Approximate Cost Of Health Insurance

Health insurance is an essential aspect of financial planning and personal well-being, offering individuals and families peace of mind and access to necessary medical care. The cost of health insurance varies widely depending on several factors, including geographic location, age, health status, and the specific coverage options chosen. Understanding these factors and how they influence premiums is crucial for making informed decisions about health insurance coverage.

Factors Influencing Health Insurance Costs

Several key factors contribute to the variation in health insurance costs. These factors are often interconnected and can significantly impact the overall expense of health coverage.

Geographic Location

One of the primary determinants of health insurance costs is the geographic location of the insured individual. Healthcare costs, including medical services and prescription drugs, can vary significantly across different regions. Urban areas often have higher healthcare costs due to the concentration of specialized medical facilities and higher living expenses. In contrast, rural areas may have lower costs but may also face challenges with access to certain medical specialties.

For instance, the average annual premium for a family health insurance plan in a major city like New York City could be significantly higher than in a smaller town in a less populated state. This disparity is influenced by factors such as the cost of living, the availability of healthcare providers, and the overall demand for healthcare services in a given area.

Age and Health Status

Age and health status are fundamental factors that insurance companies consider when determining premiums. Generally, younger individuals tend to have lower premiums because they are statistically less likely to require extensive medical care. As individuals age, their health risks increase, leading to higher insurance costs. Pre-existing medical conditions can also impact premiums, as these conditions may require ongoing treatment and specialized care.

Consider the case of a 30-year-old healthy individual who might pay a relatively low premium for health insurance, whereas a 60-year-old with a history of chronic illness could face significantly higher costs for comparable coverage.

Coverage Options and Plan Types

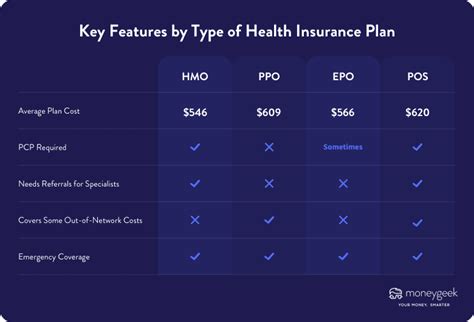

The type of health insurance plan and the specific coverage options chosen play a pivotal role in determining the overall cost. There are various plan types, including Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and Exclusive Provider Organizations (EPOs), each with its own network of providers and cost structures.

Additionally, individuals have the flexibility to choose from different levels of coverage, such as catastrophic plans (which offer basic coverage for major medical events) or comprehensive plans (which provide a broader range of services and benefits). The level of coverage chosen directly impacts the premium, with more comprehensive plans typically costing more.

Estimating Health Insurance Costs: A Comprehensive Guide

Understanding the approximate cost of health insurance involves considering a range of factors and making informed choices about coverage. While the exact premium can vary significantly, here’s a step-by-step guide to estimating health insurance costs based on common variables.

Step 1: Assess Your Healthcare Needs

Begin by evaluating your personal healthcare needs and those of your family members. Consider factors such as the frequency of doctor visits, the need for specialized medical services, and any ongoing prescriptions. This assessment will help you determine the level of coverage required and guide your choice of plan type.

Step 2: Determine Your Preferred Plan Type

Research and compare the different plan types available in your area. Consider factors such as the flexibility of provider networks, out-of-pocket costs, and any additional benefits offered by each plan. For example, if you frequently travel, a plan with a wider network of providers might be more suitable. On the other hand, if you have specific healthcare providers you prefer, an HMO plan that includes them in its network could be a better fit.

Step 3: Calculate Premium Based on Age and Health Status

Insurance companies use age and health status to calculate premiums. Younger, healthier individuals generally pay lower premiums, while older individuals or those with pre-existing conditions may face higher costs. Obtain quotes from multiple insurance providers to get an accurate estimate of your premium based on your specific age and health status.

| Age Group | Approximate Premium Range |

|---|---|

| 18-29 years | $200 - $400 per month |

| 30-49 years | $300 - $600 per month |

| 50+ years | $400 - $800 per month |

Step 4: Consider Additional Costs and Benefits

Health insurance plans often have additional costs, such as deductibles, copayments, and coinsurance. Deductibles are the amount you pay out of pocket before insurance coverage kicks in, while copayments are fixed amounts you pay for specific services. Coinsurance refers to the percentage of costs you share with the insurance provider.

