Anthem Health Insurance Plans

In the ever-evolving landscape of healthcare, choosing the right health insurance plan is a crucial decision that can impact your well-being and financial security. Anthem, a leading health insurance provider, offers a comprehensive range of plans tailored to meet diverse needs. This article delves into the intricacies of Anthem health insurance plans, exploring their coverage, benefits, and unique features to help you make an informed choice.

Understanding Anthem Health Insurance Plans

Anthem Health Insurance, a subsidiary of the larger health care company, Anthem Inc., provides a variety of health insurance plans across several states in the U.S. These plans are designed to cater to the unique healthcare needs of individuals and families, offering a range of benefits and coverage options. With a focus on accessibility and affordability, Anthem aims to provide quality healthcare solutions to its policyholders.

Plan Options and Coverage

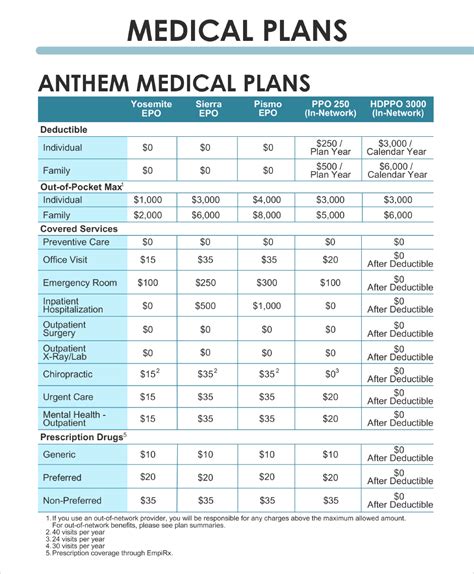

Anthem’s portfolio of health insurance plans includes a wide range of options, from individual and family plans to Medicare Advantage plans and employer-sponsored group plans. Each plan type is tailored to meet the specific needs of its target audience, offering varying levels of coverage and benefits.

For instance, their individual and family plans offer comprehensive medical, dental, and vision coverage, with options for additional riders like critical illness coverage and accident protection. These plans are ideal for self-employed individuals, early retirees, and families seeking flexible and comprehensive healthcare coverage.

On the other hand, Medicare Advantage plans are designed to supplement traditional Medicare coverage, offering additional benefits such as prescription drug coverage, dental, and vision care. These plans are tailored for individuals aged 65 and above, providing an all-in-one solution for their healthcare needs.

Anthem's employer-sponsored group plans are customized to meet the unique needs of businesses and their employees. These plans often include a range of benefits such as medical, dental, vision, and prescription drug coverage, with the option to add additional benefits like wellness programs and mental health support.

| Plan Type | Coverage Highlights |

|---|---|

| Individual & Family Plans | Comprehensive medical, dental, vision coverage with optional critical illness and accident protection. |

| Medicare Advantage Plans | Supplemental coverage to traditional Medicare, including prescription drug, dental, and vision benefits. |

| Employer-Sponsored Group Plans | Customized coverage for businesses, often including medical, dental, vision, and prescription drug benefits, with additional wellness and mental health support. |

Benefits and Unique Features

Anthem health insurance plans come with a host of benefits and unique features that set them apart. One notable feature is their 24⁄7 access to a virtual care team, providing policyholders with on-demand medical advice and support. This virtual care service is particularly beneficial for managing non-emergency medical concerns, offering convenience and peace of mind.

Anthem also offers a wide network of in-network providers, ensuring policyholders have access to a broad range of healthcare professionals and facilities. This extensive network helps to keep costs down, as in-network care is often more affordable than out-of-network services.

Additionally, Anthem's plans include preventive care benefits, covering a range of services aimed at maintaining good health and catching potential issues early. These benefits often include annual physicals, immunizations, and screenings for various health conditions, helping policyholders stay on top of their health and well-being.

For those managing chronic conditions, Anthem provides specialized support programs, offering personalized care plans and resources to help manage conditions like diabetes, heart disease, and asthma. These programs often include access to health coaches, educational resources, and support groups, ensuring policyholders receive the necessary care and guidance.

The Enrollment Process

Enrolling in an Anthem health insurance plan is a straightforward process. Policyholders can choose to enroll directly through Anthem’s website, where they can compare plans, receive quotes, and complete the enrollment process. Alternatively, they can seek guidance from a licensed insurance agent who can help navigate the various plan options and provide personalized recommendations.

Anthem also offers open enrollment periods, during which anyone can enroll in a plan without needing a qualifying life event. These periods typically occur once a year, allowing individuals and families to review their coverage needs and make changes as necessary. Outside of the open enrollment period, individuals may still be able to enroll if they experience a qualifying life event, such as marriage, divorce, birth of a child, or loss of other health coverage.

Cost and Financial Assistance

The cost of Anthem health insurance plans can vary based on factors such as the plan type, level of coverage, and the policyholder’s location. Generally, plans with higher levels of coverage and more comprehensive benefits come with higher premiums. However, Anthem also offers a range of cost-saving options and financial assistance programs to make their plans more accessible.

For instance, Anthem's Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) allow policyholders to set aside pre-tax dollars to pay for qualified medical expenses. These accounts can help reduce the overall cost of healthcare, as the funds can be used to cover a range of medical, dental, and vision expenses.

Additionally, Anthem provides premium tax credits and cost-sharing reductions for eligible individuals and families. These financial assistance programs can help reduce the cost of monthly premiums and out-of-pocket expenses, making healthcare more affordable for those who need it most.

The Future of Anthem Health Insurance Plans

As the healthcare landscape continues to evolve, Anthem remains committed to providing innovative solutions and comprehensive coverage. With a focus on digital health and telemedicine, Anthem is continually enhancing its virtual care offerings, making it easier and more convenient for policyholders to access the care they need.

Anthem is also dedicated to promoting health and wellness, with a range of initiatives aimed at preventing disease and improving overall well-being. These initiatives often include educational resources, wellness programs, and incentives for policyholders to lead healthier lives. By focusing on prevention and early intervention, Anthem aims to reduce the overall cost of healthcare and improve the long-term health outcomes of its policyholders.

Furthermore, Anthem is actively engaged in research and development, exploring new technologies and treatment options to enhance the quality of care its policyholders receive. This commitment to innovation ensures that Anthem remains at the forefront of the healthcare industry, offering cutting-edge solutions and comprehensive coverage to its policyholders.

What are the key benefits of Anthem health insurance plans?

+

Anthem health insurance plans offer a range of benefits, including 24⁄7 access to a virtual care team, a wide network of in-network providers, preventive care benefits, and specialized support programs for managing chronic conditions.

How do I enroll in an Anthem health insurance plan?

+

You can enroll directly through Anthem’s website or seek guidance from a licensed insurance agent. Enrollment periods typically occur once a year during open enrollment, but you may also be eligible to enroll outside of this period if you experience a qualifying life event.

What financial assistance programs does Anthem offer?

+

Anthem offers Health Savings Accounts (HSAs), Flexible Spending Accounts (FSAs), premium tax credits, and cost-sharing reductions to help make healthcare more affordable for eligible individuals and families.

How is Anthem innovating in the healthcare space?

+

Anthem is focused on digital health and telemedicine, enhancing its virtual care offerings. They also prioritize health and wellness initiatives, and are actively engaged in research and development to bring innovative solutions and comprehensive coverage to their policyholders.