autonomous vehicles become a reality, insurance companies will need to navigate complex questions about liability and coverage.

In conclusion, while finding affordable auto insurance in California can be challenging, it's not impossible. By understanding the factors that influence rates and employing strategic shopping techniques, you can find coverage that meets your needs without breaking the bank. Stay informed, shop around regularly, and don't be afraid to ask questions to ensure you're getting the best value for your insurance dollar.

How often should I shop around for auto insurance quotes in California?

+It’s a good idea to shop around for auto insurance quotes at least once a year, and more frequently if you experience major life changes such as getting married, buying a home, or turning 25.

Can I get auto insurance without a credit check in California?

+No, insurance companies in California are allowed to use credit-based insurance scores when determining rates. However, if you have concerns about your credit score, you can request a quote based on your driving record and other factors, and then discuss your credit score with your agent to understand how it may impact your rates.

What is the Low-Cost Auto Insurance Program (CLCA) in California?

+The CLCA is a program designed to provide reduced-cost basic liability coverage to good drivers who meet certain income requirements. It offers rates as low as $425 per year, making it a highly attractive option for eligible drivers.