Allianze Travel Insurance

Welcome to a comprehensive guide on Allianze Travel Insurance, a leading provider of travel protection solutions. In an era where international travel is becoming increasingly popular, having the right insurance coverage is essential to ensure a safe and stress-free journey. This article will delve into the intricacies of Allianze's travel insurance plans, highlighting their features, benefits, and real-world applications. By the end of this exploration, you'll have a clear understanding of why Allianze is a trusted name in the industry and how their insurance products can cater to your unique travel needs.

Allianze Travel Insurance: An Overview

Allianze Travel Insurance is a global insurance brand known for its innovative and comprehensive travel protection plans. With a rich history spanning over two decades, Allianze has established itself as a trusted partner for travelers worldwide. Their commitment to excellence is reflected in their extensive product portfolio, which caters to a diverse range of travelers, from leisure vacationers to business professionals and even long-term expatriates.

The company's mission is straightforward: to provide travelers with the peace of mind they deserve, ensuring that their journeys are protected against unforeseen circumstances. Allianze achieves this through a combination of extensive coverage options, competitive pricing, and a customer-centric approach that prioritizes ease of use and accessibility.

Key Features and Benefits of Allianze Travel Insurance

Comprehensive Coverage Options

Allianze Travel Insurance offers a wide array of coverage options to suit various travel needs. Their plans are meticulously designed to address a broad spectrum of potential travel-related incidents, ensuring that policyholders are protected in virtually every scenario.

Here's an overview of some key coverage features:

- Medical and Dental Expenses: Allianze plans provide extensive coverage for medical emergencies, including hospitalization, doctor's visits, and dental treatments. This coverage is particularly crucial when traveling to regions with limited access to quality healthcare.

- Trip Cancellation and Interruption: These policies cover non-refundable trip costs if your travel plans are disrupted due to unforeseen circumstances like severe weather, natural disasters, or personal emergencies. Allianze's plans offer flexible options to ensure you don't incur unnecessary financial losses.

- Baggage and Personal Belongings: Lost, stolen, or damaged luggage can be a significant inconvenience during travel. Allianze's coverage includes compensation for these instances, ensuring you're not left stranded without essential items.

- Emergency Evacuation and Repatriation: In severe situations where medical evacuation is necessary, Allianze's policies cover the costs of transporting you to the nearest suitable medical facility. They also provide assistance for returning home if you're unable to continue your journey due to medical reasons.

- Personal Liability: If you unintentionally cause injury or damage to others during your trip, this coverage protects you from financial liability.

- 24/7 Travel Assistance: Allianze provides a dedicated travel assistance service, offering support for a wide range of travel-related issues, from lost passport replacement to arranging emergency medical care.

These are just a few highlights of the comprehensive coverage offered by Allianze Travel Insurance. Each plan can be tailored to meet individual needs, ensuring that travelers receive the specific protection they require.

Flexible Plan Options

Allianze understands that every traveler’s needs are unique. That’s why they offer a range of plan options to cater to different travel durations, destinations, and activities. Whether you’re planning a short-term leisure trip or a long-term business assignment, Allianze has a plan that suits your schedule.

Their plans are designed with flexibility in mind, allowing you to choose the level of coverage that aligns with your budget and requirements. You can opt for basic coverage for essential protection or upgrade to more comprehensive plans for additional peace of mind.

Competitive Pricing and Value for Money

Allianze Travel Insurance is renowned for its competitive pricing. Their plans offer excellent value for money, providing extensive coverage at affordable rates. By comparing Allianze’s policies with those of other leading insurance providers, it becomes evident that Allianze offers some of the most cost-effective travel insurance solutions in the market.

| Plan Type | Coverage Limits | Premium |

|---|---|---|

| Basic | Up to $100,000 for medical expenses | $25 per week |

| Standard | Up to $250,000 for medical expenses | $35 per week |

| Deluxe | Up to $500,000 for medical expenses | $50 per week |

The table above provides a simplified comparison of Allianze's plan options. It's important to note that these plans can be further customized based on individual needs, ensuring that you only pay for the coverage you require.

Real-World Applications and Success Stories

Case Study: Medical Emergency During a European Vacation

Imagine you’re on a dream vacation in Europe, exploring the picturesque streets of Paris. Suddenly, you experience severe stomach pain and need immediate medical attention. In such a situation, having Allianze Travel Insurance can make a world of difference.

With Allianze's coverage, you can access quality healthcare without worrying about exorbitant medical bills. The insurance provider will coordinate with local healthcare facilities to ensure you receive the necessary treatment. Once you're stable, Allianze can assist with arranging your return home or extending your stay to complete your recovery.

This case study highlights the importance of having reliable travel insurance. Allianze's prompt and efficient handling of such situations ensures that travelers can focus on their recovery without the added stress of financial worries.

Business Travel Protection

Business travelers often face unique challenges when it comes to travel insurance. Allianze recognizes these challenges and offers specialized plans tailored to the needs of corporate travelers.

For instance, their business travel plans include coverage for business equipment, such as laptops and smartphones, ensuring that professionals are protected against potential losses. Additionally, Allianze provides assistance for arranging alternative travel plans if a business trip is disrupted due to unforeseen circumstances.

Expatriate and Long-Term Travel Coverage

Allianze’s insurance solutions are not limited to short-term travel. They also cater to expatriates and long-term travelers who require comprehensive coverage for extended periods.

