Affordable Insurance For Car

Securing affordable car insurance is a top priority for many vehicle owners, especially with the rising costs of coverage. The challenge lies in finding the right balance between comprehensive protection and a budget-friendly policy. In this expert guide, we delve into the intricacies of car insurance, offering practical tips and insights to help you navigate the market and find the best coverage for your needs without breaking the bank.

Understanding Car Insurance: A Comprehensive Overview

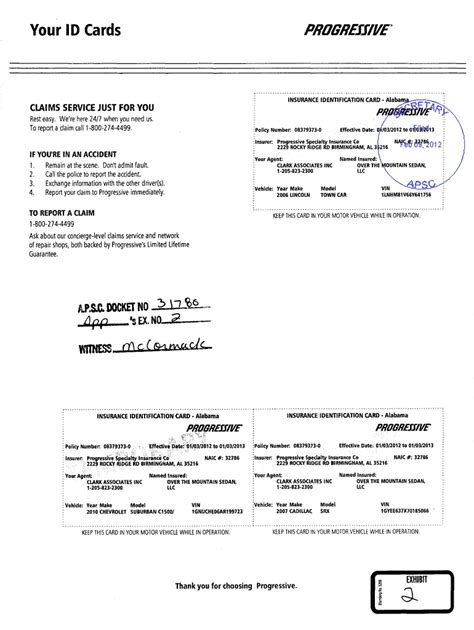

Car insurance is a legal requirement in most countries and an essential safeguard for vehicle owners. It provides financial protection against a range of risks, including accidents, theft, and damage to your vehicle or others’ property. With a myriad of coverage options and varying prices, understanding the fundamentals of car insurance is crucial for making informed decisions.

The Key Components of Car Insurance

Car insurance policies typically consist of several core components, each addressing specific risks and offering varying levels of coverage. These include:

- Liability Coverage: This is the most basic form of car insurance, covering the cost of damages and injuries you cause to others in an accident.

- Collision Coverage: This optional coverage pays for repairs to your vehicle after an accident, regardless of fault.

- Comprehensive Coverage: This coverage extends beyond accidents, providing protection against theft, vandalism, and natural disasters.

- Personal Injury Protection (PIP): PIP covers medical expenses for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have enough insurance.

Each of these components can be customized to fit your needs and budget. It's important to strike a balance between the level of coverage and the cost to ensure you're adequately protected without overspending.

Factors Influencing Car Insurance Rates

The cost of car insurance can vary significantly based on several factors. Understanding these factors can help you make more informed choices and potentially save money.

- Driver’s Profile: Your age, driving record, and credit score are key determinants of your insurance rates. Younger drivers and those with a history of accidents or traffic violations may face higher premiums.

- Vehicle Type: The make, model, and year of your car play a role in insurance costs. Sports cars and luxury vehicles often come with higher premiums due to their higher repair costs and theft risks.

- Coverage Level: The more comprehensive your coverage, the higher your premiums will likely be. However, it’s essential to strike a balance between cost and protection.

- Location: Insurance rates can vary based on your geographical location. Urban areas often have higher rates due to increased traffic and accident risks.

- Discounts and Bundles: Many insurance companies offer discounts for good driving records, safe vehicles, and bundled policies (e.g., combining car and home insurance).

Strategies for Finding Affordable Car Insurance

Securing affordable car insurance requires a combination of research, understanding, and strategic decision-making. Here are some expert tips to guide you in your search for cost-effective coverage.

Shop Around and Compare Quotes

One of the most effective ways to find affordable car insurance is to compare quotes from multiple providers. Each insurance company has its own rating system and factors that influence premiums. By getting quotes from at least three different insurers, you can identify the most competitive rates for your specific needs.

Use online quote comparison tools or contact insurance brokers to request quotes. Ensure you're comparing policies with similar coverage levels to make an accurate assessment.

Assess Your Coverage Needs

Before settling on a policy, carefully assess your coverage needs. Consider the value of your vehicle, your driving habits, and the risks you’re most likely to face. For example, if you have an older vehicle with a low market value, you might consider opting for liability-only coverage or increasing your deductible to reduce premiums.

Additionally, evaluate the coverage limits you need. Higher limits can provide greater financial protection but also increase your premiums. Strike a balance that ensures you're adequately protected without overpaying.

Explore Discounts and Bundles

Insurance companies often offer a variety of discounts to attract and retain customers. These can include discounts for safe driving records, vehicle safety features, good student grades, and loyalty. Some insurers also provide bundle discounts if you combine your car insurance with other policies, such as home or renters’ insurance.

Research the discounts available from different insurers and consider how you can qualify for these savings. For example, if you have a teenager who's a good student, you might be eligible for a good student discount. Or, if you're considering switching to a new insurer, ask about loyalty discounts to see if they can match or beat your current rates.

Maintain a Good Driving Record

Your driving record is a significant factor in determining your insurance rates. A clean driving record with no accidents or traffic violations can lead to lower premiums. Conversely, a history of accidents or moving violations can result in higher rates or even policy cancellations.

Practice safe driving habits, obey traffic laws, and avoid distractions while on the road. Regularly review your driving record and dispute any inaccuracies to ensure your insurance premiums are based on an accurate assessment of your driving history.

Consider Higher Deductibles

Increasing your deductible can significantly reduce your insurance premiums. A deductible is the amount you pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you’re essentially sharing more of the financial risk with your insurer, which can lead to lower monthly premiums.

