Affordable Vehicle Insurance

In today's world, where vehicles are an essential part of our daily lives, having affordable and reliable insurance is a top priority for many individuals and families. Vehicle insurance is a critical aspect of responsible ownership, offering financial protection and peace of mind. This comprehensive guide will delve into the intricacies of affordable vehicle insurance, exploring the factors that influence its cost, the coverage options available, and the strategies to secure the best value for your hard-earned money.

Understanding the Landscape of Affordable Vehicle Insurance

Affordable vehicle insurance is more than just a low-cost policy; it’s about finding the right balance between coverage and price. This section will provide an in-depth analysis of the key factors that contribute to the cost of vehicle insurance, helping you navigate the market with confidence.

Factors Influencing Insurance Premiums

The cost of vehicle insurance is influenced by a multitude of factors, each playing a unique role in determining the overall premium. These factors can be broadly categorized into personal and vehicle-related attributes.

- Personal Factors: Age, gender, driving history, and credit score are key personal attributes that insurance providers consider. For instance, young drivers and those with a history of accidents or traffic violations may face higher premiums. Additionally, a good credit score can often lead to more favorable insurance rates.

- Vehicle Factors: The type of vehicle you own, its age, make, and model, and even the safety features it possesses, all impact insurance costs. High-performance cars, luxury vehicles, and those with a higher likelihood of theft or accidents tend to be more expensive to insure.

- Location: Where you live and where you primarily drive your vehicle can significantly affect your insurance rates. Urban areas with higher population density and traffic congestion often come with increased risks, leading to higher premiums. Conversely, rural areas may offer more affordable insurance options.

- Usage: How and how often you use your vehicle also influences insurance costs. Commuters who drive long distances daily may pay more than those who primarily use their vehicles for occasional leisure trips.

- Coverage and Deductibles: The level of coverage you choose and the corresponding deductibles play a pivotal role in determining your insurance premium. Higher coverage limits and lower deductibles generally result in higher premiums, while opting for lower coverage and higher deductibles can lead to more affordable insurance.

By understanding these factors, you can make informed decisions when shopping for vehicle insurance, ensuring you get the coverage you need at a price that fits your budget.

Comparing Insurance Providers and Policies

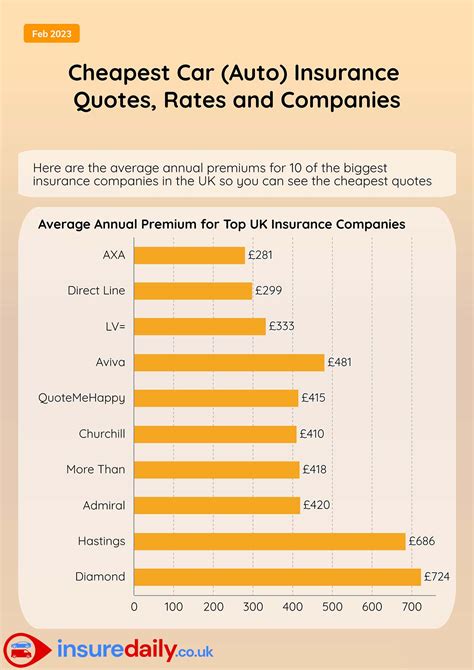

The market for vehicle insurance is diverse, with numerous providers offering a wide range of policies. It’s crucial to compare these options to find the most affordable and suitable insurance for your needs.

- Research and Reviews: Start by researching reputable insurance providers in your area. Online reviews and testimonials can provide valuable insights into the quality of service and the overall customer experience.

- Coverage Options: Compare the coverage options offered by different providers. Ensure that the policies you’re considering align with your specific needs, whether it’s comprehensive coverage, liability-only insurance, or something in between.

- Pricing and Discounts: Compare the premiums for similar coverage levels across providers. Many insurance companies offer discounts for various reasons, such as safe driving records, multiple policy bundles, or vehicle safety features. Take advantage of these discounts to reduce your insurance costs.

- Customer Service and Claims Process: Consider the reputation and reliability of the insurance provider’s customer service and claims handling. Efficient and responsive customer service can make a significant difference, especially during the claims process.

- Online Quotes and Tools: Utilize online quote generators and comparison tools to quickly and easily compare insurance options. These tools often provide a comprehensive overview of different policies, allowing you to make informed decisions.

The Impact of Credit Score on Insurance Costs

Your credit score is an important factor that insurance providers use to assess your financial reliability. A good credit score can lead to significant savings on your insurance premiums, as it indicates a lower risk of financial loss for the insurance company.

