Apartment Insurance

Protecting your home and belongings is essential, and when it comes to apartment living, having the right insurance coverage is crucial. Apartment insurance, often referred to as renters' insurance, provides financial protection for tenants against various risks and unforeseen events. In this comprehensive guide, we will delve into the world of apartment insurance, exploring its importance, coverage options, and how it can safeguard your rental space.

Understanding Apartment Insurance

Apartment insurance is a specialized type of insurance policy designed specifically for individuals who rent their living spaces. Unlike homeowners’ insurance, which covers the structure and its contents, apartment insurance primarily focuses on the personal belongings and liabilities of the tenant. It offers peace of mind, ensuring that you are financially prepared to handle unexpected incidents that may occur within your rented apartment.

Let's explore the key aspects of apartment insurance and why it is a vital consideration for any renter.

Protecting Your Personal Belongings

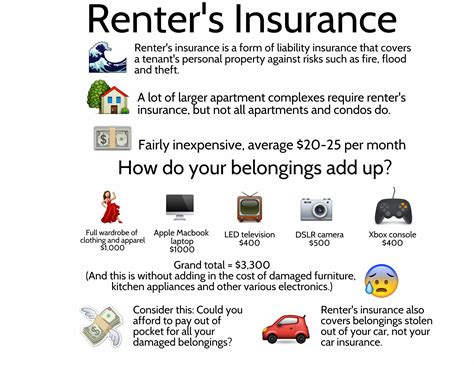

One of the primary benefits of apartment insurance is the coverage it provides for your personal property. Your belongings, such as furniture, electronics, clothing, and valuable items, are at risk of damage or loss due to various reasons, including theft, fire, water damage, or natural disasters. Apartment insurance steps in to compensate for these losses, ensuring that you can replace or repair your possessions without incurring significant financial burden.

Consider the following scenario: a fire breaks out in your apartment complex, causing extensive damage to multiple units, including yours. Without apartment insurance, you would be left to cover the cost of replacing all your belongings, which could amount to thousands of dollars. With a comprehensive apartment insurance policy, you can rest assured that your insurer will provide the necessary funds to help you rebuild your home and purchase new items.

| Coverage Type | Description |

|---|---|

| Personal Property Coverage | Reimburses you for the loss or damage to your belongings due to covered perils. |

| Additional Living Expenses | Provides coverage for temporary living arrangements if your apartment becomes uninhabitable due to a covered event. |

| Liability Protection | Offers financial protection if you are found legally responsible for causing injury or property damage to others. |

Liability Protection: Safeguarding Your Responsibilities

Apartment insurance not only covers your personal belongings but also extends to liability protection. This aspect of the policy is crucial as it shields you from financial liability in case you are held responsible for causing injury or property damage to others within your rental unit.

Imagine a situation where a guest slips and falls in your apartment, resulting in injuries. If they decide to take legal action against you, liability coverage within your apartment insurance policy can help cover the associated legal expenses and any compensation awarded. This protection is especially valuable, as it prevents a single incident from leading to significant financial strain or even bankruptcy.

Furthermore, liability coverage can also come into play if you accidentally cause damage to the apartment itself. For instance, if a pipe bursts due to your negligence, leading to water damage in the unit below, your liability coverage can help cover the repair costs, preventing a potentially costly dispute with your landlord or neighboring tenants.

Additional Living Expenses: Covering Temporary Displacement

Apartment insurance policies often include coverage for additional living expenses, providing financial support during times when your apartment becomes uninhabitable due to a covered event. This coverage ensures that you have the means to maintain your standard of living while your apartment undergoes repairs or restoration.

Let's say a severe storm causes extensive water damage to your apartment, rendering it unsafe to live in. With additional living expenses coverage, your insurance provider will reimburse you for the cost of temporary housing, meals, and other necessary expenses until your apartment is once again ready for occupancy. This coverage is particularly beneficial, as it allows you to focus on your well-being and the restoration process without worrying about the financial impact of sudden displacement.

Choosing the Right Apartment Insurance Policy

When selecting an apartment insurance policy, it’s essential to carefully consider your specific needs and circumstances. Here are some key factors to keep in mind to ensure you choose the right coverage for your rental situation.

Assessing Your Valuables

The first step in choosing an apartment insurance policy is evaluating the value of your personal belongings. Take inventory of your possessions, including furniture, electronics, jewelry, and any other valuable items. Determine the replacement cost for each item to get an accurate estimate of the total value of your belongings. This assessment will help you choose an appropriate coverage limit for your policy.

Consider investing in a home inventory app or software to streamline the process of documenting your possessions. These tools allow you to upload photos, descriptions, and estimated values, creating a comprehensive record that can be easily shared with your insurance provider. By having an accurate inventory, you can ensure that your apartment insurance policy adequately covers your valuable assets.

Understanding Coverage Options

Apartment insurance policies offer various coverage options, and it’s crucial to understand the differences to make an informed decision. The two primary types of coverage are replacement cost and actual cash value.

