Apply For Health Insurance Online

Empowering Your Healthcare Journey: Navigating the Online Health Insurance Application Process

In today's digital age, the process of applying for health insurance has undergone a remarkable transformation. With just a few clicks, you can embark on a seamless journey towards securing comprehensive healthcare coverage. This article will guide you through the steps and intricacies of applying for health insurance online, empowering you to make informed decisions and take control of your well-being.

The online application process for health insurance offers a convenient and efficient way to explore and select a plan that aligns with your unique needs. Whether you're a young professional seeking basic coverage or a family requiring extensive medical services, understanding the online application process is key to making the right choice. In this article, we'll delve into the steps, considerations, and benefits of applying for health insurance online, ensuring you have the knowledge and confidence to navigate this important aspect of your healthcare journey.

The Online Health Insurance Application: A Step-by-Step Guide

Applying for health insurance online is a straightforward process that can be completed at your own pace and convenience. Here's a detailed breakdown of the steps involved:

Step 1: Research and Compare Plans

Before diving into the application process, it’s crucial to research and compare different health insurance plans. Consider factors such as coverage options, premiums, deductibles, and provider networks. Online comparison tools and resources can help you evaluate plans based on your specific needs and budget. Look for reputable websites and platforms that provide comprehensive information, ensuring you have a clear understanding of your options.

| Plan Type | Coverage Highlights | Premium Range |

|---|---|---|

| Basic Coverage | Essential healthcare services, preventive care, and limited specialist access. | $150 - $250/month |

| Comprehensive Coverage | Broad range of medical services, including specialist care and advanced treatments. | $300 - $500/month |

| Family Plans | Covers the entire family, with customizable options for individual needs. | $450 - $800/month |

💡 Tip: Take advantage of online reviews and testimonials from existing policyholders to gain insights into the quality of coverage and customer satisfaction.

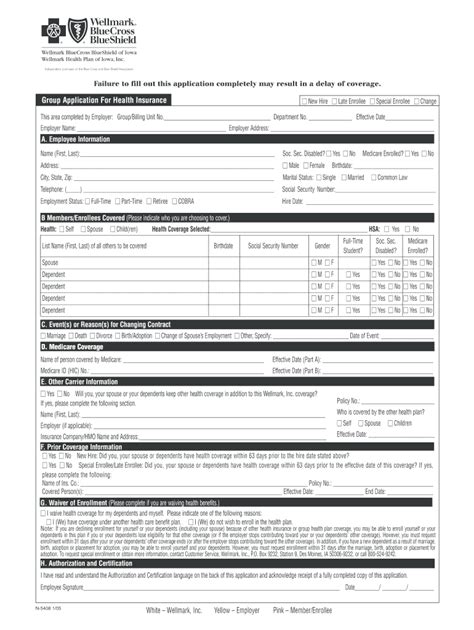

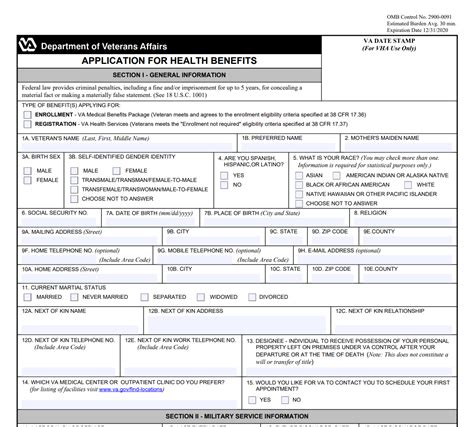

Step 2: Gather Necessary Documents

To streamline the application process, gather all the required documents beforehand. This typically includes proof of identity (e.g., driver’s license or passport), income documentation (pay stubs or tax returns), and any relevant medical records or prescription histories. Having these documents readily available will expedite the application and ensure a smooth experience.

Step 3: Choose a Reputable Insurance Provider

With a solid understanding of your coverage needs and a selection of potential plans, it’s time to choose a reputable insurance provider. Consider factors such as financial stability, customer service reputation, and the provider’s track record in handling claims. Online reviews and ratings can provide valuable insights into the provider’s performance and reliability.

