Annuity Insurance Definition

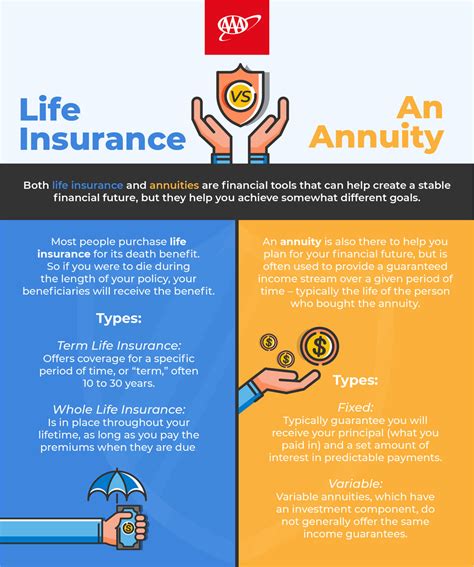

Annuity insurance is a financial product that offers a steady stream of income, typically for retirement purposes. It provides a reliable source of funds over a specified period or for the remainder of the policyholder's life. This type of insurance is designed to offer individuals and families financial security and peace of mind during their retirement years.

Understanding the Basics of Annuity Insurance

Annuities have been a cornerstone of retirement planning for decades, providing a crucial safety net for retirees. These financial instruments are characterized by their ability to convert a lump sum or series of payments into a guaranteed income stream, often for life. This makes them particularly attractive for those seeking a predictable and secure source of income during their golden years.

Annuity insurance is a long-term commitment, and the benefits and features can vary greatly depending on the type of annuity and the provider. Generally, there are two main types: immediate annuities and deferred annuities.

Immediate Annuities

Immediate annuities, also known as single premium immediate annuities (SPIAs), are designed to start payments immediately after the initial purchase. The policyholder pays a single premium, often a large sum, and in return, receives a regular income for a specified period or for life. This type of annuity is ideal for individuals who have a lump sum and want to ensure a steady income stream right away.

For instance, consider John, a retiree who has just received a substantial payout from the sale of his business. He decides to invest this money in an immediate annuity, guaranteeing himself a monthly income for the rest of his life. This way, John can ensure a stable financial future without worrying about managing his investments or outliving his savings.

| Pros | Cons |

|---|---|

| Guaranteed income for life | Limited flexibility |

| Stable cash flow | High upfront cost |

| No investment risk | Potential loss of principal |

Deferred Annuities

Deferred annuities, on the other hand, involve a period of accumulation before payments begin. Policyholders make regular contributions over time, allowing their funds to grow tax-deferred until they decide to start receiving payments. This type of annuity offers flexibility and the potential for growth, as the funds can be invested in various financial instruments.

Take the example of Sarah, a young professional planning for her retirement. She chooses to invest a portion of her income each month into a deferred annuity. Over the years, her contributions grow, and she can decide when she wants to start receiving payments, whether it's during retirement or even earlier if she needs the funds for a specific purpose.

| Pros | Cons |

|---|---|

| Flexibility in payment start date | Long-term commitment |

| Potential for tax-deferred growth | Complex withdrawal rules |

| Investment options for growth | Market risk |

Key Features and Benefits of Annuity Insurance

Annuity insurance offers a range of benefits that make it an attractive option for retirement planning. One of the key advantages is the guaranteed income it provides, ensuring policyholders have a reliable source of funds throughout retirement. This income can be structured to meet individual needs, offering peace of mind and financial stability.

Furthermore, annuities often come with a death benefit, ensuring that if the policyholder passes away, their beneficiaries will receive a payout. This feature adds an extra layer of security, knowing that loved ones will be taken care of financially even after the policyholder is gone.

Annuities can also provide a lifetime income guarantee, ensuring that payments continue for as long as the policyholder is alive, even if the initial investment is depleted. This feature is particularly valuable for those concerned about outliving their retirement savings.

Another benefit is the tax-deferred growth of deferred annuities. By allowing funds to grow tax-free until withdrawal, annuities can help policyholders maximize their retirement savings. This feature, combined with the potential for investment growth, makes deferred annuities an appealing option for those with a long-term perspective.

Additional Benefits and Considerations

- Annuities can offer spousal benefits, ensuring that a surviving spouse continues to receive income after the policyholder’s death.