However, it's important to note that the use of credit scores in insurance pricing is not universal. Some states have implemented regulations that limit or prohibit the use of credit scores in insurance pricing, ensuring that insurance remains accessible and affordable for all.

Maximizing Affordability: Strategies for Lower Insurance Costs

Finding affordable vehicle insurance is not just about comparing rates; it’s about employing strategic approaches to reduce your insurance costs while maintaining adequate coverage. This section will outline practical strategies to help you save on your vehicle insurance premiums.

Bundling Policies for Discounts

One effective way to reduce your insurance costs is by bundling multiple policies with the same provider. Many insurance companies offer discounts when you purchase multiple types of insurance, such as auto, home, or renters’ insurance, from them.

By bundling your policies, you not only save on premiums but also streamline your insurance management. It's a win-win situation, as you benefit from cost savings and the convenience of having all your insurance needs handled by a single provider.

Safe Driving and Discounts

Maintaining a clean driving record is not only essential for your safety but also for keeping your insurance costs low. Many insurance providers offer safe driving discounts, rewarding drivers who have a history of responsible and accident-free driving.

Additionally, some insurance companies now utilize telematics devices or smartphone apps to monitor driving behavior. These tools can track your driving habits, such as speed, braking, and mileage, and offer discounts based on your demonstrated safe driving practices. This innovative approach to insurance pricing, known as usage-based insurance or pay-as-you-drive insurance, provides an incentive for drivers to adopt safer driving habits.

Understanding Coverage Options

Choosing the right level of coverage is crucial for both financial protection and affordability. It’s essential to understand the different types of coverage available and select the options that best suit your needs and budget.

- Liability Coverage: This is the most basic form of vehicle insurance, covering damages or injuries you cause to others in an accident. It's legally required in most states and is an essential component of any insurance policy.

- Comprehensive Coverage: This coverage protects against damages caused by events other than collisions, such as theft, vandalism, weather-related incidents, or collisions with animals. While it may not be legally required, comprehensive coverage is highly recommended to safeguard your vehicle from a wide range of potential risks.

- Collision Coverage: Collision coverage pays for repairs to your vehicle after an accident, regardless of who is at fault. It's an essential component of comprehensive insurance and provides valuable protection for your vehicle's physical integrity.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in the event of an accident with a driver who either doesn't have insurance or doesn't have sufficient insurance to cover the damages. It's an important safeguard to have, ensuring you're not left financially vulnerable in the event of an accident caused by an uninsured driver.

Utilizing High Deductibles

Opting for a higher deductible can be an effective way to reduce your insurance premiums. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you’re essentially agreeing to pay more in the event of a claim, which can lead to significant savings on your insurance policy.

However, it's important to strike a balance. While a higher deductible can result in lower premiums, it also means you'll have to pay more out of pocket if you need to make a claim. Consider your financial situation and risk tolerance when deciding on the appropriate deductible level for your insurance policy.

Other Cost-Saving Tips

- Shop Around Regularly: Insurance rates can change over time, so it’s a good practice to shop around every year or whenever your policy is up for renewal. This ensures you’re always getting the best deal and aren’t paying more than necessary.

- Ask for Discounts: Don’t hesitate to inquire about available discounts. Many insurance companies offer a variety of discounts, such as those for good students, mature drivers, or membership in certain organizations. Even if you don’t qualify for all of them, you may still be eligible for some savings.

- Maintain a Good Credit Score: As mentioned earlier, your credit score can impact your insurance premiums. Work on improving and maintaining a good credit score to potentially reduce your insurance costs.

- Consider Usage-Based Insurance: If you’re a safe and cautious driver, you may benefit from usage-based insurance. This type of insurance uses telematics or smartphone apps to monitor your driving behavior and offer discounts based on your safe driving practices.

Navigating the Future of Affordable Vehicle Insurance

The landscape of vehicle insurance is constantly evolving, driven by advancements in technology and changing consumer needs. As we move forward, it’s essential to stay informed about emerging trends and developments that could impact the affordability and accessibility of vehicle insurance.

Emerging Technologies and Insurance

The integration of technology into the insurance industry is revolutionizing the way insurance is priced and delivered. Here are some key technological advancements that are shaping the future of affordable vehicle insurance:

- Telematics and Usage-Based Insurance: As mentioned earlier, telematics and usage-based insurance are gaining traction, offering discounts to drivers who demonstrate safe driving habits. This technology provides real-time data on driving behavior, allowing insurance providers to offer more accurate and personalized premiums.

