Affordable Secondary Health Insurance

In the world of healthcare, navigating insurance options can be a complex task, especially when it comes to secondary health insurance. While primary insurance plans are often provided by employers or government programs, secondary insurance acts as a valuable complement, offering additional coverage and peace of mind. However, the term "affordable" is subjective and varies based on individual circumstances and the specific insurance market. This article aims to delve into the realm of affordable secondary health insurance, exploring its benefits, considerations, and how individuals can make informed choices to secure comprehensive healthcare coverage without breaking the bank.

Understanding Secondary Health Insurance

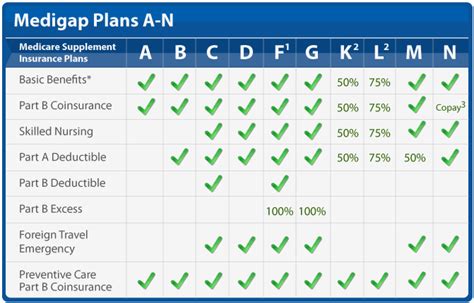

Secondary health insurance, also known as supplemental or gap insurance, is designed to fill the gaps left by primary insurance plans. It acts as a secondary layer of protection, covering expenses that primary insurance may not fully cover, such as deductibles, co-payments, and out-of-pocket maximums. This type of insurance is particularly beneficial for individuals with high-deductible health plans or those who want to minimize their financial risk in the event of a serious illness or injury.

Key Benefits of Secondary Health Insurance

The primary advantage of secondary health insurance is the enhanced financial protection it provides. By covering a portion of the costs associated with medical care, it can significantly reduce the financial burden on individuals and families. This is especially crucial for unexpected medical emergencies, where the costs can quickly add up.

Additionally, secondary insurance often offers a broader range of coverage options. For instance, it may include benefits for specific treatments or services that are not typically covered by primary insurance. This can include alternative therapies, dental or vision care, or even travel insurance for medical emergencies while abroad. By tailoring the coverage to individual needs, secondary insurance plans provide a more comprehensive safety net.

| Secondary Insurance Benefits | Description |

|---|---|

| Deductible Coverage | Secondary insurance can help cover deductibles, reducing out-of-pocket expenses. |

| Co-Payment Support | It often provides assistance for co-payments, making medical services more affordable. |

| Out-of-Pocket Maximums | Secondary insurance can help limit the financial impact of high out-of-pocket maximums. |

| Specialized Treatments | Some plans offer coverage for specific treatments or therapies not typically included in primary insurance. |

Affordability and Cost Considerations

When discussing affordable secondary health insurance, it’s essential to consider the various factors that influence the cost and value of such plans.

Premium Costs

Premiums are the regular payments made to maintain the insurance coverage. For secondary health insurance, premiums can vary widely based on the level of coverage, the insurance provider, and the individual’s age and health status. Generally, plans with higher coverage limits or more comprehensive benefits will have higher premiums. It’s crucial to strike a balance between the desired level of coverage and the affordability of the premium.

Some insurance companies offer discounts or incentives for long-term policyholders or for enrolling in multiple plans. These can help reduce the overall cost of secondary insurance and make it more accessible.

Coverage Limits and Deductibles

The coverage limits and deductibles of a secondary insurance plan directly impact its affordability. Higher coverage limits mean the plan will provide more financial protection, but it will also result in a higher premium. Similarly, lower deductibles can make the plan more attractive, as individuals won’t have to pay as much out of pocket before the insurance kicks in. However, lower deductibles often correspond with higher premiums.

Individual vs. Family Plans

The decision to opt for an individual or family plan can significantly affect the affordability of secondary insurance. Family plans typically offer more comprehensive coverage and may be more cost-effective for larger households. However, for single individuals or those with specific healthcare needs, an individual plan tailored to their requirements might be a more affordable option.

