Australia Travel Insurance

When planning a trip to Australia, one of the essential aspects to consider is travel insurance. With its vast landscapes, unique wildlife, and diverse attractions, Australia offers an incredible travel experience. However, it is crucial to be prepared for any unforeseen circumstances that may arise during your journey. Travel insurance provides peace of mind and financial protection, ensuring you can enjoy your trip without worrying about unexpected expenses or challenges.

Understanding the Importance of Australia Travel Insurance

Australia is renowned for its natural beauty, from the iconic Sydney Harbour and the Great Barrier Reef to the vast Outback. However, along with these attractions come potential risks and unexpected situations. Whether you’re exploring the bustling cities, embarking on adventure sports, or simply enjoying a relaxing beach vacation, having comprehensive travel insurance is vital.

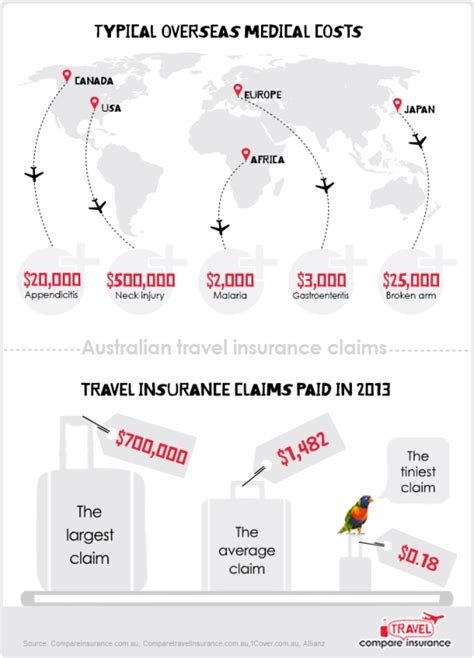

Australia is known for its excellent healthcare system, but the costs associated with medical treatment can be substantial, especially for tourists. Travel insurance ensures that you have access to quality medical care without incurring exorbitant expenses. It covers a range of medical emergencies, from minor injuries and illnesses to more severe conditions requiring hospitalization.

Key Benefits of Australia Travel Insurance

Here are some of the key advantages of investing in travel insurance for your Australian adventure:

- Medical Coverage: Comprehensive medical coverage is a priority. It ensures you have access to necessary medical treatments, prescription medications, and even emergency dental care.

- Trip Cancellation and Delay: Travel insurance provides protection in case your trip is canceled or delayed due to unforeseen circumstances, such as severe weather, natural disasters, or personal emergencies.

- Baggage and Personal Belongings: Losing or damaging your luggage can be a significant setback. Travel insurance covers the cost of replacing lost or stolen items, giving you peace of mind.

- Emergency Assistance: In the event of an emergency, travel insurance offers 24⁄7 assistance, providing support for medical evacuations, arranging alternative accommodations, and coordinating with local authorities.

- Adventure Sports Coverage: If you plan to engage in adventure activities like surfing, scuba diving, or skydiving, specialized travel insurance policies can provide coverage for these high-risk activities.

Choosing the Right Australia Travel Insurance Policy

With numerous travel insurance providers and policies available, selecting the right one for your trip to Australia can be a daunting task. Here are some factors to consider when choosing an insurance plan:

Coverage Options

Assess your specific needs and the activities you plan to undertake during your trip. Look for a policy that offers adequate coverage for medical emergencies, trip cancellation, and baggage protection. Consider additional coverage for adventure sports if applicable.

Policy Limits and Deductibles

Examine the policy limits and deductibles carefully. Ensure that the limits align with your potential needs and that the deductibles are affordable. Higher policy limits often come with higher premiums, so strike a balance based on your budget and expected risks.

Provider Reputation and Reviews

Research the reputation and reliability of the insurance provider. Check online reviews and ratings to ensure they have a track record of prompt claim settlements and customer satisfaction. A reputable provider ensures you receive the support you need during your travels.

Policy Exclusions

Carefully review the policy exclusions to understand what is not covered. Common exclusions may include pre-existing medical conditions, hazardous activities, or certain types of travel incidents. If you have specific concerns, discuss them with the insurance provider to clarify coverage.

Price Comparison

Compare prices from different insurance providers to find the best value for your needs. Consider the coverage, limits, and exclusions when evaluating the cost. Remember that the cheapest option may not always offer the best protection.

| Insurance Provider | Policy Type | Premium | Coverage Highlights |

|---|---|---|---|

| InsureMyTrip | Comprehensive Plan | $60/week | Medical, Trip Cancellation, Adventure Sports |

| World Nomads | Standard Plan | $55/week | Medical, Trip Delay, Baggage Protection |

| Travel Guard | Essential Plan | $45/week | Medical, Emergency Assistance, Limited Adventure Coverage |

What to Do in Case of an Emergency

Despite our best efforts, emergencies can still occur during travel. If you find yourself in a medical or personal emergency situation while in Australia, follow these steps:

Seek Immediate Medical Attention

If you require urgent medical care, contact the nearest hospital or medical facility. In Australia, the emergency number is 000. Explain your situation and provide details about your medical condition or injury. Follow the instructions provided by the medical professionals.

Contact Your Insurance Provider

As soon as possible, contact your travel insurance provider’s emergency hotline. They will guide you through the necessary steps and provide assistance. Have your policy details and claim number ready for quick reference.

Document and Preserve Evidence

Keep a record of all medical expenses, prescriptions, and any other relevant documents. Take photographs of damaged or lost belongings and note the circumstances leading to the loss. This documentation will be crucial when filing a claim.

File a Claim

Once you have returned from your trip, promptly file a claim with your insurance provider. Provide all the necessary documentation and follow their claim process guidelines. Keep a record of your communications and any correspondence with the insurance company.

Conclusion: Peace of Mind for Your Australian Adventure

Travel insurance is an essential investment when planning a trip to Australia. It provides financial protection and peace of mind, ensuring you can fully enjoy your Australian experience without worrying about unexpected events. By choosing the right policy and being prepared, you can explore this incredible country with confidence, knowing that you are covered in case of any unforeseen circumstances.

Frequently Asked Questions

What happens if I have a pre-existing medical condition and need to visit a doctor in Australia?

+

If you have a pre-existing medical condition, it is crucial to declare it when purchasing travel insurance. Most policies cover pre-existing conditions as long as they are stable and do not require immediate treatment. However, some conditions may have specific restrictions or exclusions. Ensure you carefully review your policy’s terms and conditions and consult with your insurance provider to understand the coverage for your specific condition.

Are there any restrictions on adventure activities covered by Australia travel insurance?

+

Yes, adventure activities often have specific restrictions and exclusions. Common exclusions may include high-risk activities like bungee jumping, rock climbing, or extreme sports. However, some insurance providers offer specialized adventure sports coverage that can be added to your policy. Review the policy details carefully and consider your planned activities to ensure adequate coverage.

Can I purchase travel insurance after I’ve already arrived in Australia?

+

It is generally recommended to purchase travel insurance before your trip, ideally at the time of booking. Most policies require you to purchase insurance before your departure date. However, some providers may offer limited coverage options for last-minute purchases. It is best to plan ahead and secure your travel insurance before traveling to Australia to ensure comprehensive protection.

What should I do if my luggage is delayed or lost during my trip to Australia?

+

In the event of luggage delay or loss, it is important to take immediate action. First, contact the airline or transportation provider to file a report. Keep a copy of the report for your records. Then, contact your travel insurance provider to inform them about the incident and initiate a claim process. They will guide you on the necessary steps to take and the documentation required to claim compensation for your lost or delayed luggage.