All About Car Insurance

Unveiling the Essentials: A Comprehensive Guide to Car Insurance

In the intricate world of vehicle ownership, one of the most crucial decisions you'll make is choosing the right car insurance. This financial safety net can be the difference between a smooth recovery from an accident and a financial nightmare. With so many options and terms floating around, understanding car insurance is vital. Let's embark on a journey to demystify this essential aspect of car ownership.

Car insurance is a contract between you and an insurance provider. It's designed to protect you financially in the event of an accident, theft, or other vehicle-related damages. This protection comes at a cost, and the insurance premium you pay is determined by various factors such as your driving history, the make and model of your car, and even your location. However, the benefits of having comprehensive car insurance far outweigh the costs, offering peace of mind and financial security.

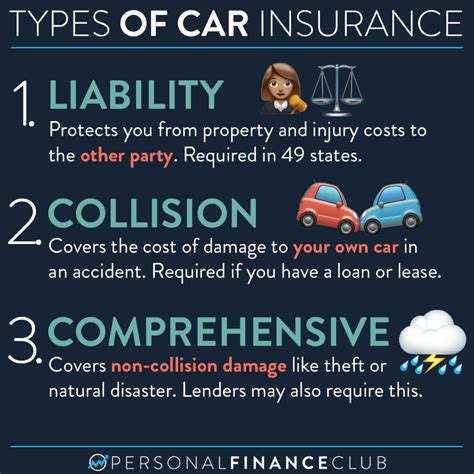

Understanding the Basics: Types of Car Insurance

Car insurance policies can be categorized into several types, each offering different levels of coverage. Let's delve into these categories to help you make an informed choice.

Liability Coverage

Liability coverage is the most basic form of car insurance. It protects you from financial loss if you’re found legally responsible for causing bodily injury or property damage to others. This coverage is mandatory in most states and is essential for protecting your assets. However, it’s important to note that liability coverage does not extend to your own vehicle or injuries you may sustain in an accident.

Collision Coverage

Collision coverage, as the name suggests, comes into play when your vehicle is involved in a collision with another vehicle or object. This coverage pays for the repair or replacement of your vehicle, regardless of who is at fault. Collision insurance is particularly beneficial if you own a newer or more valuable vehicle, as it can help cover the costs of extensive repairs or a total loss.

Comprehensive Coverage

Comprehensive coverage, often referred to as “other than collision” coverage, protects against damages that aren’t caused by a collision. This includes events like theft, vandalism, natural disasters, or even hitting an animal. Comprehensive coverage is highly recommended, especially if you live in an area prone to natural disasters or if your vehicle is often parked outdoors.

Personal Injury Protection (PIP) and Medical Payments Coverage

Personal Injury Protection (PIP) and Medical Payments coverage focus on providing medical benefits to the insured and their passengers in the event of an accident, regardless of fault. PIP coverage can also include lost wages and other related expenses. Medical Payments coverage, on the other hand, specifically covers medical expenses for the insured and their passengers. Both of these coverages are crucial for ensuring your health and financial well-being in the aftermath of an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/Underinsured Motorist Coverage steps in when you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage can help protect you from financial loss and ensures you’re not left paying for damages out of pocket.

Factors Influencing Your Car Insurance Premium

The cost of your car insurance premium is determined by a myriad of factors. Understanding these factors can help you make informed decisions and potentially lower your insurance costs.

Vehicle Factors

The make, model, and year of your vehicle play a significant role in determining your insurance premium. Factors such as the vehicle’s safety ratings, its theft rate, and the cost of repairs can all influence the insurance rate. Additionally, the primary use of your vehicle (e.g., personal, business, or pleasure) can also impact your premium.

Driver Factors

Your driving history is a major consideration for insurance providers. A clean driving record with no accidents or violations can lead to lower premiums. Conversely, a history of accidents or traffic violations can significantly increase your insurance costs. Age and gender also play a role, with younger drivers and certain age groups often facing higher premiums.

Location Factors

Where you live and where you park your vehicle can impact your insurance rates. Urban areas with higher populations and denser traffic often result in higher premiums due to the increased risk of accidents and theft. Additionally, weather conditions and the frequency of natural disasters in your area can also influence your insurance costs.

Usage Factors

How you use your vehicle can affect your insurance premium. If you drive fewer miles per year, you may be eligible for a low-mileage discount. Conversely, if you frequently drive during peak hours or in high-risk areas, your premium may be higher. Usage-based insurance (UBI) programs, which track your driving habits, can offer discounts to safe drivers.

The Claims Process: What to Expect

Understanding the claims process is essential for making the most of your car insurance. Here's a step-by-step guide to help you navigate this process effectively.

Step 1: Report the Accident

Immediately after an accident, it’s crucial to report it to your insurance provider. Most insurance companies have a dedicated claims hotline or online portal for reporting accidents. Provide as much detail as possible about the accident, including the date, time, location, and any relevant details about the other driver(s) involved.

Step 2: Gather Information

Collect all the necessary information from the scene of the accident. This includes the other driver’s name, contact information, insurance details, and license plate number. Take photos of the accident scene, including any visible damages to your vehicle and the other vehicle(s) involved. If there were witnesses, obtain their contact information as well.

Step 3: Contact Your Insurance Provider

After gathering all the relevant information, contact your insurance provider to start the claims process. They will guide you through the next steps, which may include providing additional details, submitting photographs, and filling out claim forms.

