Apartment Insurance Price

Securing the right insurance coverage for your apartment is crucial, as it provides peace of mind and financial protection against unforeseen events. However, understanding the factors that influence apartment insurance prices can be complex. In this comprehensive guide, we will delve into the world of apartment insurance, exploring the various aspects that determine the cost of coverage and offering expert insights to help you make informed decisions.

Unraveling the Factors: Understanding Apartment Insurance Prices

The price of apartment insurance is influenced by a multitude of factors, each playing a unique role in determining the overall cost. Let's break down these factors and examine how they impact your insurance premium.

Location and Geographical Factors

One of the primary determinants of apartment insurance prices is the location of your residence. Insurance providers carefully assess the risks associated with different areas, taking into account factors such as crime rates, weather conditions, and the prevalence of natural disasters. For instance, an apartment located in a region prone to hurricanes or earthquakes may attract higher insurance premiums due to the increased risk of property damage.

Furthermore, the specific neighborhood and its characteristics can also impact insurance costs. Areas with higher crime rates or a history of frequent break-ins may result in higher premiums, as insurance companies factor in the potential for theft or vandalism. On the other hand, apartments in safer neighborhoods may enjoy more affordable insurance rates.

| Location Risk Factors | Impact on Premium |

|---|---|

| Crime Rates | Increased premiums in high-crime areas |

| Weather and Natural Disasters | Higher premiums in regions prone to hurricanes, floods, or earthquakes |

| Neighborhood Safety | Affordable rates in secure neighborhoods; higher costs in high-risk areas |

Coverage Amount and Deductibles

The level of coverage you select significantly influences the price of your apartment insurance. Opting for higher coverage limits, which provide more financial protection in the event of a claim, will generally result in higher premiums. Conversely, choosing lower coverage amounts can lead to reduced insurance costs.

Additionally, the deductible you select plays a crucial role in determining your insurance premium. A deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. By choosing a higher deductible, you can often lower your insurance premium, as you're assuming a larger share of the financial responsibility in the event of a claim. However, it's essential to strike a balance, as a higher deductible may impact your ability to cover unexpected expenses.

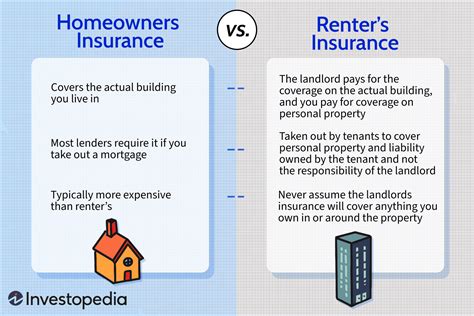

Type of Insurance and Additional Coverage

Apartment insurance policies come in various forms, and the type of coverage you choose can impact the overall price. Basic policies typically offer coverage for your personal belongings and liability protection, while comprehensive policies may include additional features such as coverage for additional living expenses in case you need to relocate temporarily due to a covered loss.

Furthermore, adding optional coverage to your policy can increase the cost. For example, if you have valuable items like jewelry or artwork, you may want to purchase scheduled personal property coverage to ensure they're adequately protected. Similarly, adding coverage for specific risks, such as water damage or identity theft, can increase your premium but provide essential protection.

Policyholder's Age and Occupation

Insurance companies often consider the age and occupation of the policyholder when determining insurance premiums. Younger individuals may face higher insurance costs due to their perceived higher risk of engaging in activities that could lead to property damage or liability claims. Similarly, certain occupations, such as those involving manual labor or high-risk activities, may also result in increased insurance premiums.

Claims History and Credit Score

Your insurance history and credit score are important factors that insurance providers take into account when calculating your premium. A history of frequent claims or significant losses may lead to higher insurance costs, as it indicates a higher risk of future claims. Similarly, a poor credit score can also impact your insurance rates, as it may suggest a higher likelihood of financial instability and increased risk of non-payment.

Optimizing Your Apartment Insurance: Strategies and Considerations

Understanding the factors that influence apartment insurance prices is the first step towards optimizing your coverage. Here are some expert strategies and considerations to help you navigate the process and potentially reduce your insurance costs.

Shop Around and Compare Quotes

Insurance rates can vary significantly between providers, so it's essential to shop around and compare quotes. Obtain quotes from multiple insurance companies to get a clear understanding of the range of prices available. Online comparison tools can be a convenient way to gather quotes and assess the market.

When comparing quotes, pay attention to the specific coverage offered and ensure you're comparing policies with similar features. Look for any hidden fees or exclusions that may impact your overall cost. By thoroughly evaluating multiple quotes, you can identify the best value for your insurance needs.

Bundle Policies for Potential Savings

Bundling your apartment insurance with other policies, such as auto insurance or renters insurance, can often result in significant savings. Insurance providers often offer discounts when you combine multiple policies, as it simplifies their administrative processes and reduces the risk of policy cancellations.