Choosing the Right Affordable Plan

Selecting an affordable secondary health insurance plan requires careful consideration and research. Here are some key steps to guide the decision-making process:

Assess Your Healthcare Needs

Before choosing a plan, it’s crucial to understand your current and potential future healthcare needs. Consider any ongoing medical conditions, the likelihood of requiring specialized treatments, and the financial impact of unexpected medical emergencies. This assessment will help determine the type and level of coverage required.

Compare Multiple Providers

The insurance market is competitive, and prices can vary significantly between providers. Compare quotes from several companies to ensure you’re getting the best value for your money. Look beyond just the premium costs; consider the coverage limits, deductibles, and any additional benefits or perks offered by each provider.

Evaluate Plan Features

Each insurance plan will have unique features and exclusions. Carefully review the policy documents to understand what is and isn’t covered. Look for plans that offer the specific benefits you need, such as coverage for prescription drugs, mental health services, or specific medical procedures. Avoid plans with excessive exclusions or limitations that could leave you financially vulnerable.

Consider Network Providers

Many insurance plans have networks of preferred healthcare providers. Choosing a plan with a broad network can provide more options and potentially lower costs, as in-network providers often offer discounted rates. However, if you have a preferred healthcare provider or specialist, ensure they are included in the network before committing to a plan.

Read Reviews and Ratings

Online reviews and ratings from current and past policyholders can provide valuable insights into the reliability and customer service of insurance providers. Look for companies with a solid reputation for prompt claim processing, fair practices, and positive customer experiences. A company with a strong track record is more likely to provide a seamless and stress-free insurance experience.

Maximizing the Value of Secondary Insurance

Once you’ve chosen an affordable secondary health insurance plan, there are strategies to maximize its value and ensure it meets your healthcare needs effectively.

Understand Your Coverage

Take the time to thoroughly understand your insurance policy. Know what is covered, any exclusions or limitations, and the specific terms and conditions. This knowledge will help you make informed decisions about your healthcare and avoid unexpected expenses.

Utilize Preventive Care

Many secondary insurance plans offer coverage for preventive care services, such as annual check-ups, screenings, and vaccinations. Taking advantage of these services can help identify potential health issues early on, leading to better overall health and potentially reducing future medical costs.

Manage Chronic Conditions

If you have a chronic condition, work with your healthcare provider to develop a management plan. This may involve regular check-ins, prescribed medications, or lifestyle changes. By actively managing your condition, you can potentially reduce the frequency and severity of medical episodes, thus minimizing the financial impact.

Explore Discounts and Incentives

Insurance providers often offer discounts or incentives for healthy lifestyle choices, such as gym memberships, smoking cessation programs, or weight loss initiatives. Taking advantage of these programs can not only improve your overall health but may also lead to reduced insurance premiums or other benefits.

Stay Informed and Advocate for Yourself

The healthcare industry can be complex, and it’s essential to stay informed about your rights and options. Keep yourself updated on any changes to your insurance plan, such as coverage updates or premium adjustments. If you encounter issues with your insurance provider, don’t hesitate to advocate for yourself. Many companies have customer support teams dedicated to resolving concerns and ensuring policyholders receive the benefits they’re entitled to.

How does secondary health insurance work with my primary insurance plan?

+Secondary health insurance acts as a complement to your primary insurance plan. When you incur medical expenses, your primary insurance will cover the costs first, up to its coverage limits. Any remaining costs, such as deductibles or co-payments, are then covered by your secondary insurance plan. This two-tiered approach ensures you have more comprehensive financial protection.

Are there any age restrictions for affordable secondary health insurance plans?

+Age can play a role in the affordability and availability of secondary health insurance plans. Younger individuals may find more affordable options, as they generally have fewer medical needs and are less likely to require extensive coverage. However, many providers offer plans specifically tailored to older adults, ensuring they too can access affordable secondary insurance.

What happens if I have multiple secondary insurance plans?

+Having multiple secondary insurance plans can provide additional financial protection. In such cases, the plans typically coordinate benefits to ensure you don’t receive more than the total amount of your medical expenses. The order in which the plans pay out will depend on their coordination of benefits rules, which are often based on the type of insurance (e.g., group or individual) and the order of enrollment.