Are Health Insurance Premiums Tax Deductible Selfemployed

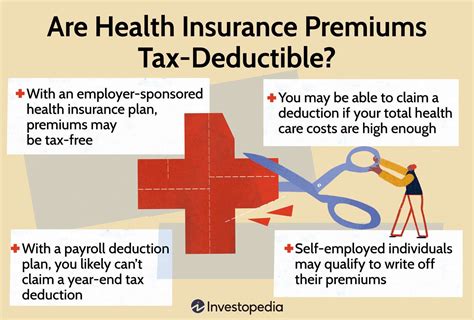

Health insurance is a crucial aspect of financial planning, especially for the self-employed, as they bear the responsibility of securing their own healthcare coverage. In the United States, the tax deductibility of health insurance premiums for the self-employed is an important consideration when managing personal finances and optimizing tax strategies.

Understanding Tax Deductibility for the Self-Employed

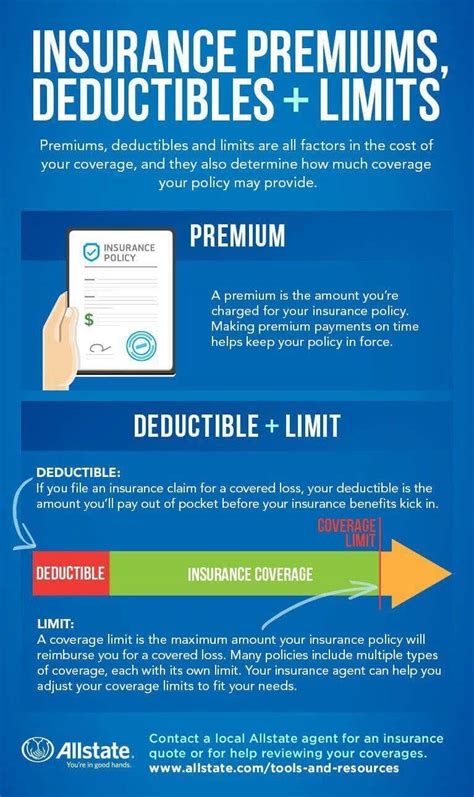

The Internal Revenue Service (IRS) recognizes the unique financial circumstances of the self-employed and allows certain deductions to help mitigate the costs of running a business. One such deduction is for health insurance premiums, which can significantly reduce taxable income and thus lower the overall tax liability.

Under the Affordable Care Act (ACA), also known as Obamacare, individuals and families can benefit from tax credits and subsidies to make healthcare more affordable. These credits and subsidies are especially beneficial for those with low to moderate incomes, providing assistance in purchasing health insurance plans through the Health Insurance Marketplace.

How Health Insurance Premiums are Tax Deductible for the Self-Employed

The tax deductibility of health insurance premiums for the self-employed is a straightforward process. Here's a step-by-step guide to understanding and claiming this deduction:

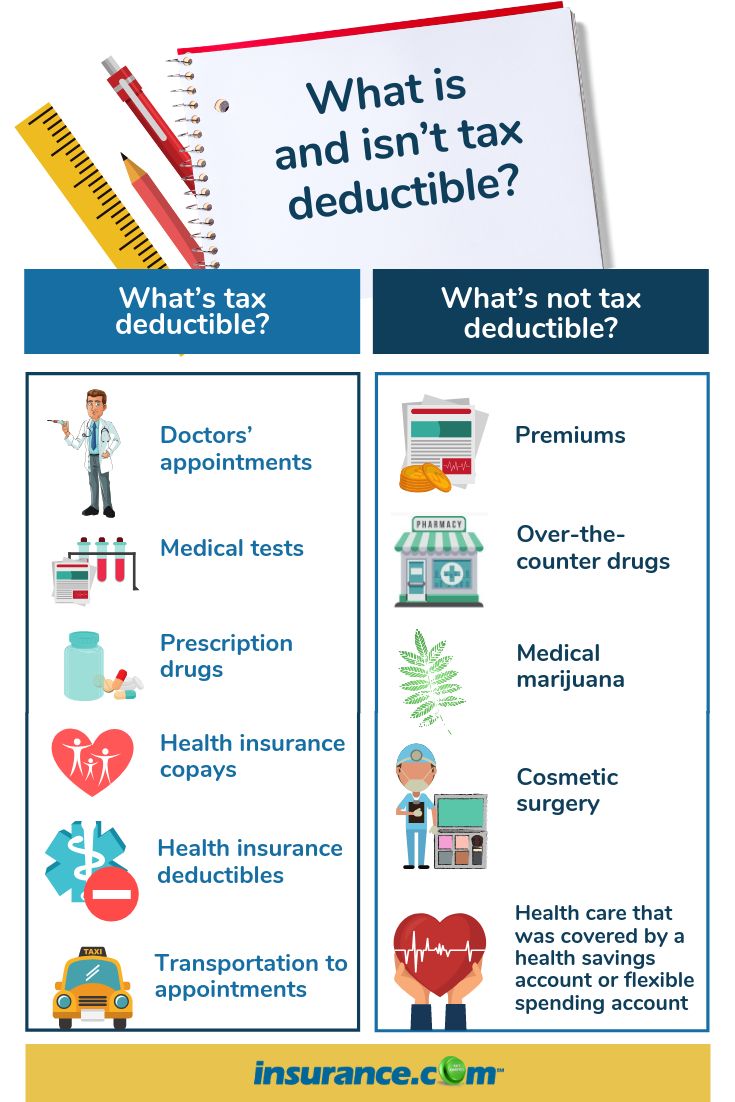

- Premium Payment Method: To qualify for the deduction, the self-employed individual must pay their health insurance premiums directly from their business income or business account. Premiums paid from personal accounts or with personal funds are not deductible.

