Affordable Insurance For Homeowners

Securing affordable insurance for homeowners is a significant concern for many individuals and families. Homeownership comes with various responsibilities, and one of the most crucial aspects is protecting your property and assets through adequate insurance coverage. This article aims to provide an in-depth exploration of the factors influencing homeowners' insurance rates, strategies to reduce costs, and expert insights to help you navigate the complex world of home insurance.

Understanding Homeowners’ Insurance Costs

The cost of homeowners’ insurance can vary significantly based on numerous factors. Understanding these elements is essential for homeowners seeking affordable coverage. Here’s a breakdown of the key factors influencing insurance rates:

Location and Geographical Factors

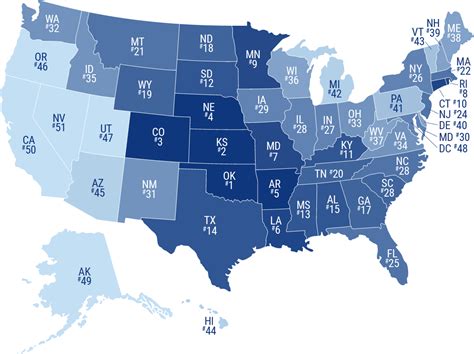

The geographical location of your home plays a pivotal role in determining insurance rates. Areas prone to natural disasters like hurricanes, earthquakes, or floods often carry higher insurance costs. Insurance companies assess the risk associated with these events and adjust premiums accordingly. For instance, regions with a history of severe weather conditions may have higher average insurance premiums.

| Location | Average Annual Premium |

|---|---|

| Miami, FL | $2,500 |

| Los Angeles, CA | $1,800 |

| Chicago, IL | $1,200 |

Home Value and Construction

The value and construction of your home significantly impact insurance costs. Higher-value homes or those with unique architectural features may require specialized coverage, leading to increased premiums. Additionally, the materials used in construction can affect insurance rates. For example, homes built with fire-resistant materials may qualify for reduced premiums.

Coverage Limits and Deductibles

The level of coverage you choose directly influences your insurance costs. Higher coverage limits often result in higher premiums. Similarly, selecting a higher deductible can reduce your monthly payments but requires you to pay more out-of-pocket in the event of a claim. It’s essential to strike a balance between coverage and affordability.

Claims History and Credit Score

Your insurance claims history and credit score are factors that insurance companies consider when determining rates. A history of frequent claims may lead to higher premiums, as it indicates a higher risk of future claims. Similarly, a good credit score can positively impact your insurance rates, as it reflects your financial responsibility.

Discounts and Bundling

Insurance companies often offer discounts to attract and retain customers. These discounts can significantly reduce your insurance costs. Some common discounts include:

- Multi-Policy Discount: Bundling your home and auto insurance policies with the same provider can result in substantial savings.

- Safety Features Discount: Installing security systems, smoke detectors, or fire sprinklers may qualify you for discounts.

- Loyalty Discount: Staying with the same insurance provider for an extended period can lead to reduced rates.

- New Home Discount: Purchasing insurance for a newly constructed home often comes with introductory discounts.

Strategies to Reduce Homeowners’ Insurance Costs

While insurance rates are influenced by various factors, there are strategies homeowners can employ to reduce their insurance costs. Here are some expert tips to consider:

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers. Take the time to shop around and compare quotes from multiple insurance companies. Online comparison tools can be particularly useful for this purpose. By comparing quotes, you can identify the most competitive rates and potentially save hundreds of dollars annually.

Increase Your Deductible

Opting for a higher deductible can lead to lower insurance premiums. While this strategy requires you to pay more out-of-pocket in the event of a claim, it can significantly reduce your monthly insurance costs. However, it’s essential to ensure that the chosen deductible is affordable and aligns with your financial capabilities.

Improve Your Home’s Security

Enhancing the security of your home can qualify you for insurance discounts. Installing security systems, surveillance cameras, or smart home devices that monitor for potential hazards can reduce the risk of break-ins or accidents. Insurance companies often reward such initiatives with lower premiums.

Maintain a Good Credit Score

Your credit score is an important factor in determining insurance rates. Maintaining a good credit score can positively impact your insurance costs. Focus on timely bill payments, reducing credit card balances, and managing your credit responsibly to improve your score and potentially qualify for lower insurance rates.

Review Your Coverage Regularly

Insurance needs can change over time. Regularly review your insurance coverage to ensure it aligns with your current requirements. As your home value or contents change, you may need to adjust your coverage limits. By regularly assessing your needs, you can avoid overpaying for unnecessary coverage or identify opportunities to reduce costs.

Expert Insights and Future Trends

Staying informed about the latest trends and expert insights in the insurance industry can help homeowners make more informed decisions. Here are some key considerations:

The Rise of Technology in Insurance

Technology is revolutionizing the insurance industry. Insurtech companies are leveraging data analytics and artificial intelligence to offer personalized insurance solutions. These innovations allow for more accurate risk assessment and can lead to more affordable insurance options. Keep an eye on emerging technologies and explore how they can benefit your insurance needs.

Climate Change and Natural Disasters

The increasing frequency and severity of natural disasters due to climate change pose a significant challenge for the insurance industry. As a result, insurance companies are reevaluating their risk assessment models. Homeowners in high-risk areas may face higher insurance costs or even difficulty in obtaining coverage. It’s crucial to stay informed about local climate risks and explore mitigation strategies to reduce your vulnerability.

The Role of Insurance Brokers

Insurance brokers can be valuable allies in navigating the complex world of homeowners’ insurance. They have expertise in assessing your specific needs and can shop around on your behalf to find the most suitable and affordable coverage. Consider consulting an insurance broker to explore your options and potentially save on insurance costs.

Future of Homeowners’ Insurance

The future of homeowners’ insurance is likely to be shaped by technological advancements and changing risk landscapes. As data analytics and predictive modeling improve, insurance companies will have more accurate tools to assess risks. This may lead to more personalized and affordable insurance options. Additionally, the rise of shared economy platforms may introduce new insurance models, offering flexible coverage tailored to specific needs.

How can I find out if my home is in a high-risk area for natural disasters?

+You can check with your local government or county offices to access maps and reports on natural disaster risks in your area. Additionally, online tools and resources provided by organizations like FEMA (Federal Emergency Management Agency) can offer insights into your specific location’s vulnerability.

Are there any government programs or subsidies available to help with homeowners’ insurance costs?

+Some states and local governments offer programs to assist homeowners with insurance costs, particularly in areas prone to natural disasters. These programs may provide grants, subsidies, or low-interest loans to help cover insurance premiums. It’s worth researching such programs in your region to see if you’re eligible.

What are some common mistakes homeowners make when choosing insurance coverage?

+Common mistakes include underinsuring their property, not understanding the coverage limits and exclusions, and failing to review policies annually. It’s essential to carefully review your policy, understand what’s covered, and adjust your coverage as needed to ensure you’re adequately protected.