- Replacement Cost: This coverage option provides the full cost of replacing your belongings without deducting for depreciation. It ensures that you can purchase new items of similar quality and value, regardless of their age.

- Actual Cash Value: With this coverage, your insurer will reimburse you for the current value of your belongings, taking into account depreciation. While it may offer lower premiums, it may not fully cover the cost of replacing your items with new ones.

Additionally, consider optional coverage enhancements such as personal liability increases, identity theft protection, or personal property coverage for high-value items like jewelry or artwork. These add-ons can provide extra protection tailored to your specific needs.

Comparing Quotes and Providers

To find the best apartment insurance policy for your situation, it’s essential to compare quotes from multiple providers. Obtain quotes from different insurance companies, ensuring that you’re getting a range of options to choose from. Consider factors such as coverage limits, deductibles, and any additional benefits or discounts offered.

When comparing quotes, pay close attention to the policy details and exclusions. Some providers may offer more comprehensive coverage for specific risks, such as water damage or theft, while others may have limitations or exclusions that could impact your protection. Reading the fine print and seeking clarification from insurance agents can help you make an informed decision.

Furthermore, take advantage of online comparison tools and insurance aggregator websites to streamline the quote comparison process. These platforms allow you to input your information once and receive multiple quotes from different providers, making it easier to find the most suitable and cost-effective apartment insurance policy.

Filing an Apartment Insurance Claim

In the unfortunate event that you need to file an apartment insurance claim, it’s important to follow the proper procedures to ensure a smooth and timely resolution. Here’s a step-by-step guide to help you through the claims process.

Notifying Your Insurer

As soon as you become aware of a covered loss or damage, contact your apartment insurance provider to report the incident. Most insurance companies have dedicated claim hotlines or online portals where you can initiate the claims process. Provide as much detail as possible about the event, including the date, time, and any relevant circumstances.

When notifying your insurer, have your policy number and a basic understanding of the coverage limits and deductibles handy. This information will help expedite the initial assessment of your claim.

Documenting the Loss

Thoroughly document the loss or damage to your belongings. Take photos or videos of the affected areas and items, ensuring that you capture the extent of the damage. If possible, obtain estimates or quotes for repairs or replacements to support your claim.

Additionally, create a detailed inventory of the damaged or lost items. Include information such as the item's description, purchase date, original cost, and estimated replacement value. This documentation will be invaluable when it comes to justifying the amount of your claim.

Providing Supporting Documentation

To support your apartment insurance claim, gather and provide any relevant documentation to your insurer. This may include receipts, invoices, or proof of purchase for the affected items. If applicable, obtain police reports or other official records related to the incident, such as fire department reports or damage assessments.

Keep copies of all communications with your insurance provider, including emails, letters, and any recorded conversations. These records will serve as evidence of your claim and the steps taken to resolve it.

Working with Adjusters

Insurance adjusters play a crucial role in the claims process. They are responsible for evaluating your claim, assessing the extent of the damage, and determining the appropriate compensation. Cooperate fully with the adjuster assigned to your case, providing all the necessary information and documentation they request.

During the adjustment process, the adjuster may visit your apartment to inspect the damage or request additional details. Be prepared to answer their questions and provide any additional information they may need to make an accurate assessment. Working collaboratively with the adjuster can help expedite the claims process and ensure a fair resolution.

Apartment Insurance FAQ

Is apartment insurance mandatory for renters?

+

While apartment insurance is not legally required in most jurisdictions, it is highly recommended. Renters are responsible for their personal belongings and liabilities, and having insurance provides essential protection against unforeseen events.

What does apartment insurance typically cover?

+

Apartment insurance typically covers personal property, additional living expenses, and liability protection. It safeguards your belongings against damage or loss and provides financial assistance during temporary displacement due to covered events.

How much does apartment insurance cost?

+

The cost of apartment insurance varies depending on factors such as coverage limits, deductibles, and the location of your apartment. On average, renters can expect to pay around 150 to 300 per year for basic coverage, with the potential for additional costs if optional enhancements are added.

Can I bundle my apartment insurance with other policies for discounts?

+

Yes, many insurance providers offer bundle discounts when you combine your apartment insurance with other policies, such as auto insurance or homeowners’ insurance. Bundling can result in significant savings, so it’s worth exploring this option.

How often should I review and update my apartment insurance policy?

+

It’s recommended to review your apartment insurance policy annually or whenever significant changes occur in your life or possessions. This ensures that your coverage remains adequate and up-to-date, reflecting your current needs and circumstances.

Apartment insurance is an essential aspect of responsible renting, offering financial protection and peace of mind. By understanding the coverage options, choosing the right policy, and following the claims process, you can ensure that your rental space and belongings are adequately safeguarded. Remember, apartment insurance is an investment in your security and well-being, providing a safety net against unforeseen events that can disrupt your life.