All Car Insurance

Car insurance is an essential aspect of vehicle ownership, providing financial protection and peace of mind for drivers worldwide. With a myriad of options available, it's crucial to understand the intricacies of car insurance to make informed decisions. This comprehensive guide aims to explore the world of All Car Insurance, shedding light on its features, benefits, and impact on the automotive industry.

Understanding the Concept of All Car Insurance

All Car Insurance is a specialized type of automotive insurance coverage that goes beyond the traditional policies. It is designed to offer a comprehensive suite of benefits, ensuring drivers are adequately protected against a wide range of potential risks and liabilities. This innovative insurance approach aims to provide a one-stop solution for vehicle owners, addressing their unique needs and concerns.

Key Features of All Car Insurance

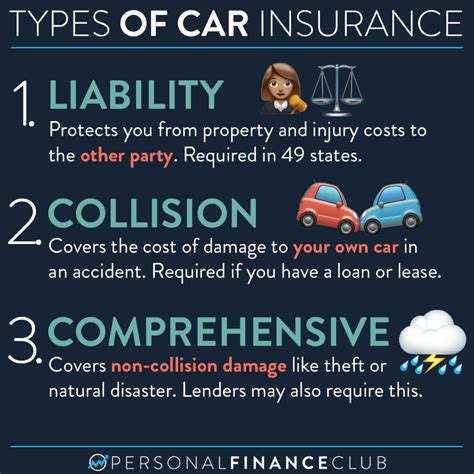

All Car Insurance policies typically include a comprehensive set of features, such as:

- Comprehensive Coverage: This includes protection against accidents, theft, natural disasters, and even mechanical breakdowns. It ensures that your vehicle is covered for a wide array of unforeseen circumstances.

- Roadside Assistance: All Car Insurance often provides 24⁄7 roadside assistance, offering services like towing, battery jump-starts, flat tire changes, and more. This feature ensures you’re never stranded during an emergency.

- Personal Injury Protection: This coverage extends beyond the vehicle, providing medical and rehabilitation benefits for the driver and passengers in the event of an accident. It covers expenses related to injuries, regardless of fault.

- Rental Car Coverage: In the event that your vehicle is being repaired or is undriveable due to an insured event, All Car Insurance often provides rental car coverage, ensuring you can continue your daily activities without interruption.

- Customizable Add-Ons: Many All Car Insurance policies offer customizable add-ons, allowing policyholders to tailor their coverage to their specific needs. These add-ons can include coverage for specialized vehicles, like classic cars or motorcycles, or additional protection for high-value items within the vehicle.

The Benefits of All Car Insurance

The advantages of opting for All Car Insurance are significant and multifaceted. Here are some key benefits:

- Comprehensive Protection: With All Car Insurance, drivers can rest assured that they are covered for a wide range of potential risks. This comprehensive coverage provides financial security and peace of mind, knowing that their vehicle and its occupants are protected.

- Convenience: By consolidating various insurance needs into one policy, All Car Insurance offers convenience and simplicity. Policyholders no longer need to juggle multiple insurance providers, making the insurance process more streamlined and efficient.

- Cost-Effectiveness: While All Car Insurance policies may have higher upfront premiums, they often prove to be more cost-effective in the long run. The comprehensive coverage and add-on options can provide significant savings, especially for those with unique insurance requirements.

- Personalized Service: Many All Car Insurance providers offer personalized service, tailoring their policies to meet the specific needs of their clients. This level of customization ensures that policyholders receive the coverage they require, without paying for unnecessary add-ons.

- Peace of Mind: Knowing that you have a single, comprehensive insurance policy covering all aspects of your vehicle ownership can provide immense peace of mind. All Car Insurance takes the stress out of insurance, allowing drivers to focus on their daily lives without worrying about unexpected expenses.