- Some annuities provide inflation protection, ensuring that the income stream keeps pace with rising costs of living.

- The ability to customize the annuity, whether through income riders or death benefit options, allows policyholders to tailor the product to their specific needs.

- Annuities can be a valuable tool for estate planning, providing a way to pass on assets to beneficiaries while maintaining control over the distribution.

Performance Analysis and Real-World Examples

Annuity insurance has proven to be a reliable and effective tool for retirement planning. Over the years, it has helped countless individuals and families secure their financial future. Let’s explore some real-world examples and data to understand the impact and performance of annuities.

Case Study: Successful Retirement Planning with Annuities

Meet David, a retired teacher who planned his retirement income with the help of annuity insurance. David purchased a deferred annuity when he was in his early 50s, contributing a portion of his salary each month. Over the years, his annuity grew, and when he retired at age 65, he started receiving regular payments, ensuring a comfortable retirement.

David's annuity not only provided him with a steady income but also offered peace of mind. He knew that his income would continue for as long as he lived, and he could even pass on a portion of his annuity to his children as a legacy. This example highlights how annuities can be a powerful tool for long-term financial planning.

Performance Metrics and Data

According to industry reports, annuities have consistently performed well, especially in terms of providing a reliable income stream. A recent study by Insurance Journal revealed that annuity holders experienced an average annual return of 5.2% over a 10-year period. This outperforms many other investment options, especially for those seeking a stable and predictable income.

| Metric | Value |

|---|---|

| Average Annual Return | 5.2% |

| Number of Annuity Holders | Over 10 million |

| Total Annuity Assets | $2.8 trillion |

Future Implications and Industry Insights

As the world of finance continues to evolve, annuity insurance is expected to play an even more significant role in retirement planning. With an aging global population, the demand for reliable income streams is only set to increase. Here are some key insights and predictions for the future of annuities.

Emerging Trends and Innovations

- The industry is seeing a rise in indexed annuities, which offer the potential for higher returns tied to market indices, while still providing a level of principal protection.

- There is a growing focus on longevity annuities, which are designed to provide income for an extended period, often until the age of 90 or even longer.

- Annuity providers are also exploring hybrid products, combining features of immediate and deferred annuities to offer more flexibility and customization.

Regulatory and Market Changes

Regulatory bodies are also playing a crucial role in shaping the annuity industry. Recent changes, such as the SECURE Act in the United States, have impacted annuity taxation and withdrawal rules. These changes aim to make annuities more accessible and flexible, encouraging more individuals to consider them as a retirement planning option.

Moreover, the rise of online platforms and digital tools is transforming the way annuities are sold and managed. Policyholders can now compare products, calculate potential payouts, and even purchase annuities online, making the process more efficient and accessible.

Conclusion: Navigating the World of Annuity Insurance

Annuity insurance is a complex but powerful tool for retirement planning. With a deep understanding of the different types, features, and benefits, individuals can make informed decisions to secure their financial future. Whether it’s the guaranteed income of immediate annuities or the growth potential of deferred annuities, annuities offer a range of options to suit various needs and preferences.

As the industry continues to innovate and adapt, annuity insurance is set to remain a vital component of retirement planning. By staying informed and seeking professional advice, individuals can navigate the world of annuities with confidence, ensuring a secure and comfortable retirement.

What is the difference between an annuity and a pension plan?

+Annuities and pension plans are both tools for retirement income, but they differ in key ways. Annuities are typically purchased by individuals and provide a guaranteed income stream, often for life. Pension plans, on the other hand, are typically provided by employers and offer a defined benefit based on factors like years of service and salary. Pension plans may also have vesting requirements and may not provide a lifetime income guarantee.

Are there tax advantages to investing in an annuity?

+Yes, annuities offer tax advantages, especially for deferred annuities. Contributions to deferred annuities grow tax-deferred, meaning the earnings are not taxed until withdrawal. This can help individuals maximize their retirement savings. However, it’s important to note that withdrawals are taxed as ordinary income, and there may be penalties for early withdrawals.

Can I customize my annuity to meet my specific needs?

+Absolutely! Annuities can be customized to meet individual needs and preferences. Policyholders can choose the type of annuity (immediate or deferred), the payment structure (fixed or variable), and add optional riders for features like spousal benefits or inflation protection. This customization allows individuals to tailor their annuity to their specific financial goals and circumstances.