An Automobile Insurance Policy Typically Includes

Automobile insurance, also known as car insurance or motor insurance, is a crucial aspect of vehicle ownership. It provides financial protection against various risks and liabilities associated with owning and operating a motor vehicle. An automobile insurance policy is a legally binding contract between the policyholder and the insurance company, outlining the coverage, exclusions, and conditions of the insurance agreement.

Comprehensive Coverage and Its Components

A typical automobile insurance policy consists of several key components, each designed to address specific risks and scenarios. These components work together to offer a comprehensive protection package for vehicle owners. Here’s a detailed breakdown of what an automobile insurance policy typically includes:

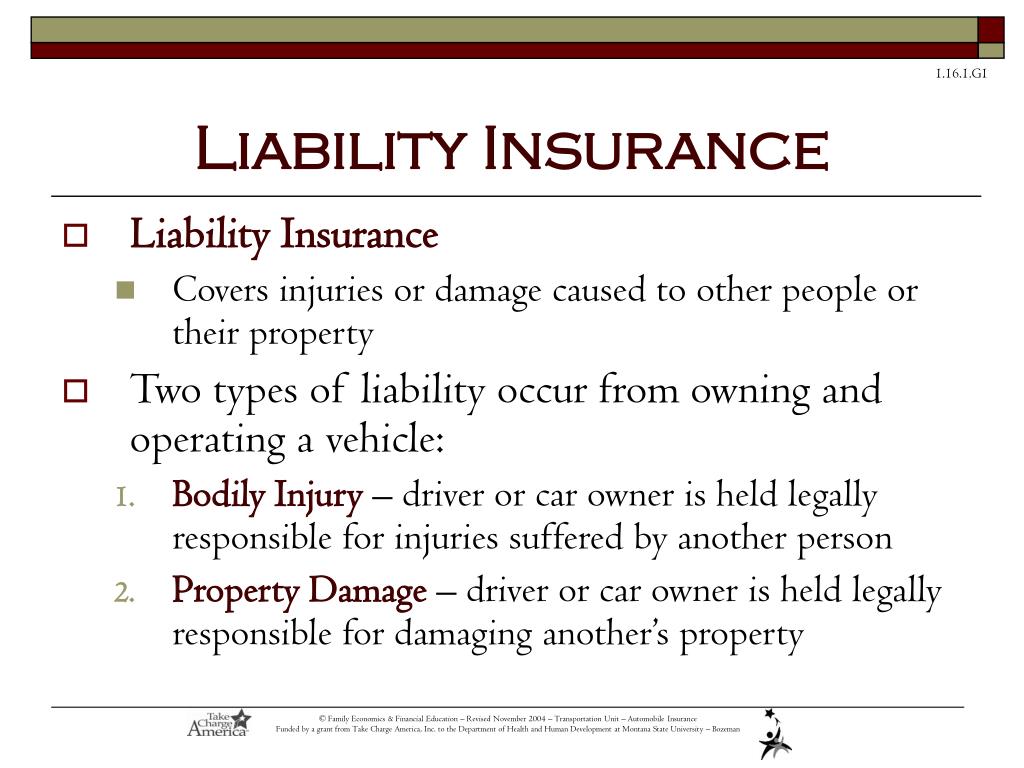

Liability Coverage

Liability coverage is a fundamental part of any automobile insurance policy. It provides protection in the event that the policyholder is held legally responsible for bodily injury or property damage caused to others in an accident. This coverage typically includes:

- Bodily Injury Liability: Covers medical expenses, rehabilitation costs, and compensation for pain and suffering incurred by others as a result of an accident caused by the policyholder.

- Property Damage Liability: Pays for the repair or replacement of property, such as vehicles, buildings, or other assets, damaged by the policyholder in an accident.

Collision Coverage

Collision coverage safeguards the policyholder’s vehicle in the event of an accident. It covers the cost of repairing or replacing the insured vehicle, regardless of who is at fault. Collision coverage typically includes:

- Repair or Replacement Costs: Pays for the repairs needed after a collision, up to the vehicle’s actual cash value or the policy limit, whichever is lower.

- Rental Car Coverage: Provides temporary rental car expenses if the insured vehicle is being repaired or is deemed a total loss.

Comprehensive Coverage

Comprehensive coverage protects the insured vehicle against non-collision-related incidents. This coverage typically includes:

- Theft: Covers the cost of replacing a stolen vehicle or compensates for its value.

- Vandalism: Pays for repairs needed due to intentional damage or acts of vandalism.

- Natural Disasters: Covers damages caused by events like floods, hurricanes, earthquakes, or hailstorms.

- Fire and Explosions: Provides compensation for damages resulting from fires or explosions.

- Glass Damage: Covers the cost of repairing or replacing windshields, windows, or sunroofs.

