America's Top Health Insurance

In the vast landscape of health insurance options available in the United States, finding the best coverage that suits individual needs can be a challenging task. With numerous providers, plans, and varying benefits, it's essential to explore the market thoroughly. This article aims to shed light on some of America's top health insurance providers, highlighting their unique features and the benefits they offer to consumers.

Understanding Health Insurance in the USA

Health insurance is a vital component of the American healthcare system, providing financial protection and access to medical services. It plays a crucial role in ensuring individuals can receive necessary healthcare without facing overwhelming financial burdens. The United States boasts a diverse range of health insurance providers, each offering distinct plans tailored to meet the varying needs of its population.

The complexity of the healthcare industry in the US is well-known, with a variety of insurance plans, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs). Each plan type has its own network of healthcare providers and coverage rules, making it essential for individuals to understand their options thoroughly before making a decision.

In recent years, the Affordable Care Act (ACA) has significantly impacted the health insurance landscape, introducing new regulations and mandates. One of the key provisions of the ACA is the requirement for health insurance plans to cover essential health benefits, including ambulatory patient services, emergency services, hospitalization, maternity and newborn care, mental health and substance use disorder services, prescription drugs, rehabilitative and habilitative services and devices, laboratory services, preventive and wellness services, and chronic disease management. These mandates aim to ensure that individuals have access to a comprehensive range of healthcare services without facing financial hardship.

Leading Health Insurance Providers in America

Now, let’s delve into some of the leading health insurance providers in the United States, exploring their offerings and the advantages they bring to policyholders.

UnitedHealthcare

UnitedHealthcare is a prominent player in the health insurance market, known for its comprehensive coverage options. With a wide network of healthcare providers across the nation, UnitedHealthcare offers plans tailored to meet various healthcare needs. Their plans often include a range of benefits, such as coverage for preventive care, prescription medications, and specialty services.

One of the standout features of UnitedHealthcare is its emphasis on preventive care. The company understands the importance of early detection and treatment in managing health conditions. As such, many of their plans cover annual wellness exams, immunizations, and screenings without any out-of-pocket costs. This proactive approach to healthcare can significantly reduce long-term healthcare costs and improve overall health outcomes.

In addition to its comprehensive coverage, UnitedHealthcare also offers a user-friendly digital platform. Policyholders can easily manage their accounts, view claim details, and access their insurance cards through the UnitedHealthcare app or website. This digital convenience enhances the overall customer experience and streamlines the healthcare process.

Blue Cross Blue Shield

Blue Cross Blue Shield (BCBS) is a trusted name in the health insurance industry, providing coverage to millions of Americans. With a rich history spanning over a century, BCBS has established itself as a reliable provider, offering a wide range of insurance plans to cater to different demographics.

BCBS's strength lies in its local presence. The organization is composed of 36 independent companies operating in various states and regions. This localized approach ensures that BCBS can offer plans tailored to the specific healthcare needs and regulations of each area. Whether it's providing coverage for rural communities or urban populations, BCBS aims to deliver accessible and affordable healthcare solutions.

Furthermore, BCBS is known for its extensive network of healthcare providers. Policyholders can rest assured that they will have access to a vast array of doctors, hospitals, and specialists within their network. This ensures that individuals can receive the care they need without having to travel far or worry about out-of-network costs.

Aetna

Aetna is another prominent health insurance provider in the United States, offering a diverse range of plans to suit different lifestyles and budgets. With a focus on innovation and technology, Aetna has developed user-friendly tools and resources to enhance the customer experience.

One of Aetna's unique offerings is its HealthFund program. This program allows policyholders to earn rewards for engaging in healthy behaviors, such as completing wellness activities or achieving specific health goals. The rewards can then be used to offset the cost of health-related expenses, providing an incentive for individuals to take control of their health and well-being.

Aetna also excels in providing comprehensive mental health coverage. Recognizing the importance of mental well-being, the company offers plans that cover a range of mental health services, including therapy, counseling, and medication management. This commitment to mental health support sets Aetna apart and ensures that individuals have access to the care they need to maintain their overall health.

Cigna

Cigna is a leading global health service company, offering a comprehensive suite of health insurance products and services. With a strong focus on personalized care, Cigna aims to deliver a unique and tailored experience to each policyholder.

One of Cigna's standout features is its My Cigna mobile app. This innovative tool allows policyholders to access their health information, view claim details, and locate in-network healthcare providers with ease. The app also offers a range of wellness tools and resources, empowering individuals to take an active role in managing their health.

In addition to its digital offerings, Cigna places a strong emphasis on customer service. The company's dedicated customer support teams are known for their expertise and responsiveness, ensuring that policyholders receive timely assistance and guidance whenever needed. This commitment to exceptional customer service has earned Cigna a reputation for excellence in the health insurance industry.

Humana

Humana is a well-established health insurance provider, offering a range of plans designed to meet the diverse needs of its customers. With a focus on senior care, Humana specializes in Medicare Advantage plans, providing comprehensive coverage for individuals aged 65 and above.