Additionally, bundling your policies can provide added convenience and efficiency. You'll only have one provider to contact for all your insurance needs, and you may be able to streamline your billing and claims processes. Consider the potential savings and convenience when evaluating the option of bundling your insurance policies.

Explore Discounts and Savings Opportunities

Insurance companies offer various discounts to attract customers and reward responsible behavior. Common discounts include:

- Multi-Policy Discounts: As mentioned, bundling your insurance policies can lead to substantial savings.

- Loyalty Discounts: Staying with the same insurance provider for an extended period may qualify you for loyalty discounts.

- Safety Discounts: Installing security systems, smoke detectors, or fire extinguishers in your apartment can result in reduced insurance premiums.

- Educational Discounts: Some providers offer discounts to policyholders with advanced degrees or professional certifications.

- Green Discounts: Adopting eco-friendly practices, such as using energy-efficient appliances, may lead to insurance savings.

When obtaining quotes, inquire about the discounts available and assess whether you meet the criteria. Taking advantage of these opportunities can significantly reduce your insurance costs.

Regularly Review and Adjust Your Coverage

Your insurance needs may evolve over time, so it's important to regularly review your coverage and make adjustments as necessary. Life events such as marriage, the birth of a child, or purchasing valuable items may impact your insurance requirements.

Consider increasing your coverage limits if your possessions have increased in value or if your personal liability risks have changed. On the other hand, if your circumstances have changed and you no longer require as much coverage, you may be able to reduce your premium by adjusting your policy accordingly.

Maintain a Good Credit Score

As mentioned earlier, your credit score can impact your insurance rates. Maintaining a good credit score is not only beneficial for your financial health but also for keeping your insurance costs down. Regularly monitor your credit report and take steps to improve your score if needed. This may include paying bills on time, reducing credit card balances, and correcting any errors on your credit report.

Expert Insights: Navigating the Apartment Insurance Landscape

Apartment insurance is a complex topic, and understanding the various factors that influence prices is crucial for making informed decisions. Here are some additional expert insights to guide you through the process:

The Importance of Understanding Your Policy

Reading and understanding your insurance policy is essential. Familiarize yourself with the coverage limits, deductibles, and exclusions to ensure you have a clear picture of your protection. This knowledge will help you make informed decisions when adjusting your coverage or filing a claim.

Seek Professional Advice

If you're unsure about the best apartment insurance options for your needs, consider seeking advice from an insurance professional. An experienced insurance agent can assess your specific circumstances and recommend suitable coverage options. They can also provide valuable insights into potential risks and strategies to mitigate them.

Stay Informed about Insurance Trends

The insurance industry is constantly evolving, with new products and services emerging regularly. Stay informed about insurance trends and developments to ensure you're aware of the latest options and potential cost-saving opportunities. Online resources, insurance blogs, and industry publications can provide valuable insights into the changing landscape of apartment insurance.

Consider the Long-Term Cost

When selecting an insurance policy, it's important to consider the long-term cost rather than just the initial premium. Some policies may offer lower upfront costs but come with higher deductibles or limited coverage, which could result in higher overall expenses in the long run. Evaluate the total cost of ownership when choosing an insurance provider to ensure you're making a financially sound decision.

Conclusion: Empowering Your Apartment Insurance Journey

Understanding the factors that influence apartment insurance prices is a powerful tool in your insurance journey. By comprehending the intricacies of location, coverage, and personal circumstances, you can make informed decisions and potentially reduce your insurance costs. Remember to shop around, explore discounts, and regularly review your coverage to ensure you're optimally protected.

As you navigate the world of apartment insurance, keep in mind that it's an ongoing process. Your insurance needs may change over time, so staying informed and adaptable is key. With the right knowledge and strategies, you can empower yourself to make the most of your insurance coverage and protect your apartment and belongings effectively.

How much does apartment insurance typically cost per month?

+The cost of apartment insurance can vary widely depending on several factors, including the location, coverage limits, and deductibles. On average, apartment insurance policies range from 15 to 30 per month, but prices can be significantly higher or lower based on individual circumstances.

Can I customize my apartment insurance policy to fit my specific needs?

+Absolutely! Apartment insurance policies can be tailored to meet your unique needs. You can choose different coverage limits, add optional coverages for specific risks, and adjust deductibles to find the right balance between cost and protection. Working with an insurance agent can help you create a customized policy.

What happens if I need to file a claim with my apartment insurance policy?

+Filing a claim with your apartment insurance policy typically involves notifying your insurance provider about the incident and providing relevant details. The claims process can vary depending on the nature of the claim and the specific terms of your policy. It’s important to review your policy documentation and contact your insurer for guidance.