Ameriprise Car Insurance

Ameriprise Car Insurance, a subsidiary of Ameriprise Financial, is a well-known provider of automotive insurance services in the United States. With a focus on offering comprehensive coverage and personalized policies, Ameriprise has built a strong reputation in the insurance industry. In this expert-level journal article, we will delve into the various aspects of Ameriprise Car Insurance, exploring its history, coverage options, customer experience, and more. By the end of this article, you'll have a comprehensive understanding of Ameriprise's role in the car insurance market and the value it brings to its customers.

A Legacy of Financial Services Excellence

Ameriprise Financial, the parent company of Ameriprise Car Insurance, has a rich history dating back to its founding in 1894. Originally known as Investors Syndicate, the company has evolved over the decades to become a leading provider of financial services and insurance products. Ameriprise’s expertise in financial planning and wealth management has paved the way for its success in the insurance industry, particularly in the realm of car insurance.

Ameriprise Car Insurance was established with a mission to provide individuals and families with reliable and tailored car insurance solutions. The company understands that each driver has unique needs and circumstances, and thus, it aims to offer personalized coverage that meets these specific requirements.

Comprehensive Coverage Options

Ameriprise Car Insurance offers a wide range of coverage options to cater to the diverse needs of its customers. Here’s an overview of the key coverage types available:

Liability Coverage

Liability coverage is a fundamental aspect of any car insurance policy. Ameriprise provides both bodily injury liability and property damage liability coverage. This type of insurance protects the policyholder in the event they are found at fault in an accident, covering the costs associated with injuries sustained by others and damages caused to their property.

Collision and Comprehensive Coverage

Collision coverage and comprehensive coverage are essential components of a comprehensive car insurance policy. Ameriprise offers these coverages to protect policyholders from a wide range of risks. Collision coverage provides protection in the event of a collision with another vehicle or object, while comprehensive coverage covers damages caused by non-collision incidents such as theft, vandalism, natural disasters, and animal collisions.

Personal Injury Protection (PIP)

Personal Injury Protection, or PIP, is a type of coverage that provides medical and rehabilitation benefits to the policyholder and their passengers, regardless of who is at fault in an accident. Ameriprise Car Insurance offers PIP coverage to ensure that policyholders have access to the necessary medical care and support following an accident.

Uninsured/Underinsured Motorist Coverage

Uninsured and underinsured motorist coverage is crucial to protect policyholders from financial losses caused by drivers who do not carry adequate insurance. Ameriprise offers this coverage to ensure that its policyholders are not left vulnerable in such situations.

Additional Coverage Options

Ameriprise Car Insurance also provides a range of additional coverage options to enhance the policyholder’s protection. These may include rental car reimbursement, roadside assistance, glass coverage, and more. Policyholders can tailor their coverage to suit their specific needs and preferences.

Personalized Policies and Customer Experience

One of Ameriprise Car Insurance’s key strengths lies in its ability to offer personalized policies. The company understands that every driver has a unique profile, and thus, it strives to provide customized coverage options. Ameriprise’s insurance experts work closely with policyholders to assess their needs, driving habits, and risk factors to create a policy that offers the right balance of coverage and affordability.

The customer experience is a top priority for Ameriprise. The company aims to make the insurance process as smooth and stress-free as possible. Policyholders can easily manage their insurance needs through the Ameriprise mobile app or online platform. This digital interface allows customers to access their policy information, make payments, file claims, and communicate with their dedicated insurance agent seamlessly.

Ameriprise also boasts a highly responsive and knowledgeable customer service team. Policyholders can reach out to customer support representatives via phone, email, or live chat, ensuring that their inquiries and concerns are addressed promptly.

Claim Handling Process

Ameriprise Car Insurance has implemented an efficient and streamlined claim handling process. Policyholders can file claims online, by phone, or through the mobile app. The company’s claims team works diligently to assess and process claims as quickly as possible, ensuring that policyholders receive the compensation they are entitled to in a timely manner.

In the event of an accident, Ameriprise offers additional support services, such as rental car assistance and guidance on finding reputable repair shops. This comprehensive approach to claim handling demonstrates Ameriprise's commitment to its customers' well-being and peace of mind.

