App Auto Insurance

Revolutionizing Auto Insurance: The Rise of App-Based Solutions

In the ever-evolving landscape of the insurance industry, technological advancements have paved the way for innovative solutions, particularly in the realm of automobile insurance. This comprehensive guide explores the phenomenon of App Auto Insurance, delving into its origins, benefits, and the transformative impact it is having on the way drivers manage their coverage.

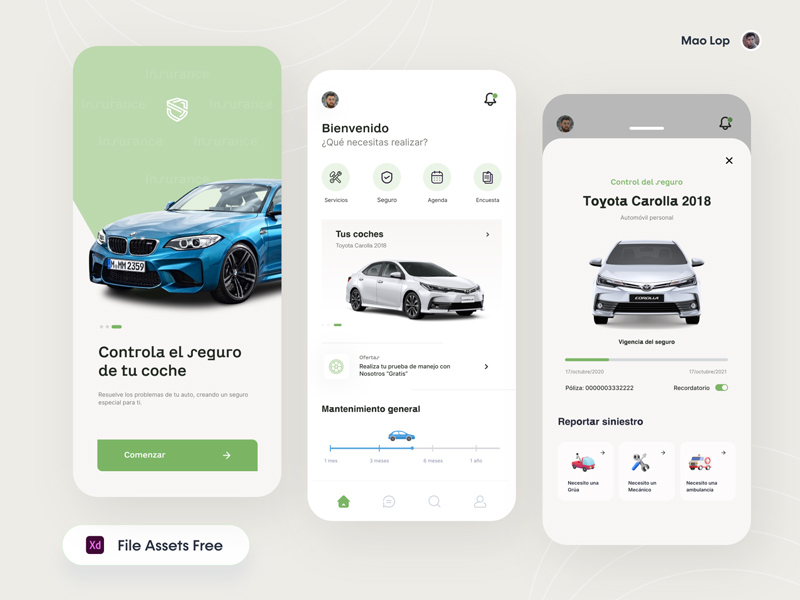

App-based auto insurance represents a significant shift from traditional insurance models, offering a streamlined and personalized experience. With the tap of a finger, drivers can now access a wealth of insurance-related services, from policy management to claims processing, all through user-friendly mobile applications. This digital revolution is not only enhancing convenience but also challenging the status quo, making insurance more accessible and tailored to the modern consumer.

The Evolution of Auto Insurance: A Digital Transformation

The journey towards App Auto Insurance began with a simple yet powerful idea: to harness the capabilities of mobile technology to simplify the often complex world of insurance. Traditional insurance processes, characterized by paperwork, phone calls, and in-person meetings, were ripe for disruption. The introduction of mobile apps aimed to revolutionize this, offering a digital platform that could provide real-time updates, personalized recommendations, and efficient claim processing.

One of the key catalysts for this transformation was the growing demand for instant gratification and convenience among consumers. With the rise of on-demand services across various industries, customers now expect swift and seamless transactions. App-based auto insurance solutions have tapped into this demand, providing an efficient, user-centric approach to managing vehicle coverage.

Moreover, the advancement of telematics technology has played a pivotal role in shaping the App Auto Insurance landscape. Telematics, a combination of telecommunications and informatics, allows for the collection and transmission of data from vehicles. This data, which includes driving behavior, mileage, and vehicle performance, has enabled insurance providers to offer more accurate and personalized policies. By leveraging telematics, apps can provide real-time feedback to drivers, encouraging safer driving habits and rewarding them with potential discounts.

Benefits of App Auto Insurance: A User-Centric Approach

The advantages of App Auto Insurance are multifaceted and cater to a wide range of consumer needs. Firstly, these apps offer unparalleled convenience. With a few swipes and taps, drivers can purchase, manage, and renew their policies, eliminating the need for time-consuming trips to insurance offices or lengthy phone calls. Real-time updates ensure that policyholders are always informed about their coverage, premiums, and any changes to their policies.

Secondly, App Auto Insurance fosters transparency in the insurance process. Through comprehensive dashboards and detailed analytics, drivers can gain insights into their driving behavior, understand how it affects their premiums, and make informed decisions to potentially lower their insurance costs. This transparency also extends to claim processes, with apps providing step-by-step guides and real-time claim status updates, eliminating the uncertainty often associated with traditional claim procedures.

