Are Healthcare Insurance Premiums Tax Deductible

Healthcare insurance is an essential aspect of financial planning and healthcare management, and understanding the tax implications can significantly impact individuals' overall financial well-being. This comprehensive guide aims to delve into the tax deductibility of healthcare insurance premiums, providing a detailed analysis of the current regulations, real-world examples, and potential future changes.

Understanding Healthcare Insurance Premiums and Tax Deductions

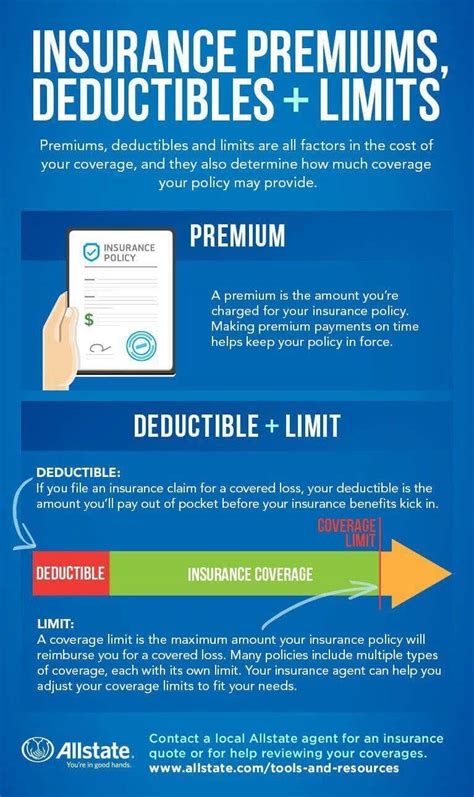

Healthcare insurance premiums refer to the regular payments made by individuals or employers to insurance companies to maintain healthcare coverage. These premiums ensure access to essential medical services, treatments, and medications. In many countries, including the United States, the deductibility of these premiums from taxable income is a subject of considerable interest and can offer significant tax benefits.

The Current Regulatory Landscape

The tax deductibility of healthcare insurance premiums varies depending on the jurisdiction and the specific healthcare system in place. In the United States, for instance, the Internal Revenue Service (IRS) provides guidelines on which healthcare expenses, including insurance premiums, are tax-deductible.

As of [current year], the IRS allows individuals to deduct qualified medical expenses, including healthcare insurance premiums, from their taxable income. However, there are certain conditions and limitations to consider. First and foremost, individuals must itemize their deductions on their tax returns to claim this benefit. This means that the total amount of itemized deductions, including medical expenses, must exceed the standard deduction amount set by the IRS.

| Tax Year | Standard Deduction for Single Filers | Standard Deduction for Married Filing Jointly |

|---|---|---|

| 2022 | $12,950 | $25,900 |

| 2023 | $13,000 | $26,000 |

Additionally, the IRS sets a threshold for medical expenses, which must exceed a certain percentage of the taxpayer's adjusted gross income (AGI) before they can be deducted. For the tax year [current year], the threshold is set at 7.5% of AGI for all taxpayers.

Real-World Examples

Let’s consider a hypothetical scenario to illustrate the potential tax savings from deducting healthcare insurance premiums. Meet Sarah, a single individual with an AGI of 50,000 for the tax year [current year]. Sarah's annual healthcare insurance premium is 6,000. Since the threshold for medical expense deductions is 7.5% of AGI, Sarah must exceed 3,750 (50,000 x 7.5%) in medical expenses to qualify for deductions.

If Sarah has additional qualified medical expenses, such as prescription medication costs or copayments, and her total medical expenses exceed $3,750, she can deduct the amount that surpasses this threshold from her taxable income. In this case, if her total medical expenses, including the insurance premium, amount to $6,500, she can deduct $2,750 ($6,500 - $3,750) from her taxable income.

Tax Strategies and Considerations

When it comes to maximizing tax benefits from healthcare insurance premiums, there are several strategies individuals can employ:

- Itemize Deductions: As mentioned earlier, itemizing deductions is crucial to claiming the tax benefits of healthcare insurance premiums. Individuals should carefully evaluate their eligible expenses and consider if itemizing will result in a lower taxable income compared to taking the standard deduction.

- Track Medical Expenses: Maintaining accurate records of all medical expenses, including insurance premiums, copayments, prescription medications, and other qualified expenses, is essential. This ensures that individuals can accurately calculate their total medical expenses and determine if they exceed the threshold for deductions.

- Explore Tax-Advantaged Accounts: Some countries offer tax-advantaged accounts specifically for healthcare expenses, such as Health Savings Accounts (HSAs) or Flexible Spending Accounts (FSAs). These accounts allow individuals to set aside pre-tax dollars to pay for qualified medical expenses, including insurance premiums. Exploring these options can provide additional tax savings.

- Consider High-Deductible Health Plans (HDHPs): HDHPs are insurance plans with higher deductibles and lower premiums. Combining an HDHP with a tax-advantaged account like an HSA can offer significant tax benefits. Individuals can contribute pre-tax dollars to their HSA to cover out-of-pocket expenses, and any remaining funds in the account can roll over year after year.

Future Implications and Potential Changes

The tax deductibility of healthcare insurance premiums is subject to ongoing legislative and regulatory changes. As healthcare systems evolve and governments aim to provide more accessible and affordable healthcare, the tax treatment of premiums may also undergo modifications.

In recent years, there have been discussions and proposals to make healthcare insurance premiums fully tax-deductible, regardless of whether individuals itemize their deductions. This change would simplify the tax filing process and provide more widespread tax benefits to individuals with healthcare coverage. However, such proposals have yet to be implemented on a national scale.

Additionally, the emergence of innovative healthcare models, such as value-based care and direct primary care, may influence the tax treatment of premiums in the future. These models often involve different payment structures and may impact the deductibility of healthcare expenses. Staying informed about potential legislative changes and consulting tax professionals is essential to navigate these evolving landscapes.

Conclusion

Understanding the tax deductibility of healthcare insurance premiums is crucial for individuals seeking to optimize their financial well-being. By familiarizing themselves with the current regulations, tracking their medical expenses, and exploring tax-advantaged strategies, individuals can make informed decisions to maximize their tax benefits. As the healthcare and tax landscapes continue to evolve, staying proactive and seeking expert advice will ensure individuals can navigate these changes effectively.

Can I deduct healthcare insurance premiums if I don’t itemize my deductions on my tax return?

+No, in most jurisdictions, including the United States, you must itemize your deductions to claim the tax benefit of deducting healthcare insurance premiums. This means your total itemized deductions, including medical expenses, must exceed the standard deduction amount.

Are there any limits to how much I can deduct for healthcare insurance premiums and other medical expenses?

+Yes, there are limits and thresholds for deducting medical expenses. As of [current year], the IRS sets a threshold of 7.5% of your adjusted gross income (AGI) for medical expenses to be deductible. Only the amount exceeding this threshold can be deducted from your taxable income.

Can I deduct healthcare insurance premiums for myself, my spouse, and dependents?

+Yes, you can deduct healthcare insurance premiums for yourself, your spouse, and any qualifying dependents for whom you provide healthcare coverage. However, the premiums must be for qualified health plans and meet the IRS’s criteria for deductibility.