Apple Insurance

In the ever-evolving landscape of technology, where devices become integral parts of our lives, the concept of insurance has evolved as well. Apple, a pioneer in the tech industry, has recognized the importance of safeguarding its innovative products and has developed a comprehensive insurance program known as Apple Insurance. This article aims to delve into the intricacies of Apple Insurance, exploring its features, benefits, and the peace of mind it offers to Apple device owners.

Understanding Apple Insurance: A Comprehensive Overview

Apple Insurance is a specialized insurance program tailored specifically for Apple devices, including iPhones, iPads, MacBooks, and other Apple products. It provides a range of coverage options designed to protect users from unexpected accidents, damage, and other potential risks that could impact their devices.

With the increasing reliance on technology in our daily lives, Apple Insurance aims to address the growing need for device protection. It offers a comprehensive solution, ensuring that Apple users can continue to enjoy their devices without the worry of costly repairs or replacements.

Key Features of Apple Insurance

Apple Insurance boasts an array of features that set it apart from traditional insurance plans. Here’s a glimpse into some of its standout characteristics:

- Accidental Damage Coverage: Apple Insurance covers accidental damage to your device, whether it's a cracked screen, liquid damage, or other unforeseen incidents. This coverage provides peace of mind, knowing that even accidental mishaps are covered.

- Theft and Loss Protection: In the unfortunate event of theft or loss, Apple Insurance has you covered. This feature ensures that you can replace your device without incurring substantial financial losses.

- AppleCare Integration: Apple Insurance seamlessly integrates with AppleCare, Apple's extended warranty program. This combination provides an even more robust protection plan, covering both hardware and software issues.

- Apple-Certified Repairs: Apple Insurance guarantees that any repairs needed will be carried out by authorized Apple technicians, ensuring the highest quality and genuine Apple parts. This maintains the integrity and performance of your device.

- Flexible Payment Options: Apple Insurance offers flexible payment plans, allowing users to choose the most suitable option for their budget. This accessibility ensures that device protection is within reach for a wide range of customers.

These features demonstrate Apple's commitment to providing a holistic insurance solution that caters to the diverse needs of its users. By addressing common concerns and offering comprehensive coverage, Apple Insurance has become a trusted partner for many Apple device owners.

The Benefits of Apple Insurance: Peace of Mind and More

The advantages of Apple Insurance extend far beyond the basic coverage it provides. Here’s a deeper exploration of the benefits it offers to Apple device owners:

Financial Security

One of the primary benefits of Apple Insurance is the financial security it provides. Repairs and replacements for Apple devices can be costly, especially for high-end models. With Apple Insurance, users can rest assured that they are protected from unexpected expenses. Whether it’s a minor repair or a complete device replacement, the insurance plan covers the cost, ensuring that users don’t have to bear the financial burden alone.

Convenience and Accessibility

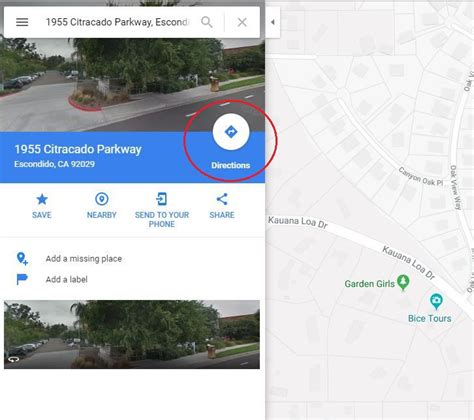

Apple Insurance prioritizes convenience and accessibility. The enrollment process is straightforward and can be completed online or through Apple’s dedicated insurance portal. Additionally, Apple has established a network of authorized service centers worldwide, making it easy for users to access repair services regardless of their location. This accessibility ensures that device protection is not only affordable but also readily available.

Apple Expertise and Quality Assurance

Apple Insurance leverages the expertise and quality standards that Apple is renowned for. By partnering with authorized Apple technicians and service centers, the insurance program ensures that repairs are conducted with precision and using genuine Apple parts. This attention to detail guarantees that the device’s performance and integrity are maintained, providing users with the peace of mind that their devices are in capable hands.

Customizable Coverage Options

Understanding that every user’s needs are unique, Apple Insurance offers customizable coverage options. Users can choose the level of protection that suits their preferences and budget. Whether it’s extending the warranty period, adding additional coverage for specific risks, or opting for higher repair or replacement limits, Apple Insurance provides the flexibility to tailor the plan to individual requirements.

