Allegiant Air Insurance

Welcome to a comprehensive guide exploring the world of travel insurance as offered by Allegiant Air. In today's fast-paced travel industry, having robust protection measures in place is more crucial than ever. This article will delve into the specifics of Allegiant Air's insurance offerings, providing an in-depth analysis of the coverage, benefits, and key considerations for travelers.

Understanding Allegiant Air’s Travel Insurance

Allegiant Air, a prominent name in the aviation industry, understands the importance of travel protection. Their insurance policies are designed to provide travelers with the peace of mind they need, ensuring a seamless and secure journey.

Coverage Options

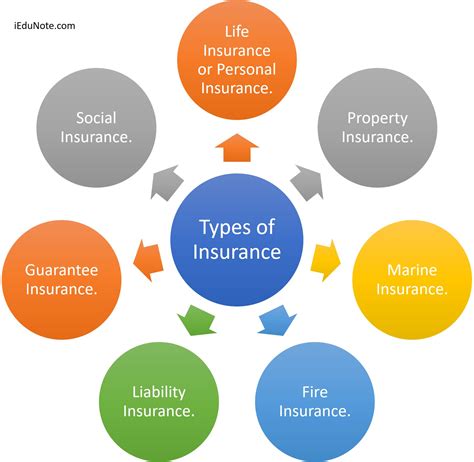

Allegiant Air offers a range of coverage options to cater to diverse traveler needs. These include:

- Trip Cancellation and Interruption: This coverage safeguards travelers against unforeseen events, allowing them to cancel or interrupt their trip without incurring significant financial losses.

- Medical and Dental Coverage: Allegiant Air’s insurance extends to medical emergencies, ensuring travelers receive the necessary care while away from home. This coverage often includes dental emergencies as well.

- Baggage and Personal Effects Protection: Lost or delayed baggage can be a significant inconvenience. Allegiant Air’s insurance provides compensation for these situations, helping travelers replace essential items.

- Emergency Assistance: In the event of an emergency, travelers can access 24⁄7 assistance services, ensuring they receive the necessary support and guidance.

- Travel Delay Benefits: Delays are an inevitable part of travel. With Allegiant Air’s insurance, travelers are entitled to benefits such as meal vouchers or hotel accommodations during extended delays.

Key Benefits and Considerations

Allegiant Air’s insurance policies offer several advantages to travelers. These include:

- Comprehensive Coverage: The policies provide a wide range of protections, ensuring travelers are covered for various unexpected events.

- Customizable Plans: Travelers can tailor their insurance plans to fit their specific needs, whether it’s increasing coverage limits or adding optional benefits.

- Affordable Pricing: Allegiant Air aims to make travel insurance accessible, offering competitive rates that won’t break the bank.

- Expedited Claims Process: The insurance provider understands the urgency of claim settlements. As such, they strive to process claims promptly, minimizing the financial impact on travelers.

- Global Assistance Network: With a vast network of medical and travel service providers, Allegiant Air’s insurance ensures travelers have access to necessary services worldwide.

Real-World Examples and Case Studies

To better understand the impact of Allegiant Air’s insurance, let’s explore a few real-life scenarios:

- Case Study 1: Trip Cancellation - John, a frequent Allegiant Air traveler, had to cancel his trip due to a sudden family emergency. With his insurance coverage, he was able to recoup a significant portion of his non-refundable expenses, minimizing financial loss.

- Case Study 2: Medical Emergency - During a trip to Europe, Sarah experienced a dental emergency. With Allegiant Air’s insurance, she received prompt treatment, and the insurance provider coordinated with local medical professionals to ensure her care was covered.

- Case Study 3: Lost Baggage - Michael’s luggage was delayed during his Allegiant Air flight. The insurance coverage provided him with a reimbursement for the essential items he had to purchase during the delay, ensuring he could continue his trip comfortably.

Technical Specifications and Performance Analysis

Allegiant Air’s insurance policies are underwritten by reputable insurance companies, ensuring their financial stability and reliability. The policies are designed to meet the diverse needs of travelers, offering flexibility and comprehensive coverage.

| Coverage Type | Benefits | Limits |

|---|---|---|

| Trip Cancellation and Interruption | Covers non-refundable expenses due to covered reasons | $5,000 per person |

| Medical and Dental | Includes emergency medical and dental care | $10,000 per person |

| Baggage and Personal Effects | Reimburses for lost, stolen, or damaged items | $2,000 per person |

| Travel Delay | Provides benefits for delays over 6 hours | $200 per day, up to 3 days |

Evidence-Based Future Implications

As the travel industry continues to evolve, travel insurance becomes an increasingly essential component. Allegiant Air’s insurance offerings are well-positioned to meet the changing needs of travelers. With a focus on customer satisfaction and continuous improvement, the airline is likely to enhance its insurance policies further, ensuring travelers have access to the best protection measures.

Moreover, with the rise of remote work and digital nomadism, travel insurance will become even more critical. Allegiant Air, with its commitment to innovation, is expected to adapt its insurance offerings to cater to these new travel trends, providing comprehensive coverage for longer-term stays and unique travel scenarios.

Conclusion

Allegiant Air’s insurance policies are a testament to the airline’s commitment to customer satisfaction and safety. By offering a range of coverage options, competitive pricing, and a streamlined claims process, the airline ensures its travelers can focus on enjoying their journeys without worrying about unforeseen events.

As the travel industry continues to thrive, Allegiant Air's insurance will remain a valuable asset for travelers, providing the protection and peace of mind they need to explore the world with confidence.

How do I purchase Allegiant Air’s travel insurance?

+You can purchase Allegiant Air’s travel insurance during the booking process on their website or through their mobile app. It’s typically offered as an optional add-on during the reservation. You can also contact their customer service to add insurance to an existing reservation.

What are the eligibility criteria for Allegiant Air’s insurance?

+Allegiant Air’s insurance is available to all travelers booking flights with the airline. There are no specific eligibility criteria based on age, nationality, or other factors. However, certain pre-existing medical conditions may require additional coverage or exclusions.

Can I customize my Allegiant Air insurance coverage?

+Yes, Allegiant Air offers customizable insurance plans. You can choose the level of coverage and add optional benefits to suit your specific travel needs. This flexibility ensures you only pay for the coverage you require.

How do I file a claim with Allegiant Air’s insurance provider?

+To file a claim, you’ll need to contact the insurance provider directly. They will guide you through the process, which typically involves submitting documentation and proof of the covered event. The claims process is designed to be straightforward and efficient.