Affordable Dental Care Insurance

Unlocking Affordable Dental Care: A Comprehensive Guide to Dental Insurance

Maintaining good oral health is crucial for overall well-being, but dental care can often be costly. Fortunately, dental insurance plans provide an accessible and cost-effective solution. In this in-depth article, we will explore the world of affordable dental care insurance, shedding light on its benefits, coverage options, and how it can revolutionize your oral health journey.

The Significance of Dental Insurance

Dental insurance plays a pivotal role in promoting oral health by making dental care more financially manageable. Here's a closer look at why it's an essential consideration:

1. Cost-Effective Dental Care

Regular dental visits are essential for preventing oral health issues. Dental insurance plans offer a range of preventive services, such as cleanings, check-ups, and X-rays, at a significantly reduced cost. This ensures that individuals can maintain their oral health without breaking the bank.

For instance, a standard cleaning and check-up procedure can cost upwards of $200 without insurance. However, with a dental plan, this expense is often covered or available at a much lower out-of-pocket cost. This makes it feasible for individuals to prioritize their dental health without worrying about financial strain.

| Procedure | Average Cost (Without Insurance) | Average Cost (With Insurance) |

|---|---|---|

| Dental Cleaning | $200 | $50 - $100 |

| Dental Check-up | $150 | $25 - $50 |

| X-rays | $100 - $300 | $20 - $50 |

2. Early Detection and Treatment

Dental insurance encourages regular check-ups, which are vital for early detection of oral health issues. By identifying problems like cavities, gum disease, or oral cancer in their early stages, individuals can seek timely treatment, often resulting in less invasive and more affordable procedures.

For example, treating a cavity in its early stages may only require a simple filling, costing around $150. However, if left untreated, it could develop into a more severe issue, such as an abscessed tooth, which may necessitate a root canal procedure costing upwards of $1,000.

3. Specialized Care and Emergencies

Dental insurance plans also provide coverage for specialized care, such as orthodontics, endodontics, and oral surgery. Additionally, they offer vital support during dental emergencies, ensuring individuals can access urgent care without incurring excessive costs.

Consider the case of a severe toothache caused by an infected tooth. Without insurance, the cost of emergency treatment, including an extraction and antibiotic prescription, could exceed $1,500. With dental insurance, this expense is significantly reduced, making it more manageable to handle unexpected dental crises.

Understanding Dental Insurance Coverage

Dental insurance plans offer a spectrum of coverage options, each designed to cater to different needs and budgets. Let's delve into the key types of dental insurance coverage:

1. Preventive Care Coverage

This is the cornerstone of most dental insurance plans. It covers essential preventive services like dental cleanings, check-ups, X-rays, and often includes fluoride treatments and sealants for children. By prioritizing preventive care, these plans aim to maintain optimal oral health and prevent the onset of more serious issues.

For instance, a typical preventive care plan may cover two annual cleanings and check-ups, along with a set number of X-rays. This ensures individuals can maintain their oral hygiene and catch potential problems early on.

2. Basic Restorative Coverage

Basic restorative coverage focuses on treating common dental issues. It typically includes services like fillings, root canals, and extractions. This coverage ensures that individuals can address dental problems promptly, preventing them from escalating into more complex and costly issues.

A basic restorative plan might cover a certain percentage of the cost of fillings and root canals, providing individuals with the means to manage these issues effectively.

3. Major Restorative Coverage

Major restorative coverage is designed to address more extensive dental procedures. It often includes coverage for crowns, bridges, and dentures. This type of coverage is essential for individuals requiring more significant dental work to restore their oral health and function.

For example, a major restorative plan might cover a portion of the cost of a dental crown, which is a crucial component in restoring a damaged tooth's functionality and appearance.

4. Orthodontic Coverage

Orthodontic coverage is a specialized type of dental insurance that focuses on aligning teeth and jaws. It covers procedures like braces and clear aligners, making it accessible for individuals seeking orthodontic treatment. This coverage is particularly beneficial for children and teenagers, as early intervention can prevent more severe orthodontic issues in adulthood.

An orthodontic plan might cover a certain percentage of the cost of braces or clear aligners, providing a more affordable option for individuals seeking a straighter smile.

Choosing the Right Dental Insurance Plan

Selecting the appropriate dental insurance plan depends on several factors, including your specific dental needs, budget, and the availability of plans in your region. Here are some key considerations to guide your decision-making process:

1. Assess Your Dental Needs

Start by evaluating your current and future dental needs. Consider your oral health history, any existing conditions, and potential future treatments. This assessment will help you choose a plan that aligns with your requirements.

For instance, if you have a history of gum disease, you may prioritize a plan with robust periodontal coverage. Similarly, if you're considering orthodontic treatment, an insurance plan with comprehensive orthodontic coverage would be a wise choice.

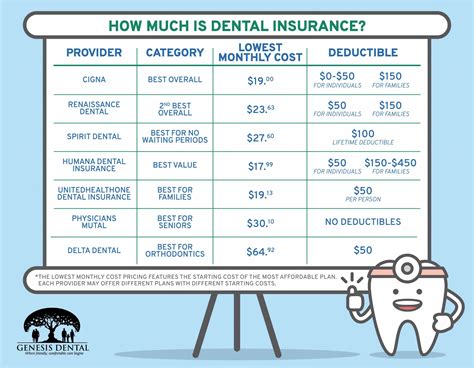

2. Evaluate Plan Costs

Dental insurance plans come with various costs, including monthly premiums, deductibles, and copayments. Assess your budget and determine how much you can comfortably afford. Keep in mind that while some plans may have lower premiums, they might have higher out-of-pocket costs for specific procedures.