Humana's Medicare Advantage plans offer a wealth of benefits, including coverage for doctor visits, hospital stays, prescription medications, and specialized care. Policyholders can also access a range of wellness programs and preventive services, such as fitness classes, health coaching, and chronic disease management support. These additional services aim to promote healthy lifestyles and prevent the onset of chronic conditions.

Furthermore, Humana is dedicated to making healthcare more accessible and convenient. The company offers a wide network of healthcare providers, ensuring that policyholders can easily find in-network doctors and specialists. Additionally, Humana provides a range of digital tools and resources, such as its MyHumana app, which allows policyholders to manage their healthcare needs from the comfort of their homes.

Comparative Analysis: Choosing the Right Health Insurance

When it comes to selecting the right health insurance plan, there are several key factors to consider. Each provider offers unique advantages and coverage options, so it’s crucial to evaluate your specific needs and prioritize accordingly.

One of the primary considerations is the network of healthcare providers. Ensure that the insurance plan you choose offers a sufficient number of in-network providers in your area. This will guarantee that you have access to the medical care you need without incurring excessive out-of-network costs.

Additionally, assess the coverage limits and exclusions of each plan. Some plans may have higher deductibles or co-pays, while others may have more comprehensive coverage for specific services. Understanding these nuances will help you make an informed decision that aligns with your healthcare requirements and budget.

It's also essential to consider the additional benefits and services offered by each provider. Many health insurance plans now include wellness programs, telemedicine services, and access to health coaching. These value-added services can significantly enhance your overall healthcare experience and promote a healthier lifestyle.

Lastly, don't underestimate the importance of customer service and digital convenience. A user-friendly digital platform and responsive customer support can make a significant difference in your overall satisfaction with your health insurance provider.

The Future of Health Insurance in America

The health insurance landscape in the United States is continuously evolving, driven by technological advancements, changing consumer preferences, and evolving healthcare regulations. As we look ahead, several key trends are shaping the future of health insurance.

Firstly, the rise of telemedicine and virtual healthcare services is expected to continue. With the ongoing COVID-19 pandemic, many individuals have embraced the convenience and accessibility of virtual consultations. Health insurance providers are likely to further integrate telemedicine into their offerings, providing policyholders with remote access to medical advice and care.

Secondly, there is a growing focus on personalized healthcare and precision medicine. Health insurance companies are investing in technologies and data analytics to develop tailored treatment plans and preventive strategies based on an individual's unique health profile. This shift towards personalized care has the potential to revolutionize the way healthcare is delivered and improve patient outcomes.

Lastly, the integration of health insurance with other lifestyle and wellness platforms is gaining traction. Health insurance providers are collaborating with fitness apps, nutrition tracking tools, and mental health support services to offer a more holistic approach to healthcare. By incentivizing healthy behaviors and providing resources for overall well-being, these collaborations aim to improve health outcomes and reduce healthcare costs in the long run.

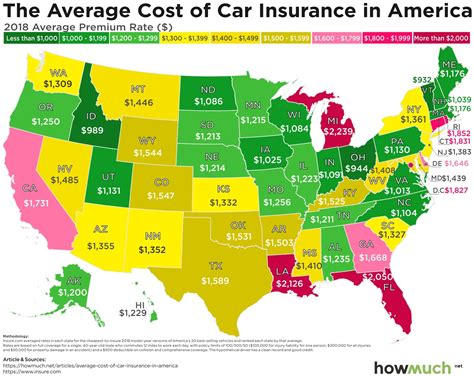

What is the average cost of health insurance in the United States?

+The cost of health insurance can vary significantly based on factors such as location, age, and the specific plan chosen. On average, the monthly premium for an individual can range from 400 to 700, while family plans can cost upwards of $1,500 per month. However, it’s important to note that these averages can vary widely depending on the state and the level of coverage desired.

Are there any government-funded health insurance options in the USA?

+Yes, the United States government provides several health insurance programs, including Medicare for individuals aged 65 and older, Medicaid for low-income individuals and families, and the Children’s Health Insurance Program (CHIP) for children. These programs offer comprehensive coverage at little to no cost for eligible individuals.

How can I choose the right health insurance plan for my needs?

+Choosing the right health insurance plan involves assessing your specific healthcare needs, budget, and preferences. Consider factors such as the network of healthcare providers, coverage limits, additional benefits, and customer service. It’s advisable to compare plans from different providers and seek guidance from insurance brokers or healthcare professionals to make an informed decision.

What are some common exclusions or limitations in health insurance plans?

+Health insurance plans may have exclusions or limitations for certain services or treatments. Common exclusions include cosmetic procedures, experimental treatments, and pre-existing conditions (depending on the plan). It’s crucial to carefully review the plan’s benefits and limitations to understand what is and isn’t covered.

How can I make the most of my health insurance coverage?

+To maximize your health insurance coverage, stay informed about your plan’s benefits and network providers. Utilize preventive care services, such as annual check-ups and screenings, to catch potential health issues early. Additionally, take advantage of any wellness programs or resources offered by your insurance provider to promote a healthier lifestyle and potentially reduce future healthcare costs.