Affordable Health Care Insurance

In today's rapidly changing world, access to affordable and comprehensive health care insurance is more crucial than ever. With rising medical costs and an ever-evolving healthcare landscape, individuals and families are seeking insurance options that provide adequate coverage without breaking the bank. This article aims to delve into the intricacies of affordable health care insurance, exploring its importance, the various plans available, and the factors that influence their affordability.

Understanding Affordable Health Care Insurance

Affordable health care insurance is designed to offer individuals and families financial protection against the high costs of medical treatments, hospital stays, and other healthcare services. It provides a safety net, ensuring that individuals can access necessary medical care without facing crippling financial burdens. In many countries, including the United States, health insurance is a critical component of the healthcare system, shaping the accessibility and quality of care.

The concept of affordable health care insurance is not merely about the cost of premiums; it encompasses a range of factors, including coverage limits, deductibles, co-pays, and the overall scope of services covered. A truly affordable plan should strike a balance between these elements, providing an adequate level of coverage while remaining financially accessible to a broad spectrum of the population.

The Significance of Affordable Health Care

The importance of affordable health care insurance extends far beyond individual financial considerations. It has profound implications for public health and societal well-being. Here are some key reasons why affordable health care insurance is vital:

- Access to Healthcare Services: Affordable insurance ensures that individuals can access a wide range of healthcare services, from routine check-ups and preventive care to specialized treatments and emergency care. This access promotes early detection and treatment of illnesses, leading to better health outcomes and reduced long-term healthcare costs.

- Financial Protection: Health insurance provides financial security, protecting individuals and families from catastrophic medical expenses. In the event of a serious illness or accident, insurance coverage can mean the difference between manageable financial obligations and overwhelming debt.

- Improved Health Outcomes: Studies have shown that individuals with health insurance are more likely to receive timely and appropriate medical care, leading to improved health outcomes. This includes better management of chronic conditions, increased life expectancy, and reduced mortality rates.

- Economic Stability: Affordable health care insurance contributes to the overall economic stability of a nation. It reduces the financial strain on individuals and families, allowing them to maintain their standard of living and continue contributing to the economy. Additionally, it lowers the burden on public healthcare systems, ensuring that resources are available for those in need.

Types of Affordable Health Care Insurance Plans

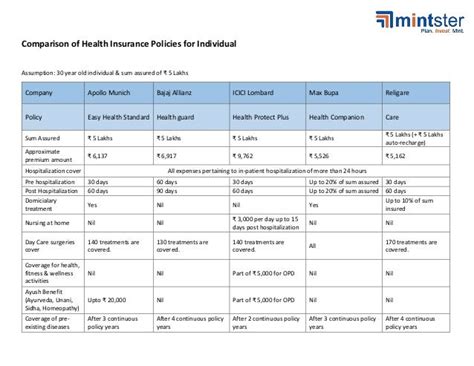

The landscape of affordable health care insurance is diverse, offering a range of plan options to cater to different needs and budgets. Understanding the different types of plans is crucial when choosing the most suitable and cost-effective option. Here are some common types of affordable health insurance plans:

1. Private Health Insurance Plans

Private health insurance plans are offered by insurance companies and are available to individuals and families. These plans provide a wide range of coverage options, including:

- Fee-for-Service Plans: Also known as indemnity plans, these allow individuals to choose their healthcare providers and receive reimbursement for covered services. They offer flexibility but may have higher premiums and out-of-pocket costs.

- Managed Care Plans: These plans include Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs). HMOs typically have a network of providers, and members must choose a primary care physician. PPOs offer more flexibility, allowing members to visit providers inside and outside the network.

- High-Deductible Health Plans (HDHPs): HDHPs have higher deductibles but lower premiums. They are often paired with Health Savings Accounts (HSAs), allowing individuals to save pre-tax dollars for medical expenses.

2. Government-Sponsored Programs

In many countries, governments play a significant role in providing affordable health care insurance through various programs. These programs aim to ensure that all citizens have access to essential healthcare services.

- Medicare: Medicare is a government-funded health insurance program primarily for individuals aged 65 and older. It offers coverage for hospital stays, physician services, and prescription drugs. Some younger individuals with certain disabilities or conditions may also be eligible.

- Medicaid: Medicaid is a joint federal and state program that provides health coverage to low-income individuals and families. It covers a wide range of services, including doctor visits, hospital care, and long-term care. Eligibility is based on income and other factors.

- Children's Health Insurance Programs (CHIP): CHIP is designed to provide health coverage for children in families who earn too much to qualify for Medicaid but cannot afford private insurance. It offers comprehensive coverage, including dental and vision care.

3. Employer-Sponsored Health Plans

Many employers offer health insurance plans as part of their employee benefits package. These plans are often more affordable for employees due to the employer’s contribution to the premiums. The coverage and options can vary widely depending on the employer and the plan chosen.

Factors Influencing Affordability

The affordability of health care insurance is influenced by a multitude of factors. Understanding these factors can help individuals make informed choices when selecting a plan. Here are some key considerations:

- Premium Costs: The premium is the amount paid monthly or annually to maintain insurance coverage. Premiums can vary significantly based on the type of plan, the level of coverage, and the insurer. Generally, plans with higher premiums offer more comprehensive coverage.