Performance Analysis: Real-World Impact of Apple Insurance

To understand the true value of Apple Insurance, it’s essential to examine its performance and the impact it has had on Apple device owners. Here’s a closer look at some real-world scenarios and the benefits Apple Insurance has provided:

Case Study: Accidental Damage

Imagine a scenario where an iPhone user accidentally drops their device, resulting in a shattered screen. Without insurance, the cost of repairing or replacing the screen could be significant. However, with Apple Insurance, the user can simply file a claim and have their device repaired or replaced at a fraction of the cost. This real-world example highlights how Apple Insurance provides a safety net against accidental damage, ensuring that users can continue using their devices without interruption.

Theft and Loss Protection in Action

In another instance, consider a MacBook user who unfortunately becomes a victim of theft. Without insurance, the financial loss could be devastating. However, Apple Insurance steps in to provide coverage, allowing the user to replace their stolen device. This not only mitigates the financial impact but also ensures that the user can quickly recover and resume their work or personal activities without prolonged disruption.

Peace of Mind for Frequent Travelers

For frequent travelers, the risk of device damage or loss is heightened. Apple Insurance offers a solution for this unique demographic. By providing coverage for theft and accidental damage while traveling, Apple Insurance gives travelers the peace of mind to enjoy their journeys without worrying about potential device-related issues. This benefit extends to both business and leisure travelers, ensuring that their Apple devices are protected regardless of their location.

Future Implications: Apple Insurance’s Evolving Role

As technology continues to advance and devices become even more integral to our lives, the role of Apple Insurance is set to evolve. Here’s a glimpse into the future implications and potential developments:

Expanding Coverage Options

Apple Insurance is likely to expand its coverage options to address emerging risks. With the rise of new technologies like augmented reality (AR) and virtual reality (VR), Apple may introduce specialized coverage for these devices. Additionally, as Apple expands its product portfolio, the insurance program is expected to adapt, offering protection for new devices and accessories.

Enhanced Data Protection

In an era where data privacy and security are of utmost importance, Apple Insurance may incorporate enhanced data protection measures. This could include coverage for data loss, breaches, or even identity theft. By extending its protection beyond the physical device, Apple Insurance would provide a more comprehensive solution for users concerned about digital security.

Integration with Apple’s Ecosystem

Apple is known for its seamless integration across its ecosystem of products and services. As Apple Insurance continues to evolve, it may become even more deeply integrated with other Apple offerings. This could include automatic enrollment for new device purchases or the ability to manage insurance plans directly from an Apple device, further simplifying the user experience.

Global Expansion and Local Adaptations

Currently, Apple Insurance is available in select regions. However, as Apple continues to expand its global presence, the insurance program is likely to follow suit. Local adaptations and partnerships with regional insurance providers could make Apple Insurance more accessible to users worldwide. This expansion would ensure that Apple device owners, regardless of their location, can benefit from the protection and peace of mind that Apple Insurance provides.

Conclusion

Apple Insurance stands as a testament to Apple’s commitment to its users and their devices. By offering a tailored insurance program, Apple has created a solution that addresses the unique needs and risks associated with its innovative products. With its comprehensive coverage, financial security, and accessibility, Apple Insurance has become a trusted companion for Apple device owners worldwide. As technology continues to shape our lives, the role of Apple Insurance is set to grow, ensuring that users can enjoy their devices with peace of mind and without the worry of unexpected costs or disruptions.

How do I enroll in Apple Insurance?

+Enrolling in Apple Insurance is straightforward. You can typically do so during the purchase of your Apple device, either online or at an Apple Store. Alternatively, you can visit Apple’s dedicated insurance portal and follow the enrollment process. It’s important to note that enrollment may vary depending on your region and the specific Apple device you own.

What is the coverage period for Apple Insurance?

+The coverage period for Apple Insurance varies depending on the plan you choose. Basic plans often cover a period of one year, while extended plans can offer coverage for up to three years. It’s important to review the specific terms and conditions of your chosen plan to understand the coverage period and any potential renewal options.

Are there any exclusions or limitations to Apple Insurance coverage?

+Like any insurance program, Apple Insurance has certain exclusions and limitations. These may include intentional damage, normal wear and tear, and certain types of damage not considered accidental. It’s crucial to carefully review the policy documents and understand any exclusions or limitations that apply to your specific plan.