- Qualifying Health Insurance Plans: The insurance plan must be a medical and dental plan that provides benefits for illness, injury, or disability. Plans that only cover specific diseases or accidents do not qualify for the deduction. Additionally, the plan should be considered a "major medical" plan by the IRS, covering a broad range of medical expenses.

- Deduction Calculation: The self-employed individual can deduct the full amount of premiums paid for health insurance, including dental and vision coverage, for themselves, their spouse, and any dependents. This deduction is taken on Schedule C of Form 1040 as a business expense.

- Tax Savings: By deducting health insurance premiums, the self-employed can reduce their taxable income, resulting in lower tax payments. The exact amount of savings depends on the individual's tax bracket and the total amount of premiums paid.

| Example of Tax Savings |

|---|

| If a self-employed individual pays $10,000 in health insurance premiums and falls in the 24% tax bracket, they can save $2,400 in taxes by deducting these premiums. This deduction lowers their taxable income by $10,000, resulting in a significant tax benefit. |

Benefits of Tax Deductible Health Insurance Premiums

The tax deductibility of health insurance premiums offers several advantages to the self-employed:

- Cost Savings: By deducting health insurance premiums, the self-employed can significantly reduce their tax liability, resulting in direct cost savings. This is especially beneficial for those with higher-cost health insurance plans.

- Financial Planning: The ability to deduct health insurance premiums provides greater financial flexibility and stability for the self-employed. It allows them to better manage their business expenses and plan for the future.

- Incentive for Healthcare Coverage: The tax deduction acts as an incentive for the self-employed to maintain health insurance coverage. With the deduction, they can effectively reduce the net cost of their healthcare, making it more affordable and accessible.

- Compliance with the ACA: By claiming the health insurance premium deduction, the self-employed demonstrate their compliance with the Affordable Care Act's requirement to have minimum essential coverage. This helps avoid potential penalties for not having adequate health insurance.

Potential Challenges and Considerations

While the tax deductibility of health insurance premiums is a valuable benefit, there are a few challenges and considerations to keep in mind:

- Complexity of Tax Laws: The tax laws regarding health insurance deductions can be complex and may change over time. It's important for the self-employed to stay updated with the latest regulations and seek professional advice when needed.

- Qualifying for Deductions: To qualify for the deduction, the self-employed must ensure they meet all the requirements, such as paying premiums directly from their business and having a qualifying health insurance plan. Failure to meet these criteria may result in the deduction being disallowed.

- Record-Keeping: Accurate record-keeping is essential for claiming the health insurance premium deduction. The self-employed should maintain proper documentation of their premium payments and insurance plans to support their tax filings.

Conclusion

The tax deductibility of health insurance premiums is a significant advantage for the self-employed, providing cost savings, financial planning opportunities, and compliance with healthcare regulations. By understanding the requirements and staying informed about tax laws, the self-employed can effectively utilize this deduction to optimize their tax strategies and ensure access to quality healthcare.

Frequently Asked Questions

Can I deduct health insurance premiums if I'm self-employed and my spouse works for an employer with health insurance coverage?

+Yes, you can still deduct your health insurance premiums as a self-employed individual, even if your spouse has health insurance coverage through their employer. The deduction is based on your own business expenses and premiums, regardless of your spouse's employment status.

<div class="faq-item">

<div class="faq-question">

<h3>Are there any limits to the amount I can deduct for health insurance premiums as a self-employed individual?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>There is no specific limit on the amount you can deduct for health insurance premiums as a self-employed individual. You can deduct the full amount of premiums paid for yourself, your spouse, and any dependents, as long as they meet the IRS's criteria for qualifying health insurance plans.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I deduct health insurance premiums for my children who are not my dependents?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, you can only deduct health insurance premiums for yourself, your spouse, and your dependents as defined by the IRS. Children who are not considered dependents for tax purposes do not qualify for the deduction, even if they are your biological or adopted children.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Do I need to itemize deductions to claim the health insurance premium deduction as a self-employed individual?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>No, you do not need to itemize deductions to claim the health insurance premium deduction as a self-employed individual. This deduction is considered an "above-the-line" adjustment to income, meaning it reduces your taxable income before any itemized deductions are considered.</p>

</div>

</div>

<div class="faq-item">

<div class="faq-question">

<h3>Can I deduct health insurance premiums if I'm self-employed and my spouse is also self-employed?</h3>

<span class="faq-toggle">+</span>

</div>

<div class="faq-answer">

<p>Yes, both self-employed spouses can deduct their respective health insurance premiums. Each individual can claim the deduction based on their own business expenses and premiums, regardless of their spouse's self-employment status.</p>

</div>

</div>

</div>