Allstate Insurance Health Insurance

In the ever-evolving landscape of healthcare, choosing the right health insurance provider is a critical decision. With numerous options available, it's essential to delve into the specifics and benefits offered by each company. This comprehensive guide aims to explore Allstate Insurance's approach to health coverage, shedding light on its unique features, policies, and how it stands out in the competitive market.

Allstate Insurance: A Comprehensive Health Coverage Provider

Allstate Insurance, a renowned name in the insurance industry, has expanded its horizons to offer comprehensive health insurance plans. With a rich history of providing reliable insurance solutions, Allstate brings its expertise and customer-centric approach to the healthcare sector.

Allstate's health insurance division is designed to cater to the diverse needs of individuals and families, offering a range of plans that provide extensive coverage and peace of mind. Let's uncover the key aspects that make Allstate a notable player in the health insurance market.

Policy Options and Coverage

Allstate Insurance offers a diverse range of health insurance policies, ensuring that customers can find a plan tailored to their specific healthcare requirements. Here’s an overview of the key policy options:

- Individual Health Plans: Ideal for single individuals, these plans provide comprehensive coverage for medical emergencies, routine check-ups, and specialized treatments. Allstate offers flexible deductibles and customizable benefits to suit varying lifestyles and health needs.

- Family Health Plans: Recognizing the importance of family health, Allstate provides family-oriented plans that cover multiple members under a single policy. These plans ensure that parents and children receive adequate healthcare without the hassle of managing separate policies.

- Senior Health Plans: As individuals age, their healthcare needs evolve. Allstate's senior health plans are designed to address the unique requirements of the elderly, offering specialized coverage for age-related ailments and providing access to senior-friendly healthcare facilities.

- Maternity and Child Health Plans: Expecting parents and young families can benefit from Allstate's maternity and child health plans. These plans offer coverage for prenatal care, delivery, and postnatal services, ensuring that both mother and child receive the best possible care.

Allstate's coverage extends beyond basic medical expenses. The company provides additional benefits such as prescription drug coverage, vision and dental care, and even mental health support. With a focus on holistic healthcare, Allstate aims to address a wide spectrum of health-related needs.

Network of Healthcare Providers

A critical aspect of health insurance is the network of healthcare providers available to policyholders. Allstate has established an extensive network of trusted medical professionals, hospitals, and clinics across the country. This network ensures that policyholders have access to quality healthcare services without compromising on convenience.

Policyholders can easily locate in-network providers through Allstate's online directory, ensuring they receive the best possible care at preferred rates. The network includes a diverse range of specialists, ensuring that individuals with specialized medical needs can find the right healthcare experts.

Customer-Centric Approach and Support

Allstate Insurance prides itself on its customer-centric approach, offering personalized support and assistance to policyholders. The company understands that navigating the complexities of health insurance can be daunting, and thus, provides dedicated customer service representatives to guide individuals through the process.

Allstate's support extends beyond policy enrollment. Policyholders can access educational resources, online tools, and guidance on managing their health and insurance plans. The company's website offers a wealth of information, including articles, videos, and interactive tools to empower individuals to make informed healthcare decisions.

Flexible Payment Options and Value-Added Benefits

Allstate Insurance recognizes that healthcare expenses can be a significant financial burden. To ease the financial strain, the company offers flexible payment options, allowing policyholders to choose plans that fit their budget. Additionally, Allstate provides value-added benefits such as health and wellness programs, discounts on health-related products, and access to exclusive health initiatives.

By partnering with various healthcare organizations and wellness brands, Allstate ensures that policyholders receive additional perks and incentives to maintain a healthy lifestyle. These value-added benefits further enhance the overall value proposition of Allstate's health insurance plans.

Claims Process and Transparency

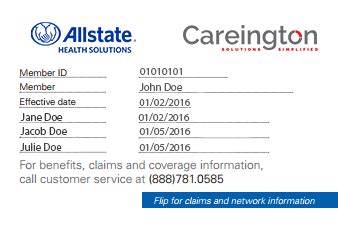

Allstate Insurance understands the importance of a streamlined and transparent claims process. The company has implemented a simple and efficient claims procedure, ensuring that policyholders can receive reimbursements promptly. Allstate’s online platform allows policyholders to track their claims, providing real-time updates and reducing administrative burdens.

Furthermore, Allstate prioritizes transparency by providing clear and concise policy documents. Policyholders can easily understand their coverage limits, deductibles, and benefits, ensuring they are well-informed about their insurance plans. This transparency builds trust and confidence in Allstate's health insurance offerings.

Innovative Technology and Digital Solutions

In an era driven by digital advancements, Allstate Insurance embraces technology to enhance its health insurance services. The company has developed user-friendly mobile apps and online portals, enabling policyholders to manage their policies, access healthcare resources, and connect with healthcare providers conveniently.

Allstate's digital solutions also include telemedicine options, allowing individuals to consult with healthcare professionals remotely. This not only improves accessibility but also reduces the need for in-person visits, especially for minor ailments or follow-up consultations.

| Plan Type | Coverage Highlights |

|---|---|

| Individual Health Plan | Flexible deductibles, prescription drug coverage, access to specialist care |

| Family Health Plan | Covers multiple family members, includes pediatric and senior-specific benefits |

| Senior Health Plan | Age-appropriate coverage, access to geriatric specialists, long-term care options |

| Maternity and Child Health Plan | Prenatal care, delivery, and postnatal services, pediatric dental and vision coverage |

Conclusion

Allstate Insurance’s foray into the health insurance market brings a customer-centric and innovative approach to healthcare coverage. With a range of policy options, an extensive network of healthcare providers, and a focus on digital solutions, Allstate offers a compelling proposition for individuals and families seeking reliable health insurance. By prioritizing customer needs and embracing technological advancements, Allstate is well-positioned to meet the evolving demands of the healthcare industry.

FAQ

How do I choose the right health insurance plan for my family?

+

Selecting the right health insurance plan depends on various factors such as your family’s healthcare needs, budget, and preferred healthcare providers. Consider the age and health conditions of family members, and choose a plan that offers comprehensive coverage. Allstate’s family health plans provide an excellent option, covering multiple members under one policy.

What additional benefits does Allstate’s health insurance offer?

+

Allstate’s health insurance plans come with a range of value-added benefits. These include prescription drug coverage, vision and dental care, and even mental health support. Additionally, policyholders can access health and wellness programs, receive discounts on health-related products, and participate in exclusive health initiatives.

How can I locate in-network healthcare providers under Allstate’s plan?

+

Allstate provides an online directory where policyholders can easily locate in-network healthcare providers. This directory includes a diverse range of specialists, ensuring that individuals with specialized medical needs can find the right experts. Policyholders can also access this information through Allstate’s mobile app for added convenience.

What support does Allstate provide for managing health insurance policies?

+

Allstate offers dedicated customer service representatives to guide policyholders through the process of managing their health insurance policies. The company provides educational resources, online tools, and guidance on healthcare decisions. Policyholders can access these resources through Allstate’s website and mobile app, ensuring they receive the support they need.

How does Allstate’s claims process work, and how long does it typically take to receive reimbursements?

+

Allstate has implemented a streamlined claims process to ensure policyholders receive reimbursements promptly. Policyholders can submit claims online or through the mobile app, and track their progress in real-time. Allstate aims to process claims within a week, providing policyholders with timely financial support.