Discounts and Savings

Ameriprise Car Insurance recognizes the importance of offering competitive pricing and discounts to its policyholders. The company provides a variety of discounts to help customers save on their insurance premiums. These discounts may include:

- Multi-Policy Discount: Policyholders who bundle their car insurance with other Ameriprise insurance products, such as homeowners or renters insurance, can enjoy significant savings.

- Safe Driver Discount: Drivers with a clean driving record and no at-fault accidents or traffic violations may be eligible for a safe driver discount.

- Good Student Discount: Ameriprise offers discounts to young drivers who maintain good grades in school.

- Loyalty Discount: Policyholders who have been with Ameriprise for an extended period may qualify for loyalty discounts, rewarding their long-term commitment.

- Anti-Theft Discount: Installing approved anti-theft devices in your vehicle can lead to reduced insurance premiums.

By taking advantage of these discounts, policyholders can further reduce their insurance costs while maintaining comprehensive coverage.

Technology and Digital Innovation

Ameriprise Car Insurance embraces technology and digital innovation to enhance the customer experience and streamline its operations. The company’s mobile app and online platform offer a user-friendly interface, allowing policyholders to manage their insurance needs with ease. Customers can access their policy details, make payments, and view their coverage options at any time, ensuring convenience and efficiency.

Additionally, Ameriprise utilizes advanced data analytics and risk assessment tools to tailor coverage recommendations to individual policyholders. This technology-driven approach enables the company to offer personalized policies that are both comprehensive and cost-effective.

Telematics and Usage-Based Insurance

Ameriprise has also explored the use of telematics and usage-based insurance to further customize coverage and provide discounts to safe drivers. Telematics devices, which are installed in vehicles, track driving behavior and habits, allowing Ameriprise to offer more precise risk assessments and potentially lower premiums for safe drivers.

Community Engagement and Corporate Responsibility

Ameriprise Car Insurance, as part of Ameriprise Financial, is committed to community engagement and corporate social responsibility. The company actively supports various charitable initiatives and causes, focusing on education, financial literacy, and environmental sustainability. Ameriprise believes in giving back to the communities it serves and strives to make a positive impact beyond its core business operations.

Conclusion: A Trusted Provider of Car Insurance

Ameriprise Car Insurance stands out as a trusted and reliable provider of automotive insurance services. With its rich history in financial services, Ameriprise has the expertise and resources to offer comprehensive coverage options and personalized policies. The company’s focus on customer experience, efficient claim handling, and innovative use of technology further enhances its reputation in the industry.

Whether you're seeking liability coverage, collision protection, or additional benefits like rental car reimbursement, Ameriprise Car Insurance has the solutions to meet your needs. With its commitment to community and corporate responsibility, Ameriprise ensures that its customers not only receive quality insurance coverage but also contribute to a positive societal impact.

How can I get a quote for Ameriprise Car Insurance?

+To get a quote for Ameriprise Car Insurance, you can visit their official website or contact their customer service team. You’ll need to provide some basic information about your vehicle, driving history, and coverage preferences. Ameriprise’s insurance experts will then assist you in finding the right policy and provide a customized quote.

What are the key benefits of Ameriprise Car Insurance’s personalized policies?

+Ameriprise’s personalized policies offer several benefits. They provide tailored coverage that suits your specific needs and circumstances, ensuring you have the right protection. Additionally, personalized policies often result in more affordable premiums, as they are customized to your unique profile.

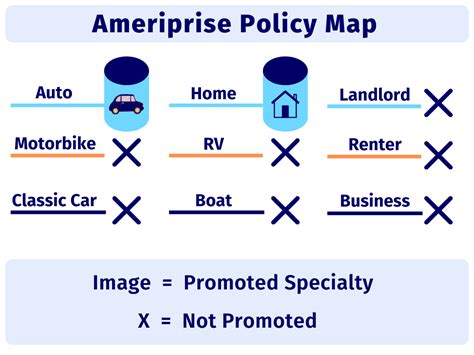

Can Ameriprise Car Insurance cover high-value vehicles and collectibles?

+Yes, Ameriprise Car Insurance offers specialized coverage for high-value vehicles and collectibles. Their policies can accommodate the unique needs of classic car enthusiasts, luxury vehicle owners, and those with unique driving habits. Ameriprise understands the value and sentiment attached to such vehicles and provides comprehensive coverage to protect them.