Allstate Homeowners Insurance Company

Welcome to an in-depth exploration of one of America's leading insurance providers, Allstate. In this comprehensive guide, we'll delve into the world of Allstate Homeowners Insurance, uncovering the intricacies of their offerings, the benefits they provide, and how they stand out in a highly competitive market. As an informed consumer, understanding the nuances of insurance is crucial, and Allstate's comprehensive approach to homeowners' insurance deserves a detailed analysis.

The Allstate Advantage: A Comprehensive Overview

Allstate, a household name in the insurance industry, is renowned for its innovative and comprehensive insurance solutions. Their commitment to providing tailored coverage options has made them a preferred choice for millions of homeowners across the United States. In this section, we’ll dissect the key features and advantages that set Allstate’s homeowners’ insurance apart from its competitors.

Personalized Coverage Options

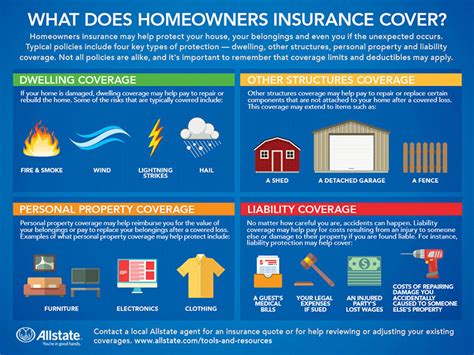

Allstate understands that every homeowner’s needs are unique. That’s why they offer a wide range of coverage options, allowing customers to customize their insurance plans according to their specific requirements. From basic liability coverage to more comprehensive plans that include protection against natural disasters and theft, Allstate ensures that homeowners can find a policy that fits their needs perfectly.

| Coverage Type | Description |

|---|---|

| Liability Coverage | Protects homeowners from legal liabilities arising from accidents or injuries that occur on their property. |

| Dwelling Coverage | Covers the physical structure of the home, including repairs or reconstruction in case of damage. |

| Personal Property Coverage | Reimburses homeowners for the loss or damage of personal belongings due to covered events. |

| Additional Living Expenses | Provides financial support for temporary housing and additional expenses incurred if a home becomes uninhabitable due to a covered loss. |

Catastrophe Protection

Allstate recognizes the importance of safeguarding homes against natural disasters, which can cause devastating damage. Their catastrophe protection coverage offers financial support in the event of natural catastrophes such as hurricanes, earthquakes, and wildfires. This specialized coverage ensures that homeowners can recover and rebuild with the necessary financial assistance.

Theft and Burglary Protection

Homeowners face the risk of theft and burglary, which can result in significant financial losses. Allstate’s comprehensive homeowners’ insurance policies include coverage for stolen items and provide assistance in case of a break-in. This added layer of protection gives homeowners peace of mind, knowing that their valuables are safeguarded.

The Allstate Experience: A Seamless Journey

Allstate’s dedication to providing an exceptional customer experience is evident in every step of the insurance journey. From policy selection to claims processing, Allstate ensures a seamless and efficient process, making homeowners’ lives easier during times of uncertainty.

Policy Selection and Customization

Allstate’s online platform and network of knowledgeable agents guide homeowners through the process of selecting the right coverage. Their interactive tools and resources empower customers to make informed decisions, ensuring that they choose a policy that aligns with their specific needs and budget.

Claims Processing and Customer Support

In the event of a claim, Allstate’s efficient claims processing system ensures a swift and stress-free experience. Their dedicated customer support team is readily available to assist homeowners throughout the claims process, providing guidance and support every step of the way. Allstate’s commitment to timely claim settlements is a testament to their focus on customer satisfaction.

Digital Tools and Resources

Allstate embraces technology to enhance the insurance experience. Their digital platform offers a range of tools and resources, including a mobile app that allows customers to manage their policies, file claims, and access important documents anytime, anywhere. This digital approach ensures convenience and accessibility for modern homeowners.

Allstate’s Competitive Edge: Industry Insights

In a highly competitive insurance market, Allstate stands out for its innovative approaches and customer-centric philosophy. Their unique value propositions and strategic initiatives have solidified their position as a leading insurance provider.

Innovative Products and Services

Allstate continuously innovates to stay ahead of the curve. Their product offerings include unique features such as the “Claim Satisfaction Guarantee,” which ensures that customers are satisfied with the claims process. Additionally, Allstate’s “Home Assistance Services” provide homeowners with a network of trusted professionals for home maintenance and repairs, adding value beyond traditional insurance coverage.

Customer-Centric Approach

Allstate’s success lies in its unwavering commitment to its customers. Their “Customer Focus” initiative ensures that every decision and strategy is centered around delivering exceptional value and service. This customer-centric approach has fostered strong relationships and loyalty among homeowners, making Allstate a trusted partner in their insurance journey.

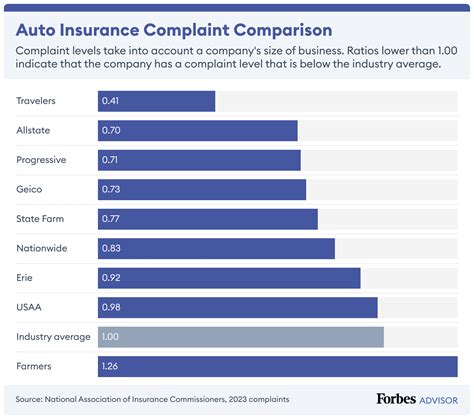

Industry Leadership and Recognition

Allstate’s leadership in the insurance industry is recognized through various accolades and rankings. Their consistent focus on innovation, customer satisfaction, and financial stability has earned them top positions in industry reports. Allstate’s commitment to excellence and continuous improvement sets them apart as a trusted and reliable insurance provider.

The Future of Allstate Homeowners Insurance

As the insurance landscape continues to evolve, Allstate remains at the forefront, adapting to meet the changing needs of homeowners. Their commitment to innovation and customer satisfaction positions them well for the future. With a focus on digital transformation, personalized coverage, and an unwavering dedication to customer service, Allstate is poised to remain a leading force in the homeowners’ insurance market.

What is the average cost of Allstate homeowners’ insurance?

+The cost of Allstate homeowners’ insurance varies based on factors such as location, property value, and coverage options. On average, homeowners can expect to pay between 1,000 and 2,000 annually for a standard policy. However, Allstate’s customizable coverage allows customers to adjust their premiums according to their specific needs and budget.

Does Allstate offer discounts on homeowners’ insurance?

+Absolutely! Allstate provides various discounts to help homeowners save on their insurance premiums. These include discounts for bundling policies (e.g., auto and home insurance), loyalty rewards, safety features (such as smoke detectors and security systems), and more. Allstate’s agents can guide homeowners through the available discounts to help them find the best value.

How does Allstate handle claims for natural disasters?

+Allstate is well-equipped to handle claims resulting from natural disasters. They have a dedicated team and specialized resources to assist homeowners in the aftermath of such events. Their efficient claims process ensures prompt attention and support, helping homeowners recover and rebuild with minimal disruption.