Medical Payments Coverage

Medical payments coverage, also known as Personal Injury Protection (PIP), provides coverage for medical expenses incurred by the policyholder and their passengers after an accident, regardless of fault. This coverage typically includes:

- Medical Bills: Pays for doctor visits, hospital stays, prescription medications, and other medical treatments.

- Funeral Expenses: Covers costs associated with funeral arrangements in the event of a fatality.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects the policyholder in the event of an accident with a driver who either has no insurance or has inadequate coverage to compensate for the damages caused. This coverage typically includes:

- Bodily Injury: Provides compensation for medical expenses and other related costs when the at-fault driver has no insurance.

- Property Damage: Covers the cost of repairing or replacing the insured vehicle if the at-fault driver is uninsured or underinsured.

Additional Coverages and Optional Add-Ons

Beyond the core components, automobile insurance policies often offer additional coverages and optional add-ons to cater to specific needs. These may include:

- Roadside Assistance: Provides emergency services like towing, battery jumps, or fuel delivery in case of vehicle breakdowns.

- Gap Insurance: Covers the difference between the vehicle’s actual cash value and the remaining loan balance if the vehicle is a total loss.

- Rental Car Reimbursement: Offers additional rental car coverage beyond what is provided by collision coverage.

- Custom Parts and Equipment Coverage: Protects the value of custom modifications, accessories, or high-end equipment installed in the vehicle.

Policy Exclusions and Limitations

It’s important to note that automobile insurance policies also include exclusions and limitations. These are situations or circumstances where the insurance company will not provide coverage. Some common exclusions may include:

- Intentional acts or criminal activities.

- Normal wear and tear or mechanical breakdowns.

- Driving under the influence of drugs or alcohol.

- Racing or participating in speed contests.

- Damages caused by certain types of pests or rodents.

Policyholders should carefully review their insurance policy to understand the specific exclusions and limitations applicable to their coverage.

Understanding Policy Terms and Conditions

An automobile insurance policy is a legally binding document, and it’s crucial for policyholders to understand its terms and conditions. This includes:

- Policy Limits: The maximum amount the insurance company will pay for covered losses.

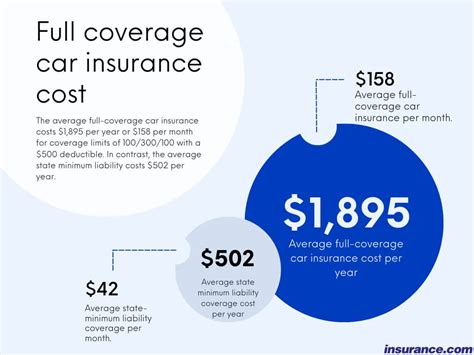

- Deductibles: The amount the policyholder must pay out of pocket before the insurance coverage kicks in.

- Premium: The cost of the insurance policy, typically paid monthly, quarterly, or annually.

- Coverage Period: The duration for which the policy is valid, often renewable annually.

- Claims Process: The steps to follow in the event of an accident or incident to ensure a smooth claims process.

Customizing Your Automobile Insurance Policy

Automobile insurance policies can be tailored to meet the unique needs and circumstances of individual policyholders. Factors such as the make and model of the vehicle, driving history, location, and desired level of coverage can influence the policy’s cost and coverage. Policyholders can work with their insurance providers to customize their policies, ensuring they have the right coverage at a competitive price.

Importance of Regular Policy Review

It’s essential for policyholders to regularly review their automobile insurance policies. Life circumstances, such as marriage, divorce, the addition of a teen driver, or the purchase of a new vehicle, can impact insurance needs. Regular policy reviews ensure that coverage remains adequate and that policyholders are not paying for unnecessary coverage.

Frequently Asked Questions

What is the difference between liability and collision coverage?

+Liability coverage protects you if you cause an accident and are found at fault, covering medical expenses and property damage for others involved. Collision coverage, on the other hand, covers damage to your own vehicle regardless of fault, typically including repairs or replacement costs.

Is comprehensive coverage necessary for all vehicles?

+While comprehensive coverage is not legally required, it is highly recommended, especially for newer vehicles. It provides protection against a wide range of non-collision incidents, including theft, vandalism, and natural disasters.

What is the purpose of uninsured/underinsured motorist coverage?

+Uninsured/underinsured motorist coverage ensures that you have financial protection if you’re involved in an accident with a driver who either has no insurance or insufficient coverage to compensate for the damages caused. It helps cover your medical expenses and other related costs in such scenarios.

How often should I review my automobile insurance policy?

+It’s advisable to review your automobile insurance policy annually or whenever there are significant changes in your life, such as buying a new car, getting married, or moving to a different location. Regular reviews ensure that your coverage remains up-to-date and aligned with your needs.