Affordable Car Insurance Rates

Finding affordable car insurance rates is a priority for many drivers, as it can significantly impact their monthly expenses. With the right approach and an understanding of the factors that influence insurance premiums, it's possible to secure competitive rates while still enjoying adequate coverage. This comprehensive guide aims to provide expert insights and practical strategies to help you navigate the world of car insurance and make informed decisions to get the best value for your money.

Understanding the Key Factors Affecting Car Insurance Rates

Car insurance rates are influenced by a multitude of factors, and recognizing these can be the first step toward securing more affordable coverage. Here are some of the most significant elements that insurance companies consider when calculating your premium:

Vehicle Type and Usage

The make, model, and year of your vehicle play a crucial role in determining your insurance rates. Generally, newer and more expensive cars tend to have higher premiums due to their replacement and repair costs. Additionally, the primary use of your vehicle matters. If you primarily use your car for business or commute to work, your insurance rates may be higher compared to those who primarily drive for pleasure or personal errands.

Driver Profile and History

Your personal driving history and demographics are key considerations for insurance companies. Factors such as age, gender, driving experience, and accident history all contribute to the calculation of your insurance rates. For instance, young drivers (typically under 25) and those with a history of accidents or traffic violations are often considered higher risk, leading to increased premiums.

Location and Coverage Preferences

The geographic location where you primarily drive and park your car also affects your insurance rates. Areas with higher populations, congested roads, or a history of frequent accidents and claims may have higher premiums. Furthermore, the coverage options you choose, such as liability-only or comprehensive coverage, will directly impact your insurance costs.

| Coverage Type | Description | Average Premium Impact |

|---|---|---|

| Liability-Only | Covers damages to other people's property and medical expenses for injuries caused by you. | Lower premiums compared to full coverage |

| Comprehensive | Includes liability coverage plus protection for your own vehicle against theft, vandalism, and natural disasters. | Higher premiums due to broader coverage |

Strategies to Find Affordable Car Insurance Rates

Now that we’ve covered the key factors influencing insurance rates, let’s explore some practical strategies to help you secure more affordable car insurance coverage.

Shop Around and Compare Quotes

One of the most effective ways to find affordable car insurance is to compare quotes from multiple providers. Insurance rates can vary significantly between companies, so it’s essential to shop around. Online comparison tools and insurance marketplaces can be particularly useful for this purpose. By obtaining quotes from several insurers, you can identify the companies offering the most competitive rates for your specific needs.

Consider Bundling Policies

If you’re in the market for multiple types of insurance, such as car, home, or renters’ insurance, consider bundling your policies with the same provider. Many insurance companies offer discounts when you purchase multiple policies from them. This strategy can lead to significant savings, as it reduces administrative costs for the insurer and encourages customer loyalty.

Explore Discounts and Savings Opportunities

Insurance companies often provide various discounts and incentives to attract and retain customers. Some common discounts include:

- Safe Driver Discounts: Many insurers offer reduced rates to drivers with clean driving records. This may include discounts for accident-free periods or for completing defensive driving courses.

- Multi-Car Discounts: If you insure multiple vehicles with the same provider, you may be eligible for a discount on each policy.

- Student and Good Grade Discounts: Young drivers who are full-time students and maintain good grades (typically a B average or higher) may qualify for discounted rates.

- Membership and Affiliation Discounts: Some insurance companies offer reduced rates to members of specific organizations, such as alumni associations, professional groups, or military personnel.

- Pay-in-Full Discounts: Paying your insurance premium in full for the entire policy term, rather than in installments, can sometimes result in savings.

Adjust Your Coverage Levels

While it’s essential to have adequate car insurance coverage, you may be able to reduce your premiums by adjusting your coverage levels. Assess your specific needs and financial situation to determine if you can opt for higher deductibles or reduce certain types of coverage. For example, if you own an older vehicle that’s paid off, you may consider dropping collision and comprehensive coverage, which can significantly lower your insurance costs.

Maintain a Good Driving Record

Your driving behavior and history are key factors in determining your insurance rates. Maintaining a clean driving record by avoiding accidents and traffic violations can help keep your premiums low. Additionally, safe driving practices, such as avoiding aggressive driving, using seat belts, and adhering to speed limits, not only reduce the risk of accidents but also make you eligible for safe driver discounts.

