Aig Life Insurance Policy

Welcome to an in-depth exploration of the AIG Life Insurance Policy, a comprehensive guide designed to navigate the intricate world of life insurance. This article aims to provide an expert-level understanding of AIG's life insurance offerings, their unique features, and the benefits they bring to policyholders. As we delve into the specifics, we will uncover the key advantages, the application process, and the overall value proposition that AIG brings to the table.

Life insurance is an essential financial tool that provides security and peace of mind to individuals and their families. It offers a financial safety net in times of uncertainty, ensuring that loved ones are protected and their future is secure. Among the myriad of life insurance providers, AIG stands out with its comprehensive range of policies tailored to meet diverse needs.

Understanding AIG’s Life Insurance Policies

American International Group, commonly known as AIG, is a leading global insurance provider with a rich history spanning over a century. Their life insurance division has established a strong reputation for delivering innovative and reliable coverage solutions. AIG’s life insurance policies are designed to cater to a wide range of demographics, offering customizable options to fit individual needs.

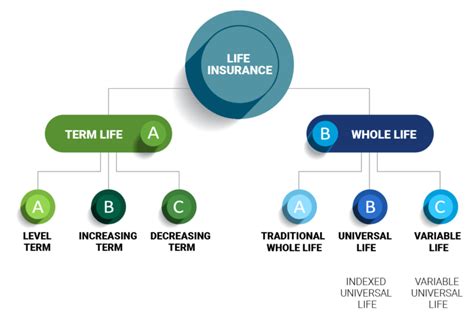

AIG's life insurance policies can be broadly categorized into two main types: Term Life Insurance and Permanent Life Insurance. Each type serves a distinct purpose and offers unique benefits to policyholders.

Term Life Insurance

Term life insurance is a straightforward and cost-effective option designed to provide coverage for a specified period, typically ranging from 10 to 30 years. It offers high coverage amounts at a relatively low cost, making it an ideal choice for individuals seeking temporary financial protection. Term life insurance is particularly useful for covering specific financial goals or obligations, such as mortgage payments or children’s education expenses.

AIG's term life insurance policies offer flexibility and customization. Policyholders can choose the term length that aligns with their specific needs, ensuring coverage during critical life stages. Additionally, riders and optional benefits can be added to enhance the policy, such as accelerated death benefit for critical illness or waiver of premium in case of disability.

| Policy Type | Coverage Period | Key Features |

|---|---|---|

| Standard Term | 10, 15, 20, 30 years | Affordable, renewable, convertible to permanent life insurance |

| Level Term | Fixed term (e.g., 20 years) | Level premiums, suitable for long-term financial planning |

| Return of Premium Term | Varies | Returns premium payments at the end of the term if no claims are made |

Permanent Life Insurance

Permanent life insurance, as the name suggests, provides lifelong coverage, offering both financial protection and a savings component. This type of policy accumulates cash value over time, which can be accessed through policy loans or withdrawals. Permanent life insurance is a popular choice for long-term financial planning and wealth accumulation.

AIG's permanent life insurance policies come in various forms, each with unique features and benefits. These policies often offer guaranteed death benefits, flexible premium payments, and the potential for cash value growth.

| Policy Type | Key Features |

|---|---|

| Whole Life Insurance | Guaranteed death benefit, cash value accumulation, level premiums |

| Universal Life Insurance | Flexible premiums, adjustable death benefit, cash value growth potential |

| Indexed Universal Life Insurance | Linked to market indices, offers potential for higher cash value growth with some protection against market downturns |

The Application Process: A Smooth Journey to Coverage

Applying for an AIG life insurance policy is a straightforward and efficient process, designed to be as seamless as possible. AIG understands the importance of timely coverage, especially during critical life events.

Step 1: Choose Your Policy

The first step is to carefully evaluate your needs and select the type of policy that aligns with your financial goals and circumstances. Whether you opt for term life insurance for temporary coverage or permanent life insurance for long-term protection and savings, AIG has a range of options to choose from.

Step 2: Gather Necessary Information

Once you’ve decided on the policy type, gather the required information. This typically includes personal details such as name, date of birth, address, and contact information. Additionally, you’ll need to provide details about your health, lifestyle, and any pre-existing conditions.

Step 3: Complete the Application

AIG provides a user-friendly online application process, allowing you to complete the application at your convenience. The application typically includes questions about your health, occupation, and lifestyle. It’s important to answer these questions accurately to ensure the best possible outcome.