Step 4: Assessment and Repair

Once your insurance provider receives your claim, they will assess the damage and determine the extent of coverage. If the repairs are covered under your policy, you’ll be directed to a preferred repair shop or given a list of approved shops. The insurance company may also send an adjuster to inspect the damage and provide an estimate for the repairs.

Step 5: Receiving Payment

After the repairs are completed and approved, you’ll receive payment for the damages. This payment may be made directly to the repair shop or to you, depending on your insurance policy and the nature of the claim. If you’ve rented a replacement vehicle during the repair process, the insurance company may also cover these costs.

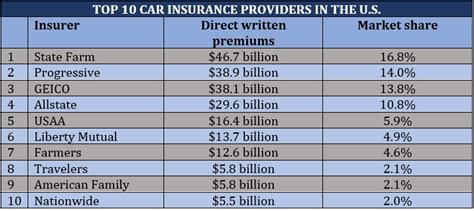

Tips for Choosing the Right Car Insurance Provider

With countless car insurance providers in the market, selecting the right one can be daunting. Here are some tips to guide you in making the right choice.

Research and Compare

Take the time to research and compare different insurance providers. Look at their reputation, customer reviews, and financial stability. Online resources and consumer reports can provide valuable insights into the quality of service and coverage offered by various providers.

Understand Your Needs

Before choosing an insurance provider, understand your specific needs and priorities. Consider factors such as the type of coverage you require, the value of your vehicle, and any additional benefits or discounts that are important to you. Tailor your search to find a provider that aligns with your unique requirements.

Consider Discounts and Bundles

Insurance providers often offer a range of discounts and bundles to attract customers. Look for discounts based on your driving history, vehicle safety features, and even your profession. Bundling your car insurance with other policies, such as home or renters insurance, can also lead to significant savings.

Read the Fine Print

When comparing policies, pay close attention to the fine print. Understand the exclusions and limitations of each policy. Look for policies that offer comprehensive coverage without excessive restrictions. It’s also essential to understand the terms and conditions related to claims and policy cancellations.

Customer Service and Claims Handling

The quality of customer service and claims handling can significantly impact your experience with an insurance provider. Look for providers with a reputation for prompt and efficient claims processing. Consider factors such as response time, customer support availability, and the overall satisfaction of policyholders.

The Future of Car Insurance: Emerging Trends

The world of car insurance is evolving, and several emerging trends are shaping the industry. Let's explore some of these trends and their potential impact.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and GPS to track driving behavior, is revolutionizing the way insurance is priced. Usage-Based Insurance (UBI) programs offer real-time feedback on driving habits, allowing insurers to provide more accurate and personalized premiums. This technology is particularly beneficial for safe drivers, as it can lead to significant savings.

Artificial Intelligence and Data Analytics

Artificial Intelligence (AI) and data analytics are being leveraged by insurance providers to enhance their operations. AI-powered chatbots and virtual assistants are improving customer service, while data analytics is optimizing risk assessment and claims handling. These technologies are expected to further streamline the insurance process and improve overall efficiency.

Connected Car Technology

With the rise of connected car technology, vehicles are becoming increasingly integrated with insurance providers. Connected car data can provide real-time insights into driving behavior, vehicle performance, and potential issues. This data can be used to improve safety, optimize insurance coverage, and even predict and prevent accidents.

Autonomous Vehicles and Insurance

The advent of autonomous vehicles is set to disrupt the insurance industry. As self-driving cars become more prevalent, the traditional liability model may need to be reevaluated. Insurance providers are already exploring new coverage models that take into account the reduced risk of accidents in autonomous vehicles. This shift could lead to significant changes in the way car insurance is structured.

Blockchain and Smart Contracts

Blockchain technology and smart contracts are being explored by insurance providers to enhance security and efficiency. Blockchain can provide a secure, transparent, and immutable record of insurance policies and claims, reducing fraud and streamlining the claims process. Smart contracts, which automatically execute when certain conditions are met, can further automate and streamline insurance transactions.

Conclusion: Empowering Your Financial Security

Car insurance is an essential tool for protecting your financial well-being and ensuring peace of mind on the road. By understanding the different types of coverage, the factors influencing your premium, and the claims process, you can make informed decisions and navigate the world of car insurance with confidence. Remember, choosing the right car insurance provider and policy is a crucial step in safeguarding your future.

How much does car insurance typically cost?

+The cost of car insurance can vary significantly based on several factors, including the make and model of your vehicle, your driving history, and your location. On average, you can expect to pay anywhere from 500 to 1,500 per year for basic liability coverage. However, the cost can be much higher or lower depending on your specific circumstances.

What factors can increase my insurance premium?

+Several factors can lead to an increase in your insurance premium. These include a history of accidents or traffic violations, a younger age (typically under 25), living in an urban area with higher crime rates, and driving a high-performance or luxury vehicle. Additionally, certain occupations or hobbies that involve high-risk activities can also impact your premium.

Can I reduce my insurance premium?

+Absolutely! There are several ways to reduce your insurance premium. Maintaining a clean driving record, taking defensive driving courses, and installing anti-theft devices in your vehicle can all lead to discounts. Additionally, bundling your car insurance with other policies, such as home or renters insurance, can often result in significant savings.

What should I do if I’m involved in an accident?

+If you’re involved in an accident, the first step is to ensure the safety of everyone involved. Call the police to report the accident and gather as much information as possible, including the other driver’s details, insurance information, and any witness statements. Contact your insurance provider to report the accident and follow their guidance for filing a claim.