Animal Insurance Coverage

Animal insurance coverage is a critical aspect of responsible pet ownership, offering peace of mind and financial protection to pet owners. This comprehensive guide will delve into the world of animal insurance, exploring its intricacies, benefits, and real-world applications. From understanding the various types of coverage to navigating policy options, we will provide an in-depth analysis to assist pet owners in making informed decisions about their beloved companions' well-being.

Understanding Animal Insurance Coverage

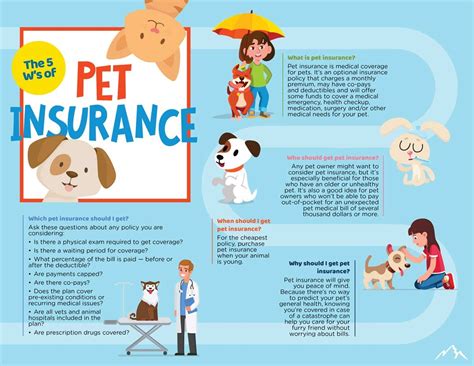

Animal insurance, often referred to as pet insurance, is a specialized form of insurance designed to cover the medical expenses and certain liabilities associated with owning a pet. Much like human health insurance, it provides a safety net for unexpected veterinary costs, ensuring pet owners can access necessary treatments without financial strain.

The Need for Animal Insurance

Pets are an integral part of many families, providing companionship, emotional support, and even contributing to our overall health and well-being. However, the costs of veterinary care can be substantial, especially in emergencies or for chronic conditions. Animal insurance steps in to alleviate this financial burden, allowing pet owners to focus on their pet’s health without compromising their own financial stability.

Types of Animal Insurance

There are primarily two types of animal insurance policies: accident-only and comprehensive coverage. Accident-only policies, as the name suggests, cover injuries resulting from accidents, such as fractures, bites, or poisoning. Comprehensive coverage, on the other hand, offers a broader range of benefits, including accident coverage, illness treatment, and sometimes even routine care such as vaccinations and check-ups.

| Policy Type | Coverage |

|---|---|

| Accident-Only | Injury treatment resulting from accidents |

| Comprehensive | Accident coverage, illness treatment, and routine care |

Key Features and Benefits

Animal insurance policies offer a range of features and benefits tailored to pet owners’ needs. Here are some of the key advantages:

Vet Visit Flexibility

Most animal insurance policies provide coverage for visits to any licensed veterinarian, giving pet owners the freedom to choose the best care for their pet, regardless of location.

Reimbursement for Treatment Costs

Insurance companies typically reimburse a portion of the veterinary bills, with the specific amount depending on the policy’s coverage and the pet’s condition. This reimbursement can significantly reduce the financial impact of unexpected medical treatments.

Coverage for Chronic Conditions

Some comprehensive policies cover chronic illnesses, such as diabetes or arthritis, providing long-term care for pets with ongoing health issues. This feature is especially beneficial for older pets or those with known health conditions.

Routine Care Coverage

Certain policies extend coverage to routine care, including vaccinations, flea and tick treatments, and annual check-ups. This can be a cost-effective way to ensure your pet receives regular preventive care.

Specialist Referrals

In cases where a pet requires specialized treatment, such as surgery or advanced diagnostics, animal insurance can cover the costs associated with referrals to veterinary specialists.

Choosing the Right Policy

Selecting the appropriate animal insurance policy involves careful consideration of various factors. Here’s a step-by-step guide to help you make an informed decision:

Assess Your Pet’s Needs

Begin by evaluating your pet’s current and potential future health needs. Consider their age, breed, and any pre-existing conditions. For example, if your pet has a known condition, comprehensive coverage might be more suitable.

Compare Policies

Research and compare different insurance providers and their policy offerings. Look at the scope of coverage, including accident, illness, and routine care. Pay attention to policy exclusions and any waiting periods before coverage kicks in.

Review Deductibles and Co-pays

Understand the financial obligations associated with each policy. Deductibles are the amount you pay upfront before the insurance coverage begins, while co-pays are your share of the bill for each visit. Choose a policy with deductibles and co-pays that align with your financial comfort.

Check for Breed-Specific Coverage

Certain breeds are prone to specific health issues. Ensure the policy you choose provides adequate coverage for these potential conditions. Some insurance companies offer breed-specific policies that address common breed-related health concerns.

Consider Lifetime vs. Annual Coverage

Policies often offer lifetime or annual coverage. Lifetime coverage provides a set annual limit that renews each year, ensuring continuous coverage for your pet’s life. Annual coverage, on the other hand, resets the limit annually, meaning you may need to consider a higher limit to accommodate potential long-term conditions.

Real-World Application: Case Studies

To illustrate the impact of animal insurance, let’s explore a couple of real-life scenarios:

Emergency Surgery for a Golden Retriever

Max, a 5-year-old Golden Retriever, suddenly became lethargic and lost his appetite. After a rushed visit to the vet, it was discovered that he had swallowed a foreign object, requiring immediate surgery. The procedure and hospital stay amounted to $5,000. With his comprehensive insurance policy, Max’s owners were reimbursed for 80% of the total cost, easing their financial burden during this stressful time.

Ongoing Care for a Senior Cat

Whiskers, a 14-year-old domestic shorthair cat, was diagnosed with chronic kidney disease. His owners opted for a comprehensive policy that covered his routine care, including regular blood work and medications. With this coverage, they could provide the necessary care without straining their budget, ensuring Whiskers’ comfort and longevity.

The Future of Animal Insurance

As the pet insurance industry continues to evolve, we can expect advancements in coverage options and accessibility. Here are some potential future developments:

Integration of Telemedicine

With the rise of telemedicine in human healthcare, animal insurance may follow suit. This could mean more accessible veterinary advice and even remote consultations, making healthcare more convenient for pet owners.

Personalized Policies

Insurance providers may offer more tailored policies, taking into account an individual pet’s health history and risk factors. This level of personalization could ensure more precise coverage and potentially lower premiums for low-risk pets.

Expanded Coverage for Preventive Care

As the focus on preventive healthcare grows, animal insurance policies may further extend their coverage to include a wider range of preventive measures, such as dental care and obesity management programs.

FAQ

Can I insure an older pet?

+Yes, many insurance companies offer policies for older pets. However, the coverage and premiums may differ compared to policies for younger pets.

What if my pet has a pre-existing condition?

+Some policies may exclude pre-existing conditions from coverage. It’s important to carefully review the policy’s terms and conditions before enrolling.

Are there discounts available for multiple pets?

+Yes, some insurance providers offer discounts when you insure multiple pets under the same policy.

Can I switch insurance providers?

+Yes, you have the freedom to switch insurance providers. However, be aware of any waiting periods or exclusions that may apply when transferring coverage.