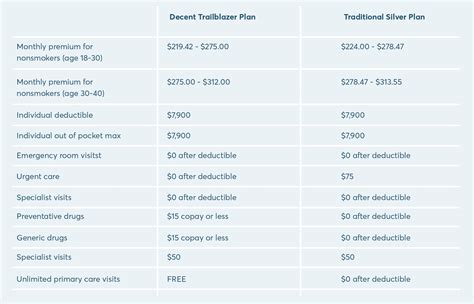

Additionally, these apps promote personalization and customization. By utilizing advanced algorithms and data analytics, insurance providers can offer tailored policies that align with individual driving habits and preferences. This level of customization not only ensures that drivers receive the coverage they need but also presents opportunities for cost savings, as policies can be adjusted based on real-world driving data.

Case Study: Policy Customization through App-Based Insights

Consider the example of John, a cautious driver, who installs an App Auto Insurance solution on his smartphone. Through the app's telematics features, John's driving behavior is continuously monitored, including his adherence to speed limits, sudden braking, and overall mileage. Over time, the app's analytics reveal that John is an exceptionally safe driver, rarely exceeding speed limits and maintaining a steady, controlled driving style.

Based on these insights, John's insurance provider, leveraging the data collected through the app, offers him a customized policy with reduced premiums. This policy is tailored to his specific driving habits, rewarding him for his safe driving behavior. The app's real-time feedback and personalized recommendations further encourage John to maintain his safe driving practices, ensuring he continues to receive the most competitive insurance rates.

Enhancing the Claims Process: A Seamless Experience

One of the most significant transformations brought about by App Auto Insurance is the enhancement of the claims process. Traditional claim procedures often involved lengthy and cumbersome processes, requiring drivers to navigate complex paperwork, navigate multiple phone calls, and potentially face delays and uncertainties. App-based solutions have revolutionized this, offering a streamlined, efficient, and transparent claims experience.

With App Auto Insurance, drivers can initiate a claim through their mobile devices, often with just a few taps. The app guides users through the entire process, providing clear instructions and step-by-step guidance. This includes capturing and uploading relevant photos and documents, such as accident scenes, vehicle damage, and driver's license information. The app's intuitive design ensures that users can complete these steps quickly and accurately, reducing the potential for errors and delays.

Real-Time Claim Tracking: Empowering Policyholders

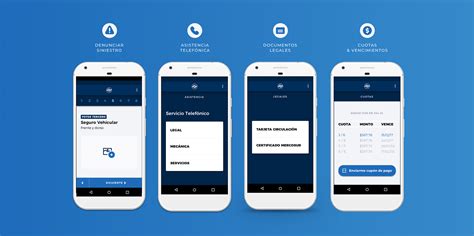

A key feature of App Auto Insurance is the ability to provide real-time claim tracking. Once a claim is submitted, policyholders can access a dedicated claim dashboard within the app. This dashboard offers a comprehensive overview of the claim's progress, from the initial submission to the final settlement. Policyholders can track each stage of the process, from the assessment of the claim by the insurance provider to the repair or replacement of the vehicle.

This level of transparency empowers policyholders, giving them control and visibility over their claims. They can receive instant notifications about the status of their claim, potential delays, or any additional information required from their end. This real-time tracking not only reduces anxiety and uncertainty but also fosters a sense of trust and satisfaction, as policyholders can actively participate in the claims process rather than being passive recipients of updates.

| App Auto Insurance Claims Process | Steps |

|---|---|

| Initiate Claim | Users can start a claim directly from the app, providing basic details and capturing necessary information. |

| Upload Documents | Policyholders can upload relevant documents, such as accident reports, photos, and repair estimates, all within the app. |

| Real-Time Updates | The app provides instant notifications and updates about the claim's progress, keeping policyholders informed. |

| Collaborative Claims Management | Users can communicate with their insurance provider through the app, ensuring a seamless and efficient resolution process. |

| Final Settlement | Once the claim is approved, the app facilitates the final settlement, ensuring a swift and hassle-free conclusion to the process. |

The Future of App Auto Insurance: A Data-Driven Revolution

As App Auto Insurance continues to gain traction, its future holds immense potential for further innovation and transformation. The key driver of this evolution is the continued advancement of data analytics and telematics. With more vehicles equipped with advanced sensors and connectivity, insurance providers will have access to an unprecedented wealth of data.