However, it's important to choose a deductible amount that you're comfortable paying if you need to make a claim. Consider your financial situation and emergency funds before deciding on a higher deductible.

Review Your Policy Regularly

Car insurance rates can change over time due to various factors, including changes in your personal circumstances, vehicle, or driving habits. Regularly review your policy to ensure it still meets your needs and offers the best value. Compare your current rates with those from other insurers to see if you can find a better deal.

Additionally, review your coverage limits and consider adjusting them as your circumstances change. For example, if you've paid off your car loan, you might want to consider reducing your collision and comprehensive coverage, as these are often required by lenders.

Making the Most of Your Car Insurance Policy

Once you’ve secured an affordable car insurance policy, there are additional steps you can take to maximize the benefits and value of your coverage.

Understand Your Policy’s Terms and Conditions

Take the time to thoroughly read and understand your car insurance policy. Familiarize yourself with the coverage limits, deductibles, and any exclusions or limitations. This knowledge will help you make informed decisions when filing a claim and ensure you receive the full benefits of your policy.

File Claims Wisely

While car insurance is designed to provide financial protection, it’s important to use it wisely. Small claims, especially those below your deductible, may not be worth filing. The cost of the claim, including your deductible and potential premium increases, might outweigh the benefits.

Consider your options carefully before filing a claim. If the damage is minor and you have the financial means to cover the repairs, it might be more cost-effective to pay out of pocket and avoid potential premium increases.

Maintain a Safe Vehicle

A well-maintained vehicle is less likely to be involved in accidents or require costly repairs. Regularly service your car, keep up with maintenance, and address any issues promptly. This not only helps prevent accidents but can also reduce the risk of unexpected breakdowns and costly repairs.

Additionally, consider installing safety features such as anti-theft devices or advanced driver-assistance systems. Many insurers offer discounts for vehicles equipped with these features, as they reduce the risk of theft and accidents.

Explore Usage-Based Insurance

Usage-based insurance, also known as pay-as-you-drive insurance, is an innovative approach to car insurance that rewards safe driving habits. With this type of policy, your premiums are based on your actual driving behavior, such as miles driven, time of day, and driving habits.

If you have a safe driving record and drive infrequently or during low-risk hours, you might benefit from usage-based insurance. This can lead to significant savings, especially if you're a cautious driver who logs fewer miles than average.

Future Trends in Affordable Car Insurance

The car insurance industry is constantly evolving, driven by technological advancements and changing consumer needs. Here’s a glimpse into some of the trends that could impact the affordability and accessibility of car insurance in the future.

Telematics and Usage-Based Insurance

Usage-based insurance is expected to gain traction, with more insurers offering policies that reward safe driving habits. Telematics devices, which track driving behavior and provide real-time data, will play a key role in this trend. These devices can monitor factors like acceleration, braking, and cornering, providing insurers with accurate data to assess risk and set premiums.

Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning technologies are already being used in the insurance industry to streamline processes and enhance accuracy. In the future, these technologies are expected to play a larger role in risk assessment and claims processing. AI-powered systems can analyze vast amounts of data, including driving behavior, traffic patterns, and weather conditions, to more accurately predict risks and set premiums.

Connected Cars and Vehicle-to-Everything (V2X) Communication

The rise of connected cars and V2X communication will bring about significant changes in car insurance. These technologies enable vehicles to communicate with each other, infrastructure, and pedestrians, enhancing safety and reducing the risk of accidents. Insurers are likely to leverage this data to offer more precise risk assessments and tailored coverage options.

Data-Driven Risk Assessment

The insurance industry is increasingly leveraging big data analytics to gain insights into risk factors. By analyzing vast datasets, insurers can identify patterns and trends that influence accident risks. This data-driven approach will likely lead to more accurate risk assessments and tailored insurance offerings, potentially reducing costs for low-risk drivers.

Autonomous Vehicles and Insurance Liability

The advent of autonomous vehicles (AVs) will present new challenges and opportunities for the insurance industry. As AVs become more prevalent, questions of liability in accidents will shift from drivers to manufacturers and software developers. This could lead to a shift in insurance coverage, with more emphasis on product liability and cyber insurance to protect against hacking and software failures.

Conclusion: Navigating the Path to Affordable Car Insurance

Securing affordable car insurance is a complex but achievable goal. By understanding the key components of car insurance, assessing your coverage needs, and exploring various strategies, you can find a policy that offers comprehensive protection without straining your budget. Regularly review your policy, maintain a safe driving record, and stay informed about the latest trends in the insurance industry to make the most of your coverage.

Remember, car insurance is a vital safeguard, and finding the right balance between cost and coverage is essential. With the right approach and a thorough understanding of the market, you can navigate the path to affordable car insurance with confidence.

How often should I review my car insurance policy?

+It’s recommended to review your car insurance policy annually or whenever your circumstances change significantly. This allows you to stay up-to-date with any changes in coverage, premiums, or discounts.

Can I negotiate car insurance rates with my insurer?

+While car insurance rates are largely based on standardized formulas, you can negotiate certain aspects of your policy. For example, you might be able to discuss coverage limits, deductibles, or additional discounts to find a more favorable rate.

What factors influence the cost of comprehensive coverage?

+The cost of comprehensive coverage can be influenced by factors such as the make and model of your vehicle, your location, and the frequency of claims in your area. Comprehensive coverage also includes deductibles, so a higher deductible can reduce your premiums.