- Deductibles and Co-pays: Deductibles are the amount an individual must pay out of pocket before the insurance coverage kicks in. Co-pays are fixed amounts paid for specific services, such as doctor visits or prescriptions. Plans with lower deductibles and co-pays may have higher premiums.

- Network of Providers: Health insurance plans often have networks of preferred providers, including hospitals, clinics, and individual practitioners. Using in-network providers typically results in lower out-of-pocket costs. Plans with a broader network may offer more flexibility but may have higher premiums.

- Coverage Limits: Insurance plans have limits on the amount they will pay for specific services or treatments. These limits can be annual, lifetime, or per-incident. It's essential to understand these limits to ensure that the plan meets one's healthcare needs.

- Age and Health Status: Age and health status play a significant role in determining insurance premiums. Younger and healthier individuals often have lower premiums, while older individuals or those with pre-existing conditions may face higher costs.

- Family Size: Family health insurance plans typically cover multiple individuals, and the cost increases with the number of family members enrolled. Some plans offer discounts for families, making them more affordable.

Maximizing Affordability: Tips and Strategies

Navigating the world of affordable health care insurance can be challenging, but there are strategies to make it more manageable and cost-effective. Here are some tips to help individuals and families maximize affordability:

1. Compare Plans and Providers

Research and compare different health insurance plans and providers. Utilize online tools, insurance brokers, or healthcare navigators to evaluate options based on coverage, costs, and provider networks. Look for plans that offer the right balance of coverage and affordability for your specific needs.

2. Understand Your Healthcare Needs

Assess your healthcare needs and priorities. Consider factors such as prescription drug requirements, frequent doctor visits, or the need for specialized treatments. Choose a plan that aligns with your healthcare requirements to avoid unnecessary expenses.

3. Explore Government Programs

If you are eligible, consider government-sponsored health insurance programs like Medicare, Medicaid, or CHIP. These programs offer affordable or even free coverage to specific populations, ensuring access to essential healthcare services.

4. Take Advantage of Employer Benefits

If you are employed, explore the health insurance options offered by your employer. Employer-sponsored plans often provide substantial savings due to the employer’s contribution. Understand the coverage and benefits offered to make an informed decision.

5. Consider High-Deductible Plans with HSAs

High-Deductible Health Plans (HDHPs) paired with Health Savings Accounts (HSAs) can be a cost-effective option. HDHPs have lower premiums, and HSAs allow you to save pre-tax dollars for medical expenses. This strategy can be particularly beneficial if you have minimal healthcare needs or have the financial means to cover the deductible.

6. Negotiate with Providers

If you are facing high out-of-pocket costs, consider negotiating with healthcare providers. Many providers are willing to work with patients to set up payment plans or offer discounts for prompt payment. This can help reduce the financial burden of medical expenses.

7. Stay Informed and Educated

Stay up-to-date with healthcare reforms, insurance regulations, and changes in the healthcare landscape. Understanding the latest developments can help you make more informed choices and take advantage of new opportunities for affordable coverage.

The Future of Affordable Health Care Insurance

The future of affordable health care insurance is shaped by ongoing policy reforms, technological advancements, and shifting societal needs. As healthcare costs continue to rise, the focus is on innovative solutions to make insurance more accessible and cost-effective.

One promising development is the increasing adoption of telemedicine and digital health solutions. These technologies enable remote consultations, monitoring, and treatment, reducing the need for in-person visits and associated costs. Additionally, the integration of artificial intelligence and data analytics in healthcare is expected to improve efficiency and lower costs.

Policy reforms also play a crucial role in shaping the future of affordable health care insurance. Efforts to expand access to insurance, simplify enrollment processes, and enhance coverage options are underway in many countries. These reforms aim to ensure that more individuals can obtain and maintain affordable health insurance, regardless of their circumstances.

Furthermore, the concept of value-based care is gaining traction. This approach focuses on providing high-quality, cost-effective healthcare by incentivizing healthcare providers to deliver efficient and coordinated care. By shifting the focus from volume to value, it is hoped that healthcare costs can be reduced while improving patient outcomes.

In conclusion, affordable health care insurance is a cornerstone of a resilient and equitable healthcare system. By providing financial protection and access to essential healthcare services, it empowers individuals and families to lead healthier lives. As the healthcare landscape evolves, staying informed and adaptable is key to navigating the complexities of insurance options and ensuring that affordable coverage remains within reach for all.

What is the average cost of health insurance in the United States?

+The average cost of health insurance varies widely depending on factors such as age, location, and the type of plan. As of 2023, the average monthly premium for an individual is approximately 450, while for a family, it can be around 1,150. However, these figures can fluctuate significantly based on individual circumstances.

Are there any government subsidies available for health insurance?

+Yes, government subsidies are available to help individuals and families with low to moderate incomes afford health insurance. The Affordable Care Act (ACA) provides tax credits and cost-sharing reductions to make insurance more affordable. Eligibility is determined based on income and family size.

How can I reduce my health insurance costs?

+There are several strategies to reduce health insurance costs. These include choosing a plan with a higher deductible and lower premiums, taking advantage of employer-sponsored plans, and exploring government-sponsored programs like Medicaid or CHIP. Additionally, maintaining a healthy lifestyle and managing chronic conditions can help lower costs over time.