Additionally, some plans offer extra benefits, such as dental or vision coverage, which can be valuable but may also increase the overall cost. Weigh these additional costs and benefits against your healthcare needs to make an informed decision.

Step 5: Explore Cost-Saving Options

There are several strategies to reduce the cost of health insurance while maintaining adequate coverage. Here are some cost-saving options to consider:

- Employer-Sponsored Plans: Many employers offer health insurance as a benefit, which can significantly reduce costs. Inquire about the options available through your employer.

- Government Programs: Depending on your income and family size, you may qualify for government-sponsored programs like Medicaid or the Children's Health Insurance Program (CHIP). These programs provide low-cost or no-cost health coverage.

- High-Deductible Health Plans (HDHPs): HDHPs typically have lower premiums but higher deductibles. These plans are often paired with Health Savings Accounts (HSAs), which allow you to save pre-tax dollars for healthcare expenses.

- Family Plans vs. Individual Plans: Family plans generally provide better value than individual plans, as the premium is spread across multiple family members. Consider the cost difference and choose the most cost-effective option for your family's needs.

Future Implications and Trends in Health Insurance Costs

The landscape of health insurance is constantly evolving, influenced by various factors such as healthcare reforms, technological advancements, and demographic shifts. Understanding these future implications can provide valuable insights into the potential trajectory of health insurance costs.

Healthcare Reform and Policy Changes

Healthcare reform efforts, such as the Affordable Care Act (ACA), have had a significant impact on health insurance costs and coverage options. The ACA introduced mandates and subsidies aimed at making health insurance more accessible and affordable. However, the future of these reforms remains uncertain, and changes in policy could influence insurance premiums and the availability of certain coverage options.

Technological Advancements and Digital Health

The integration of technology into healthcare, known as digital health, is expected to play a crucial role in shaping the future of health insurance. Telemedicine, for instance, has gained prominence during the COVID-19 pandemic, offering convenient and cost-effective healthcare services. As digital health solutions continue to evolve, they may lead to more efficient healthcare delivery and potentially reduce insurance costs over time.

Demographic Shifts and Aging Population

The aging of the global population is a significant demographic trend that will impact health insurance costs. As the population ages, the demand for healthcare services increases, and so do the associated costs. This trend may lead to higher premiums, especially for individuals in older age brackets. However, it also presents an opportunity for insurance providers to develop innovative coverage options tailored to the needs of an aging population.

Market Competition and Consumer Empowerment

The health insurance market is becoming increasingly competitive, with a growing number of providers offering a wide range of coverage options. This competition can drive down costs and improve consumer choices. Additionally, with the rise of consumer-driven health plans and health savings accounts, individuals are taking a more active role in managing their healthcare expenses, which can lead to more informed decision-making and potentially lower overall costs.

Conclusion: Navigating the Complex World of Health Insurance Costs

Estimating the approximate cost of health insurance involves a nuanced understanding of various factors, from geographic location and age to the specific coverage options chosen. By following the comprehensive guide outlined above, individuals can make informed decisions about their health insurance coverage, weighing the costs against their personal healthcare needs and financial circumstances.

As the landscape of health insurance continues to evolve, staying informed about healthcare reforms, technological advancements, and demographic shifts is essential. These factors will shape the future of health insurance costs and coverage options, impacting the financial well-being and healthcare access of individuals and families worldwide.

How do health insurance premiums vary by state?

+Health insurance premiums can vary significantly by state due to differences in healthcare costs, regulations, and the overall healthcare market. For instance, states with a higher concentration of healthcare providers and more specialized medical services may have higher premiums. Additionally, state-specific mandates and regulations can influence the cost of coverage.

Are there any ways to reduce health insurance costs for families with multiple members?

+Yes, family plans often provide better value than individual plans. When purchasing health insurance for a family, the premium is typically calculated based on the age and health status of the oldest member. However, the overall cost is spread across multiple family members, making it more affordable. Additionally, some insurance providers offer family discounts or special rates for families with multiple children.

What impact does pre-existing conditions have on health insurance premiums?

+Pre-existing conditions can significantly impact health insurance premiums. Insurance companies may charge higher rates or even deny coverage to individuals with certain pre-existing conditions. However, under the Affordable Care Act (ACA), insurance providers cannot deny coverage or charge higher premiums based solely on pre-existing conditions. This protection ensures that individuals with pre-existing conditions have access to affordable healthcare.