Allstate Proof Of Insurance

In today's fast-paced world, having instant access to important documents is not just a convenience but a necessity. This is especially true when it comes to something as critical as Proof of Insurance, which can be required in various situations, from vehicle registration to unexpected roadside incidents. Allstate, a renowned insurance provider, understands the importance of accessibility and has taken significant steps to ensure that their customers can easily access their Proof of Insurance whenever and wherever needed.

The Evolution of Proof of Insurance: A Digital Transformation

Gone are the days when individuals had to rummage through physical files or contact their insurance agents to obtain a copy of their Proof of Insurance. With the advent of digital technologies, insurance providers like Allstate have embraced a digital transformation, revolutionizing the way customers access and manage their insurance documents.

Allstate's innovative approach to Proof of Insurance is a prime example of this digital evolution. By offering a digital version of the traditional Proof of Insurance document, they have not only made it easier for customers to access their insurance information but have also reduced the reliance on physical paper, contributing to a more sustainable and environmentally friendly approach.

The Benefits of Allstate’s Digital Proof of Insurance

Allstate’s digital Proof of Insurance offers a multitude of benefits to its customers, enhancing convenience, accessibility, and peace of mind. Here’s a detailed look at some of these advantages:

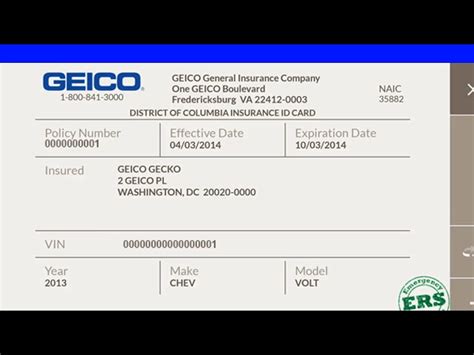

- Instant Accessibility: With the digital version, customers can access their Proof of Insurance in mere seconds. Whether it's needed during a traffic stop, while registering a new vehicle, or in the event of an accident, having instant access can significantly reduce stress and potential legal complications.

- Multiple Storage Options: Allstate's digital Proof of Insurance can be stored in various places, including the customer's smartphone, cloud storage, or even their email inbox. This versatility ensures that customers can retrieve their Proof of Insurance even if their primary device is lost, damaged, or out of battery.

- Real-Time Updates: Unlike physical documents, which can become outdated or inaccurate over time, Allstate's digital Proof of Insurance is automatically updated. This means that customers always have the most current and accurate information, ensuring compliance with legal requirements and avoiding potential penalties.

- Enhanced Security: Allstate employs robust security measures to protect customers' digital Proof of Insurance documents. These measures include encryption technologies and secure cloud storage, ensuring that customers' information remains confidential and safe from unauthorized access.

- Environmental Sustainability: By offering a digital Proof of Insurance, Allstate reduces the need for paper, contributing to a greener and more sustainable environment. This eco-friendly approach aligns with the growing global movement towards digital solutions and helps minimize the environmental impact of insurance practices.

The table below provides a comparison between traditional physical Proof of Insurance and Allstate's digital version, highlighting the key differences and benefits:

| Category | Physical Proof of Insurance | Allstate Digital Proof of Insurance |

|---|---|---|

| Accessibility | Requires physical storage and retrieval | Instant access from multiple devices |

| Storage | Limited to physical storage locations | Versatile storage options: smartphone, cloud, email |

| Updates | Manual updates required | Real-time automatic updates |

| Security | Prone to loss, damage, or theft | Enhanced security with encryption and cloud storage |

| Environmental Impact | Contributes to paper waste | Reduces paper waste, promotes sustainability |

How to Access Allstate’s Digital Proof of Insurance

Accessing Allstate’s digital Proof of Insurance is a straightforward process. Customers can follow these simple steps:

- Log in to their Allstate account via the official Allstate website or the Allstate mobile app.

- Navigate to the "Documents" or "Insurance Documents" section.

- Locate the Proof of Insurance document and select it.

- Choose the desired format for the document (PDF, image, etc.)

- Save the document to their preferred storage location (smartphone, cloud, email, etc.)

It's important to note that Allstate's digital Proof of Insurance is a legal and official document, recognized by law enforcement and other entities. Customers can rest assured that their digital Proof of Insurance carries the same weight and validity as a physical document.

Tips for Managing Your Allstate Digital Proof of Insurance

To ensure that your Allstate digital Proof of Insurance remains easily accessible and up-to-date, consider the following tips:

- Regularly check and update your Allstate account to ensure that your Proof of Insurance reflects any recent changes or renewals.

- Store your digital Proof of Insurance in multiple locations to prevent loss or data corruption. This could include your smartphone, a cloud storage service, and your email inbox.

- Familiarize yourself with the various ways you can access your digital Proof of Insurance, such as through the Allstate app, your online account, or even via email.

- In the event of an accident or other unexpected situation, ensure that you know how to quickly access and present your digital Proof of Insurance.

By following these simple tips, you can make the most of Allstate's digital Proof of Insurance and enjoy the peace of mind that comes with easy access to this critical document.

The Future of Insurance: Allstate’s Commitment to Innovation

Allstate’s introduction of digital Proof of Insurance is just one example of the company’s ongoing commitment to innovation and customer-centric solutions. By leveraging technology, Allstate is able to enhance the overall customer experience, making insurance more accessible, convenient, and reliable.

Looking ahead, Allstate's future plans include further digital transformations and enhancements to their insurance offerings. This could involve the development of new digital tools and platforms, the integration of advanced technologies such as artificial intelligence and machine learning, and the continued focus on environmental sustainability.

As the insurance industry continues to evolve, Allstate remains at the forefront, driving change and setting new standards for customer service and satisfaction. With their digital Proof of Insurance and other innovative initiatives, Allstate is not just keeping up with the times but leading the way into the future of insurance.

How often should I check my Allstate digital Proof of Insurance for updates?

+It’s recommended to check your digital Proof of Insurance at least once a month to ensure that it reflects any recent changes or renewals. This practice helps maintain the accuracy and validity of your document.

Can I use my Allstate digital Proof of Insurance for vehicle registration purposes?

+Yes, your Allstate digital Proof of Insurance is a legally recognized document and can be used for vehicle registration and other official purposes. It carries the same weight and validity as a physical Proof of Insurance document.

What if I lose or delete my Allstate digital Proof of Insurance?

+If you lose or delete your digital Proof of Insurance, you can easily retrieve a new copy by logging into your Allstate account and following the steps outlined above. Allstate’s digital documents are securely stored and accessible at any time.