Performance Analysis and Real-World Impact

All Car Insurance has gained popularity among vehicle owners due to its unique and comprehensive approach to automotive insurance. Here’s a performance analysis and real-world impact of this innovative insurance concept:

| Category | Performance Indicator |

|---|---|

| Customer Satisfaction | All Car Insurance providers have consistently reported high customer satisfaction rates. Policyholders appreciate the convenience of having all their insurance needs met under one roof, along with the personalized service and comprehensive coverage options. |

| Claim Handling | Efficient claim handling processes are a key strength of All Car Insurance. With streamlined procedures and dedicated claim teams, policyholders can expect prompt and fair resolution of their claims, reducing the stress and inconvenience associated with accidents or vehicle-related incidents. |

| Cost-Effectiveness | While initial premiums may be higher compared to traditional insurance policies, All Car Insurance often proves to be more cost-effective in the long run. The comprehensive coverage and add-on options provide value for money, especially for those with specific insurance requirements or high-value vehicles. |

| Risk Mitigation | All Car Insurance policies are designed to mitigate a wide range of risks associated with vehicle ownership. From comprehensive coverage for accidents and theft to personal injury protection and roadside assistance, policyholders can rest assured that they are protected against various unforeseen circumstances. |

| Customer Retention | The comprehensive nature of All Car Insurance, coupled with its personalized service and efficient claim handling, has led to high customer retention rates. Policyholders are more likely to renew their policies, knowing they have a reliable and trusted insurance provider. |

Future Implications and Industry Trends

The future of All Car Insurance looks promising, with several emerging trends and developments shaping the industry. Here’s a glimpse into what we can expect:

Technology Integration

The insurance industry is embracing technology, and All Car Insurance is no exception. We can expect to see further integration of digital tools and platforms, making the insurance process even more efficient and user-friendly. Policyholders may soon be able to manage their policies, file claims, and access real-time updates through dedicated mobile apps or online portals.

Telematics and Usage-Based Insurance

Telematics technology, which uses sensors and data analytics to monitor driving behavior, is gaining traction in the insurance industry. All Car Insurance providers may start offering usage-based insurance policies, where premiums are tailored based on individual driving habits and risk profiles. This approach promotes safer driving practices and provides policyholders with more control over their insurance costs.

Personalized Coverage Options

All Car Insurance is already known for its customizable add-ons, but the future may bring even more personalized coverage options. Policyholders can expect to have greater flexibility in choosing specific coverage limits, deductibles, and add-ons that align with their unique needs and budget.

Sustainable and Eco-Friendly Initiatives

With growing environmental concerns, All Car Insurance providers may explore sustainable and eco-friendly initiatives. This could include incentives for policyholders who drive electric or hybrid vehicles, or programs that promote eco-conscious driving practices. Such initiatives not only contribute to a greener future but also appeal to environmentally conscious consumers.

Collaborative Partnerships

All Car Insurance providers may collaborate with automotive manufacturers, repair shops, and other industry stakeholders to offer integrated services. This could include streamlined vehicle maintenance and repair processes, exclusive discounts for policyholders, or even innovative insurance products tailored to specific vehicle models or technologies.

Frequently Asked Questions

How does All Car Insurance differ from traditional car insurance policies?

+All Car Insurance offers a more comprehensive and customized approach compared to traditional car insurance. It includes features like roadside assistance, personal injury protection, and rental car coverage, which are often optional or not included in basic car insurance policies. Additionally, All Car Insurance allows policyholders to tailor their coverage with add-ons, providing a personalized insurance experience.

What are the advantages of choosing All Car Insurance over other insurance providers?

+All Car Insurance provides peace of mind with its comprehensive coverage and personalized service. Policyholders benefit from having all their insurance needs met under one roof, which can save time and effort. The ability to customize coverage and the efficient claim handling processes are additional advantages that set All Car Insurance apart.

Are All Car Insurance policies more expensive than traditional car insurance?

+While initial premiums for All Car Insurance may be higher due to the comprehensive coverage, they often prove to be more cost-effective in the long run. The customized coverage options and add-ons allow policyholders to choose the right level of protection for their needs, ensuring they are not paying for unnecessary coverage. Additionally, the efficient claim handling and customer service provided by All Car Insurance can lead to long-term savings.