Affordable Health Insurance Virginia

Finding affordable health insurance in Virginia can be a challenging task, especially with the ever-changing healthcare landscape and varying personal circumstances. However, with the right information and a strategic approach, it is possible to secure comprehensive coverage without breaking the bank. This comprehensive guide aims to demystify the process of obtaining affordable health insurance in Virginia, providing valuable insights and practical tips to help you make informed decisions.

Understanding Virginia’s Healthcare Market

Virginia’s healthcare market offers a range of options, catering to diverse needs and budgets. From individual plans to family coverage, understanding the landscape is crucial. The state has embraced the Affordable Care Act (ACA), providing residents with access to a competitive marketplace for health insurance. This means Virginians can compare plans and prices, ensuring they find the best value for their healthcare needs.

Key Factors Influencing Health Insurance Costs

Several factors play a significant role in determining the cost of health insurance premiums in Virginia. These include age, location, tobacco usage, and the type of plan chosen. For instance, younger individuals may opt for plans with higher deductibles and lower premiums, while older adults may prefer plans with lower deductibles for more immediate coverage. Additionally, the number of people covered under a plan can impact the overall cost.

| Factor | Impact on Premium |

|---|---|

| Age | Younger adults pay less, while older individuals pay more. |

| Location | Urban areas often have higher premiums compared to rural regions. |

| Tobacco Usage | Smokers may face higher premiums or be excluded from certain plans. |

| Plan Type | Higher deductibles lead to lower premiums, and vice versa. |

Navigating Virginia’s Health Insurance Marketplace

The Virginia Health Benefit Exchange, also known as Cover Virginia, is the state’s official marketplace for health insurance. It offers a user-friendly platform where residents can compare plans, prices, and benefits. By understanding the different plan categories and their unique features, you can make an informed decision that suits your healthcare needs and budget.

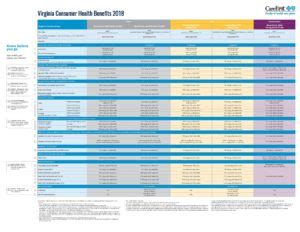

Plan Categories and Their Benefits

Virginia’s health insurance marketplace offers four main plan categories: Bronze, Silver, Gold, and Platinum. Each category represents a different level of coverage and cost.

- Bronze Plans: These plans have the lowest premiums but higher deductibles and out-of-pocket costs. They are ideal for individuals who rarely need medical care and can afford larger expenses when they do.

- Silver Plans: Offering a balance between premiums and out-of-pocket costs, Silver plans are a popular choice. They typically cover around 70% of healthcare costs, making them suitable for those who anticipate needing medical services throughout the year.

- Gold Plans: With higher premiums, Gold plans cover approximately 80% of healthcare costs. They are ideal for individuals who anticipate frequent medical visits or have ongoing health conditions.

- Platinum Plans: These plans offer the highest level of coverage, with premiums covering around 90% of healthcare costs. Platinum plans are suitable for those who require extensive medical care and wish to minimize out-of-pocket expenses.

Maximizing Cost Savings: Strategies and Tips

Securing affordable health insurance is not just about finding the right plan; it’s also about understanding strategies to minimize costs. Here are some practical tips to help you save on your health insurance premiums in Virginia.

Utilize Tax Credits and Subsidies

One of the most significant cost-saving measures available to Virginians is the premium tax credit. This credit, provided through the Affordable Care Act, helps reduce the cost of monthly premiums for those who qualify. The amount of the credit is based on income and family size, and it can be substantial for low- to middle-income households. By understanding your eligibility and claiming this credit, you can significantly lower your insurance costs.

Consider Short-Term Plans

For those who are between jobs or facing a gap in coverage, short-term health insurance plans can be a cost-effective solution. These plans offer temporary coverage, typically lasting from one to twelve months, and are often more affordable than traditional plans. However, it’s important to note that short-term plans often have limited benefits and may not cover pre-existing conditions.

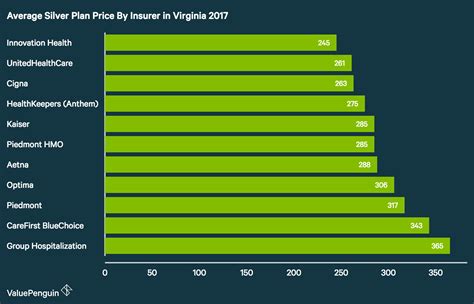

Shop Around and Compare Prices

The Virginia Health Benefit Exchange provides a platform to compare plans and prices from various insurers. Taking the time to research and compare can lead to significant savings. Consider factors such as deductibles, copays, and out-of-pocket maximums when making your decision. Additionally, some insurers offer discounts or incentives for enrolling online or paying premiums annually.

