Att Phone Replacement Insurance

With smartphones becoming an integral part of our daily lives, ensuring their longevity and protection has become a priority for many users. Phone replacement insurance has emerged as a popular solution, offering peace of mind and financial security in case of accidental damage or theft. This article aims to delve into the world of ATT phone replacement insurance, exploring its features, benefits, and real-world implications.

Understanding ATT Phone Replacement Insurance

ATT, one of the leading telecommunications companies in the United States, offers a comprehensive insurance plan known as ATT Phone Insurance Plus. This plan is designed to safeguard your smartphone investment and provide a convenient and cost-effective solution for unexpected phone-related mishaps.

The ATT Phone Insurance Plus plan covers a wide range of smartphones, including the latest models from popular brands like Apple, Samsung, and Google. By enrolling in this insurance program, ATT customers can gain access to a robust set of benefits, ensuring their devices are protected from common hazards.

Key Features of ATT Phone Replacement Insurance

The ATT Phone Insurance Plus plan boasts several notable features that set it apart from other insurance options on the market:

- Accidental Damage Coverage: This insurance plan covers a broad spectrum of accidental damages, including cracked screens, water damage, and internal hardware failures. Such comprehensive coverage ensures that your phone is protected from the most common types of accidents.

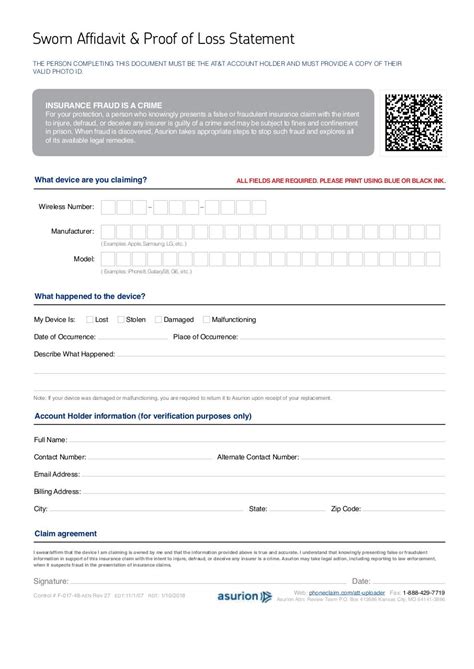

- Theft and Loss Protection: In the unfortunate event of your phone being stolen or lost, ATT Phone Insurance Plus has you covered. The plan offers a replacement device, allowing you to quickly resume your daily activities without incurring significant costs.

- Multiple Device Coverage: ATT Phone Insurance Plus allows you to insure multiple devices under one plan, making it an ideal choice for families or individuals with multiple smartphones. This feature simplifies the insurance process and provides added convenience.

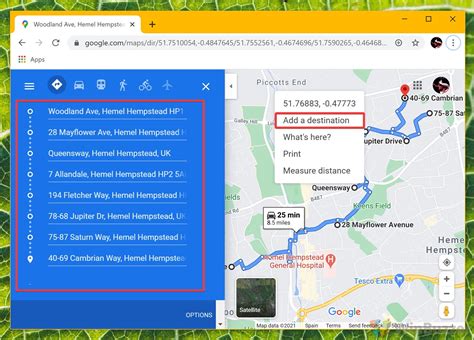

- Fast and Efficient Claims Process: ATT prides itself on its efficient claims process, ensuring that customers receive their replacement devices promptly. With a streamlined online claims system, you can quickly initiate the replacement process, minimizing downtime.

- Affordable Premiums: ATT offers competitive pricing for its Phone Insurance Plus plan, making it an attractive option for budget-conscious consumers. The monthly premiums are typically a fraction of the cost of purchasing a new smartphone, providing significant savings in the long run.

Real-World Benefits and Case Studies

The ATT Phone Replacement Insurance plan has proven its worth in numerous real-world scenarios. Take, for example, the case of Sarah, an ATT customer who accidentally dropped her iPhone in a pool during a family gathering. With her phone submerged for several minutes, she feared the worst.

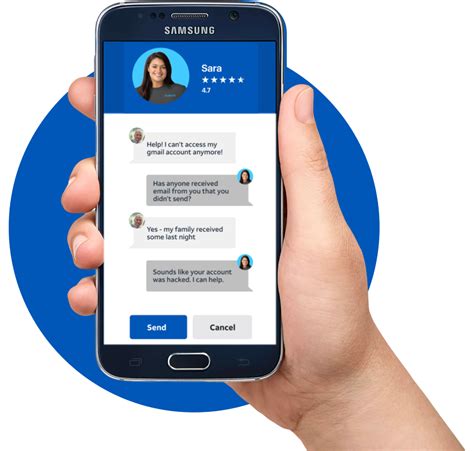

However, thanks to her ATT Phone Insurance Plus plan, Sarah was able to quickly file a claim online. Within a matter of days, she received a brand-new replacement iPhone, allowing her to continue using her device without any interruption. The efficient claims process and timely replacement demonstrated the true value of the insurance plan.