The Future of Affordable Car Insurance

The insurance industry is evolving, and several trends and technologies are shaping the future of affordable car insurance rates. Here are some key developments to watch:

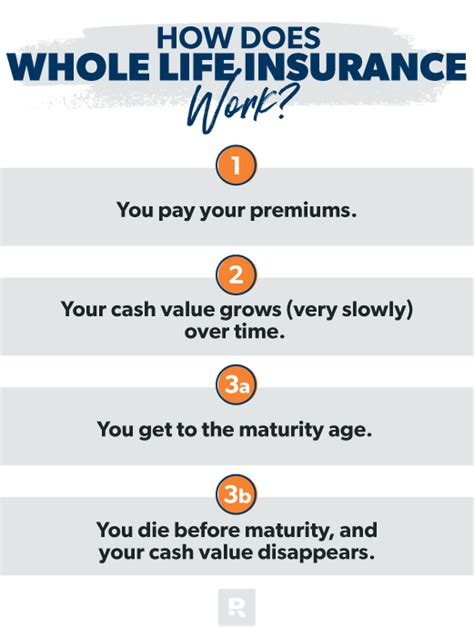

Usage-Based Insurance (UBI)

Usage-Based Insurance, also known as Pay-As-You-Drive (PAYD) or Pay-How-You-Drive (PHYD), is an innovative approach to car insurance that bases premiums on actual driving behavior. With UBI, insurers use telematics devices or smartphone apps to track driving habits such as mileage, speed, braking, and time of day. Drivers who exhibit safe and cautious driving behaviors can qualify for lower insurance rates. This technology incentivizes safer driving and provides a more accurate assessment of individual risk, potentially leading to more affordable insurance rates for responsible drivers.

InsurTech Innovations

The emergence of InsurTech, a blend of insurance and technology, is transforming the insurance industry. InsurTech companies are leveraging advanced technologies like artificial intelligence, machine learning, and data analytics to offer more personalized and efficient insurance products. These innovations can streamline the insurance process, reduce costs for insurers, and potentially lead to more affordable rates for consumers. Additionally, InsurTech startups are exploring new business models, such as on-demand insurance and parametric insurance, which can provide greater flexibility and affordability for policyholders.

Government Initiatives and Regulation

Government policies and regulations play a crucial role in shaping the car insurance landscape. Some jurisdictions are exploring initiatives to make insurance more affordable and accessible. For example, some states are considering reforms to no-fault insurance laws, which could potentially reduce insurance costs by limiting lawsuits and encouraging more efficient claim settlements. Additionally, government initiatives focused on road safety, such as improving infrastructure and implementing stricter traffic laws, can contribute to a safer driving environment and, in turn, lead to more stable insurance rates.

Conclusion: Securing Affordable Car Insurance Rates

Finding affordable car insurance rates requires a combination of understanding the factors that influence premiums, employing strategic approaches, and staying informed about industry developments. By shopping around, considering discounts, adjusting coverage levels, and maintaining a safe driving record, you can significantly reduce your insurance costs. Additionally, keeping an eye on emerging trends like Usage-Based Insurance and InsurTech innovations can provide exciting opportunities for more affordable and personalized coverage in the future.

FAQ

What is the average cost of car insurance in the United States?

+

The average cost of car insurance in the U.S. varies significantly depending on several factors, including the state you reside in, your driving history, and the coverage options you choose. As of [insert most recent available data], the national average cost for car insurance was approximately 1,674 per year, or around 139 per month. However, it’s important to note that this is just an average, and your personal insurance rates may be higher or lower depending on your specific circumstances.

Can I get car insurance if I have a poor credit score?

+

Yes, you can still obtain car insurance even if you have a poor credit score. However, it’s important to understand that credit history is one of the factors insurance companies use to assess risk and determine insurance rates. A poor credit score may lead to higher premiums, as it is often seen as an indicator of increased risk. To mitigate this, you can shop around for insurance quotes from different providers, as rates can vary significantly between companies. Additionally, maintaining a clean driving record and considering usage-based insurance options may help offset the impact of a poor credit score on your insurance rates.

How often should I review and adjust my car insurance policy?

+

It’s generally recommended to review your car insurance policy annually or whenever there are significant changes in your personal circumstances or the insurance market. Reviewing your policy annually allows you to ensure that your coverage levels and premiums are still appropriate and competitive. Additionally, whenever you experience major life events such as getting married, buying a new car, moving to a different location, or changing jobs, it’s a good idea to reassess your insurance needs and potentially adjust your policy accordingly. Regular policy reviews can help you stay up-to-date with the latest insurance offerings and potentially save money on your premiums.