Consider a plan with a higher premium but lower deductibles and copayments if you anticipate frequent dental visits or extensive procedures. This can provide more financial predictability.

3. Explore Network Options

Dental insurance plans often have networks of preferred providers. These are dentists and specialists who have agreed to provide services at a discounted rate to plan members. Choosing a plan with a broad network ensures you have a wider range of choices for dental care providers.

Research the network of providers in your area to ensure that your preferred dentist or specialist is included. If not, consider a plan with a more extensive network or explore out-of-network options, although these may come with higher costs.

4. Review Coverage Limits and Exclusions

Each dental insurance plan has specific coverage limits and exclusions. Review these carefully to understand what procedures are covered and to what extent. Some plans may have annual or lifetime maximums, while others may exclude certain procedures or have waiting periods before certain benefits become effective.

For example, some plans may exclude cosmetic procedures like teeth whitening or have waiting periods for major restorative work. Ensure that the plan's coverage aligns with your anticipated needs.

Maximizing Your Dental Insurance Benefits

Once you've chosen a dental insurance plan, it's essential to make the most of your benefits. Here are some strategies to ensure you get the most value from your coverage:

1. Stay Informed

Familiarize yourself with your plan’s benefits, coverage limits, and exclusions. Understand the processes for making claims and any specific requirements for certain procedures. Staying informed will help you navigate your plan effectively and avoid unexpected surprises.

2. Schedule Regular Dental Check-ups

Take advantage of your preventive care coverage by scheduling regular dental check-ups and cleanings. These visits are crucial for maintaining good oral health and catching potential issues early. Most plans cover two annual check-ups, so be sure to use this benefit fully.

3. Discuss Treatment Options with Your Dentist

Communicate openly with your dentist about your dental insurance coverage. They can guide you toward procedures that are covered by your plan and help you understand any associated costs. Additionally, they can provide valuable insights into alternative treatments that may be more cost-effective or better suited to your needs.

4. Consider Pre-authorization for Major Procedures

For major restorative or orthodontic procedures, consider seeking pre-authorization from your insurance provider. This process involves submitting a detailed treatment plan and cost estimate to your insurer for review and approval. Pre-authorization can help ensure that your procedure is covered and give you a clear understanding of your financial responsibility.

5. Utilize Additional Benefits

Many dental insurance plans offer additional benefits beyond basic coverage. These may include discounts on dental products, access to a dental hotline for advice, or even coverage for dental accidents and injuries. Take advantage of these perks to further enhance your oral health and overall experience with your plan.

The Future of Affordable Dental Care

The landscape of dental insurance is continually evolving, driven by advancements in dental technology and changing consumer needs. Here's a glimpse into the future of affordable dental care and the trends that are shaping the industry:

1. Digital Dentistry and Telehealth

The integration of digital technology into dentistry is transforming the way dental care is delivered. From digital impressions for dental restorations to remote consultations via telehealth, these advancements are making dental care more accessible and efficient. Telehealth, in particular, offers the potential for remote diagnosis and treatment planning, especially for less complex dental issues.

2. Preventive Focus and Education

There is a growing emphasis on preventive dental care and patient education. Dental insurance providers are recognizing the long-term benefits of promoting good oral hygiene and early intervention. This shift is expected to lead to more comprehensive preventive coverage and initiatives aimed at educating individuals about oral health best practices.

3. Value-Based Care Models

Value-based care models are gaining traction in the dental industry. These models focus on providing high-quality care while controlling costs. Dentists and specialists are increasingly adopting value-based approaches, which emphasize patient outcomes and satisfaction. This shift is likely to result in more affordable and patient-centric dental care.

4. Integration of Dental and Medical Care

The connection between oral health and overall systemic health is becoming increasingly evident. As a result, there is a growing trend towards integrating dental and medical care. This integration aims to provide a more holistic approach to patient care, recognizing the impact of oral health on general well-being. Collaborative efforts between dental and medical professionals are expected to enhance the overall patient experience and improve health outcomes.

How do I find the best dental insurance plan for my needs?

+The key is to thoroughly research and compare different plans. Consider your specific dental needs, budget, and the availability of providers in your area. Online comparison tools and speaking with insurance brokers can be helpful. Additionally, reading reviews and understanding the fine print of each plan’s coverage and exclusions is essential.

Are there any dental insurance plans that cover 100% of the costs?

+While some plans may cover 100% of certain preventive procedures, it’s uncommon for plans to cover all costs without any out-of-pocket expenses. Most plans have deductibles, copayments, and coverage limits. However, some employer-sponsored plans or specialized insurance policies may offer more comprehensive coverage.

Can I use my dental insurance to see any dentist, or are there restrictions?

+Most dental insurance plans have a network of preferred providers. You can typically choose any dentist within this network, but you may incur higher costs if you see an out-of-network provider. Some plans allow for out-of-network coverage, but with reduced benefits. It’s essential to check your plan’s network and understand any potential restrictions.

What happens if I need a dental procedure that is not covered by my insurance plan?

+If a procedure is not covered by your plan, you will typically be responsible for the full cost. However, it’s worth discussing this with your dentist and insurance provider, as they may be able to offer alternative treatments or suggest ways to manage the costs. Some plans also offer optional riders or add-ons to provide coverage for specific procedures.