This data-driven approach will enable insurance providers to offer even more personalized and tailored policies. By analyzing driving behavior, traffic patterns, and even weather conditions, insurance companies can provide dynamic pricing models that reflect the actual risk associated with a driver's behavior. This shift towards usage-based insurance has the potential to revolutionize the industry, rewarding safe drivers with lower premiums and encouraging safer driving habits across the board.

The Role of Machine Learning and AI

The integration of machine learning and artificial intelligence (AI) is set to play a pivotal role in the future of App Auto Insurance. These technologies will enable insurance providers to automate various processes, from policy underwriting to claims assessment. AI-powered algorithms can analyze vast amounts of data in real-time, making informed decisions and recommendations, ensuring a faster and more accurate insurance experience.

For instance, AI can be utilized to detect potential fraud in claims, identifying anomalies or inconsistencies in driving behavior data. This not only protects insurance providers from fraudulent activities but also ensures that honest policyholders are not penalized. Additionally, AI-driven apps can provide personalized driving tips and recommendations, further enhancing driver safety and reducing the risk of accidents.

Expanding Services: Beyond Traditional Insurance

The scope of App Auto Insurance is expanding beyond traditional coverage. Insurance providers are increasingly incorporating additional services into their apps, transforming them into comprehensive mobility platforms. These services can include roadside assistance, car maintenance scheduling, and even car-sharing or ride-hailing options, offering policyholders a one-stop solution for all their mobility needs.

For instance, imagine an app that not only provides insurance coverage but also integrates with a car-sharing service, allowing users to book and unlock vehicles directly from their smartphones. This seamless integration of insurance and mobility services enhances the user experience, making it more convenient and efficient for policyholders to manage their transportation needs.

Conclusion: Embracing the Digital Age of Auto Insurance

App Auto Insurance represents a paradigm shift in the insurance industry, offering a more efficient, transparent, and personalized experience for drivers. Through the power of mobile technology and data analytics, insurance providers are revolutionizing the way coverage is managed and delivered. The benefits of App Auto Insurance are clear, from enhanced convenience and customization to a streamlined claims process.

As the industry continues to evolve, the focus on data-driven solutions and the integration of advanced technologies will shape the future of auto insurance. With App Auto Insurance at the forefront, drivers can expect a more connected, intelligent, and tailored insurance experience, empowering them to make informed decisions and stay protected on the road.

Frequently Asked Questions

How does App Auto Insurance differ from traditional insurance policies?

+

App Auto Insurance offers a more streamlined and digital experience, allowing policyholders to manage their coverage through a mobile app. It provides real-time updates, personalized recommendations, and an efficient claims process, unlike traditional insurance policies that often involve paperwork and phone calls.

What are the benefits of using App Auto Insurance?

+

App Auto Insurance offers convenience, transparency, and customization. Policyholders can easily manage their coverage, track claims in real-time, and receive personalized recommendations based on their driving behavior. This leads to a more efficient and tailored insurance experience.

How does App Auto Insurance enhance the claims process?

+

App Auto Insurance streamlines the claims process by allowing policyholders to initiate claims through the app, upload necessary documents, and track the progress in real-time. This provides a more efficient, transparent, and collaborative experience, reducing delays and uncertainties associated with traditional claims procedures.

What role does data analytics play in App Auto Insurance?

+

Data analytics is crucial in App Auto Insurance as it enables insurance providers to offer personalized policies based on individual driving habits. By analyzing telematics data, insurance companies can provide dynamic pricing models and encourage safer driving behaviors, leading to a more tailored and cost-effective insurance experience.

What can we expect from the future of App Auto Insurance?

+

The future of App Auto Insurance is focused on data-driven solutions and advanced technologies. With the integration of machine learning and AI, insurance providers will offer even more personalized policies and efficient services. Additionally, the scope of App Auto Insurance will expand beyond traditional coverage, incorporating mobility services for a comprehensive user experience.