Step 4: Complete the Online Application

Now, it’s time to embark on the actual application process. Most insurance providers offer secure online platforms where you can create an account and start your application. Follow the step-by-step instructions, providing accurate and detailed information. Be prepared to answer questions about your medical history, lifestyle factors, and desired coverage options.

During the application, you'll be prompted to select your preferred plan and choose additional coverage options if desired. Take your time to review all the details, ensuring that the plan aligns with your needs and budget. Remember, this is a critical step, so accuracy and honesty are essential.

Step 5: Review and Submit

Once you’ve completed the application, carefully review all the information you’ve provided. Ensure that your personal details, coverage choices, and any additional add-ons are accurately reflected. Double-check for any errors or discrepancies, as these can impact your coverage and premium rates.

If you're satisfied with your application, proceed to submit it. Some providers may require electronic signatures or additional verification steps to complete the process. Keep a close eye on your email inbox for any further instructions or communication from the insurance provider.

Benefits of Applying for Health Insurance Online

Applying for health insurance online offers a range of advantages that enhance your overall experience. Here are some key benefits to consider:

Convenience and Accessibility

The online application process allows you to apply for health insurance from the comfort of your home or on the go. You can access application platforms at any time, eliminating the need for in-person appointments or lengthy paperwork. This flexibility is especially beneficial for busy individuals or those with limited mobility.

Time Efficiency

Online applications streamline the process, saving you valuable time. You can research, compare plans, and complete the application within a fraction of the time it would take using traditional methods. This efficiency ensures a quicker path to securing the coverage you need.

Enhanced Transparency

Online platforms provide transparent and detailed information about coverage options, premiums, and provider networks. You can easily access and compare plan details, ensuring you make an informed decision. This transparency empowers you to choose a plan that best suits your healthcare needs and budget.

Personalized Experience

Online application platforms often offer personalized tools and calculators to help you find the right coverage. These tools consider your specific needs, such as age, health status, and family size, to suggest suitable plans. This personalized approach ensures you receive tailored recommendations, making the decision-making process more efficient.

Tips for a Successful Online Health Insurance Application

To ensure a smooth and successful online health insurance application, consider the following tips:

- Gather all necessary documents beforehand to avoid delays.

- Read through the application carefully, ensuring accuracy and completeness.

- Be honest and transparent about your medical history and lifestyle factors.

- Take advantage of online resources and tools to research and compare plans effectively.

- Consider adding optional coverages that align with your specific needs, such as dental or vision care.

- Review your policy documents thoroughly after receiving them to ensure accuracy.

Conclusion: Empower Your Healthcare Journey

Applying for health insurance online is a powerful tool that empowers you to take control of your healthcare journey. With the right information and a step-by-step approach, you can navigate the process with confidence, securing the coverage you need to protect your well-being. Remember, your health is a priority, and having the right insurance plan is an essential step towards a healthier and more secure future.

Can I apply for health insurance online even if I have a pre-existing medical condition?

+Absolutely! Many health insurance providers offer coverage for individuals with pre-existing conditions. However, the specific terms and conditions may vary. It’s important to disclose your medical history accurately during the application process. Some providers may require additional information or assessments to determine coverage eligibility and premiums.

What if I’m not sure about the coverage options? Can I seek guidance during the online application process?

+Yes, most reputable insurance providers offer customer support throughout the online application process. You can reach out to their customer service team via live chat, email, or phone for assistance. They can provide guidance on coverage options, explain plan details, and address any concerns or questions you may have.

How long does it typically take to receive a decision on my health insurance application?

+The timeline for receiving a decision can vary depending on the insurance provider and the complexity of your application. In most cases, you can expect a decision within a few business days. However, if additional information or medical assessments are required, the process may take slightly longer. It’s always a good idea to follow up with the provider if you haven’t received a response within a reasonable timeframe.