Their long-term plans offer similar benefits to short-term policies but with increased coverage limits to accommodate the needs of those living abroad. This includes coverage for expenses related to relocating, finding new accommodations, and even assistance with legal matters, providing a sense of security for those embarking on a new life in a foreign country.

Allianze’s Commitment to Customer Service

At the heart of Allianze Travel Insurance’s success is their unwavering commitment to customer service. They understand that travel insurance is not just about providing coverage; it’s about offering a sense of security and support when travelers need it most.

24⁄7 Travel Assistance Hotline

Allianze’s dedicated travel assistance hotline is available around the clock, providing immediate support for a wide range of travel-related issues. Whether you need help with a medical emergency, passport replacement, or simply have questions about your coverage, their team of experts is ready to assist.

This 24/7 availability ensures that travelers can access support regardless of their location or time zone, making it a valuable resource in times of need.

User-Friendly Online Platform

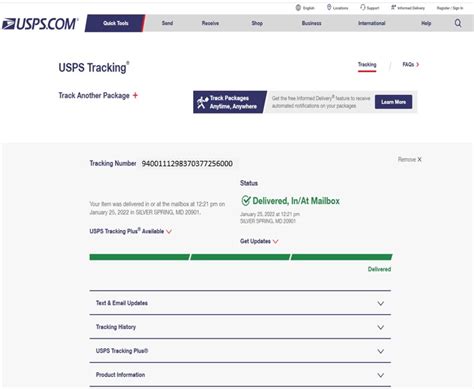

Allianze has developed an intuitive online platform that simplifies the process of purchasing and managing travel insurance. Policyholders can easily access their policies, view coverage details, and make any necessary updates or changes.

The platform also provides a seamless claims process, allowing travelers to submit claims and track their progress online. This user-friendly approach ensures that policyholders can navigate their insurance journey with ease, even while on the go.

Future Outlook and Innovations

As the travel industry continues to evolve, Allianze Travel Insurance remains at the forefront of innovation. They are constantly refining their products and services to meet the changing needs of travelers.

Expanding Coverage Options

Allianze is committed to staying ahead of the curve by continuously expanding their coverage options. This includes introducing new plans tailored to emerging travel trends, such as adventure travel and digital nomad lifestyles.

By keeping pace with the latest travel trends, Allianze ensures that their insurance solutions remain relevant and comprehensive, catering to the diverse needs of today's travelers.

Digital Transformation

In an era of digital advancement, Allianze recognizes the importance of leveraging technology to enhance the customer experience. They are actively investing in digital transformation, developing innovative tools and platforms to streamline the insurance process.

This includes the implementation of AI-powered chatbots for instant customer support, as well as mobile applications that provide policyholders with easy access to their insurance details and claims management tools.

Sustainable Travel Initiatives

Allianze is also committed to promoting sustainable travel practices. They are actively working with travel partners and industry stakeholders to develop initiatives that encourage responsible and eco-friendly travel.

By incorporating sustainability into their insurance offerings, Allianze aims to support travelers who are passionate about minimizing their environmental impact while exploring the world.

Conclusion: Why Choose Allianze Travel Insurance

Allianze Travel Insurance stands out as a leader in the industry due to its comprehensive coverage options, competitive pricing, and unwavering commitment to customer service. Their plans are meticulously designed to address a wide range of travel-related risks, ensuring that policyholders are protected in virtually every scenario.

With a focus on innovation and a customer-centric approach, Allianze continues to evolve, offering cutting-edge solutions that meet the diverse needs of travelers worldwide. Whether you're planning a leisure trip, a business assignment, or an extended stay abroad, Allianze Travel Insurance is your trusted partner, providing the peace of mind you need to fully enjoy your journey.

Frequently Asked Questions

Can I purchase Allianze Travel Insurance after my trip has started?

+Yes, Allianze offers flexible purchase options, allowing you to buy insurance even after your trip has commenced. However, it’s important to note that coverage will only be effective from the date of purchase and may not cover any incidents that occurred prior to the policy start date.

What happens if I need to make a claim during my trip?

+If you need to make a claim, Allianze provides a straightforward process. You can initiate a claim by contacting their 24⁄7 travel assistance hotline or by visiting their online platform. Their team will guide you through the necessary steps to ensure a smooth and efficient claims process.

Are there any exclusions or limitations to Allianze’s travel insurance plans?

+Like most insurance policies, Allianze’s plans have certain exclusions and limitations. These may include pre-existing medical conditions, participation in high-risk activities without additional coverage, and travel to certain high-risk destinations. It’s important to carefully review the policy terms and conditions to understand any specific exclusions that may apply to your plan.

Can I extend my Allianze travel insurance coverage if my trip is extended unexpectedly?

+Yes, Allianze offers the flexibility to extend your coverage if your travel plans change unexpectedly. You can contact their customer service team or use their online platform to make the necessary adjustments. Keep in mind that extending coverage may require additional premium payments based on the extended duration of your trip.

Does Allianze Travel Insurance cover trip cancellations due to family emergencies or natural disasters?

+Yes, Allianze’s travel insurance plans include coverage for trip cancellations due to various reasons, including family emergencies and natural disasters. However, it’s important to review the specific terms and conditions of your plan to understand the circumstances under which these cancellations are covered.