Step 4: Medical Examination (if required)

In some cases, AIG may require a medical examination as part of the application process. This is especially common for permanent life insurance policies or for applicants with certain health conditions. The medical exam is usually conducted by a paramedical professional at a time and location convenient for you.

Step 5: Policy Underwriting

Once your application and any necessary medical examinations are complete, AIG’s underwriting team will carefully review your application. This process ensures that your policy is tailored to your specific needs and circumstances. The underwriting process may include a review of your medical history, driving record, and other relevant factors.

Step 6: Policy Issuance

Upon successful completion of the underwriting process, AIG will issue your life insurance policy. You’ll receive a policy document outlining the coverage, benefits, and any exclusions. It’s important to review this document carefully to ensure it aligns with your expectations.

The Value Proposition: Why Choose AIG Life Insurance

AIG’s life insurance policies offer a compelling value proposition, providing a range of benefits that set them apart from competitors. Here are some key advantages of choosing AIG for your life insurance needs:

Financial Strength and Stability

AIG is a globally recognized insurance provider with a strong financial foundation. Their reputation for stability and reliability ensures that policyholders can trust AIG to be there when they need it most. AIG’s financial strength is a critical factor in providing long-term security and peace of mind.

Customizable Policies

AIG understands that every individual has unique needs and circumstances. Their life insurance policies are highly customizable, allowing policyholders to tailor their coverage to their specific requirements. Whether it’s adjusting term lengths, adding riders, or choosing the right permanent life insurance policy, AIG offers flexibility.

Innovative Features

AIG is known for its innovative approach to insurance. Their life insurance policies often incorporate cutting-edge features and benefits. For example, their permanent life insurance policies offer advanced cash value growth options, providing policyholders with the potential for higher returns.

Excellent Customer Service

AIG prides itself on its commitment to excellent customer service. Their dedicated team of professionals is always ready to assist policyholders with any queries or concerns. From the application process to claims management, AIG ensures a smooth and supportive experience.

Claims Process Efficiency

In the unfortunate event of a claim, AIG’s streamlined claims process ensures prompt and efficient handling. Their experienced claims team works diligently to process claims quickly, providing financial support to policyholders and their beneficiaries when it matters most.

Conclusion: AIG’s Commitment to Your Future

AIG’s life insurance policies are designed with a singular focus: to provide comprehensive financial protection and peace of mind. Whether you’re seeking temporary coverage with term life insurance or long-term financial security with permanent life insurance, AIG offers a range of customizable options to meet your unique needs.

With their financial strength, innovative features, and commitment to customer service, AIG stands as a trusted partner in your financial journey. Their life insurance policies offer the stability and flexibility needed to navigate life's uncertainties, ensuring that you and your loved ones are protected every step of the way.

Frequently Asked Questions

What are the key differences between term life insurance and permanent life insurance?

+

Term life insurance offers temporary coverage for a specified period, providing high coverage amounts at a low cost. It is ideal for covering specific financial goals or obligations. On the other hand, permanent life insurance provides lifelong coverage with a savings component, allowing for cash value accumulation. Permanent life insurance is suitable for long-term financial planning and wealth accumulation.

How does AIG ensure the financial stability of its life insurance policies?

+

AIG’s financial stability is a key strength. They have a strong global presence and a long history of financial reliability. Their life insurance policies are backed by robust financial reserves, ensuring that policyholders can trust AIG to honor their commitments. AIG’s financial strength is regularly assessed by leading rating agencies.

Can I add riders to my AIG life insurance policy?

+

Yes, AIG offers a range of optional riders and benefits that can be added to your life insurance policy. These include accelerated death benefit for critical illness, waiver of premium in case of disability, and other features that enhance your coverage and provide additional protection.

What happens if I need to make a claim under my AIG life insurance policy?

+

In the event of a claim, AIG’s experienced claims team will guide you through the process. They will assist with the necessary documentation and work diligently to process your claim promptly. AIG understands the importance of timely financial support during difficult times.

How can I contact AIG’s customer service for support or queries?

+

AIG’s customer service team is dedicated to providing excellent support. You can reach them through various channels, including a toll-free phone number, email, or live chat on their website. They are committed to assisting you with any questions or concerns you may have about your life insurance policy.