Affordable Ppo Medical Insurance

Affordable PPO Medical Insurance: Navigating the Healthcare System with Cost-Effective Coverage

In today's healthcare landscape, finding affordable and comprehensive medical insurance is a top priority for many individuals and families. Preferred Provider Organization (PPO) plans have gained popularity for their flexibility and cost-saving benefits. This article delves into the world of affordable PPO medical insurance, exploring its advantages, key features, and how it can provide cost-effective coverage for your healthcare needs.

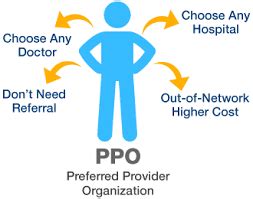

Understanding PPO Insurance Plans

PPO insurance plans offer a unique blend of flexibility and cost savings. Unlike Health Maintenance Organizations (HMOs) that restrict members to specific networks, PPOs provide greater freedom in choosing healthcare providers. Members have the option to visit in-network providers, who offer discounted rates, or out-of-network providers, although at a higher cost.

The appeal of PPO plans lies in their balance between choice and affordability. While they may have higher premiums compared to HMOs, the trade-off is the ability to access a wider range of healthcare services and specialists without prior referrals. This flexibility can be especially beneficial for individuals with specific healthcare needs or those who prefer a particular doctor or facility.

Key Features of Affordable PPO Plans

Affordable PPO medical insurance plans typically offer the following key features:

- Network of Providers: PPO plans provide access to a broad network of healthcare professionals, including primary care physicians, specialists, and hospitals. This network ensures you have a variety of options when seeking medical care.

- Lower Out-of-Pocket Costs: While visiting in-network providers, you benefit from discounted rates on services, procedures, and medications. This can significantly reduce your out-of-pocket expenses compared to out-of-network care.

- Flexible Referrals: PPO plans generally do not require referrals from primary care physicians to see specialists. This flexibility allows you to directly access the care you need without the hassle of obtaining prior authorization.

- Coverage for Pre-Existing Conditions: Affordable PPO plans often cover pre-existing conditions, ensuring that individuals with ongoing health issues can access necessary treatments without facing additional financial burdens.

- Out-of-Network Coverage: While in-network care is more affordable, PPO plans also provide coverage for out-of-network services. This is particularly beneficial when specialized care is required or when traveling.

The Benefits of Affordable PPO Insurance

Affordable PPO medical insurance offers a range of advantages that make it an appealing choice for individuals and families:

1. Choice and Flexibility

One of the primary benefits of PPO plans is the freedom to choose your healthcare providers. Whether you have a trusted family doctor or require specialized care, PPOs allow you to maintain your preferred healthcare team without restrictions.

2. Cost Savings

While PPO plans may have slightly higher premiums, they can lead to significant cost savings in the long run. By utilizing in-network providers, you benefit from discounted rates, reducing your out-of-pocket expenses. This is especially beneficial for individuals with chronic conditions or those who require frequent medical visits.

| In-Network vs. Out-of-Network Costs |

|---|

| In-Network: Lower copays, deductibles, and coinsurance |

| Out-of-Network: Higher costs, but still covered by the plan |

3. Comprehensive Coverage

Affordable PPO plans often offer comprehensive coverage, including preventive care, specialist visits, hospital stays, prescription medications, and more. This ensures that your healthcare needs are met without financial strain.

4. Coverage for Pre-Existing Conditions

PPO plans typically cover pre-existing conditions, which is a significant advantage for individuals with ongoing health issues. This ensures that necessary treatments and medications are accessible without exclusions or waiting periods.

Finding the Right Affordable PPO Plan

When searching for an affordable PPO medical insurance plan, consider the following factors to find the best fit for your needs:

- Premium Costs: Compare the monthly premiums of different PPO plans. While premiums are an important consideration, ensure you also evaluate the overall value and coverage provided.

- Network of Providers: Research the network of healthcare providers associated with the plan. Ensure that your preferred doctors and facilities are included to maintain continuity of care.

- Out-of-Pocket Expenses: Understand the potential out-of-pocket costs, including deductibles, copays, and coinsurance. Assess how these expenses align with your healthcare needs and budget.

- Coverage Details: Review the plan's coverage details, including what is and isn't covered. Pay attention to any exclusions or limitations to ensure the plan meets your specific healthcare requirements.

- Prescription Drug Coverage: If you take prescription medications regularly, confirm that the plan offers comprehensive prescription drug coverage at an affordable cost.

Tips for Saving on PPO Insurance

To maximize your savings on affordable PPO medical insurance, consider these strategies:

- Compare Multiple Plans: Shop around and compare different PPO plans to find the most cost-effective option. Consider using online comparison tools or consulting with insurance brokers.

- Evaluate Network Options: Assess the network of providers offered by each plan. Opt for a plan with a robust network that includes your preferred healthcare professionals and facilities.

- Consider High-Deductible Plans: If you're generally healthy and don't anticipate frequent medical expenses, a high-deductible PPO plan can be a cost-saving option. These plans often have lower premiums, and you can further save by contributing to a Health Savings Account (HSA) to cover deductibles and other out-of-pocket costs.

- Review Plan Benefits Regularly: Insurance plans and their benefits can change annually. Stay informed about any updates or changes to your plan's coverage and costs. Regularly review your options during open enrollment periods to ensure you're still getting the best value.

FAQs

What is the difference between an HMO and a PPO plan?

+HMOs and PPOs differ in their network restrictions and referral requirements. HMOs have a more limited network and often require referrals to see specialists, while PPOs offer a broader network and allow direct access to specialists without prior authorization.

Are affordable PPO plans suitable for families with young children?

+Yes, affordable PPO plans can be an excellent choice for families. They offer flexibility in choosing pediatricians and specialists, comprehensive coverage for well-child visits and immunizations, and often include family-friendly benefits like maternity care and pediatric dental coverage.

Can I change my PPO plan during the year if my healthcare needs change?

+In most cases, you are locked into your insurance plan for the entire year, with limited exceptions. However, certain life events like getting married, having a baby, or losing other health coverage may allow you to switch plans during the year.

What is the typical cost of an affordable PPO plan?

+The cost of an affordable PPO plan can vary based on factors like your age, location, and the specific plan benefits. Generally, you can expect monthly premiums to range from 200 to 600, with potential out-of-pocket expenses like deductibles and copays.