- Artificial Intelligence (AI) and Machine Learning: AI and machine learning algorithms are being used to analyze vast amounts of data, including driving behavior, vehicle performance, and environmental factors. This enables insurance providers to make more informed decisions about risk assessment and pricing, potentially leading to more accurate and affordable insurance policies.

- Blockchain Technology: Blockchain, the technology behind cryptocurrencies like Bitcoin, is being explored for its potential to enhance insurance processes. It can improve data security, streamline claims processing, and even enable the creation of decentralized insurance platforms, offering greater transparency and efficiency.

- Internet of Things (IoT) Devices: IoT devices, such as connected car sensors and smart home devices, are providing valuable data that can be used to assess risk and offer personalized insurance rates. These devices can monitor driving behavior, vehicle performance, and even home security, allowing insurance providers to offer more tailored coverage and pricing.

Regulatory Changes and Consumer Protection

Regulatory bodies play a crucial role in ensuring that the insurance industry remains fair and accessible to consumers. Here’s how regulatory changes are shaping the future of affordable vehicle insurance:

- Consumer Protection Laws: Many states have implemented consumer protection laws that regulate the use of credit scores and other personal information in insurance pricing. These laws aim to prevent discrimination and ensure that insurance remains affordable and accessible to all, regardless of their personal attributes.

- Market Competition and Transparency: Regulatory bodies also work to promote market competition and transparency. By encouraging a diverse and competitive insurance market, consumers have more options and can make more informed choices, leading to better deals and more affordable insurance.

- Data Privacy and Security: With the increasing use of technology in the insurance industry, data privacy and security have become critical concerns. Regulatory bodies are working to establish guidelines and standards to protect consumer data, ensuring that personal information is handled securely and ethically.

The Role of Education and Awareness

Education and awareness play a vital role in helping consumers make informed decisions about their vehicle insurance. Here’s how these factors contribute to the future of affordable insurance:

- Consumer Education: Providing consumers with clear and accessible information about insurance coverage, pricing, and their rights as policyholders is essential. Educated consumers are better equipped to choose the right insurance for their needs and advocate for themselves when issues arise.

- Awareness of Discounts and Benefits: Many insurance providers offer a variety of discounts and benefits, but not all consumers are aware of them. Increasing awareness of these opportunities can help consumers save money on their insurance premiums and take advantage of additional perks, such as roadside assistance or rental car coverage.

- Understanding Insurance Terminology: Insurance policies can be complex, with a lot of technical language and legal jargon. Educating consumers about common insurance terms and concepts can help them better understand their policies and make more informed decisions when selecting coverage.

The Future of Affordable Vehicle Insurance: A Summary

The future of affordable vehicle insurance is promising, driven by technological advancements, regulatory changes, and consumer education. As technology continues to evolve, we can expect more personalized and accurate insurance pricing, based on real-time data and advanced analytics. Regulatory bodies will continue to play a critical role in ensuring a fair and competitive insurance market, protecting consumers’ rights and interests.

Additionally, consumer education and awareness will be key in empowering individuals to make informed choices about their insurance coverage. By staying informed about insurance options, discounts, and their rights as policyholders, consumers can navigate the insurance market with confidence and secure the most affordable and suitable coverage for their needs.

FAQ

What is the average cost of vehicle insurance in the US?

+

The average cost of vehicle insurance in the US varies based on numerous factors, including the state you live in, your driving history, and the make and model of your vehicle. As of 2023, the national average for car insurance premiums is around $1,674 per year, according to data from the Insurance Information Institute. However, it’s important to note that this average can vary significantly depending on individual circumstances.

How can I lower my insurance premiums if I have a poor driving record?

+

If you have a poor driving record, it can be challenging to lower your insurance premiums. However, there are a few strategies you can employ. First, consider enrolling in a defensive driving course. Completing such a course can demonstrate to insurance providers that you’re committed to improving your driving skills and may result in a discount. Additionally, shop around and compare quotes from multiple insurance providers. Some companies may offer more lenient rates for drivers with a history of accidents or violations. Lastly, consider increasing your deductible. While this means you’ll pay more out of pocket in the event of a claim, it can lower your overall premiums.

Are there any discounts available for electric vehicles (EVs)?

+

Yes, many insurance providers offer discounts for electric vehicles. EVs often have advanced safety features and are generally considered to be safer and more environmentally friendly than traditional vehicles. As a result, some insurance companies provide incentives in the form of discounts to encourage the adoption of electric vehicles. These discounts can vary depending on the insurance provider and the specific features of the EV, so it’s worth shopping around to find the best deal.