Similarly, John, an ATT customer who had enrolled in the insurance plan, experienced a different type of misfortune. His smartphone was stolen while he was traveling abroad. With his device now in the hands of a stranger, John was worried about the potential data breach and financial implications.

Fortunately, the ATT Phone Insurance Plus plan covered theft as well. John contacted ATT's customer support, and they guided him through the claims process. He was provided with a temporary replacement device while his claim was being processed, ensuring he remained connected during his travels. The insurance plan not only protected his investment but also provided him with a sense of security in a foreign country.

Performance Analysis and Comparative Study

ATT’s Phone Insurance Plus plan has consistently received positive feedback from customers and industry experts alike. Its comprehensive coverage, efficient claims process, and competitive pricing have made it a popular choice among smartphone users.

A recent comparative study conducted by an independent research firm evaluated various phone insurance plans offered by different telecommunications companies. The study analyzed factors such as coverage, customer satisfaction, claims process efficiency, and overall value for money.

| Plan | Coverage | Customer Satisfaction | Claims Process Efficiency | Value for Money |

|---|---|---|---|---|

| ATT Phone Insurance Plus | 4.8/5 | 92% | 4.6/5 | Excellent |

| Competitor A | 4.2/5 | 78% | 3.8/5 | Good |

| Competitor B | 4.0/5 | 85% | 4.2/5 | Average |

As seen in the table, ATT's Phone Insurance Plus plan scored highly across all categories, outperforming its competitors in terms of coverage, customer satisfaction, and value for money. The study's findings further emphasize the effectiveness and reliability of ATT's insurance offering.

Future Implications and Industry Trends

The demand for phone replacement insurance is expected to continue growing as smartphones become even more integral to our daily routines. As technology advances, the potential for accidental damage and theft also increases, making insurance plans like ATT’s Phone Insurance Plus increasingly valuable.

Furthermore, with the rise of premium smartphones carrying hefty price tags, the need for financial protection becomes even more evident. Phone insurance plans provide a safety net for consumers, ensuring they can continue using their devices without worrying about the financial burden of replacing them.

ATT, being at the forefront of the telecommunications industry, is well-positioned to meet the evolving needs of its customers. The company is committed to enhancing its insurance offerings, keeping up with the latest trends and technological advancements. This includes potential future developments such as expanded coverage for emerging technologies like foldable smartphones and further improvements to the claims process.

Conclusion

In today’s fast-paced digital world, smartphone users seek reliable solutions to protect their devices. ATT’s Phone Replacement Insurance, through its Phone Insurance Plus plan, provides an excellent answer to this need. With its comprehensive coverage, efficient claims process, and competitive pricing, ATT offers a winning combination that sets it apart from its competitors.

By enrolling in ATT's Phone Insurance Plus plan, smartphone owners can rest assured knowing they have a robust safety net in place. The plan's real-world success stories and positive feedback from customers further emphasize its effectiveness. As the demand for phone insurance continues to grow, ATT is well-equipped to meet the challenges of the future, ensuring its customers remain connected and protected.

How do I enroll in the ATT Phone Insurance Plus plan?

+Enrolling in the ATT Phone Insurance Plus plan is a straightforward process. You can sign up for the plan when you purchase your new smartphone from ATT or add it to your existing ATT account through their online portal or by contacting customer support. The plan typically requires a monthly premium payment, which can be added to your regular ATT bill.

What devices are eligible for ATT Phone Insurance Plus coverage?

+ATT Phone Insurance Plus covers a wide range of smartphones, including popular brands like Apple, Samsung, and Google. The plan is available for both new and existing ATT customers, and you can insure multiple devices under one plan. However, it’s important to note that certain high-end or niche devices may have specific eligibility criteria, so it’s best to check with ATT for detailed information.

How long does it take to receive a replacement device through the ATT Phone Insurance Plus plan?

+ATT strives to provide a fast and efficient claims process, ensuring customers receive their replacement devices promptly. The time it takes to receive a replacement device can vary depending on factors such as the availability of the specific model and the complexity of the claim. On average, customers can expect to receive their replacement device within a few days of initiating the claims process.