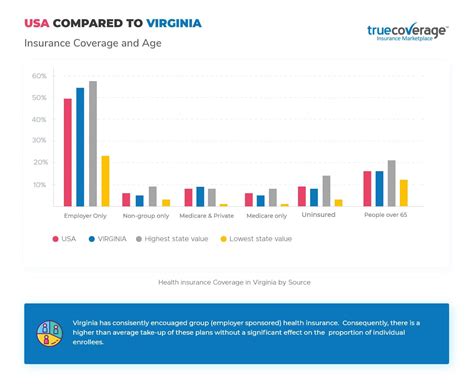

The Role of Employer-Sponsored Plans

Many Virginians receive health insurance coverage through their employers. These plans are often comprehensive and can provide significant cost savings compared to individual plans. However, it’s important to understand the specifics of your employer’s plan, including any contributions required and the level of coverage offered.

Employer-Sponsored Plan Advantages

Employer-sponsored health insurance plans in Virginia offer several advantages. Firstly, employers often contribute a significant portion of the premium, reducing the financial burden on employees. Additionally, these plans often provide a wide range of benefits, including dental and vision coverage, which may not be available in individual plans. Furthermore, employer-sponsored plans typically offer a choice of multiple providers, ensuring access to a diverse healthcare network.

Understanding Healthcare Costs: A Comprehensive Guide

Navigating the complexities of healthcare costs is an essential aspect of finding affordable health insurance. From understanding deductibles and copays to managing out-of-pocket expenses, this guide aims to demystify the financial side of healthcare.

Demystifying Healthcare Costs

Healthcare costs can be broken down into several components, each playing a role in the overall cost of your insurance plan. Understanding these components is crucial to managing your healthcare expenses effectively.

- Premiums: This is the amount you pay monthly to maintain your health insurance coverage.

- Deductibles: The deductible is the amount you must pay out of pocket before your insurance coverage kicks in.

- Copays: Copays are fixed amounts you pay for specific services, such as doctor visits or prescription drugs.

- Coinsurance: Coinsurance is the percentage of costs you share with your insurance provider after the deductible is met.

- Out-of-Pocket Maximum: This is the maximum amount you'll pay in a year for covered services, excluding premiums.

The Future of Affordable Health Insurance in Virginia

The landscape of affordable health insurance in Virginia is constantly evolving, driven by policy changes, technological advancements, and market dynamics. Staying informed about these changes is crucial for Virginians to ensure they continue to access affordable and comprehensive healthcare.

Policy Changes and Market Trends

Recent policy initiatives, such as the American Rescue Plan, have significantly impacted the affordability of health insurance in Virginia. These initiatives have expanded access to premium tax credits, making insurance more affordable for low- and middle-income households. Additionally, the continued growth of telehealth services has made healthcare more accessible and cost-effective, particularly in rural areas.

The Impact of Technology

Technology is playing an increasingly significant role in the healthcare industry, with innovations like electronic health records (EHRs) and telemedicine enhancing efficiency and reducing costs. These advancements are expected to continue shaping the future of affordable health insurance, offering Virginians more options and control over their healthcare.

Market Competition and Consumer Choice

The competitive nature of Virginia’s health insurance marketplace is a key driver of affordability. As more insurers enter the market, Virginians benefit from increased choice and more competitive pricing. This competition also encourages insurers to offer innovative plans and services, further enhancing the value and accessibility of health insurance.

Can I qualify for Medicaid in Virginia even if I’m not low-income?

+Yes, Virginia expanded its Medicaid program under the Affordable Care Act, making more residents eligible for coverage. Eligibility is determined by factors such as income, family size, and age. Those who fall within the specified income limits, regardless of their employment status, can qualify for Medicaid coverage.

What are the advantages of using a health insurance broker in Virginia?

+Health insurance brokers in Virginia can provide valuable guidance and support in navigating the complex world of health insurance. They can help you understand your options, compare plans, and find the best coverage for your needs. Additionally, brokers often have access to exclusive deals and can assist with the enrollment process, ensuring you secure the right plan for your circumstances.

Are there any special programs or discounts for specific demographics in Virginia’s health insurance market?

+Yes, Virginia offers several programs and discounts aimed at specific demographics. For instance, the Cover Virginia Health Plan provides low-cost insurance options for small businesses and their employees. Additionally, certain plans offer discounts or incentives for healthy lifestyles, such as non-smoker discounts or fitness program reimbursements.